Mercedes-Benz Q1 2025 Sales Report: Premium Lineup and Plug-in Hybrids Excel, Pure Electric Growth Awaits CLA Introduction

![]() 04/24 2025

04/24 2025

![]() 412

412

Mercedes-Benz Group (hereinafter referred to as "Mercedes-Benz") has released its sales data for the first quarter of 2025, reporting a global sale of 529,000 light vehicles, marking a 7% decrease year-on-year. Despite this overall decline, premium models and plug-in hybrids shone brightly, with notable increases in key segments. Mercedes-AMG sales surged by 17%, the G-Class by 18%, and the E-Class and GLC by 32% and 14%, respectively. Additionally, sales of plug-in hybrid passenger cars and electric light commercial vehicles saw significant growth.

Global Light Vehicle Sales Reach 529,000, with Electric Vans Leading the Charge

Prior to the launch of the highly anticipated CLA model, Mercedes-Benz sold a total of 529,200 passenger cars and light commercial vehicles (vans) worldwide in Q1 2025 amidst market uncertainties. This figure comprises 446,300 passenger cars and 82,900 light commercial vehicles.

Table 1: Mercedes-Benz Passenger Car and Van Sales in Q1 2025

Mercedes-AMG (+17%) and the G-Class (+18%) witnessed robust growth, while overall sales were bolstered by the strong demand for the Mercedes-Benz E-Class (+32%) and GLC (+14%). Sales of plug-in hybrid passenger cars rose by 8%, and electric van sales surged by 59%, thanks to a comprehensive product range.

Mercedes-Benz Truck sales figures have yet to be announced.

Plug-in Hybrids Up 8%: CLA Expected to Spark Pure Electric Growth

Mercedes-Benz Cars sold 446,300 units in Q1, of which 86,800 were electrified vehicles, down 4% year-on-year. Pure electric vehicle sales stood at 40,700, a 14% decrease from the previous year.

Affected by the halt in electric smart production in Europe and significant market shifts, Mercedes-Benz's pure electric vehicle sales fell short of last year's figures. However, the upcoming launch of the all-new CLA in the European market this summer, followed by the United States and China in the second half of 2025, is anticipated to significantly boost pure electric vehicle sales.

Furthermore, plug-in hybrids maintained their popularity in Q1, with global sales increasing by 8%, primarily driven by the US market.

Premium Models Thrive, Core Models Stabilize, Entry-Level Models Face Challenges

By model segment:

Table 2: Mercedes-Benz Passenger Car Sales by Segment in Q1 2025

Sales of premium models (Mercedes-AMG, Mercedes-Maybach, G-Class, S-Class, GLS, EQS, and EQS SUV) totaled 65,100 units, accounting for 14.6% of total sales, slightly higher than the same period last year (14.4%). Mercedes-AMG saw a 17% increase across all regions, benefiting from the introduction of new models such as the GLC, CLE, E-Class, and GT. G-Class sales rose by 18% compared to last year. Mercedes-Benz maintained its leadership in China's luxury vehicle segment with prices above one million yuan in Q1.

Core models (all derivatives of the C-Class and E-Class, including EQE and EQE SUV) sold 263,400 units, matching last year's figures. Strong market demand for the Mercedes-Benz GLC and E-Class continued, with sales increasing by 14% and 32%, respectively.

Entry-level models (all derivatives of the A-Class and B-Class, including EQA and EQB) sold 117,800 units, a 9% decrease year-on-year.

Mixed Global Performance, Growth in US and Korean Markets

Regionally, Mercedes-Benz passenger car sales declined in Asia and Europe but increased by 4% in the North American market compared to the previous year.

"Our overall sales performance reflects the mixed dynamics of the global market, with positive developments in North America and other key markets, particularly Korea. Mercedes-AMG and the G-Class once again delivered strong sales results, underscoring the allure of the premium segment," said Mathias Geisen, Member of the Management Board of Mercedes-Benz Group responsible for Marketing.

Table 3: Distribution of Mercedes-Benz Passenger Car Sales in Q1 2025

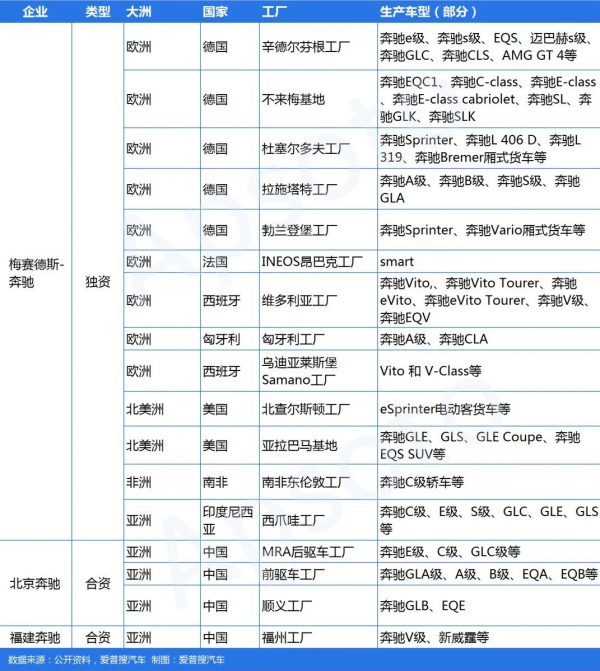

Mercedes-Benz Global Production Base Layout

Mercedes-Benz's core premium models, such as the S-Class, EQS, and AMG GT, are primarily manufactured in its German factories, especially the Sindelfingen plant, underscoring Germany's pivotal role in the brand's premium manufacturing. Factories in Hungary, France, and Spain focus on entry-level models (A-Class, CLA) and light commercial vehicles, optimizing supply chain efficiency in Europe. The Alabama plant in the US specializes in large SUVs (GLE, GLS) and electric models (EQS SUV), catering to North American consumer preferences.

In China, Beijing Benz's MRA plant produces main models like the E-Class, C-Class, and GLC, supporting domestic sales. The front-wheel-drive plant targets young consumers with entry-level models (GLA, A-Class) and electric models (EQA, EQB). The Shunyi plant manufactures the EQE, highlighting China's growing importance in Mercedes-Benz's electrification strategy. Fujian Benz specializes in commercial vehicles (V-Class, Vito), addressing the high-end MPV market gap.

Table 4: Mercedes-Benz Light Vehicle Global Production Base Layout