Falling volume, rising profits: Great Wall Motors' long-term and short-term concerns

![]() 04/07 2025

04/07 2025

![]() 364

364

Author: Poetry and Starry Sky

ID: SingingUnderStars

A few days ago, I wrote an article about BYD and briefly mentioned Great Wall Motors.

220 billion! BYD's overseas revenue alone exceeds that of Great Wall Motors in total.

The article had no intention of comparing the two negatively; it was merely an exclamation about how big BYD has become.

However, it was reported by Great Wall Motors officials, claiming that the article negatively compared Great Wall Motors and mentioned incorrect data quote , stating that Great Wall Motors' sales volume in Russia was 220,000 vehicles, not 350,000 as written by Xingkong Jun.

It's hard to take.

Let me put it this way, if I were to choose a suitable off-road vehicle for poetry and distant journeys, Xingkong Jun would prefer Great Wall Motors.

This is probably the greatest recognition for Great Wall Motors.

As an industrialist, Xingkong Jun supports BYD, Great Wall Motors, Xiaomi, and even Tesla (specifically referring to those produced in the Shanghai factory). It would be best if all could advance together and unify the global market. When looking at various automakers, comparisons are inevitable, but there is no intention to belittle one over another.

Why compare BYD and Great Wall Motors?

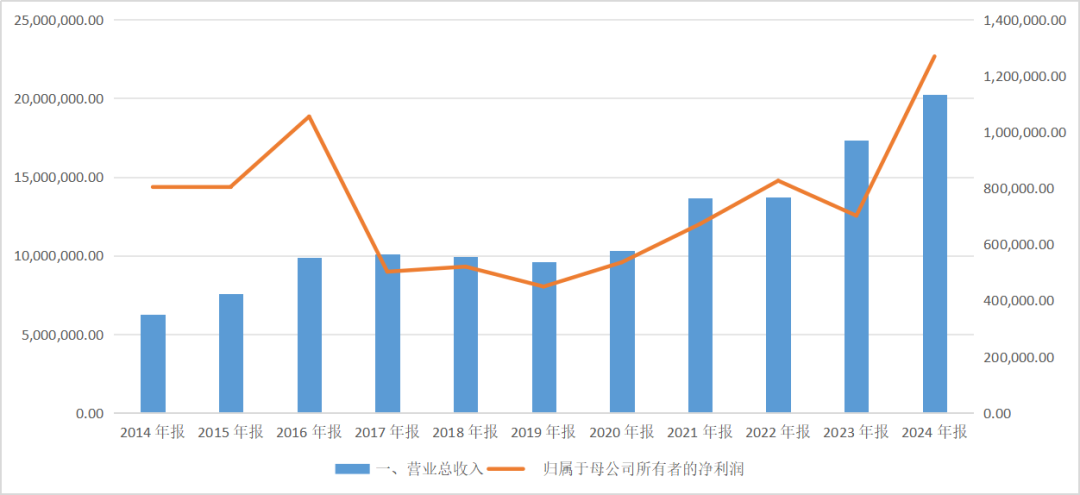

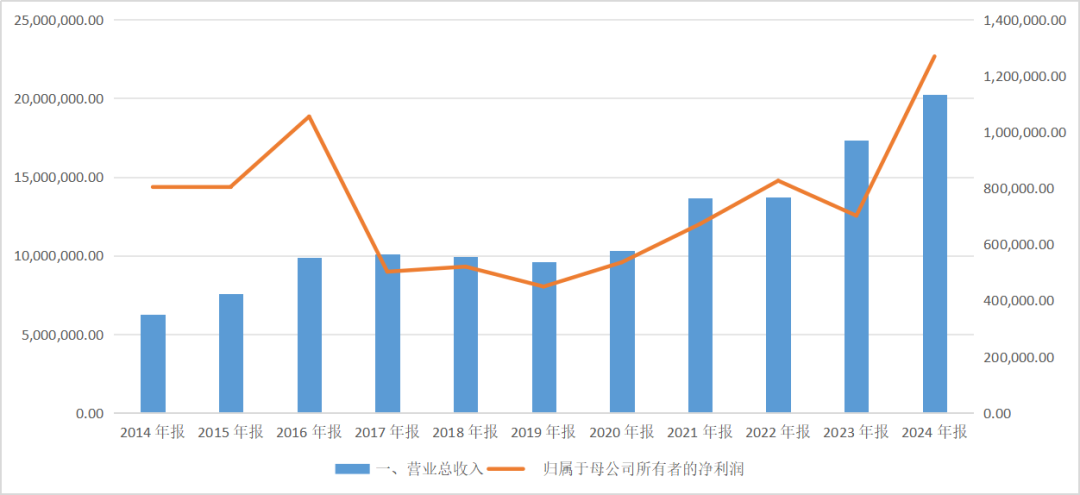

Because ten years ago, in the 2014 annual report, Great Wall Motors had sales of 62.6 billion yuan, and BYD had sales of 58 billion yuan.

At that time, they were still on par with each other.

A lot can happen in a decade.

Everyone is no longer who they once were, breaking away from the past and heading towards vastly different futures.

The same is true for companies.

01

The Past Decade of Great Wall Motors

Great Wall has always been the most popular domestic off-road vehicle brand, hands down.

As early as the Safir era, there was a saying in Beijing's automotive circle, "Drink Erguotou, smoke Zhongnanhai, eat Zhajiangmian, drive Safir." Over the past decade, the biggest crisis Great Wall faced occurred in 2017.

Data Source: iFind

Great Wall, which had been on a continuous uptrend in both sales and profits, hit a stumbling block in 2017.

Great Wall Motors sold a total of 1,070,161 new vehicles throughout the year, a year-on-year decrease of 0.4%. Although sales were close to the target, there was still a gap compared to the set sales target of 1.25 million vehicles.

The net profit attributable to shareholders of the listed company in 2017 was 5.035 billion yuan, a year-on-year decrease of 52.28%, nearly halving the profit.

Due to not meeting the established sales target, Chairman Wei Jianjun and President Wang Fengying imposed self-penalties of 3 million yuan and 2 million yuan, respectively, demonstrating their accountability for the poor performance.

Essentially, the decline in performance in 2017 was related to changes in the market. 2018 marked the first decline in China's automobile production and sales history, and the entire automotive supply chain encountered a cold winter. To save themselves, many joint venture and domestic brands flocked to the SUV sector, leading to congestion in the sector.

However, Great Wall's attempts to diversify into other models were unsuccessful, as consumers only recognized Great Wall's SUVs.

Until 2021, Great Wall had not found a particularly good way to break through, but it had laid the groundwork for overseas business.

In 2014, the signing of the Great Wall Tula factory, located 182 kilometers south of Moscow, was completed. Construction began in 2015, and official production commenced in 2019.

The second biggest crisis for Great Wall Motors in this decade was in 2022.

Wang Fengying, Great Wall's number one "meritorious official," resigned.

In January 2022, she resigned from her positions as Executive Director and Vice Chairman of Great Wall Motors, retaining only her position as General Manager; in March, she further stepped down from her positions as Executive Director and Vice Chairman; in July, she resigned from her position as General Manager to focus on the company's strategic management; on January 30, 2023, Wang Fengying officially joined XPeng Motors, leaving Great Wall Motors, where she had worked for 30 years, to serve as President of XPeng.

All good things must come to an end.

At XPeng, Wang Fengying turned the tide, cutting redundant product lines and focusing on intelligence and electrification. Her first move as the "new official" was to launch the XPeng P7i.

With its excellent intelligent performance and cost-effectiveness, the XPeng P7i quickly became a market hit, receiving over 30,000 orders within 48 hours of its launch.

Meanwhile, Wang Fengying's departure did not alter Great Wall Motors' development trajectory. Driven by high-margin overseas business, Great Wall's net profit has seen two consecutive jumps.

02

The Post-Wei Jianjun Era of Great Wall Motors

After attempting in 2016, Great Wall Motors introduced professional managers on a large scale in 2018.

Xingkong Jun has no prejudice against the profession of professional managers. On the contrary, many listed companies, after the success of their founders, did not hand over their businesses to the second generation but to professional managers, achieving remarkable success.

However, not all professional managers are the same.

There is an evaluation that there is a circle of professional managers in China, similar to Indian-origin executives in the United States, who huddle together for warmth and excel at PPT presentations and oratory skills.

Hence, there was the "overconfident male" incident.

If you trace the brands endorsed by Yang Li and the executives behind them, you will clearly see the contours of this circle of domestic Indian-origin executives.

Today, the team of professional managers from that year has left one after another, and Wei Jianjun has returned to the core to personally oversee the overall situation, with Great Wall Motors returning to the growth path.

What has Wei Jianjun been doing in recent years?

He has been working on power batteries, founding Hive Energy and growing it to rank among the top ten globally and sixth domestically.

With the power battery business stabilized, Wei Hansan has returned with a vengeance.

03

Focusing on the Existing Market

When it comes to the future development of new energy vehicles, Xingkong Jun is very radical. New energy vehicles are a national strategy that, on the one hand, reduces dependence on crude oil (more than 70% of crude oil is currently imported) and, on the other hand, can drive the industrial chain to connect with the real estate industry, achieving industrial upgrading.

Even so, Xingkong Jun believes that there will ultimately be about 30% of the fuel vehicle market that is irreplaceable. Especially in true off-road scenarios, fuel vehicles have irreplaceable advantages.

Given the overall shrinking market for fuel vehicles, if Great Wall Motors can firmly occupy the top position and combine it with hybrid and other technologies, driving some pure electric SUVs along the way, it can still achieve excess returns in the existing market.

Obviously, this is also Wei Jianjun's current thinking.

In terms of specific sub-brand sales, among the five major sub-brands, Haval's sales volume decreased by 1.25% year-on-year, while Great Wall Pickup and Ora's sales volumes decreased by 12.47% and 41.69% year-on-year, respectively.

As a female-oriented pure electric brand, Ora stands out from Great Wall Motors' overall brand image. When other pure electric brands are making large-scale efforts, it is difficult for Great Wall Motors to achieve coordinated development of this brand, leading to an inevitable plunge in sales.

04

Overseas Business

Amid international turmoil, most enterprises involved in overseas business are facing uncertainties.

In 2024, Great Wall Motors' overseas sales, revenue, and net profit all increased, but its gross profit margin fell by 7.25 percentage points year-on-year to 18.76%.

There are three main impacts:

Firstly, the primary overseas battleground, Russia, raised tariff barriers.

Russia changed the vehicle scrapping tax rate, increasing it by 70% to 85% depending on the vehicle model. However, this impact is temporary and does not affect Great Wall Motors produced locally in Russia. Due to the overcapacity of the Tula factory, which produced 130,000 vehicles, Great Wall Motors also exported 100,000 vehicles to Russia. With the commissioning of the second phase of the Tula factory, this tax rate will be saved. This also serves as a reminder to other automakers that going overseas is not just about exports but also about establishing factories (Chinese joint venture brands: We understand).

Secondly, to cope with the EU anti-subsidy tax (with a tax rate of 36.3% for Great Wall Motors), Ora raised prices by 28% in Europe, leading to a year-on-year decline in sales of 61%.

-END- Disclaimer: This article is based on the public company attributes of listed companies and an analytical study focusing on information publicly disclosed by listed companies in accordance with their legal obligations (including but not limited to temporary announcements, periodic reports, and official interaction platforms). Poetry and Starry Sky strives to ensure the fairness of the content and opinions contained in the article but does not guarantee its accuracy, completeness, or timeliness. The information or opinions expressed in this article do not constitute any investment advice, and Poetry and Starry Sky shall not be held responsible for any actions taken based on this article.

Copyright Notice: The content of this article is originally created by Poetry and Starry Sky and may not be reproduced without authorization.