Tesla's Market Value Slumps $3 Trillion: Worst Quarterly Report Highlights High Cost of Musk's Political Involvement

![]() 04/24 2025

04/24 2025

![]() 471

471

Automotive revenue fell 20% year-over-year, while energy storage revenue surged 67%, yet failed to turn the tide.

Automotive revenue fell 20% year-over-year, while energy storage revenue surged 67%, yet failed to turn the tide.

© Source / TESLA

Text / Wang Jing Editor / Yang Qian

Source / Energy Storage Research Institute

Energy Storage Research Institute

Understand energy storage here

In the first quarter of 2025, Tesla released a disappointing financial report.

The report revealed that Tesla generated revenue of $19.335 billion, a 9% decrease from the previous year. Net profit plummeted to $409 million, a 71% year-over-year drop, with a net profit margin of only 2.1%, the lowest in recent years. This figure is significantly lower than the 7.32% margin for the full year of 2024 and well below the 15.45% in 2022 and 15.47% in 2023.

Tesla's once thriving automotive business also took a severe hit, with revenue declining 20% year-over-year. Despite a 67% year-over-year growth in its energy storage business, it was insufficient to reverse the overall trend.

During the earnings call on April 23, 2025, Musk announced that he would "significantly reduce his time in politics" from May onward, focusing instead on Tesla's operations.

As an advocate of free trade, Musk indicated his continued support for tariff reductions. US media speculate that Musk's term as a "special government employee" will conclude no later than July.

In reality, Tesla has faced significant setbacks due to Musk's political involvement and the US tariff storm. Since reaching a record high of $1.259 trillion in December last year, Tesla's market value has plummeted.

As of 16:00 Beijing time on April 24, Tesla's total market value stood at approximately $804.5 billion, a drop of over $450 billion from its peak.

Musk has now evidently recognized the gravity of the situation and chosen to return to the company.

Specifically, Tesla's automotive business, its primary performance driver, is currently grappling with a triple challenge of declining sales, price pressure, and tariff impacts.

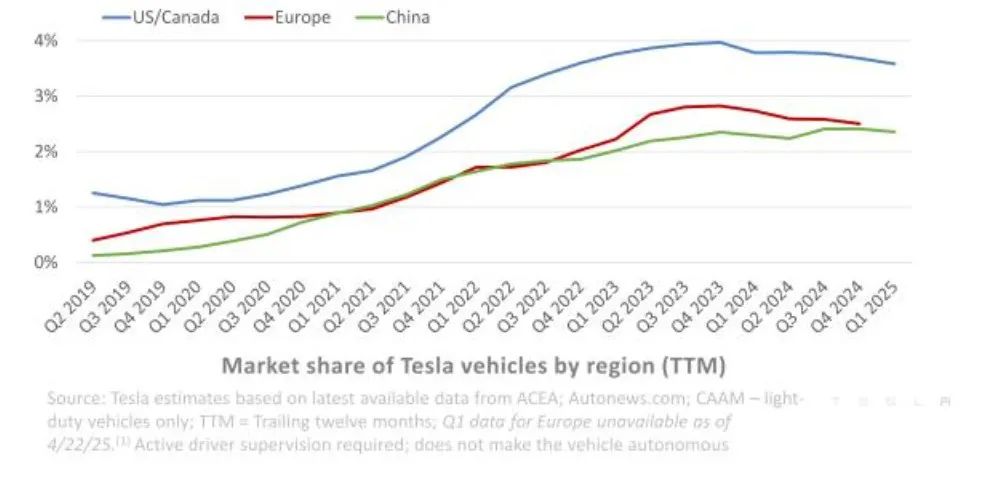

Tesla's global market share growth trend in major automotive markets. Source: Tesla financial report

In the first quarter, Tesla's global deliveries fell to 337,000 units, the lowest in nearly two years, with total revenue declining 9% year-over-year. The market share growth rates in North America, China, and Europe, the top three global markets, showed signs of slowing down. According to Tesla's financial report, the primary reasons include:

Firstly, the Model Y underwent production line upgrades at four manufacturing sites, temporarily limiting production capacity. In the first quarter, Model 3/Y production decreased by 16% year-over-year.

Secondly, to combat fierce market competition, Tesla implemented global price reductions and subsidies. While this strategy stimulated market demand to some extent, it directly led to a decrease in the average selling price (ASP) of vehicles, severely compressing profit margins.

Furthermore, fluctuations in the foreign exchange market adversely impacted Tesla, causing losses of up to $300 million.

Perhaps influenced by Musk's political engagement, Tesla's sales in California fell by 15% in the first quarter, while overall new car sales in the state increased by 8.3% year-over-year.

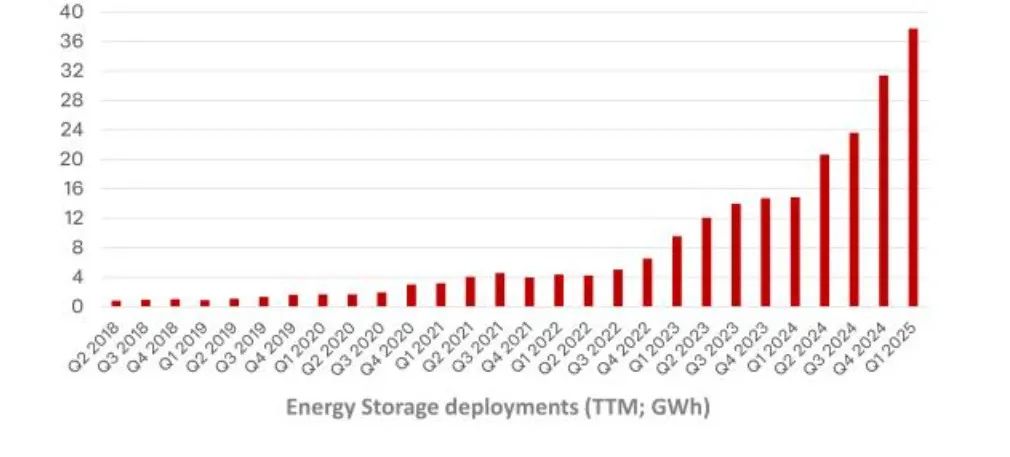

Despite the automotive business's poor performance, Tesla's energy storage business exhibited rapid growth. Revenue from the energy storage segment reached $2.73 billion in the first quarter, a 67% year-over-year increase. Newly installed energy storage capacity in the first quarter amounted to 10.4 GWh, a 154% year-over-year increase.

Tesla's energy storage installed capacity (total over the past 12 months). Source: Tesla financial report

The commissioning of the Shanghai Energy Storage Megafactory has been a significant driving force. Its first batch of Megapack products has been exported to Australia, and it has secured a 548 MWh energy storage order from the Japanese Orix Group.

However, this promising business has not been without challenges. While automotive business costs fell by 17% in the first quarter, energy storage business costs increased by 58% to 1.945 billion yuan, putting downward pressure on net profits.

Particularly, Trump's tariff policy has significantly impacted Tesla's energy storage business. As Tesla imports a significant proportion of lithium iron phosphate battery components from China, tariffs increase costs and compress profit margins.

Additionally, although Tesla has accelerated the restructuring of its overseas supply chain in China, it still struggles with tariff issues. Tesla's Shanghai Energy Storage Megafactory, with a planned annual production capacity of 40 GWh, will significantly enhance Tesla's global delivery capabilities and expand its market presence in the Asia-Pacific, Europe, and other regions, particularly facilitating entry into the Chinese market. However, this factory's energy storage capacity did not contribute to this quarter's deployment, with the first batch of products still in transit to customers.

Moreover, the US government's restrictions on Chinese energy storage products introduce uncertainties into the future development of Tesla's energy storage business.

Worsening the situation, Trump's tariff policy will raise the cost of auto parts Tesla imports from China, increasing production costs and further eroding its price competitiveness.

Consequently, Tesla resorted to a "detour tactic." Its financial report revealed that the lithium refining and cathode material production plant in the US is expected to commence production in 2025, mitigating tariff impacts by relocating key battery material production back to the US.

In summary, Tesla's first-quarter financial report underscores the double-edged sword effect of Musk's political alliance with Trump and the survival challenges faced by global enterprises under unilateralist policies. They must navigate local political games while managing global supply chain disruptions and imbalanced market competition.

Despite Trump's recent signals of tariff softening, Musk has already paid a steep price for this game. He must now strike a balance between technological innovation and geopolitical risks moving forward.