Tesla's Net Profit Slumps 51% Amidst Stagnant Pure Electric Sales Growth

![]() 02/06 2025

02/06 2025

![]() 407

407

As many individuals drove their newly acquired vehicles during the Spring Festival holiday, Tesla released its financial report for the fourth quarter and full-year 2024 on the second day of the Lunar New Year. The company reported total revenue of $97.69 billion, marking a modest 1% year-on-year increase. However, net profit attributable to ordinary shareholders fell significantly by 53% to $7.091 billion, down from $14.997 billion in fiscal year 2023. This underperformance could be interpreted as an inauspicious start to the year.

Prior to the Spring Festival, Tesla announced its first annual sales decline in over a decade. To preemptively capitalize on the "Spring Festival period" and ignite a price war, major automakers have introduced preferential policies for new car purchases.

In contrast to other manufacturers, Tesla opted to increase the price of its new Model Y instead of offering discounts, sparking widespread criticism. Nonetheless, this decision did not dampen the popularity of the new Model Y, which received 60,000 orders within a week of its launch, despite showrooms being devoid of actual cars. This not only underscores Tesla's brand appeal but also demonstrates the substantial consumption potential within the high-end pure electric vehicle market.

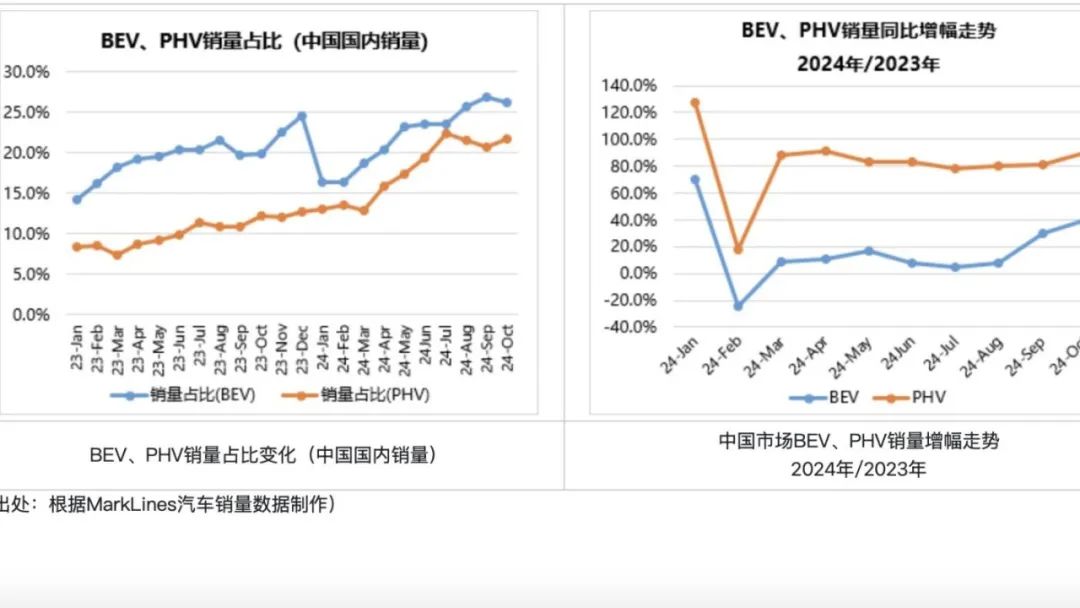

Last year, plug-in hybrid models accounted for over 40% of new energy vehicle sales, with a growth rate far outpacing that of the pure electric market. Authoritative institutions predict that by 2025, the proportion of plug-in hybrids and extended-range vehicles in the new energy vehicle market will approach 50%.

Before the launch of the new Model Y, Tesla experienced its first sales decline in a decade. Some attribute this to the lack of updates to its core products, which may have diminished their appeal, while others argue that the pure electric route has hit a bottleneck. In the Chinese market, Tesla and NIO remain the only two automakers committed to the pure electric path. Even Li Xiang, CEO of NIO, lamented, "High-end pure electric cars are extremely difficult to sell, and without a robust charging network, promotion becomes challenging."

Consequently, nearly all automakers are now incorporating fuel tanks into their new energy vehicles. Manufacturers in the internal combustion engine industry, once concerned about obsolescence, are now busier than ever...

Pure electric cars face sales hurdles, while internal combustion engines regain popularity

When analyzing the new energy vehicle market, it becomes evident that the growth rate of pure electric vehicles has slowed this year. Combining pure electric cars with sedans further exacerbates the challenge, and integrating high-end, pure electric, and sedan elements makes it virtually impossible to create a successful model.

Despite accounting for 60% of the new energy market, pure electric vehicles still possess a substantial market base. Among the top 10 selling pure electric models in 2024, with the exception of Tesla's Model Y and Model 3, most are compact and small cars priced below 150,000 yuan.

Over the past two years, battery costs have plummeted. Automakers aiming to gain a price advantage in the market have introduced new pure electric vehicles in lower price brackets, such as BYD's Haiou, Dolphin, Wuling Bingguo, and Changan Lumin.

Two years ago, the domestic new energy vehicle market began transitioning from a "dumbbell" shape, characterized by "large ends and a small middle," to a "spindle" shape with "a large middle and small ends." This shift indicates that new energy vehicles priced between 100,000 and 200,000 yuan have gradually become mainstream products, experiencing increasing sales. However, the real turning point came when BYD's DM-i technology brought the phenomenon of "electricity cheaper than oil" to the 100,000-yuan market. As major automakers successively launched new plug-in hybrid and extended-range vehicles, the growth rate of the plug-in hybrid market has outpaced that of pure electric vehicles.

Upon closer inspection, there are few popular pure electric models in the mid-size sedan and mid-to-large market segments. In other words, above the 150,000 yuan price point, pure electric vehicles are less successful compared to the low-price market.

These observations are corroborated by numerous micro-level insights. An engineer from an international Tier 1 supplier shared with Lucar that five years ago, many of his friends who were developing engines switched to the electric vehicle industry, with some now expressing regret. "Many automakers are increasing their investment in plug-in hybrid systems and better range extenders, leading to improved treatment of engine talents. Additionally, the core three-electric components of electric vehicles are nearing parameter ceilings, whereas there is still room for engine efficiency improvements."

Li Ming (pseudonym), who works for an oil tank enterprise in Jiangsu, observed a surge in the number of designated high-pressure tanks for plug-in hybrids over the past year or two, leaving them overwhelmed with orders. Initially fearing unemployment due to the rise of new energy, he is now busier than ever. "In the past two years, the demand for high-pressure tanks for plug-in hybrids has skyrocketed, and we're struggling to keep up with orders. I thought our industry was on the brink of collapse, but now I'm busier than ever," he said, adding that he had heard that Bosch had set a new business record this year, with its engine-related business booming.

Do engines justify premium pricing?

In the high-end pure electric market, Tesla stands out as a unique entity, adhering to pure electric technology without compromising on hybrids. The popularity of the new Model Y proves that consumers remain enthusiastic about pure electric products. However, while Tesla thrives, other pure electric models competing in the same segment struggle to keep pace. Models such as the Lantu Zhiyin, AITO 07, IM Motors LS6, Zeekr 7X, IM Auto R7, and Ledao L60 all target the Tesla Model Y, yet Tesla's sales remain largely unaffected.

As we move up the market hierarchy, pure electric vehicles perform increasingly poorly. Monthly sales data for 2024 reveals that pure electric models priced above 400,000 yuan with sales exceeding 10,000 units include the Zeekr 009, AITO M9, and Lixiang MEGA, each with annual sales of approximately 10,000 to 20,000 units. Among pure electric models priced above 300,000 yuan, NIO leads with a total of 102,000 new vehicle sales; however, after the BaaS program, prices are generally within the 300,000 yuan range. Other notable pure electric models include the Xpeng X9, which sold 21,000 units.

In the passenger vehicle market above 300,000 yuan, besides BBA's main fuel models, the AITO M9 and Lixiang L7 rank among the top ten in sales. This indicates that in the segment above 300,000 yuan, models other than pure electric vehicles continue to dominate.

In essence, while Tesla serves as a "good student" in the pure electric field, copying its strategy may not necessarily yield positive results. Instead, plug-in hybrids and extended-range vehicles emerge as powerful tools for achieving high premiums.

From a new car layout perspective, since 2023, a significant number of plug-in hybrid (including extended-range) models have been introduced in the mid-to-large car segment. Examples include eight new models such as BYD Song PLUS, BYD Song Pro, Lixiang L7, Lixiang L6, and AITO M9, nearly all of which have become hit models with monthly sales exceeding 10,000 units, driving rapid expansion of the entire PHEV market.

Terminal sales data indicates that in the mid/large car market, the sales growth rate of plug-in hybrids significantly outpaces that of pure electric vehicles. This trend has accelerated notably in 2024, with a remarkable year-on-year increase. The market share of plug-in hybrids in this segment has expanded from approximately 20% to 35%.

Concurrently, the small and compact car markets, which are suitable for pure electric powertrains, have witnessed few new model launches over the past two years, maintaining general market stability.

For automakers, incorporating fuel tanks offers another advantage: they can invest more in intelligent configurations. Taking the extended-range route as an example, by increasing battery capacity, automakers enable extended-range vehicles to offer a significant advantage: extended driving range, alleviating range anxiety for drivers, especially during long-distance travel or in areas with inadequate charging facilities. In terms of manufacturing costs, extended-range vehicles are typically cheaper than pure electric vehicles of the same class due to their moderate battery capacity and the configuration of generators and electric motors that do not need to meet the stringent requirements of plug-in hybrid vehicles.

With the extended-range solution, which carries relatively lower costs, automakers can dedicate more resources to the design of in-car intelligence and comfort features, such as car refrigerators, televisions, luxury sofas, or advanced intelligent systems. These features are crucial in creating a premium experience.

Therefore, we can confidently predict that from 2025 to 2027, the fastest-growing segment will revolve around new energy vehicles equipped with engines, particularly extended-range hybrids. The pure electric market is entering a plateau phase, and even Tesla, with weekly orders of 60,000, may struggle to propel it forward.