Annual revenue of 1.034 billion yuan, 61-year-old female CEO leads superchip IPO

![]() 11/29 2024

11/29 2024

![]() 369

369

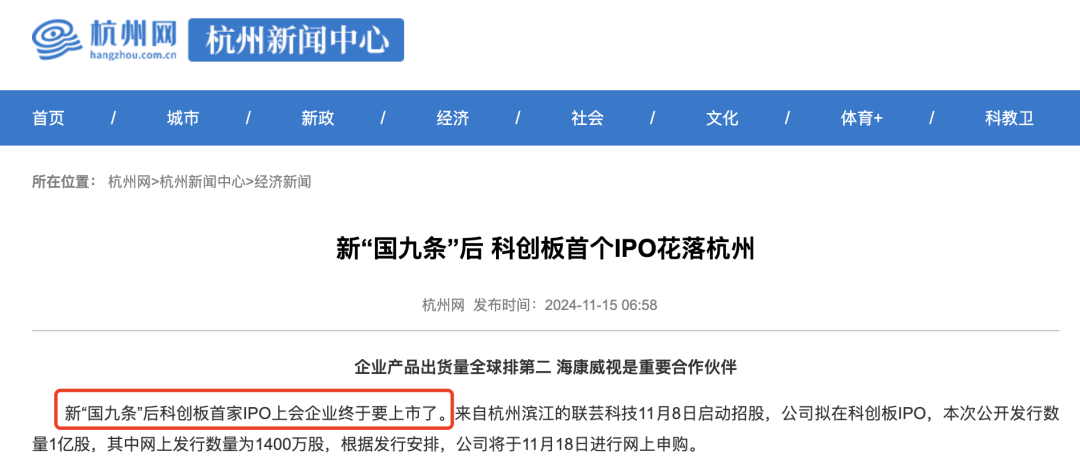

Good news of IPO from Union Memory Technology in Binjiang, Hangzhou.

On November 18, Union Memory Technology (Hangzhou) Co., Ltd. (SH688449) began subscription and will be listed on the STAR Market of the Shanghai Stock Exchange.

Union Memory Technology, founded by 61-year-old female entrepreneur Ms. Fang Xiaoling, focuses on the research and development and industrialization of data storage controller chips and occupies an important position in the global market.

Fang Xiaoling's entrepreneurial journey

Ms. Fang Xiaoling, born in Hangzhou in 1963, is a typical "academic superstar" entrepreneur.

Fang Xiaoling, image source: Shanghai Securities News

After obtaining her bachelor's and master's degrees in the Department of Science and Instrumentation at Zhejiang University, she went to the United States for further study and obtained her Ph.D. in Electronic Engineering from the University of Utah in 1995.

During her stay in the United States, she served as a principal engineer at Sonic Innovations and later co-founded JMicron, where she served as the general manager of the US region.

In 2014, she chose to return to China to start her own business, founding Union Memory Technology in Binjiang, Hangzhou, and serving as its chairman, focusing on the research and development and industrialization of data storage controller chips.

In just a few years, Fang Xiaoling led Union Memory Technology to achieve a leap in operating revenue from 177 million yuan to 1.034 billion yuan, with an average annual compound growth rate of 33.65%.

About Union Memory Technology

Founded in November 2014 in Binjiang, Hangzhou, Union Memory Technology focuses on data management, general IP, and SOC chips, and has launched a series of data storage controller chips, AIoT signal processing, and transmission chips.

Core Business

Union Memory Technology specializes in data storage controller chips, which accounted for 63%-83% of its revenue in the past three years. These chips are known as the "brain" of storage devices, responsible for managing and controlling data storage, retrieval, and writing operations.

Operating Revenue

From 2021 to 2023, Union Memory Technology achieved operating revenues of approximately 579 million yuan, 573 million yuan, and 1.034 billion yuan, respectively, with corresponding net profits of approximately 45.1239 million yuan, -79.1606 million yuan, and 52.2296 million yuan.

Market Share

In 2023, Union Memory Technology accounted for 22% of global shipments of SSD controller chips, ranking second globally as an independent SSD controller chip supplier.

In the data storage controller chip industry, Union Memory Technology competes with companies such as Silicon Motion, Marvell, Realtek, InnoGrit, and Get a little bit for market share.

Upstream and Downstream Partners

Union Memory Technology's upstream suppliers are primarily foundry fabs, such as TSMC, which is one of the company's main partners. Downstream customers include Longsys, Biwin, Yangtze Memory Technologies, etc., with the largest customer accounting for over 30% of orders.

Shareholder Structure

The largest shareholder of Union Memory Technology is Hangzhou Hongling Investment Partnership (Limited Partnership), and Tianyancha shows that its actual controller is Fang Xiaoling.

Notably, the shareholder list of Union Memory Technology also includes "security leader" Hikvision. According to the prospectus, Hikvision directly holds 22.43% of shares, making it the second-largest shareholder; Hikvision's wholly-owned subsidiary Hikvision Technology holds 14.95% of shares, making it the third-largest shareholder, with a combined shareholding ratio of 37.38% from Hikvision.

Market Demand

In the AI server storage market, the global size was 7.6 billion dollars in 2023 and is expected to expand to 49.24 billion dollars by 2026. The average size of the relevant market in mainland China is 2.12 billion dollars, and it is expected to increase to 11.43 billion dollars by 2026, indicating a continuous rise in demand for storage chips in the AI server sector.