European Auto Market | Italy March 2025: MG Breaks into Top 10 with Strong Performance

![]() 04/07 2025

04/07 2025

![]() 494

494

The Italian new car market experienced a 6.2% year-on-year growth in March 2025, with sales reaching 172,223 units, reversing the sluggish start to the year. Cumulative sales for the year, however, remain 1.6% lower at 443,906 units.

● In terms of propulsion systems, traditional gasoline and diesel vehicles continued to decline, while hybrid and electric vehicles saw robust growth, with pure electric vehicle sales surging 75.1%.

● In brand competition, Fiat retained its lead, but the standout performers were Chinese brands MG and BYD, with MG entering the top 10 for the first time, recording a 65.8% sales increase, and BYD witnessing a stunning 2452.9% growth in sales.

● In model sales, the Fiat Panda retained its top spot, while Chinese models such as the MG ZS and BYD Seal U impressed with their performances.

01

Sales Overview in Italy for March 2025

New car sales in Italy surged 6.2% year-on-year in March 2025, totaling 172,223 units, reversing the downturn observed earlier in the year. Cumulative sales for the year are still 1.6% lower at 443,906 units due to weaker performances in January and February.

● From a sales channel perspective:

◎ Private sales dipped slightly by 0.7% to 81,028 units, accounting for 46.7% of the market (down from 49.7% last year), with a cumulative decline of 5.3% to 241,459 units.

◎ Self-operated registrations fell 25.6% to 14,088 units, resulting in a cumulative decline of 14.4% to 37,696 units.

◎ Conversely, long-term leasing contracts increased by 33.3% to 46,061, accounting for 26.6% of the market and showing a cumulative increase of 11.5% to 106,300 contracts.

◎ Short-term leasing contracts rose 13.9% to 23,143, accounting for 13.3% of the market.

The leasing market has emerged as a significant driver of sales growth, while private consumption demand remains sluggish.

● The Italian auto market's propulsion system structure is rapidly evolving.

Sales of traditional fuel vehicles continued to decline:

◎ Gasoline vehicle sales fell by 9.5% to 46,220 units, with a cumulative decline of 15.7% to 118,535 units.

◎ Diesel vehicle sales dropped by 28.7% to 17,751 units, leading to a cumulative decline of 37.1% to 43,820 units.

◎ Sales of liquefied petroleum gas (LPG) vehicles increased marginally by 3.9% to 13,431 units, but cumulative sales fell by 4.4% to 41,315 units.

In contrast, new energy vehicles:

◎ Hybrid electric vehicles (HEV) surged by 23.3% to 78,796 units, with full hybrids up 23.9% to 22,308 units and mild hybrids up 23.1% to 56,488 units, resulting in a cumulative increase of 15.1% to 201,453 units, accounting for over 45% of the market.

◎ Plug-in hybrid electric vehicles (PHEV) increased by 37.4% to 7,841 units, with a cumulative increase of 30.1% to 18,916 units.

◎ Pure electric vehicles performed exceptionally well, with sales jumping 75.1% to 9,393 units, capturing 5.4% of the market. Cumulative sales rose by 72.2% to 23,073 units, accounting for 5.2% of the market. The proportion of electric vehicles in Europe remains relatively low.

● In the brand competition landscape:

◎ Fiat maintained its leading position with a market share of 9.7%, but sales fell by 2.2% year-on-year, with a cumulative share of 10.7%.

◎ Toyota ranked second, experiencing a slight decline of 1.9%, overtaking Dacia (+9.5%) to reclaim the second spot so far this year.

◎ Volkswagen slipped to third place, recording a 9.9% decrease in sales.

◎ Peugeot (+27.8%), Renault (+12.5%), Jeep (+7.1%), and BMW (+6%) all outperformed the market.

◎ MG was the standout performer, with sales increasing by 65.8% to 6,582 units, capturing a 3.8% market share, and entering the top 10 for the first time, setting a new record.

● The rise of Chinese brands in the Italian market is remarkable.

◎ With sales of 6,582 units and a 65.8% growth rate, MG not only entered the top 10 but also made significant inroads into the market.

◎ BYD sold 1,787 units, marking a 2452.9% increase in sales.

◎ Emerging Chinese brands such as Omoda and Jaecoo are also gradually entering the market, with sales totaling 987 units.

Traditional European brands like Volkswagen and Fiat are struggling with growth, while the cost advantage and technological competitiveness of Chinese brands are reshaping the Italian auto market.

02

Analysis of Model Sales and Competitive Landscape

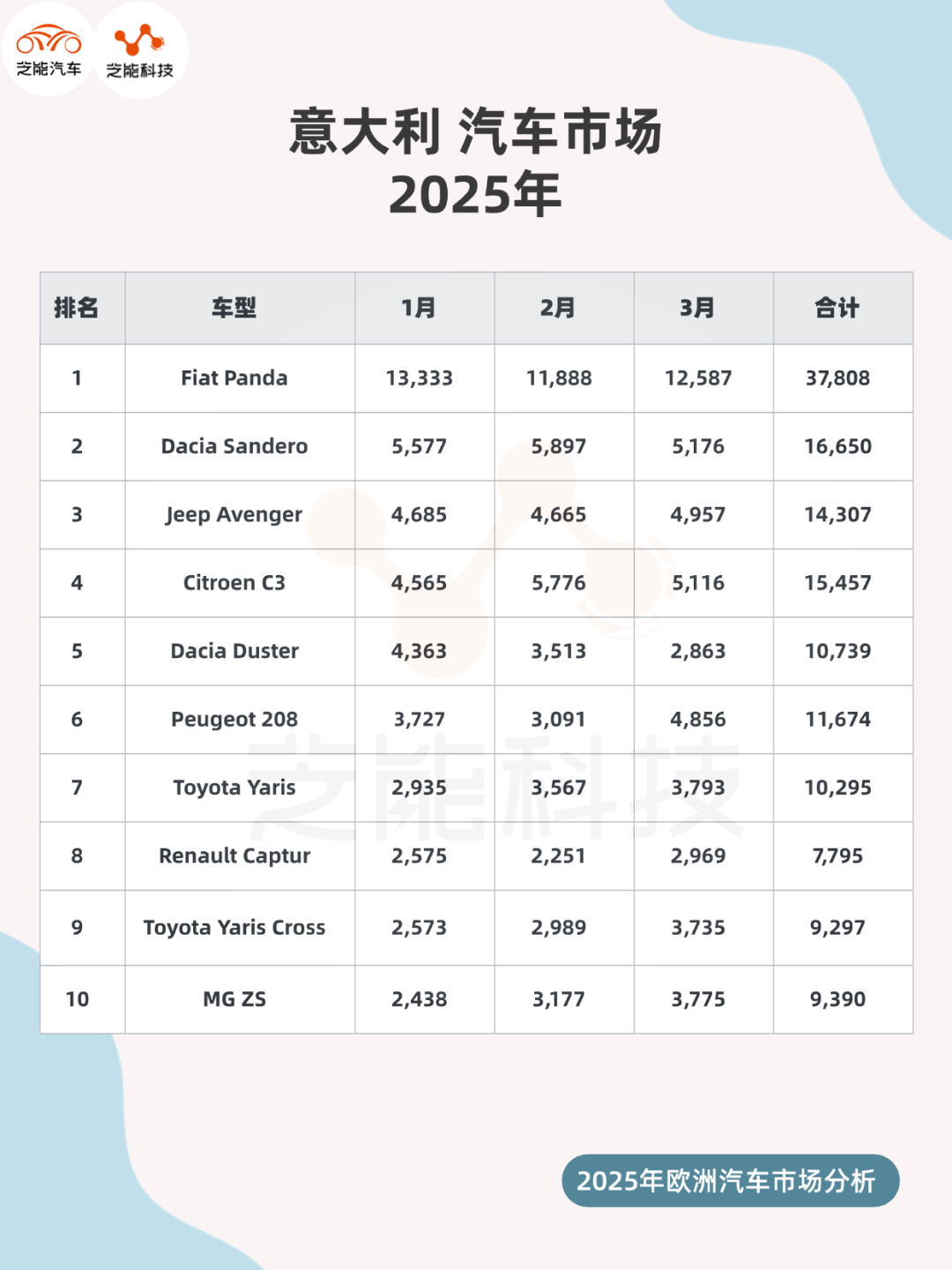

● The top four models in Italian sales remained consistent in March.

◎ The Fiat Panda firmly held onto the top spot with a 7.3% market share (up 6.6% year-on-year), maintaining a cumulative share of 8.5% for the year, underscoring its enduring popularity in the small car segment.

◎ Dacia Sandero, despite a 6.5% sales decline, retained its second-place position, facing stiff competition from Citroen C3 (+13.9%).

◎ Jeep Avenger (+51.8%) and Peugeot 208 (+51.2%) ranked fourth and fifth, respectively, indicating strong demand for SUVs and small cars.

◎ Opel Corsa (+73.6%), MG ZS (+37.2%), and Nissan Qashqai (+30.2%) were among the top 10 models, reflecting the diverse tastes of consumers.

◎ Fiat 600 saw a remarkable 5105.8% increase, ranking 15th, while MG 3 soared to 21st place, BYD Seal U rose to 34th, and Renault Symbioz entered the top 48 for the first time, demonstrating the rapid market penetration of new models.

● Chinese brand models performed exceptionally well.

◎ MG ZS entered the top 10 with a 37.2% sales increase, demonstrating its strong competitiveness in the compact SUV market. MG 3 ranked 21st, showcasing MG's diverse product lineup in the small car segment.

◎ BYD Seal U entered the top 50, ranking 34th. With its high cost-effectiveness and electrification features, the model has successfully attracted Italian consumers who value practicality and environmental sustainability.

● The competitive landscape of the Italian auto market is undergoing profound changes.

◎ While the Fiat Panda's leading position remains unchallenged, its modest growth suggests that traditional brands are under pressure to innovate.

◎ Toyota maintains its stability with its hybrid technology, while Volkswagen and Peugeot rely on SUVs and small cars to shore up their market positions.

◎ Chinese brands such as MG and BYD are entering the market with cost advantages and new energy technologies, swiftly gaining market share. MG's entry into the top 10 and BYD's explosive growth indicate that Chinese brands have transitioned from marginal players to mainstream competitors.

◎ Additionally, electric vehicle giants like Tesla (+51.3%) and emerging brands such as Cupra (+61.2%) are intensifying competition. The popularity of new energy vehicles and policy support will be crucial factors in determining the market's future.

Summary

In March 2025, the Italian auto market achieved a 6.2% growth, primarily driven by new energy vehicles. The standout performances of Chinese brands MG and BYD were the highlights of the month, with MG breaking into the top 10 for the first time and BYD experiencing a staggering 2452.9% surge in sales. These achievements underscore the success of Chinese automakers in technological innovation and market strategy.