Car industry turmoil, epicenter in China

![]() 11/28 2024

11/28 2024

![]() 472

472

Introduction

Introduction

The entire automotive supply chain is undergoing a new round of differentiation, marked by preemptive moves and lags, rises and growing pains.

'All global automakers are under pressure. The current competitive environment is extremely tough, but we still managed to turn a profit.'

These were the opening words of Elon Musk during Tesla's Q3 earnings call. Having just distributed million-dollar bonuses to American voters and received good news about profitable earnings, Musk could hardly conceal his excitement.

Faced with the performance results for July to September this year, most automaker CEOs had mixed feelings. Volkswagen CFO Arno Antlitz said that the company's performance reflected the challenging market environment, and it was necessary to significantly cut costs and improve efficiency. After announcing its latest financial report, Nissan directly laid off 9,000 employees and cut production capacity by 20%.

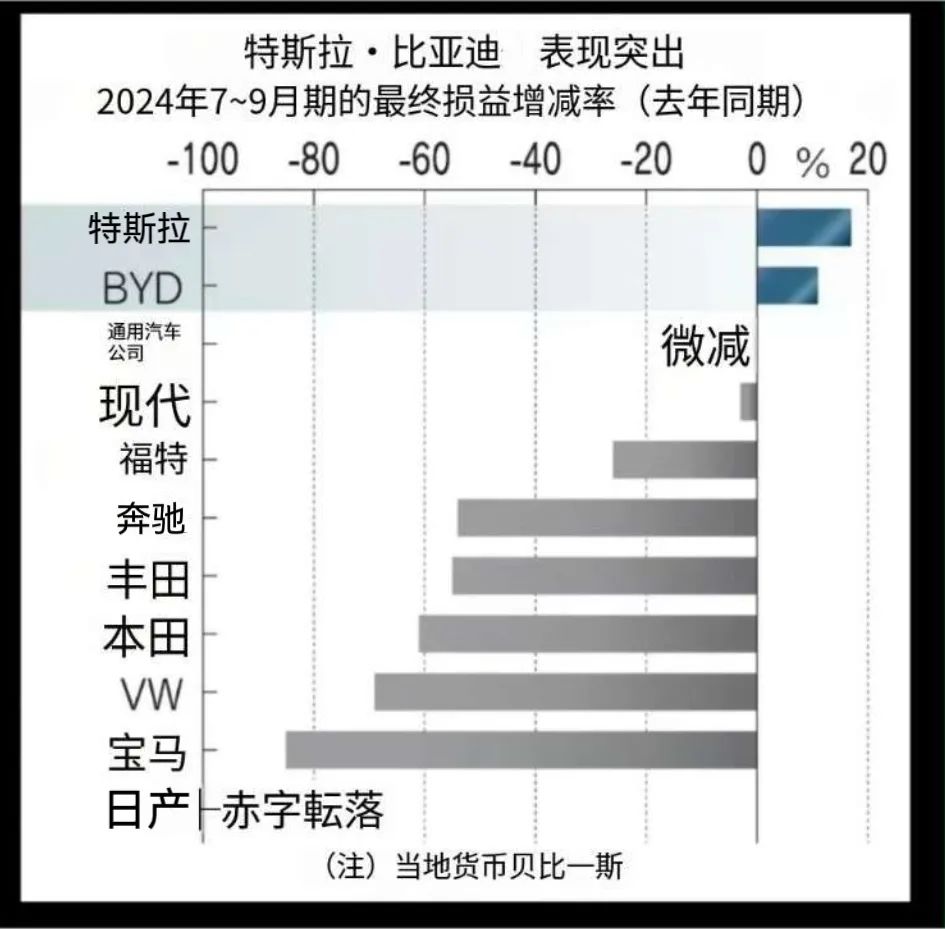

The Nikkei Asian Review analyzed in detail the third-quarter financial reports of 11 automakers. As the shift to electrification advances, pioneers like Tesla and BYD have excelled, while most traditional automakers have struggled. The entire supply chain is undergoing a new round of differentiation, marked by preemptive moves and lags, rises and growing pains.

Overall, among the world's top 11 automakers, only Tesla and BYD reported profit growth from July to September, with increases of 17% and 11% year-on-year, respectively. Additionally, while Toyota topped the profit list, its profits declined by a staggering 55% year-on-year. Nissan reported a final loss of 9.3 billion yen, prompting management to voluntarily take pay cuts. German manufacturers such as Volkswagen, Mercedes-Benz, and BMW also experienced profit declines of over 50%.

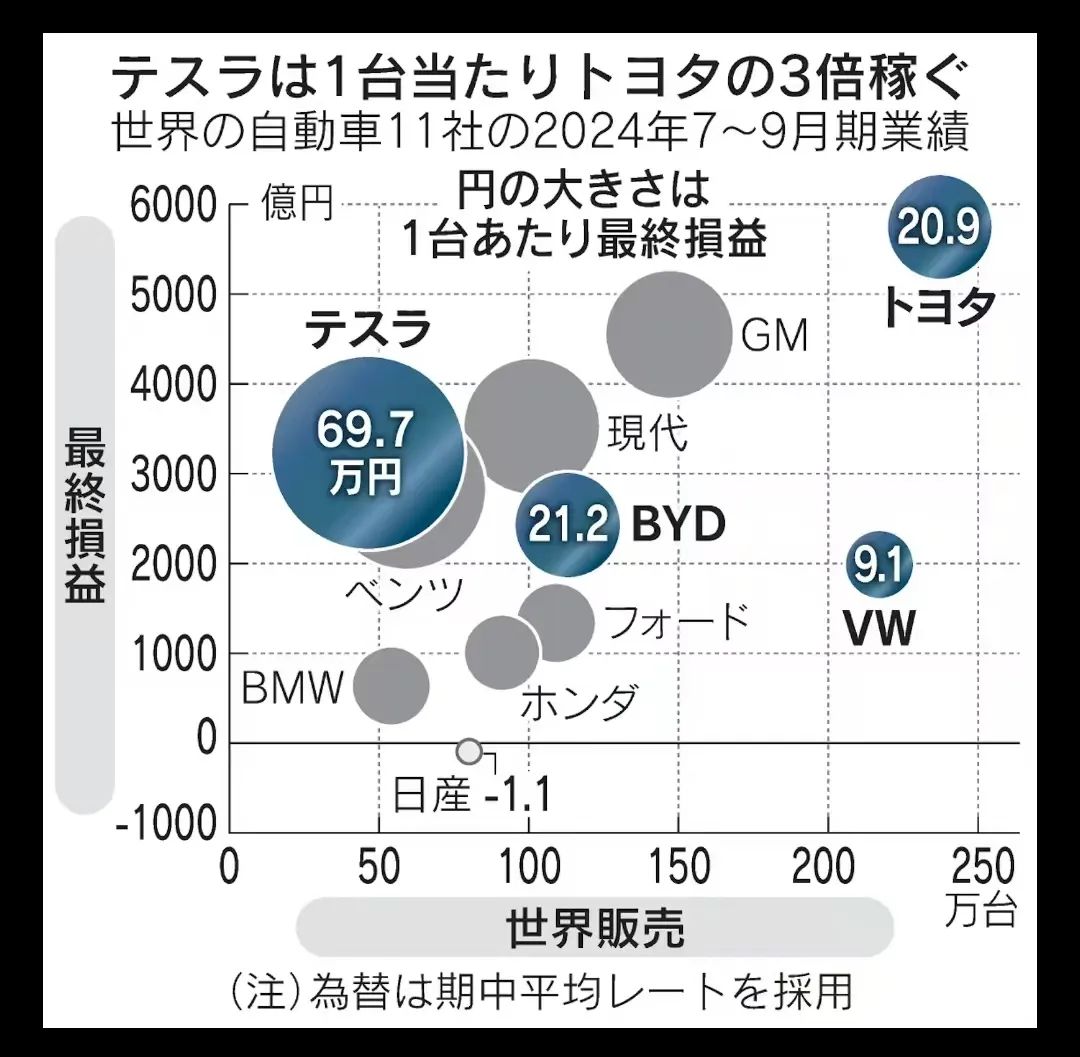

Notably, in terms of profit per vehicle, Tesla ranked first, with 690,000 yen, ahead of Mercedes-Benz's 470,000 yen and more than three times that of Toyota's 200,000 yen.

Epicenter in China

'Mercedes-Benz slashes prices by 2 million yen.'

(Equivalent to nearly RMB 100,000)

Faced with significant price reductions by luxury brands in the Chinese market, the Nikkei Asian Review used a bold subheading to express shock at the reshaping of industry order.

With China as the 'epicenter,' the global automotive industry is undergoing an unprecedented 'great shock.' Leveraging the shift to electrification, Chinese companies like BYD have risen rapidly, beginning to seize market share from traditional multinational automakers. Even Mercedes-Benz, once the iconic representative of luxury car brands, has had to lower its prices to increase sales volumes.

According to statistics from the British research firm GlobalData, the demand for new electric vehicles in the Chinese market has increased from 10% in 2021 to 24% in 2024. With the help of a series of subsidy policies, China's electrification process has advanced rapidly, while the sales share of traditional gasoline vehicles has dropped from 80% to 48%.

In China, BYD has emerged as a major force driving the popularization of new energy vehicles. In the third quarter of 2024, BYD's global sales increased by 38% year-on-year, reaching 1.13 million vehicles. Among them, pure electric vehicle sales increased by 3% to 440,000 units, while plug-in hybrid sales surged by 76% to 680,000 units.

In terms of global sales, BYD jumped from 8th place in the same period last year to 4th place globally, surpassing automakers like Ford, Hyundai, Honda, and Nissan. BYD's strong market performance in recent years has caught European and Japanese automakers off guard, and as competitors, they generally feel immense pressure.

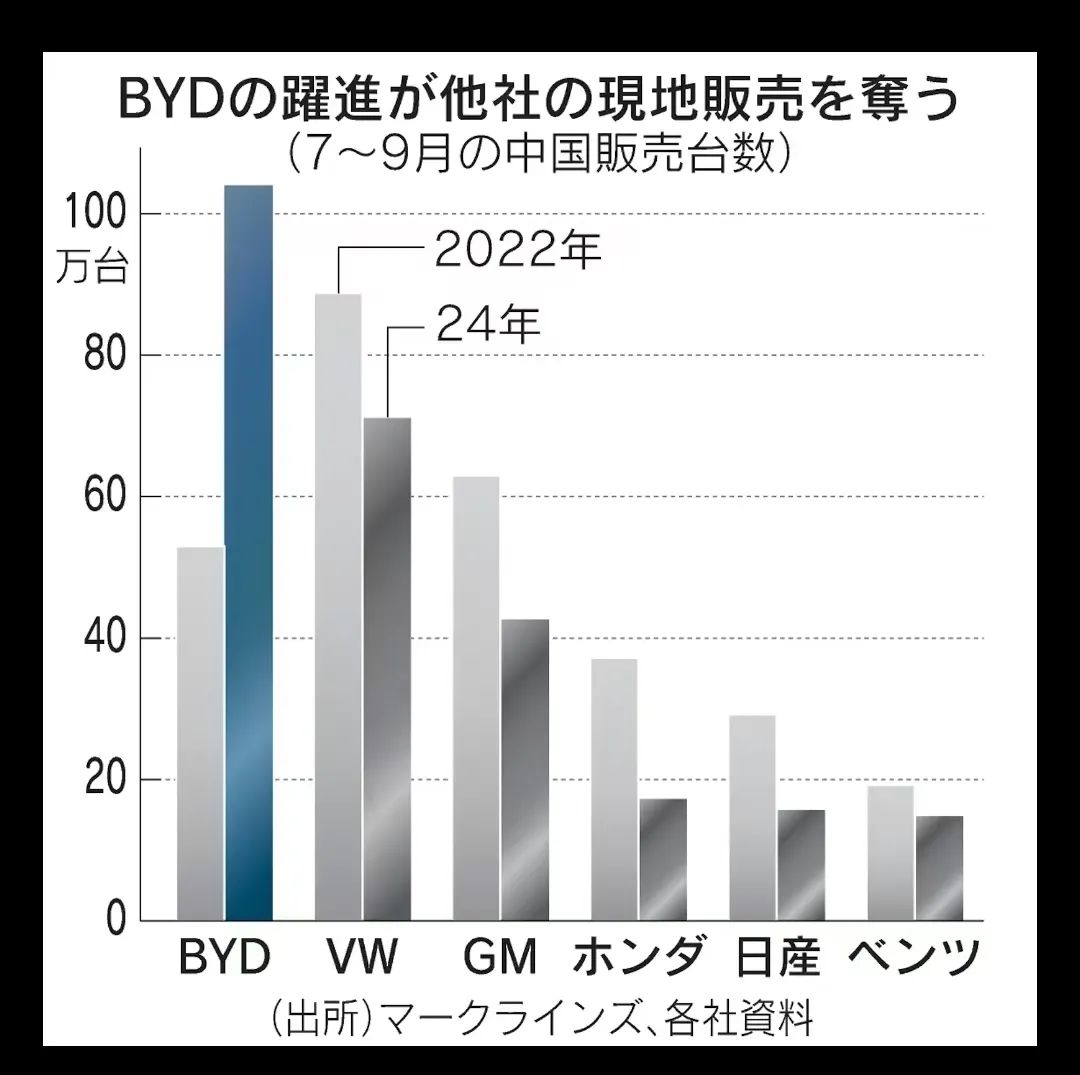

According to the Nikkei Asian Review, compared to the same period in 2022, sales of Volkswagen and Mercedes-Benz declined by about 20%, while Nissan's sales dropped by nearly 50%, and Honda's sales declined by more than 50%. Honda Executive Vice President Shinji Aoyama directly stated during the earnings call that the company's industry decline was far faster than expected, and management must acknowledge this fact.

Volkswagen has also been significantly impacted.

Over the past 40 years, Volkswagen has been one of the leaders in the Chinese market. Especially in 2017, when China sold a total of 28 million vehicles, making it the world's largest automobile production and sales country, Volkswagen Group's annual sales in China also exceeded 4 million units, accounting for 40% of the entire group's annual sales.

In the first three quarters of this year, Volkswagen's car sales in China decreased by 10.2%, erasing all gains from sales growth in other regions worldwide.

Moreover, Volkswagen's plight in China is affecting the entire globe. The group's sales have declined, leading to a significant drop in profits. To address the current difficulties, Volkswagen has closed at least three factories in its German headquarters and proposed a restructuring plan involving tens of thousands of layoffs.

U.S. Inventory Surges 1.4 Times

Historically, North America has been the most profitable market for Japanese automakers. However, in the past third quarter, with the exception of popular hybrid vehicles, growth in other models has stagnated.

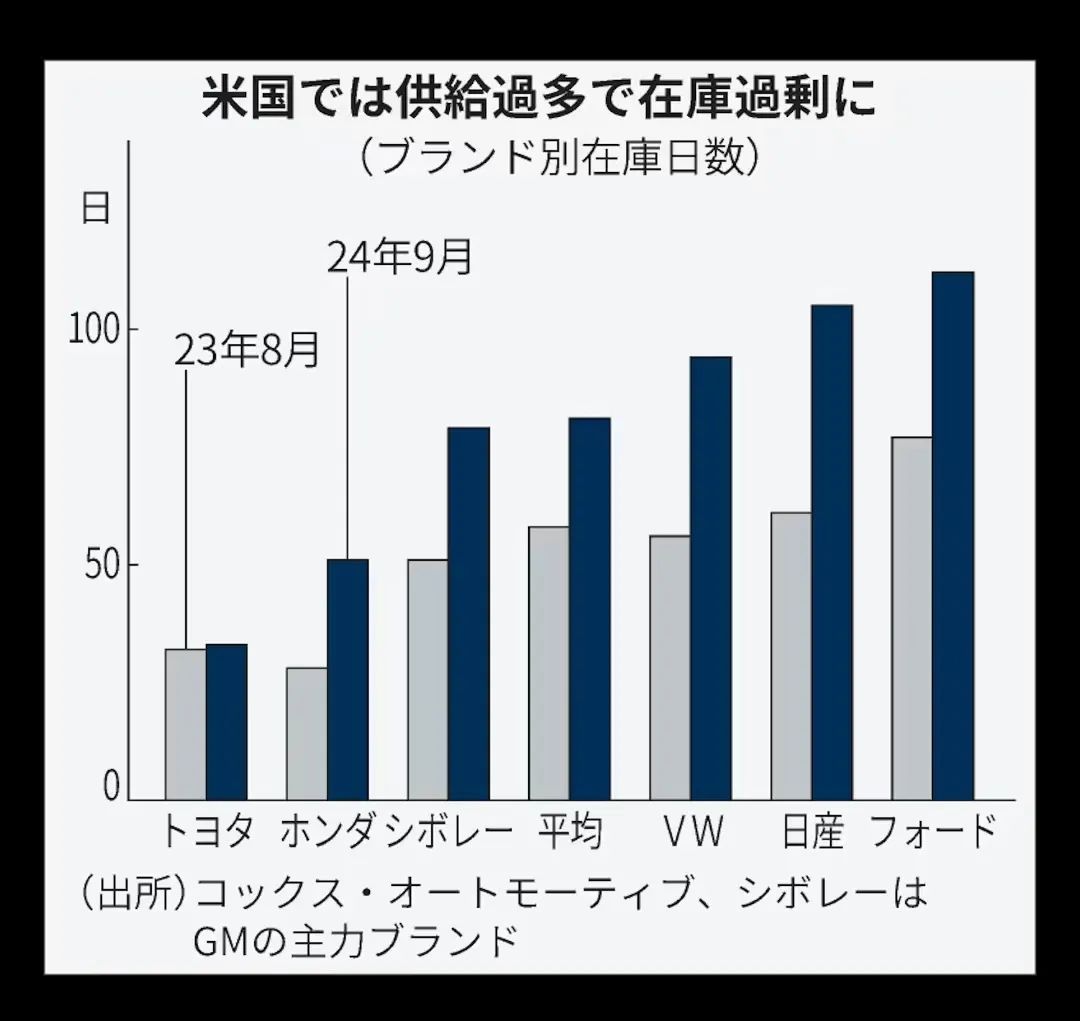

In the U.S. market, the surge in inventory has become increasingly pronounced. To reduce inventory, automakers have had to offer more incentives to dealerships or increase car loan incentives.

According to data from research firm Cox Automotive, as of the end of September 2024, the days' supply of new cars in the U.S. reached 81 days, a 40% increase compared to 58 days in August last year. To sell cars, incentives per vehicle have also continued to rise, currently reaching $3,500, a 50% year-on-year increase.

In fact, the use of incentives in the North American market began as early as around 2021, when the COVID-19 pandemic was at its peak. Japanese automakers frequently stimulated consumption in the U.S. According to the Nikkei Asian Review, due to a lack of hybrid models in the North American market, Nissan's inventory days reached 105, and incentives increased to over $4,500, yet it still incurred losses.

In the short term, the predicament in the North American market has further deepened Nissan's downturn. In the North American market, sales of pure electric vehicles have slowed, while sales of hybrid vehicles are growing. Nissan previously prioritized pure electric vehicles in North America, and is now facing passive competition.

Looking at Nissan's top 10 best-selling models in the U.S., only one new model was launched in 2022 and 2023 combined. Due to delays in new model updates and a decrease in the number of best-selling models, the number of models achieving monthly sales exceeding 1,000 units has dropped from 19 in 2014 to 12 currently.

Shortage of popular new models and sales resistance for pure electric vehicles have left Nissan with no choice but to rely on sales incentives and price reductions, leading to a significant drop in profits.

Toyota's situation is slightly better, thanks to several competitive hybrid models. The company's U.S. inventory days are 33, with incentives of around $1,450.

It is worth mentioning that North America has always been Honda's 'profit cow.' It is precisely this stable market that has allowed Honda to achieve remarkable results in the past six months. Not only have sales of gasoline and hybrid vehicles been strong, but sales of pure electric vehicles have also increased by 64,000 units compared to the same period last year.

Profitability Challenges Behind High Investments

Behind profitability lie the pressures of market sales and the heavy burden of investments in electrification. Stellantis CEO Carlos Tavares once said in an interview with the Financial Times that the long-term shift to electrification would be a huge trap for automakers, and dual investments in gasoline and electric vehicles would lead to a cliff-like decline in profitability.

The Nikkei Asian Review understands that in the current market environment, it is already difficult to significantly increase revenue. When profitability declines, the development of new vehicles and technologies can also be easily restricted.

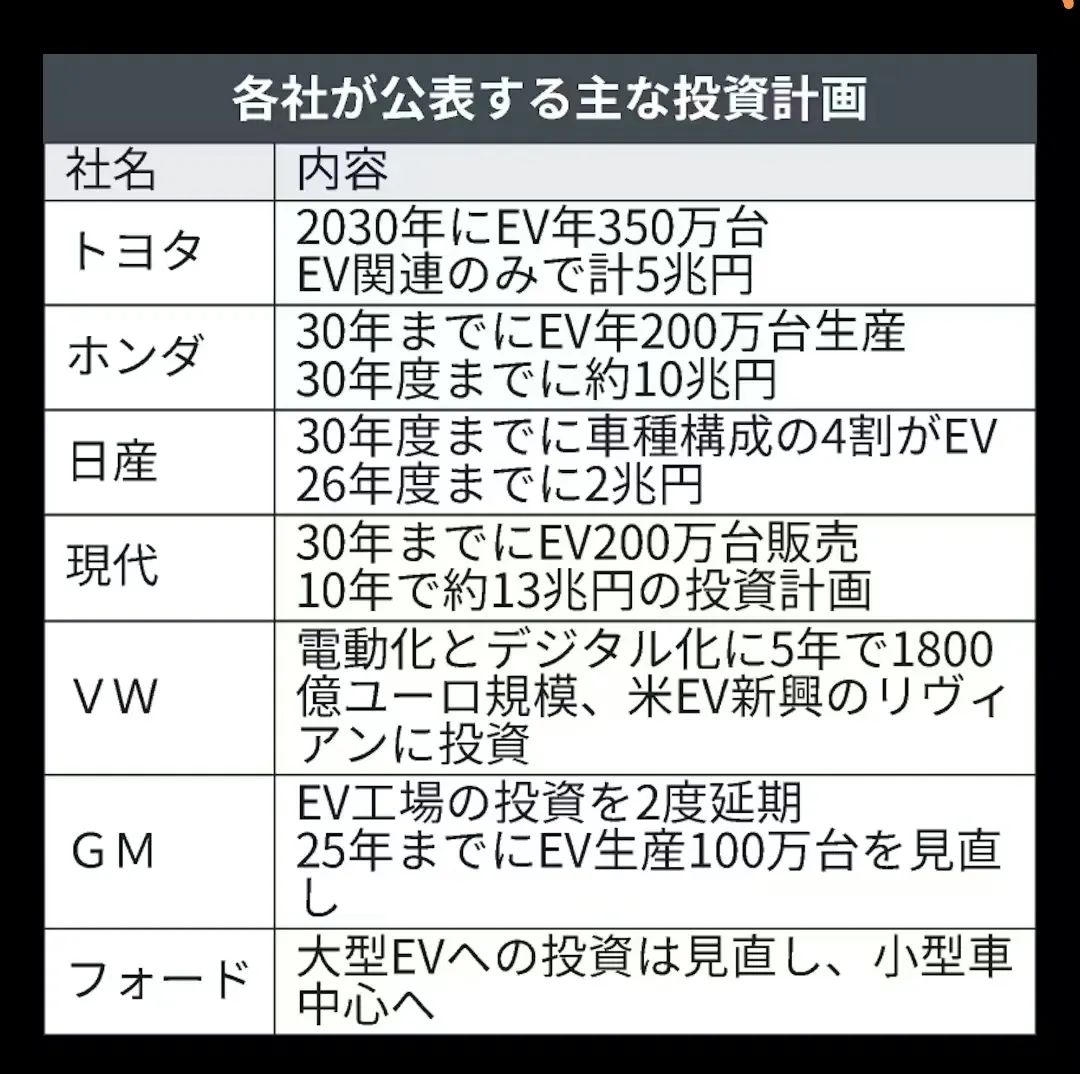

Honda plans to invest 10 trillion yen by 2030 in electrification and software development. However, in the just-concluded third quarter, high R&D expenses directly reduced Honda's operating profit by 53 billion yen.

Considering the massive investments required for the new four modernizations (electrification, intelligence, networking, and sharing), General Motors has postponed the investment in its electric pickup truck factory twice and re-evaluated its established goal of producing 1 million electric vehicles by 2025. Ford has revised its strategy in practice and has decided to re-evaluate the development of large electric vehicles, instead focusing on investments in the electrification of small vehicles.

According to QUICK FactSet data, from July to September 2024, the sales revenue of the world's 11 major automakers only achieved a profit margin of 3.8%, a decrease of more than 3 percentage points compared to 7% in the same period last year.

Among global enterprises, Tesla and BYD, which have outstanding profit performance, share commonalities in their profitability.

The Nikkei Asian Review believes that since its inception, Tesla has focused on the development of pure electric vehicles, without any baggage from the gasoline vehicle era. BYD initially focused on battery manufacturing as its business center, which is a core asset in the electric vehicle era. Today, both companies have entered the harvest period of investments in electrification.

In addition to China, other emerging markets are also putting pressure on multinational automakers. Chinese automakers are accelerating their 'going out' strategy, shifting domestic production capacity to exports. As Nissan CEO Makoto Uchida said during the earnings release, Japanese companies' businesses in Southeast Asia, the Middle East, and South America are also affected by Chinese influence.

Within the industry, the automotive sector is also experiencing the 'smiling curve' phenomenon, similar to what happened in industries like electronics in the past. The so-called 'smiling curve' in the automotive industry refers to the gradual shift of industrial added value and profitability towards the upstream and downstream of the supply chain. For example, vehicle software is becoming a crucial factor affecting vehicle functionality.

Software-defined vehicles (SDV) have gained widespread acceptance. To seize a share of the intelligent market, automakers are either developing software in-house, investing or acquiring stakes, or forming alliances to strengthen cooperation and explore new opportunities at the software level. This is a prerequisite for the long-term influence of automakers in the new era.