Renault Group's Q1 Performance Highlights: 2.9% Global Sales Growth, Electric Strategy Delivers Impressive Results

![]() 04/29 2025

04/29 2025

![]() 345

345

Image source: Renault's official website

On April 24th, local time, Renault Group unveiled its sales and financial performance for the first quarter of 2025. Despite the challenging global automotive market, Renault Group bucked the trend, achieving growth driven by its robust product line-up and dynamic electric strategy.

Financial Strength: €11.7 Billion in Revenue

Renault Group reported total revenue of €11.675 billion for Q1 2025, maintaining stability year-on-year. Automotive business revenue stood at €10.128 billion, with the product mix contributing significantly, adding 3.7 percentage points to the total.

Table 1: Renault Group's Operating Revenue in Q1 2025 (by Business)

Global Sales Surge: 2.9% Increase, Alpine Sees Near-Doubling

Renault Group sold 564,980 vehicles globally in Q1, marking a 2.9% year-on-year increase. The European market shone particularly brightly, with sales of 402,413 vehicles (passenger cars + light commercial vehicles), up 2.8%, in contrast to a 2% decline in the broader European market during the same period.

Renault Brand: Global sales of 389,016 vehicles (+6.5%), with a 3.8% increase in the European market, driven by strong performances in Spain (+38.4%), Germany (+20.9%), and the UK (+9.2%).

Dacia Brand: European sales of 154,378 vehicles (+0.6%), with the Sandero retaining its title as Europe's best-selling vehicle across all channels, and the Duster retail sales growing by 11.8%. The all-new Bigster has already secured over 13,000 pre-orders ahead of its launch.

Alpine Brand: Sales soared by 96.4%, fueled by the electric hot hatch A290 and the limited edition A110 R70. The brand will unveil the all-new electric sports car A390 in May.

Table 2: Renault Group's Sales in Q1 2025 (by Brand)

Global Market Expansion: Strong Emerging Market Performances

Renault's international business grew by 11.6%, primarily due to:

Latin America (+21.1%): Robust demand in Argentina (+89.3%), Colombia (+40.2%), and Brazil (+11.2%).

Morocco (+45.5%): Exceptional performances by the Clio and Kardian.

South Korea: The Grand Koleos successfully drove sales.

Table 3: Renault Group's Sales and Market Share in the Top 15 Global Markets

Electric Offensive: Breakthroughs in Hybrid and Pure Electric Vehicles

Renault Group's share of electrified models (hybrid + pure electric) in Europe reached 44.2%, an increase of 15.3 percentage points year-on-year:

Hybrid models accounted for 31.0% (+10.2 pts), reinforcing Renault's position as the second-largest player in the European HEV market.

Pure electric models accounted for 13.2% (+5.1 pts), with new models like the Renault 5 E-Tech and Scenic E-Tech driving a sales surge of 87.9%.

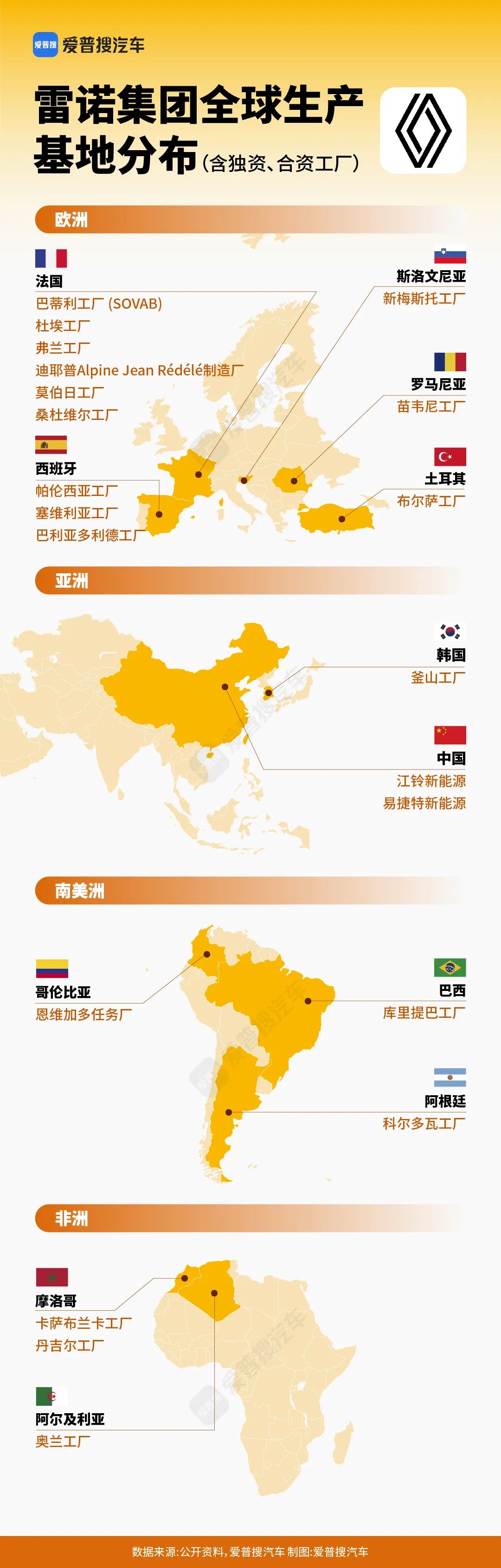

Global Production Base Layout of Renault Group

Europe serves as Renault Group's core production base, with factories in France particularly focused on the manufacture of high-end models and new energy vehicles. In countries like Turkey, Romania, Morocco, and Algeria, Renault leverages localized production to reduce costs and introduces cost-effective models tailored to emerging markets.

Factories in Argentina, Brazil, and Colombia focus on models that cater to local demands, such as pickups and SUVs, while leveraging the South American Common Market (MERCOSUR) to minimize tariff barriers. Notably, in February 2025, Geely Holding Group and Renault Group jointly announced the signing of a framework agreement: Geely Holding will invest in Renault Brazil, becoming a minority shareholder, and Renault Brazil's factory will produce new models from both Geely Holding and Renault.

In Asia, the Busan factory in South Korea produces Renault Samsung models (such as XM3, QM6) and exports models like Arkana. In China, the two joint ventures, Jiangling New Energy and eGT New Energy, specialize in new energy models. eGT, a joint venture between Dongfeng and Renault-Nissan, primarily manufactures pure electric small cars under Renault's Dacia brand for export to Europe.

Figure 1: Global Production Base Layout of Renault Group

2025 Target: Operating Margin ≥7%

Renault Group has affirmed its 2025 full-year target: an operating margin of ≥7% and free cash flow of ≥€2 billion. The Group plans to launch 7 new models throughout the year, including:

Electric models: Renault 4 E-Tech, Alpine A390

Fuel/Hybrid models: Dacia Bigster, International C-Segment SUV

Refreshed models: Renault Austral, Espace

The CEO of Renault Group stated, "Our product offensive and flexible powertrain strategy (fuel + hybrid + pure electric) ensure our competitive edge, positioning us to have the most innovative product line-up in Europe in 2025."