AI: Catalyzing a Trillion-Dollar Ecological Transformation for Operators

![]() 02/25 2025

02/25 2025

![]() 546

546

In the relentless tide of digital transformation, the synergy between "AI + Operators" stands as a match made in technological heaven. This fusion not only redraws the value contours of the telecommunications industry but also emerges as the linchpin propelling us into the intelligent era. Leveraging the tripartite resources of "cloud, network, and device," operators inherently possess the DNA to spearhead the wide-scale deployment of AI—from vast data reserves, distributed computing grids, to ubiquitous touchpoints, all cultivating a fertile ground for AI's thriving development.

Concurrently, AI is poised to restructure and elevate the application landscapes, competitive moats, and business paradigms of operators.

01. Granular Scenarios: Transitioning from "Pipeline Providers" to "AI Ecosystem Foundations"

Firstly, in the realm of application scenarios, China's telecommunications industry has often been criticized as mere "pipeline providers." However, the introduction of DeepSeek enables the three major operators to take the lead in the proliferation of AI technology. On one hand, operators boast abundant network, data, and computing resources, forging a distinctive edge in computing-network convergence. They can offer intelligent and general computing, along with IDC resources, high-quality transmission networks, and computing grids. Anchored in this integrated infrastructure, operators can more effortlessly leverage their scale in large model training and inference, laying a robust resource foundation for their foray into these models. On the other hand, targeting individual, family, corporate, and governmental users with a vast user base, their information service businesses provide ample landing grounds for large models.

Public data reveals that China Mobile, China Unicom, and China Telecom collectively boast over 1 billion 5G mobile subscribers and over 20 million governmental and enterprise clients. Behind these figures lie myriad scenarios spanning finance, energy, governance, and healthcare. When these capillary-like touchpoints are infused with DeepSeek's AI capabilities, their explosive potential far surpasses market anticipations.

A profound shift lies in ecosystem co-construction. DeepSeek's open-source strategy aligns seamlessly with operators' "platformization" strategy. For instance, China Mobile has already implemented over 10,000 "AI+" projects across numerous industries. In "AI+New Products," the intelligent assistant "Lingxi" has been launched, accurately deciphering user needs and redefining the China Mobile APP's interactive experience. The "AI+5G" new calling service, with a user base exceeding 11 million, has established an intelligent calling ecosystem characterized by high definition, visualization, and interaction, winning the "SAIL Star Award." In "AI+Industry," a collaboration with China National Petroleum Corporation has unveiled the domestic-first "Kunlun" large model for the energy and chemical sector, covering 18 application scenarios across three major product lines. A partnership with top domestic hospitals has developed the "Jiutian" medical large model, comprehensively empowering various medical scenarios such as medical decision support, medical record documentation, and intelligent follow-ups. In "AI+Family," the "Xiaoyi Butler" intelligent agent has been created, enhancing the holistic experience of home entertainment, education, and health through multi-modal capabilities like distributed perception of home users.

02. Fortified Moat: Elevating "Cloud-Network Integration" to "Cloud-Network-Intelligence Integration"

Secondly, from a moat perspective, operators' competitive advantages will evolve into cloud-network-intelligence integration. Computing power was once operators' trump card against internet giants, and DeepSeek sharpens this edge. The three major operators hold 57% of the nation's data center share. When these resources converge with DeepSeek's hundred-billion-parameter model, the most immediate impact is on cloud services.

Operators' access to DeepSeek resources primarily focuses on operator cloud services. Specifically, China Telecom's Tianyi Cloud supports DeepSeek-R1 applications through multiple platforms, offering end-to-end services from deployment to inference and fine-tuning. China Unicom's Unicom Cloud has achieved adaptability of domestic and mainstream computing power to various specifications of DeepSeek-R1 models based on the "Xingluo" platform. China Mobile's Mobile Cloud is deeply entrenched in the domestic Ascend ecosystem across the entire chain, fully supporting DeepSeek, and achieving full version coverage, full size adaptability, and full functionality utilization.

Cloud services have emerged as a pivotal strategic business driving revenue growth for operators in recent years. According to the 2024 Communications Industry Statistics Bulletin released by the Ministry of Industry and Information Technology, emerging businesses, including cloud services, account for 25% of revenue. Specifically, for the three major operators, in the first half of 2024, Tianyi Cloud's revenue reached 55.2 billion yuan, a year-on-year increase of 20.4%; Mobile Cloud's revenue was 50.4 billion yuan, a year-on-year increase of 19.3%; and Unicom Cloud's revenue was 31.7 billion yuan, with a year-on-year growth rate as high as 24.3%. It is projected that in 2024, Mobile Cloud and Tianyi Cloud will exceed the hundred billion mark, while Unicom Cloud is expected to surpass 80 billion yuan.

Apart from cloud services, the large models independently developed by operators are absorbing DeepSeek's general capabilities through transfer learning. This "leveraging strength against strength" strategy not only avoids redundancy but also fosters cutting-edge applications in vertical domains. As the "speed of AI application proliferation surpasses expectations," operators have quietly transformed from computing power suppliers to intelligent capability exporters, upgrading "cloud-network integration" to "cloud-network-intelligence integration."

03. Reassessing Potential Value: When Public Utilities Acquire Technological Attributes

When operators' cloud services achieve intelligent upgrades, their business models and valuation levels are also poised for elevation.

Specifically, on one hand, it can propel the upgrade of cloud infrastructure: DeepSeek's computing power demand spurs the expansion of operators' cloud resources, driving revenue growth from underlying infrastructure services like servers, storage, and networks, while accelerating the collaborative deployment of edge computing and AI chips.

On the other hand, it can also propel SaaS service innovation: Building on DeepSeek's general capabilities, operators can swiftly construct standardized SaaS products such as intelligent customer service, marketing content generation, and industry data analysis, fostering differentiated service advantages and enhancing user loyalty. Furthermore, it can further enhance ecosystem construction. By opening the API interfaces of DeepSeek + cloud services, operators can attract developer ecosystems to settle in, expand solutions in vertical domains like smart cities and industrial internet, and realize the business model upgrade from resource leasing to technology empowerment.

Thus, as DeepSeek helps activate the data of hundreds of millions of dormant users, operators' DCF models have already integrated AI incremental factors. The article "Operators: AI Expected to Catalyze Reassessment of Computing Power Value" by Zheshang Securities also highlights that IDC and cloud computing businesses bring about a valuation reassessment for operators.

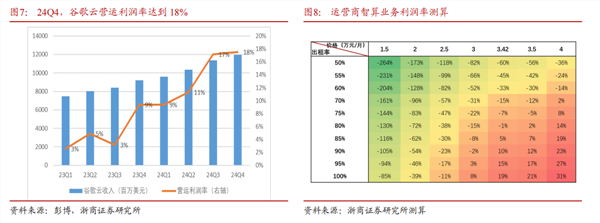

From a business segment standpoint, in terms of IDC business, Zheshang Securities believes that the financial models of the three operators and their assumptions about rack utilization and profitability indicate that under neutral assumptions, it is anticipated to bring market value elasticity of the order of 100-150 billion yuan to operators, and under optimistic assumptions, it is expected to bring market value elasticity of 180-250 billion yuan.

In cloud services, overseas cloud vendors are primarily valued using PS and EV/EBITDA. Taking Goldman Sachs' valuation of Amazon's cloud business as an example, it assigns AWS a valuation of approximately 7X based on PS. Zheshang Securities conservatively adopts a valuation discount and assigns operators' cloud business a PS of 3X, which is expected to bring market value elasticity of the order of 200-400 billion yuan to operators.

04. Conclusion: Above the Foundation, the Stars and Rivers Shine Brightly

In conclusion, the synergy between the three major operators and DeepSeek signifies the "awakening moment" for the telecommunications industry. As traditional infrastructure giants are endowed with AI wings, the energy they unleash not only redefines their own valuation but also propels society towards the intelligent era.

Looking back from the threshold of 2025, this collaboration may resemble the operators' first telegraph line and optical fiber, ultimately etched in history as the prologue to a new round of industrial revolution. In this journey, the only certainty is that when AI computing power flows like water, electricity, and gas, every ordinary individual will become a witness and beneficiary of this transformative era.

- End -