Competitive Q3: Optimist Li Bin, "The Strongest Ever" He Xiaopeng, Li Xiang Drives a Ferrari

![]() 11/27 2024

11/27 2024

![]() 612

612

NIO and XPeng Aim for Profitability

Author|Liu Yajie

Editor|Qin Zhangyong

Dropping the burden and illusions, the only way out for new energy vehicle (NEV) startups now is to make money to survive.

Third-quarter financial reports have been released, and most of the official statements are polished. For example, Li Auto boasts eight consecutive quarters of profitability, XPeng follows Xiaomi's lead by calling it the "strongest ever" financial report, and NIO even gives an exciting projection—

Doubling sales in 2025 and achieving full profitability in 2026.

Returning to the essence of business, Li Auto is arguably the most thriving. Relying on its extended-range technology, it started making money early on to support its family and gradually emerged from the shadow of the MEGA failure after returning to its area of expertise.

As the recognized top three NEV startups, the gap between NIO, XPeng, and Li Auto has gradually widened, with significant differences in their strategic approaches and revenue models. Apart from Li Auto, both NIO and XPeng lose money on every car sold. Due to NIO's aggressive marketing and the launch of its new Lexdao brand, its quarterly loss even exceeded 5 billion yuan again.

Regardless, sales volume is always the key to winning.

01 Gradually Finding the Rhythm

The third quarter is a period of explosive growth for NEV products. We once conducted a survey and found that in September alone, 54 new car models, including both gasoline and electric vehicles, were launched or unveiled, with a ratio of 2:3 for oil-electric new cars. At the same time, automakers engaged in fierce price wars, with competition intensity comparable to a brawl.

Understanding the industry background makes the performance of NEV startups even more remarkable.

Li Auto remains the "elder brother," delivering 152,800 vehicles in the third quarter, a year-on-year increase of 45.4%. The best-selling model is the lowest-priced L6. Li Xiang revealed that in the six months since its launch, cumulative deliveries of the Li Auto L6 have exceeded 139,000 units, but demand still exceeds supply, and the factory even needs to expand production during the 2025 Spring Festival.

Coupled with breakthroughs in intelligent driving this year, Li Auto's "head effect" has become increasingly apparent. In the market segment above 200,000 yuan, its market share has increased from 14.4% in the second quarter to 17.3% in the third quarter of this year.

XPeng delivered 46,500 vehicles during the same period, a year-on-year increase of 16.3%, which is very close to the combined delivery volume of the previous two quarters.

Unlike Li Auto, XPeng rose to prominence in the second half. Its biggest contributor was the MONA M03, priced starting at 119,800 yuan, which enabled XPeng to achieve monthly sales of over 20,000 vehicles for the first time this year.

In July and August of this year, relying on its existing models such as the X9, G9, and G6, XPeng delivered 11,100 and 14,000 vehicles per month, respectively. After the MONA M03 was launched, in the first full delivery period in September, XPeng delivered 21,400 vehicles that month, and deliveries exceeded 10,000 for two consecutive months after its launch.

In addition to the lower-tier market, XPeng has also turned its attention to overseas markets, where its export sales account for 15% of its overall sales volume, with a month-on-month increase of 70%, ranking first among NEV startups.

NIO also set a new record of delivering 61,800 vehicles in this quarter, marking the sixth consecutive month with monthly sales exceeding 20,000 vehicles.

Li Bin stated during the earnings call that in the first three quarters of this year, the NIO brand has consistently ranked first in the pure electric vehicle market above 300,000 yuan in China, accounting for over 40% of the market share.

Although Lexdao L60 only contributed sales of 832 vehicles in this quarter, this was mainly due to insufficient production capacity. With the support of the BaaS battery-as-a-service policy, sales of Lexdao L60 reached 4,319 vehicles in October. Li Bin predicts that Lexdao L60 production capacity will exceed 10,000 vehicles in December.

However, NIO's deliveries in October declined slightly to 20,976 vehicles compared to the previous month. Li Bin responded during the earnings call that this was a proactive move to maintain gross profit margins, which also reduced promotional expenditures.

Looking ahead to the next quarter's sales targets, NIO has provided its highest-ever quarterly delivery guidance, expecting to deliver between 72,000 and 75,000 vehicles in the fourth quarter, representing a year-on-year increase of 43.9% to 49.9%.

After the success of the MONA M03, XPeng's confidence has also increased. With the launch of the XPeng P7+, XPeng expects deliveries in the fourth quarter to double, reaching 87,000 to 91,000 vehicles.

The XPeng P7+, priced starting at 186,800 yuan, received over 31,528 orders within three hours of its launch. The official server traffic reached 20 times that of the MONA M03 launch. He Xiaopeng stated that the XPeng P7+ production capacity can exceed 10,000 vehicles in December.

Compared to NIO and XPeng, Li Auto, which already has a substantial base, has set its fourth-quarter delivery guidance at 160,000 to 170,000 vehicles, which is not a significant increase compared to the third quarter.

This also indicates that as other competitors enter the extended-range market, Li Auto's advantage as a pioneer is being diluted.

02 NIO Continues to Lose Money, While XPeng Finds a Second Growth Curve

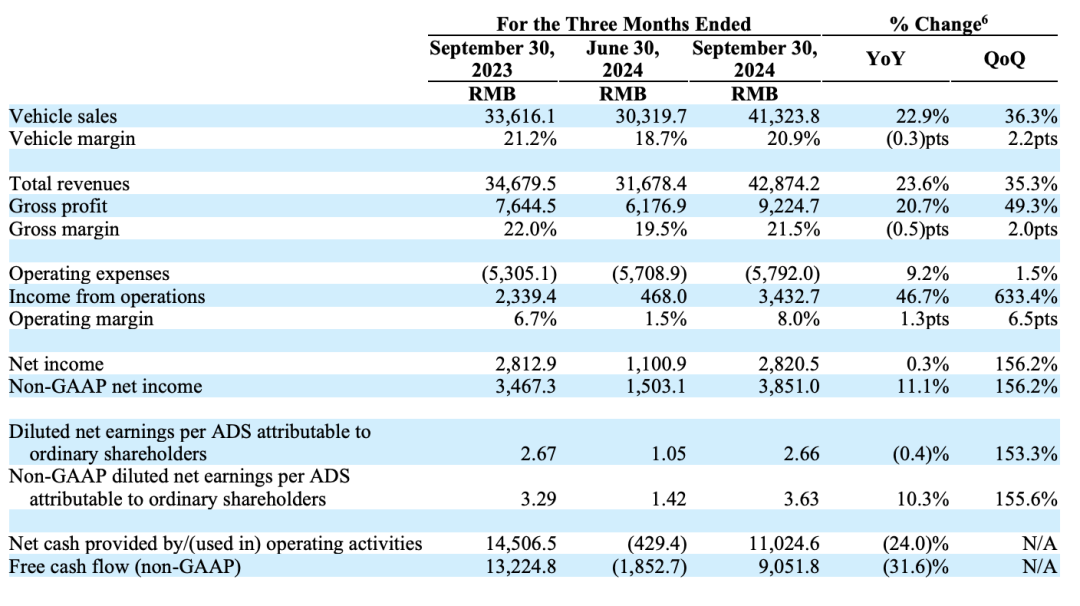

Returning to the financial reports, Li Auto remains the most profitable. Its third-quarter revenue reached 42.9 billion yuan, a year-on-year increase of 23.6%, with a quarterly net profit of 2.8 billion yuan, marking eight consecutive quarters of profitability.

In contrast, NIO and XPeng are trying to find bright spots amidst their losses.

XPeng called its third-quarter financial report the "strongest ever," with revenue reaching 10.1 billion yuan, a year-on-year increase of 18.4%. Although it still reported a net loss of 1.81 billion yuan, this was a significant narrowing compared to the 3.89 billion yuan loss in the same period in 2023.

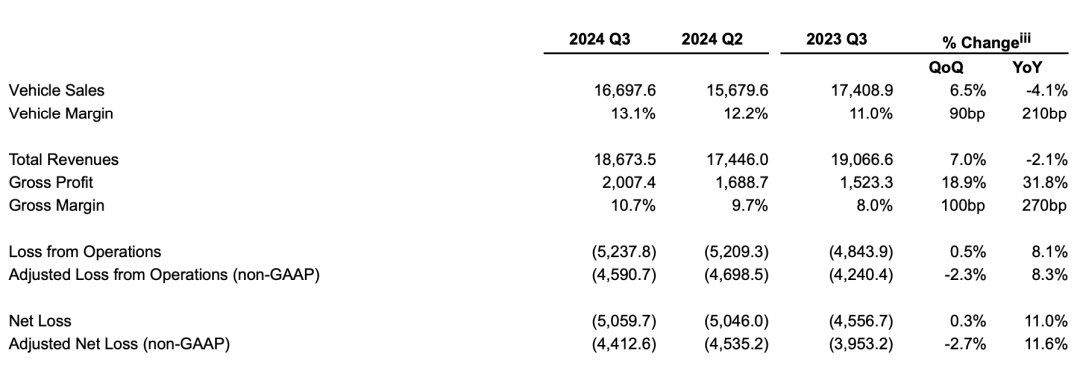

In contrast, NIO's performance was less impressive. Its third-quarter revenue was 18.67 billion yuan, a decrease of 2.1% year-on-year, with a net loss of 5.06 billion yuan, an 11% increase over the same period last year. Adjusted for US GAAP, the net loss was 4.41 billion yuan, an 11.6% increase year-on-year.

However, NIO has maintained its gross profit margin. In the third quarter, NIO's vehicle gross profit margin increased to 13.1%, compared to 11% in the same period last year and 12.2% in the second quarter of this year. NIO attributed this to optimized component costs and economies of scale driven by increased production. To ensure the gross profit margin, NIO even proactively reduced sales volume in October.

XPeng's gross profit margin reached 15.3%, a record high for a single quarter, marking the fifth consecutive quarter of positive growth.

As the company with the lowest sales volume among NIO, XPeng, and Li Auto, XPeng's automotive gross profit margin reached 8.6%, the highest level in nearly two years. The most impressive aspect of its revenue structure is service and other income, which generated 1.31 billion yuan, a year-on-year increase of 90.7% and a month-on-month increase of 1.1%. In this regard, XPeng significantly outperforms both Li Auto and NIO.

XPeng's ability to generate significant revenue is attributed to its technical cooperation with Volkswagen in areas such as electronic and electrical architectures. Increasing revenue by selling software and technology is also a way to indirectly share costs. Since it mainly involves software and technical cooperation, this part of the business has a very high profit margin, reaching 60.1%. In other words, this alone contributes 785 million yuan in gross profit to XPeng.

Li Auto relies more on vehicle sales, with vehicle sales revenue reaching 41.3 billion yuan in the third quarter, a year-on-year increase of 22.9%. Other sales and service revenue also kept pace, increasing by 45.8% year-on-year to 1.6 billion yuan.

Moreover, due to breakthroughs in intelligent driving, the proportion of customers choosing the higher-priced Max and Ultra versions has increased, offsetting the impact of the increased proportion of Li Auto L6. Li Auto's gross profit margin also exceeded market expectations, with an automotive gross profit margin of 20.9%.

Now let's look at how these three companies spend their money. NIO remains the biggest spender.

In terms of R&D investment, Li Auto's R&D expenses were 2.59 billion yuan, a decrease of 440 million yuan from the previous quarter. Some analysts believe that this is because Li Auto laid off employees in the second quarter, reducing the number of R&D personnel and expenditures on salaries. Additionally, no new products were launched in the third quarter, making the decline in expenditures reasonable.

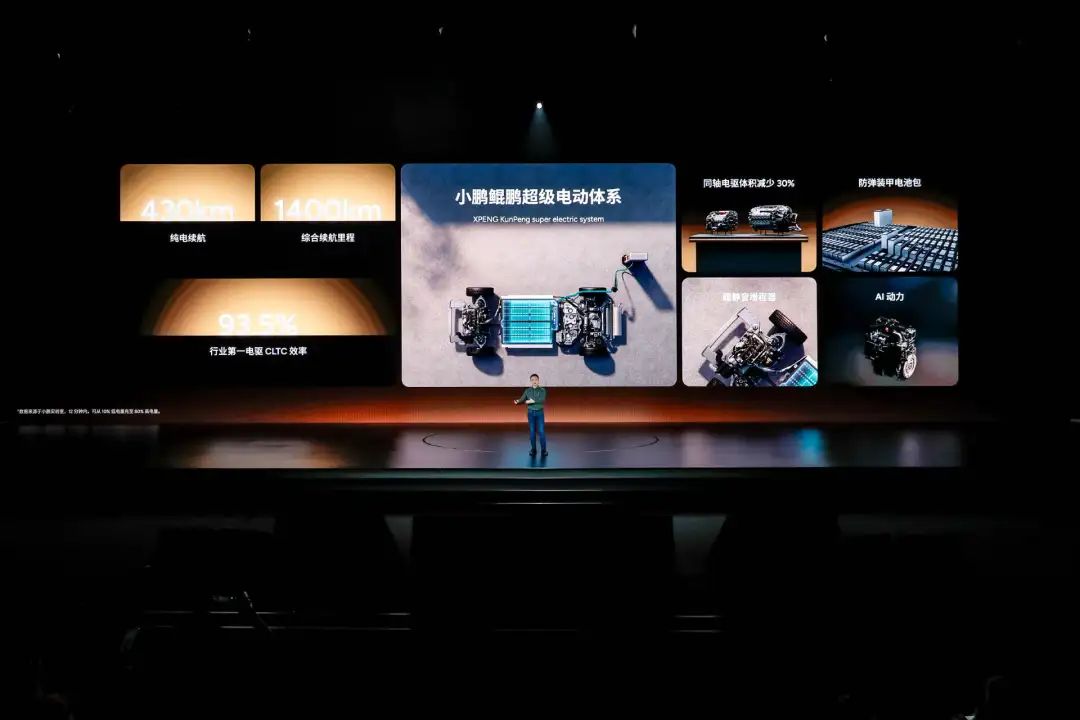

XPeng's R&D expenses increased by 25.1% year-on-year and 11.3% month-on-month to 1.63 billion yuan. Most of this money was spent on the MONA M03 and P7+, and XPeng also planned the "XPeng Kunpeng Super Electric System" for its next extended-range strategy.

NIO invested 3.32 billion yuan in R&D alone, and its costs continued to increase due to the expansion of Lexdao stores and the implementation of its battery swap technology. At the same time, NIO's average vehicle price was 270,000 yuan, lower than the market expectation of 276,000 yuan. Based on these calculations, NIO lost approximately 71,000 yuan per vehicle sold in the third quarter.

In contrast, XPeng's average vehicle price in this quarter was also lower than the market expectation of 197,000 yuan, falling to 190,000 yuan. However, XPeng lost 39,000 yuan per vehicle sold, roughly half of NIO's loss per vehicle.

03 Whose Moat is Deeper

In the third quarter of this year, China's NEV penetration rate reached 50.3%, with quarterly NEV insurance registrations exceeding those of gasoline vehicles for the first time. In the blue ocean of the NEV market, the most important thing is sustained profitability.

As of September 30, 2024, Li Auto's cash reserves reached 106.5 billion yuan. As the first domestic NEV startup to achieve profitability, Li Auto has substantial financial resources. With so much money at hand, even if it were to develop pure electric vehicles from scratch, it would not push Li Auto to the brink.

During the third-quarter earnings call, Li Xiang believed that the Li Auto L series would still be in its prime in the next one to two years.

Like XPeng, Li Xiang also believes that the biggest variable in the next three to five years will be artificial intelligence. Recently, Li Auto fully rolled out its end-to-end + VLM system. As Li Auto's new-generation intelligent driving solution, within three months, the model training data size increased from 1 million clips (valid video segments) to 4 million clips, and the average miles per intervention (MPI) tripled, laying the foundation for the launch of new pure electric models next year.

XPeng and NIO are moving closer to breakeven.

He Xiaopeng wrote that after two years of headwinds, XPeng is still far from reaching the blue ocean, but it is about to enter a new positive cycle. According to XPeng's official statement during the earnings call, the fourth quarter of 2025 may be the break-even point.

Regarding 2025, He Xiaopeng revealed that XPeng will enter a strong product cycle, launching multiple models with "strong AI capabilities and strong autonomous driving capabilities." Additionally, XPeng will introduce facelifted versions of several existing models next year.

He Xiaopeng believes that the years from 2025 to 2027 will be a knockout stage for the Chinese automotive industry, with NEV penetration exceeding 85%, and AI capabilities becoming an important criterion for the survival of automakers.

As of the third quarter of this year, XPeng's cash and cash equivalents, restricted cash, short-term investments, and time deposits amounted to 35.75 billion yuan. Although this is not a large amount, its long-term software cooperation with Volkswagen can be considered highly profitable, sharing a significant portion of costs.

Although NIO continued to lose money in the third quarter, its free cash flow turned positive, and its cash reserves increased to 42.2 billion yuan. Moreover, NIO is confident in narrowing its losses and has set a target of achieving a 100% increase in sales volume by 2025 and profitability by 2026.

Compared to Li Auto and XPeng, NIO has strong financing capabilities. On September 29, NIO announced that it had signed a strategic investment agreement with three existing shareholders, securing a new round of investment worth 3.3 billion yuan. On October 4, NIO signed a new strategic cooperation agreement with strategic investor CYVN, planning to enter the Middle East and North Africa markets.

From a business logic perspective, NIO's vision is the grandest. Battery swapping, as NIO's unique advantage, has led to the construction of 2659 battery swap stations and 24,092 charging piles as of November 15, with an average daily availability rate of charging piles exceeding 99%. The larger the scale of battery swapping infrastructure, the more pronounced NIO's advantage becomes.

In addition, while maintaining a 40% market share in the 300,000-yuan pure electric vehicle market, NIO has also launched its second and third brands.

In Li Bin's view, few customers refrain from purchasing NIO products due to the Letao brand, resulting in an overall larger increase in sales. With the official implementation of the multi-brand strategy, NIO not only hopes to boost sales across all brands but also anticipates spreading out R&D and infrastructure costs, further enhancing profitability.

Li Bin stated in the earnings call that NIO will enter a new product cycle next year, with new product deliveries from the Letao and Firefly brands.

Specifically, NIO-brand products will gradually transition to a new platform, starting with the luxury model ET9, priced at a pre-sale price of 800,000 yuan. Additionally, new products will be launched, and existing products will undergo revisions.

The Letao brand will introduce two SUVs next year, one with five seats and another with six to seven seats. The delivery volume of the Letao L60 is expected to exceed 20,000 units in March next year. The third brand, "Firefly," will be officially unveiled at NIO Day 2024 on December 21, with its first model scheduled for delivery in the first half of 2025.

Managing the positioning and operations of three brands simultaneously makes NIO's business empire truly vast, but it also signifies a massive need for financial support. While few may doubt Li Bin's business model, navigating this path is undoubtedly the most challenging and costly endeavor.