Revolutionizing Car Maintenance: From "Tiger, Cat, Dog" Dominance to Comprehensive Competition

![]() 02/25 2025

02/25 2025

![]() 513

513

2024 marks a pivotal year of transformation for the automotive maintenance industry.

In October 2023, the Ministry of Commerce, alongside nine other departments, issued the "Guiding Opinions on Promoting High-quality Development of the Automotive Aftermarket." This document is more comprehensive and systematic than previous ones, emphasizing steady growth, continuous structural optimization, and improved standardization in the sector.

The rise in new energy vehicle (NEV) penetration is a significant backdrop for this policy. In 2024, NEVs surpassed gasoline vehicles in market share for the first time. With this shift, the automotive aftermarket must adapt accordingly.

Historically, the traditional internet car maintenance sector has been dominated by the "three giants": Tuhu Auto Service, Tmall Auto Service, and JD Auto Service. However, in 2024, new players emerged: Douyin's Tongchedi launched "Dongdong Auto Service," Huolala introduced "LaLa Auto Service," and Didi's Xiaoju Auto Service opened franchising.

CATL, a leading NEV supplier, also entered the market with "Ningjia Service," leveraging its battery expertise to quickly establish a presence. Traditional 4S dealerships are also enhancing their competitiveness by optimizing service models.

The 2024 transformation may signal the start of a new era for the automotive maintenance industry.

I. The Trillion-Dollar Automotive Maintenance Market: Challenges and Opportunities

China's car parc is expected to continue growing in 2024, underpinning the long-term potential of the automotive aftermarket. However, half of newly registered vehicles are NEVs, with their penetration rate increasing steadily. According to the Ministry of Public Security, China's car parc reached 353 million in 2024, including 31.4 million NEVs (up 53.85% year-on-year) and 321.6 million gasoline vehicles (up only 1.9% year-on-year).

While the gasoline vehicle aftermarket remains substantial, standardization issues persist. From a consumer perspective, transparency and trust are major concerns in vehicle maintenance and repairs.

Firstly, maintenance and repairs lack transparency. Ordinary car owners often lack automotive expertise, leading to issues like unnecessary part replacements, over-servicing for minor issues, and excessive maintenance. Consumers struggle to verify part sources or repair necessity.

Secondly, pricing is inconsistent. Different repair shops offer vastly different prices for the same service. For complex projects like engine or transmission repairs, the lack of unified standards allows shops to set prices arbitrarily, exploiting consumers' lack of knowledge.

With NEVs becoming more common, new challenges emerge, further complicating the market. Technological bottlenecks hinder NEV maintenance, especially regarding the three-electric system (battery, motor, electronic control). Access to fault codes, often restricted to authorized repair facilities, limits third-party repairs.

Li Yi, General Manager of Tmall Auto Service, believes that NEV makers may not fully open up authorized repairs like gasoline vehicles in the next decade. Instead, they might authorize more service providers in lower-tier markets while focusing on directly operated or tightly controlled channels in first- and second-tier cities.

What solutions exist for these old and new challenges?

II. Supply Chain Restructuring: Breaking the Automotive Maintenance Deadlock

The traditional gasoline vehicle spare parts market is characterized by long-tail products, involving tens of thousands of SKUs. Establishing a unified standardized system can address these pain points, building consumer trust.

Standardizing online product and service offerings allows users to compare prices before routine maintenance. For complex repairs, strict diagnostic processes and standards prevent "replace without repair" and "over-treating minor issues."

NEVs add complexity to repairs. While gasoline vehicle technology is mature, NEVs require specialized diagnostic equipment for electronic system failures. Chain operations offering economies of scale facilitate the implementation of a unified standardized system, aligning with industry trends.

Drawing from foreign experience, especially the U.S. market where four major chain enterprises account for 30% of the market share, Chinese chain enterprises like "Tiger, Cat, and Dog" are expanding through direct sales or franchising. Guolian Securities predicts that O2O-supported car maintenance enterprises will break regional boundaries, forming industrial scale and enhancing bargaining power.

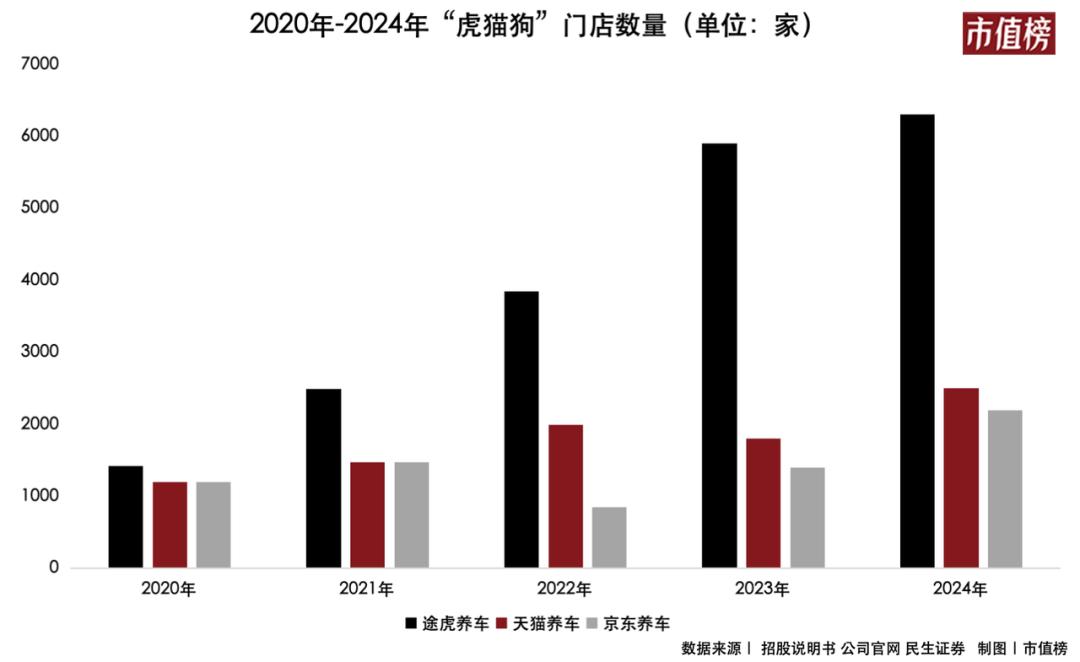

Tuhu Auto Service is expanding its service categories, focusing on car beauty and NEV businesses. By partnering with automakers, it has obtained three-electric repair qualifications and covered 73 cities by mid-2024, with a penetration rate of 8.4% among NEV users. Tuhu Auto Service now has 6,311 workshops, over 5,300 offering car beauty services.

Tmall Auto Service made NEVs a key focus in 2024, accelerating its layout in store models, talent certification systems, and OEM authorizations. As of December 2024, it had over 2,500 stores nationwide.

JD Auto Service's strategic focus on NEV sales and after-sales includes partnering with CATL for battery inspection and swapping services. JD Auto Service has 2,200 stores nationwide.

Traditional internet car maintenance enterprises continue to expand, actively engage in NEVs, and delve into the supply chain. Meanwhile, internet giants are also entering the automotive aftermarket.

In 2024, Douyin's Tongchedi established "Dongdong Auto Service" in Chongqing and opened franchising by mid-year. Huolala launched "LaLa Auto Service" in the first half of the year, beginning nationwide recruitment. Xiaoju Auto Service also opened franchising, providing NEV repair guidance to franchised stores.

CATL launched "Ningjia Service," leveraging its battery repair technology to enter the market. Even 4S dealership groups are expanding through localized service networks.

III. From Traffic Competition to "Retained Traffic Operation"

Numerous internet enterprises have attempted to enter the automotive maintenance sector, but success has been elusive without a robust offline presence. For example, Suning and Guazi launched car maintenance services but later failed.

New entrants are primarily divided into traffic factions (like Douyin, Huolala, and Didi) and industrial chain factions (like Ningjia Service and 4S dealerships).

These traffic-oriented giants leverage their large user bases and genuine traffic demands. Tongchedi Auto Service relies on Tongchedi APP, Douyin's local life, and e-commerce for traffic. LaLa Auto Service uses an "online lead generation, offline installation" model, tapping into Huolala's freight driver base. Xiaoju's franchising targets Didi's nearly 5 million drivers.

Converting these fixed maintenance and repair needs into offline services is crucial. Most cross-border internet giants adopt a light franchising model, where auto repair shops handle maintenance but are not deeply involved in store operations. While flexible, this model struggles with uniform service standards.

LaLa Auto Service requires only experience and a refundable deposit of 3,000 yuan for cooperation, with no unified storefront requirements. Xiaoju Auto Service provides electric vehicle repair skill guidance but adopts a low management fee + commission model, prioritizing traffic direction for economic benefits.

Tongchedi Auto Service has franchised and certified stores, with certified stores serving as traffic leads and franchised stores following a model similar to "Tiger, Cat, and Dog."

Under the light franchising model, service levels vary widely, hindering standardization. As a high-frequency consumer behavior requiring deep trust, car maintenance and repair need standardized, high-quality services to cultivate user loyalty.

Traditional internet car maintenance enterprises like "Tiger, Cat, and Dog" adopt direct sales and deep franchising models to build standardized products and services, continuously optimizing supply chain efficiency. With the increasing car parc and vehicle age, these enterprises can provide more cost-effective products and services, leveraging their large-scale supply chain advantages.

From standardized products such as tires and engine oil, the range has expanded to encompass tens of thousands of auto parts SKUs. This vast product variety enables users to fulfill most of their car maintenance needs on a single platform, thereby enhancing user loyalty. For instance, Tuhu's standardized tires and maintenance packages streamline users' decision-making process. By adopting a direct sales model through workshops, service quality is ensured, fostering a membership system that encourages repeat purchases. On the other hand, Alibaba collaborates with traditional supply chain manufacturers like Kangzhong, empowering them through digitalization.

Traditional internet car maintenance enterprises, including Tuhu, Tmall Auto Service, and JD Auto Service, all benefit from substantial traffic, a rapidly expanding network of stores, and promote "standardized services + supply chain integration" as a strategy to retain this traffic.

Even Tuhu, which initially had the least advantage in online traffic, has emerged as a leading player in the car maintenance market. This demonstrates that while traffic is indeed an advantage, in the long run, achieving deep-level chain operations and effectively enhancing efficiency are far more crucial factors for success.