Humanoid Robots: The Dual Edges of Innovation - Upstream Calm Meets Midstream Frenzy

![]() 04/24 2025

04/24 2025

![]() 436

436

OEMs favor large suppliers, yet most enterprises can only offer small orders that these suppliers often overlook. This supply-demand mismatch creates an uneasy stalemate, where one party's enthusiasm meets the other's indifference.

Editor: Di Xintong

A captivating scene unfolds:

In the limelight, the humanoid robot industry drama intensifies. Leading players take turns grabbing headlines with announcements of "thousands of units offline," even appearing abruptly on e-commerce shelves to face end consumers directly. This back-and-forth suggests the "era of mass production" is upon us, where humanoid robots are encountered everywhere, albeit not yet universally embraced.

However, the business world's spotlight never illuminates every corner.

When we turn the camera to the upstream supply chain, expected to bask in industry dividends, we find that behind the spotlight, this seemingly fiery industry feast has yet to spawn a "CATL-style oligopoly" on the supply chain side. Henggong Precision, a supplier of core component reducers, revealed that revenue from humanoid robots accounts for merely 1.76% of its main business income. Companies like Sanhua Intelligent Controls, which are "hot favorites" upstream in the humanoid robot industry, have also refrained from disclosing relevant order quantities.

Frankly, for most upstream enterprises, the most tangible reward from this humanoid robot frenzy might be the surging share prices reflected in K-line charts.

After all, a steep 400% increase within a few months is a rare occurrence.

Image Source: Baidu Stock Market Pass (Changsheng Bearing)

Amidst the alternating warmth and chill, a poignant question arises: If the upstream remains unmoved, how can the midstream construct machines? The industry's solution mirrors the evolution of dexterous hands. Leading players wield in-house R&D as a sharp blade, slicing through technical barriers and inadvertently compressing the traditional supply chain's survival space.

A deeper industrial logic emerges: In this chaotic pre-standardization period, upstream manufacturers burdened with heavy assets are destined for a state of "waiting for Godot"-style observation. Only when the convergence of technical routes yields economies of scale can the magic of diminishing marginal costs be unlocked.

The essence of this ice-and-fire game is the "growing pains" that emerging industries must endure. Breaking the vicious cycle necessitates not just individual advancements but a bidirectional industry flywheel—where genuine end-scenario demand must penetrate OEMs' technology route choices, thereby creating precise R&D space for the upstream and feeding back to form a mature supply chain system, which in turn injects deterministic momentum into cost reduction through scale.

When this value transmission chain truly operates smoothly, it will herald the dawn of healthy development.

Midstream enthusiasm, upstream indifference?

The attitudes of humanoid robot OEMs and the upstream are both uncertain and slightly ambiguous.

After communicating with multiple humanoid robot manufacturers, Embodied Learning Society summarized two common viewpoints: Some manufacturers believe that relatively mature solutions can be procured directly, saving substantial time costs; others contend that upstream component iteration speeds cannot keep pace with the midstream, making it difficult to differentiate technical routes. In-house R&D, they argue, not only saves time but also reduces adaptation errors.

From a procurement perspective, humanoid robot OEMs and upstream suppliers are still in a "mutual evaluation period."

On the OEM side, whether it's reducers or lead screws, numerous manufacturers and products need testing. Guo Liang (pseudonym), a researcher from a humanoid robot manufacturer, told Embodied Learning Society that in procurement, the primary considerations are the cost-effectiveness, reliability, stability, lifespan, and supply chain management capabilities of core components. Another researcher also shared that they prefer large suppliers with stronger overall capabilities.

When OEMs target well-known suppliers in hopes of gaining a "sense of certainty" for core components, they face a mismatch in order quantities.

"Large factories simply don't care about small orders," Guo Liang admitted candidly.

On one hand, the production input costs for core components are substantial, and small orders are difficult to cost-justify and highly uncertain. From an input-output ratio standpoint, it's currently not a "profitable" venture. In contrast, automobiles and cleaning robots have larger shipments and can generate more revenue within the same timeframe.

On the other hand, due to varying midstream technical routes that have yet to be standardized, companies' demands also differ, making it challenging to achieve large-scale distribution through uniform standard products, which doesn't align with upstream business logic.

A combination of these factors leads upstream suppliers to prefer selecting humanoid robot manufacturers with relatively large order quantities and deep foundations when accepting orders. According to an article in China Business News, a relevant responsible person from Hengli Precision Industry stated that the company would "intentionally select leading manufacturers in the industry" when accepting humanoid robot orders, such as Xiaomi, XPeng, etc. "After all, the entire industry is still in its early stages of development, and we are also afraid of wasting resources by spreading out too early."

OEMs favor large suppliers, yet most enterprises can only provide small orders that large suppliers overlook. This supply-demand mismatch creates an awkward stalemate, where one party is eager while the other remains indifferent.

This is also one reason why the path of in-house R&D is becoming increasingly popular. It not only allows for mastery of technical discourse but also enables escape from the upstream's constraints. During previous communication with a humanoid robot manufacturer, a similar sentiment was echoed: "We were forced to do in-house R&D."

"In terms of cost-effectiveness, in-house R&D has more advantages," said Guo Liang. Indeed, Yushu Technology has paved this path, with a 90% in-house R&D rate making it a price killer, slashing prices into the 99,000 era. Wang Xingxing has also boldly stated, "Don't compare costs with me."

On one hand, based on their product characteristics, they can develop more differentiated and tailored products, conducive to later-stage mass production; on the other hand, the laboratory is a process of constant pushing and restarting, and in-house R&D can keep pace with iteration speeds.

Thus, regardless of the reasons for in-house R&D, from a long-term perspective, it is undoubtedly a venture with relatively certain returns. However, this path demands rigorous OEM fund control, commercialization progress, and financing capabilities.

When Embodied Learning Society visited multiple humanoid robot OEMs, it was observed that no type of core component appeared "alone" in the R&D venues. Entire walls and shelves were lined with various core components of the same type, large and small, staging a component talent show, awaiting their chance to "debut in the center stage".

This is the inevitable rite of passage for emerging industries. When technical routes have yet to converge and mass production scales are nascent, the "commercial ambiguity" between OEMs and the supply chain may continue to ferment. However, it's worth anticipating that as industry leaders break through cost ceilings and end-scenario demand gradually clarifies, this industrial tango will eventually find its rhythm.

After all, in the business world, there is no eternal unrequited love, only eternal resonance of interests.

Not indifferent, just waiting and observing

Spring river water warms first, ducks know first; the upstream of the industry senses the heat first.

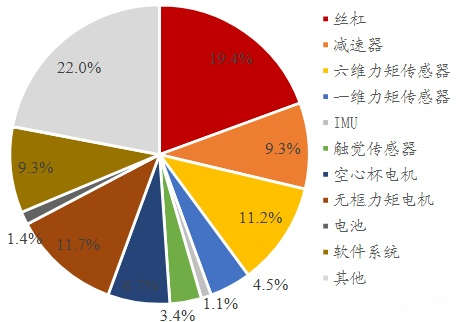

To understand what upstream support humanoid robots truly need, let's first dissect their hardware core components. From the perspective of the hardware core execution system, this system accounts for approximately 60%-70% of the total value, making it the highest-cost module. It includes rotary joints (motors, reducers); linear joints (planetary roller screws, trapezoidal screws); and dexterous hands (coreless motors, tendon ropes).

Image Source: Internet

Among them, lead screws have the highest value share, accounting for approximately 19%-25%, while frameless torque motors account for 16%-20% of value; harmonic reducers and planetary reducers account for 13%-18% of value; and coreless motors account for 8%-12% of value.

Next are sensors in the perception system (force sensors, tactile sensors, etc.); chips, encoders, etc., in the control system.

These core components often appear in groups within the same humanoid robot. For example, a humanoid robot requires as many joints as it has degrees of freedom, and a single dexterous hand can carry more than ten sensors.

It's evident that components appear on a humanoid robot in exponential numbers, and even if downstream sales are only "1," the upstream can add a "0" at the end.

Therefore, it's not that the upstream hasn't perceived the fever; they are just awaiting a "singularity moment." Beite Technology, a supplier to Tesla, once stated, "The company is confident in the future development of the humanoid robot industry, but if mass production is to be officially launched, many issues still need to be resolved. The above components developed by the company in cooperation with customers are only at the prototype stage and have not been officially designated by customers, let alone generating revenue."

In Beite Technology's view, humanoid robots are the future, and they are willing to cooperate with customers for small-scale production testing, but specific returns have yet to materialize. As of September 2024, they had not yet obtained customer-designated orders.

Beite Technology and Hengli Precision share the same underlying logic: "The direction is clear, but the customers are uncertain, so let's wait and see." By observing Beite Technology, we see that every link in the upstream route involves heavy asset investment. The essence of the current "waiting for Godot" attitude is not a lack of confidence in its development but a desire to await a bigger business narrative. And this bigger business narrative is obviously not supported by hundreds or thousands of units.

Fortunately, some upstream companies have already started making moves and are expected to break the current "unrequited love" dilemma between the two sides as soon as possible.

Sanhua Intelligent Controls has prioritized robot-related businesses, announcing plans to invest no less than 3.8 billion yuan to build a research and production base for robot electromechanical actuators and domain controllers in Qiantang District. It has also jointly developed and produced harmonic reducers with Green Harmonic, further deepening its layout in the humanoid robot industry chain. Top Group announced plans to invest 5 billion yuan to build a production base for core robot components.

By opening new production lines, the upstream can meet the needs of midstream OEMs as soon as possible and secure its future. A research report from Soochow Securities shows that based on the plan for customers to mass-produce 1 million units, assuming the actuator assembly costs 50,000 yuan per unit under large-scale mass production and the net profit rate averages 10%, it can contribute profit elasticity of 3.5 billion yuan to Sanhua Intelligent Controls.

However, to completely dispel the industrial misconception, relying solely on strong midstream demand and upstream layout is insufficient for a self-consistent industrial logic.

Two more steps towards alignment

The "extremely stretched ambiguous period" of the humanoid robot industry chain is hidden in two seemingly simple yet mutually causal propositions: If upstream components cannot break through the fragmented dilemma of "made by all nations," how can they support the midstream's ambition for scale? If end demand remains suspended in "laboratory fantasies," how can it force the convergence and unification of technical routes?

The key to navigating this industrial revolution lies in the dual-spiral structure of standardization and demand.

The first hurdle: The "battle to break walls" of standardization. The current "non-standard dilemma" of humanoid robot components is essentially a side effect of the contention among various technical routes. From lead screw specifications to reducer interfaces, the in-house R&D systems of various OEMs resemble the Tower of Babel, plunging upstream suppliers into a "customization hell".

The key to breaking the deadlock lies in finding the greatest common divisor. Just as the 3C industry once unified the market with the Type-C interface, the humanoid robot industry urgently needs leading players to spearhead the formulation of "basic protocols." When compatibility standards for key components gradually take shape, upstream heavy asset investment can shift from "gambler logic" towards a reusable scale economy model.

The second hurdle: The "misty breakthrough" of demand anchors. The ambiguity of end scenarios is like a "quantum mist" hovering over the industry chain. The consumer market fantasizes about service robots becoming a standard household item, while the industrial market anticipates a revolution in flexible manufacturing. However, the reality is that neither has yet to traverse a clear commercialization path.

Breaking the current stalemate necessitates a "demand verification campaign." Only by subjecting robots to rigorous "stress tests" in vertical scenarios can universal demand be crystallized. When a specific niche market reaches the pivotal milestone of 10,000 offline units, the industry chain's flywheel effect will inexorably take hold.

This represents a tripartite leap in the synergistic evolution across the upstream, midstream, and downstream of the industry:

Technical Route Convergence Period: Leading Original Equipment Manufacturers (OEMs) drive the standardization of fundamental modules, akin to the Open Handset Alliance (OHA) model of the Android ecosystem, fostering a shared technological foundation while preserving individual differentiation.

Demand-Supply Resonance Period: The widespread adoption of specific scenarios provides clear technical parameter guidelines to the upstream, creating a reinforcing cycle of "demand shaping standards - standards guiding research and development (R&D) - R&D reducing costs."

Industrial Synergistic Dimensional Upgrade Period: As actuator costs decline due to standardization and sensor prices fall due to mass production, humanoid robots will officially traverse the "commercial singularity." At this juncture, the expansive supply chain landscape may even outshine the entire automotive industry.

Only when the dual spiral of standardization and demand reaches its final twist will the humanoid robot industry chain potentially achieve a more astounding leap than that witnessed in the new energy vehicle sector.