Can Firefly's debut brighten NIO's future?

![]() 04/22 2025

04/22 2025

![]() 434

434

Author | Yang Lu

Editor | Li Guozheng Produced by | Bangning Studio (gbngzs)

On the evening of April 19, NIO's third brand, Firefly, launched its first model of the same name.

The launch event was very simple and relaxed, held in the exhibition hall of NIO Shanghai Center, with Firefly Brand President Jin Ge introducing the actual car. Among the crowd behind him, you can also catch a glimpse of NIO CEO Li Bin, who served as a backdrop with his employees.

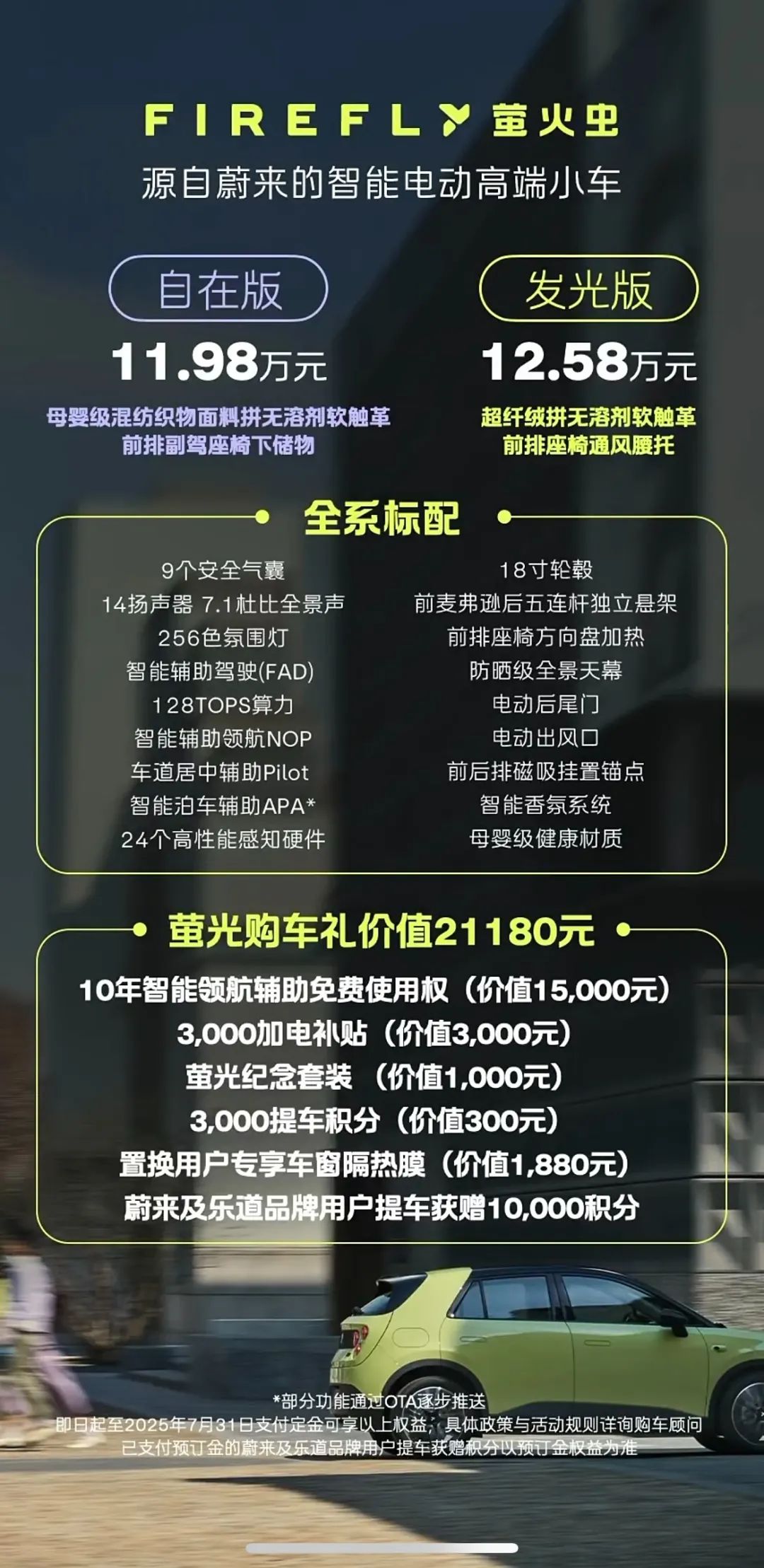

This car was unveiled at last year's NIO DAY with a pre-sale price of 148,800 yuan. Initially, there was a lot of criticism from the outside, especially for the front and rear "trio headlights," which can be described as counter-consensus design. However, after the actual car rolled off the production line and some people experienced it, its reputation improved. Coupled with the announced prices of 119,800 yuan (Freedom Edition) and 125,800 yuan (Glow Edition) that evening, Firefly's competitiveness increased.

Firefly is a crucial piece in NIO's multi-brand strategy, initially positioned as "more MINI than smart, more smart than MINI," adopting a compromise pricing strategy. For NIO, Firefly represents a new challenge and opportunity.

Entering the small car market with a downward strategy

In a recent communication meeting, Firefly explained to Bangning Studio and other media why NIO wants to promote high-end small cars.

First, product layout. Luxury car brands usually cannot directly enter the lower market. If the model positioning drops from 800,000 yuan to 200,000 yuan and then to just over 100,000 yuan in a short period, its value anchor will also decline rapidly.

Second, user demand. Staggering user groups is the way for NIO to expand. The user needs of NIO's three brands are completely different, with NIO leaning towards business, Ledao towards families, and Firefly resembling an electronic toy.

Third, there is a large market space. Data shows that the global total of small cars in 2024 was 15.1 million, the largest segment market. Among them, the European market is the largest, the Chinese market is 1.8 million, and the South American market is comparable to China.

Based on these three considerations, NIO chose to enter the small car market with its third brand, Firefly, and its first car is a global model.

Jin Ge said that making small cars is difficult, equivalent to making a dojo in a snail shell, because the boundaries of small cars in terms of size, weight, price, and cost are very limited.

Over the past two years, Jin Ge and the product project leader and team have traveled throughout China and visited more than 40 cities in the Netherlands, Italy, the United Arab Emirates, Thailand, and other places to understand the needs and lifestyles of global target users.

Last year, the European market sold nearly 5 million small cars throughout the year, with the two best-selling models being the Dacia Sandero and Renault Clio. Firefly will enter the European market for sale within this year.

Firefly's benchmark competitor is BMW Mini. The latter accounts for about 10% of BMW's sales, which is also Firefly's long-term goal.

Can Firefly gain a foothold in the small car market? Its breakthrough points can be seen from three aspects.

First, design sense. After the actual car was launched, people mostly affirmed NIO's taste.

Li Bin once responded to the controversy over Firefly's appearance in a live broadcast, saying that Firefly's headlight design was not influenced by the iPhone and that the design has high recognizability.

Nowadays, the trio headlights have even become Firefly's brand logo, with many netizens commenting that "the actual car is more endurable than the pictures".

Second, emotional value. NIO's systematic R&D and design capabilities are reused on Firefly, inheriting NIO's ingenuity in highlighting texture and providing emotional value in details.

UI design is a major highlight. The Firefly-shaped voice assistant lumo exists in the interface in the form of a small light spot and is connected to a large AI model to improve semantic understanding and execution capabilities.

Third, price. Judging from the basic configuration, Firefly's price meets the expectations of many people. Compared with Mini or smart, its price has an advantage; compared with similar products such as BYD Dolphin, Volkswagen ID.3, and Geely Xingyuan, its price remains at the same level, but Firefly has slightly more novelty.

In addition, on August 1 this year, Firefly will launch the BaaS (Battery as a Service) program, and it is predicted that the price of the entire vehicle will be less than 100,000 yuan. Jin Ge said that Firefly's battery swapping is developed according to NIO's fifth-generation battery swapping station technical standards and is expected to be connected to the fifth-generation battery swapping station at the beginning of next year.

The reason for not announcing the BaaS program at the launch but choosing August 1 is based on several considerations.

"First, the pricing of 119,800 yuan already shows enough sincerity. Second, the price difference for the BaaS program for small cars is not that large. Third, from May to July, Firefly will usher in the first wave of user peaks. Therefore, based on market strategy, we will play the BaaS card in August to welcome the second small peak," Jin Ge said.

After analysis, the users who have placed orders are mainly those who are purchasing a second car or sophisticated young first-time buyers. However, Firefly has not disclosed the order situation, and Jin Ge only revealed that overall, the orders meet expectations, with the Freedom Edition accounting for about 20%-25% and the rest being the Glow Edition.

Avoiding the pitfalls Ledao stepped into

An important goal for NIO this year is profitability, with the timeline having been postponed several times.

Last month, NIO initiated internal rectification and cost reduction reforms, aiming to make every penny invested pay off. This is because when the NIO brand was full of a sense of crisis, the second brand, Ledao, was also unable to replenish blood in a timely manner.

Li Bin summarized the reasons why Ledao's performance fell short of expectations, including: relatively low brand awareness, pressure on new orders; the store's efficiency has not been fully released, and it takes time to improve store efficiency; there are many novices among sales personnel. In addition, the early shortage of battery supply also affected the battery turnover efficiency of the battery swapping stations.

The third brand must not repeat the same mistakes. From this Firefly launch event, we can see that on the one hand, NIO's money-saving methods are everywhere; on the other hand, Firefly is trying its best to avoid the pitfalls that Ledao stepped into.

Li Bin previously revealed that the time Firefly's launch event occupied the NIO House was shortened from 5 days to 2 days, with a cost of 350,000 yuan, only needing to bear the opportunity cost that may affect the store's car sales. But if the event were held outside, it would cost one or two million yuan.

Secondly, savings were also made in battery swapping. Firefly stated that the originally planned "container-type battery swapping station" has been developed, but considering the actual situation, it was decided to cancel deployment. Relying solely on this one Firefly model, it is indeed impossible to support the company in rebuilding a new network.

In terms of production capacity, Firefly made plans in advance. Ledao had delayed deliveries due to production capacity issues, which to some extent led to poor sales. Jin Ge said, "We have stocked a batch of cars in advance, and now we are matching them with orders." However, Li Bin said, "We won't stock too many, stocking cars also costs money, and now we're all counting the costs."

In the sales process, Firefly is different from Ledao. It is sold by NIO's terminal sales staff within NIO stores, while Ledao previously recreated its own sales team.

Li Bin introduced that NIO's sales service system generally has three types of positions: sales consultants, charging and swapping services, and after-sales services. Only the sales consultants are divided into two teams, NIO and Ledao, while the charging, swapping, and after-sales services are covered by one team for all three brands.

This time, Firefly chose to be sold in NIO stores by the NIO sales team, partly out of considerations for streamlining personnel and saving expenses; on the other hand, it is also hoped that Firefly can mutually drive traffic with NIO. "Some people came to see Firefly but ended up buying an ET5 or ES8. Firefly is a high-end small car, so it is reasonable to place it in the NIO channel," Li Bin said.

Overall, Firefly's preparations are sufficient.

Today's NIO is in the dark before dawn. When other automotive groups are strategically contracting, NIO's three brand products have all been launched. In Li Bin's view, more than 60% of NIO is invested in underlying technology research and development, which can support different price segments for many brands. Therefore, using different brands to cover different users while strengthening the reuse of underlying capabilities is commercially sustainable.

Although Firefly is not the main writer for NIO to rewrite its destiny, it will be a powerful tool to help NIO escape the quagmire of losses, a spearhead for NIO to enter overseas markets, and a pioneer for China's independent boutique high-end small cars to enter the global market.