Electric vehicles founded on 'cost savings' are abandoning cost-effectiveness

![]() 11/13 2024

11/13 2024

![]() 545

545

In the last few days of October, Lei Jun's auto manufacturing venture stirred up waves again. Within 10 minutes of opening reservations for the mass-produced version of the Xiaomi SU7 Ultra, priced at up to 800,000 yuan, the number of reservations exceeded 3,680 units. This not only signifies a step forward for Xiaomi's automotive business but also strengthens the domestic new energy luxury car lineup.

Indeed, the global luxury new energy vehicle brand landscape has yet to form, and domestic automakers' obsession with luxury cars has persisted from the era of "NIO, XPeng, and Li Auto" to the present. According to data from "Autohome," among the existing new energy luxury car lineup, the top-selling brand models include: Ferrari SF90, Porsche Cayenne New Energy, Bentley Bentayga Plug-in Hybrid, Porsche Taycan, BMW iX, Ferrari 296, Audi A8 New Energy, Bentley Flying Spur Plug-in Hybrid, etc.

At a glance, they are mostly familiar top brands.

Xiaomi and BYD, of course, also want to join in. Counting the domestic luxury cars that have emerged in the past two years: the Zeekr 001 FR is priced at up to 769,000 yuan, BYD has the U8 and U9, which have both been officially released, BeyonCa targets Porsche, GAC AION has launched the Hyper Aion S Plus, and even HarmonyOS Auto is preparing to launch million-yuan luxury cars to compete with Maybach and Rolls-Royce...

Perhaps it's not too late to work hard now. Regardless of external opinions, automakers must continue to pursue luxury.

Who doesn't want to be the next 'Ferrari'?

The reasons why automakers want to manufacture luxury cars are not hard to understand. The high profits behind high-end cars have always been a key reason why many automakers are attracted to them. A typical example is Ferrari. In the first half of this year, Ferrari's average profit per car reached 851,400 yuan, more expensive than an entire Xiaomi car.

This is not an isolated case. A McKinsey report shows that from 2016 to 2021, the profit margin of the luxury car market was in the double digits, while the profit margin of the mass market remained at a low single-digit level during the same period. It is estimated that the EBIT margin of the luxury electric vehicle market will reach 21% to 25% by 2031.

This temptation is undeniably irresistible to automakers with ample activity but insufficient profitability. After all, countless automakers are still struggling with revenue. Zeekr reported a net loss of 4.205 billion yuan in the second quarter; XPeng reported a net loss of 2.653 billion yuan in the first half of the year; NIO reported a net loss of 2.2 billion yuan in the first half of the year...

In addition to having ample profit margins, automakers are keen on luxury cars because the growth momentum of the high-end car market in the past two years has been higher than that of affordable cars that once dominated the roads, especially in the new energy sector. Data shows that from 2021 to 2023, the sales share of pure electric vehicles priced above 300,000 yuan increased from 14% to 19%. It is estimated that in the next three years, nearly 80 new pure electric models priced above 300,000 yuan will be launched onto the market.

Indeed, new energy brands are accelerating their breakthrough of the barriers of the times, and there is still hope for success.

From the perspective of competing for the consumer market, studies have shown that globally, over 70% of owners of premium and luxury fuel vehicles are willing to switch to electric vehicles when purchasing their next car. What automakers need to do is to position themselves in the luxury car brand lineup before these owners replace their cars.

On the other hand, cracks have indeed appeared in the luxury car landscape of the previous generation. In the first half of this year, both Mercedes-Benz and BMW sales declined, and even Porsche has begun to yield to price wars. Discounted luxury cars are not uncommon in the auto market in 2024. According to Wilson Consulting data, in the first seven months of 2024, Audi's terminal discount rate approached 30%, BMW reached 25%, and Mercedes-Benz was close to 20%.

This gives BYD and Xiaomi an opportunity to surpass them, and domestic new energy automakers are also attempting to end the embarrassment of market positioning in the fuel car era, whether for profit or reputation. In any case, some automakers are currently performing impressively.

According to Huaxin Securities data, over the past two years, the share of companies like BYD and NIO in China's high-end market has roughly tripled, exceeding one-fifth by the end of May this year. Sales data for high-end car brands in the first half of the year showed that NIO has basically surpassed second-tier luxury brands such as Lexus, Volvo, and Cadillac.

In fact, besides realistic factors like fame and fortune, there is another reason why automakers are becoming increasingly high-profile in their luxury car ventures that cannot be ignored. Nowadays, the "wrist-wrestling" competition among new energy players is in full swing. For automakers, a luxury car is more of a self-attestation of technological progress than a way to cater to the consumer market.

More bluntly, those luxury cars priced at over a million yuan may not necessarily be a way for automakers to make money but a means of "showing off their muscles." Today, the auto manufacturing circle is becoming increasingly competitive in research and development. Intelligent driving, intelligent cockpits, intelligent chassis, 800V high-voltage fast charging... Homogeneous technology is causing anxiety among automakers.

To create a distance, they have to compete in research and development. In the first half of 2024, BYD and Lixiang's increases in R&D investment exceeded 40%, and other automakers' R&D expenses only increased. Xiaomi, which has just entered the market, announced that its investment in automotive R&D will exceed 30 billion yuan next year.

Everyone is chasing each other, and no one wants to lag behind. Creating luxury cars is an opportunity for automakers to showcase themselves. After working so hard and spending so much money, they want the outside world to see their abilities.

Does the electric car still remember its 'original intention of saving money'?

Perhaps few people remember that the reason new energy vehicles gradually overshadowed fuel vehicles is because of the word 'cost savings,' especially when rising oil prices last year led to high usage costs for fuel vehicles, and new energy vehicles surged ahead in the consumer market. But does the electric car still remember its original intention of saving money now?

A very obvious comparison is data released by the China Passenger Car Association in September. The data shows that in 2019, the average domestic car price was 151,000 yuan, 162,000 yuan in 2020, 165,000 yuan in 2021, 173,000 yuan in 2022, and reached 183,000 yuan in 2023.

In 2024, the automotive market embarked on an unprecedented large-scale price war. The scale of price reductions from January to September was 195 models, already exceeding the 150 models in the entire year of 2023 and significantly surpassing the total scale of 95 price reductions in 2022. But even the long-term price war has not affected this year's average car price.

Data shows that the average domestic car price in 2024 is still as high as 182,000 yuan, only a thousand yuan lower than last year. There are many reasons for this situation, and automakers that excessively pursue high-end positioning bear the brunt. In the past two years, although automakers seem to be indulging in price wars, the average selling price of cars is actually rising. A typical example is BYD. According to Wilson monitoring data, from January to July this year, BYD's average selling price reached 151,800 yuan, surpassing Volkswagen's 147,800 yuan.

Guosen Securities data even shows that BYD's average selling price per vehicle has increased nearly 2.5 times in ten years. On the one hand, there is a fierce price war, and on the other hand, the average car price is rising. Perhaps automakers deliberately use this method to avoid the unavoidable price war. In short, the loss of the initial cost-effectiveness advantage of new energy vehicles is an inevitable result of the collision of these two phenomena.

But can electric cars still save money? It is still a question frequently mentioned in the entire automotive consumer market. If automakers are determined to transform and join the high-end brand lineup, it will only affect the car purchase costs for some people. So, is it worth discussing whether new energy vehicles can continue to maintain the 'cost-effectiveness' of usage costs today?

First, it is clear that under the premise that a large number of automakers are focusing on research and development, the infrastructure of new energy vehicles is maturing.

Take batteries as an example. A research institution has published maintenance data on electric vehicle batteries over the past decade. Before 2015, the battery replacement rate for older models produced was 13%, while for new models produced in 2016 and beyond, the battery replacement rate was less than 1%. Among electric vehicles produced between 2011 and 2024, only 2.5% of vehicles had their batteries replaced.

It can be said that the "three-electric system," which affects the whole, has paved a positive start for reducing the usage costs of future new energy vehicles. Automakers' pursuit of high-end positioning has, to a certain extent, consolidated the technological foundation. From this perspective alone, the trend towards high-end in the entire automotive market is not necessarily a bad thing.

However, when auto manufacturing technology hits a bottleneck, and many so-called high-end cars begin to play concepts solely in intelligence and leisure and entertainment, users' subsequent usage costs hover at a high level. Last year's data showed that the systems with a higher frequency of new energy vehicle failures were intelligent connectivity, driving, steering, and braking, and interior trim.

Coincidentally, in 2024, the "failure rate per 100 new cars" in China's automotive industry was 188 times, an increase of 45 times year-on-year. Among them, the top two systems with the highest failure rates were intelligent cockpits and intelligent driving assistance. These systems happen to be the ones that new energy automakers are most accustomed to stacking on cars.

It is immediately apparent whether electric cars save money or not. Of course, luxury cars have never been created to cater to cost-effectiveness, but in that case, what consumers need may not be luxury cars.

How many steps does it take to become a 'luxury car brand'?

Due to the launch of the Xiaomi SU7 Ultra, domestic new energy luxury cars have once again been pushed to the forefront. In recent years, almost every new car launch conference has heard rhetoric about competing with Rolls-Royce and Porsche. But honestly, with the current momentum of manufacturing luxury cars, there are very few brands that truly have luxury car content.

Data shows that in the first half of 2024, there were only three independent brands with some presence in the 500,000 ultra-luxury car market: AITO, Denza, and BYD U8. However, the sales of BYD U8 have not been optimistic in recent months. From January to August this year, the sales of BYD U8 were 1,652, 780, 1,090, 952, 608, 418, 439, and 303 units, respectively.

Meanwhile, the sales of a series of comparable products to BYD U8 have been quite good. Taking Land Rover Defender as an example, insurance data shows that from January to August this year, its sales were 1,839, 715, 1,282, 1,893, 1,510, 1,649, 1,639, and 1,622 units, respectively. It is expected that automakers just starting out in the luxury car business will not be able to compete with established top brands. However, it is worth mentioning that there is a qualitative difference between manufacturing cars and manufacturing luxury cars.

Moreover, after going through a grand and glorious stage of internet automaking and experiencing a reshuffling period, the enthusiasm and sincerity that remain are few and far between.

When it comes to automaking again, the public's first reaction is to add meaningless configurations, such as in-car refrigerators, zero-gravity seats, intelligent cockpits, etc., which can be seen everywhere. Alternatively, conveying brand value through services. It is reported that some automakers have begun to provide emotional value to drivers and even derived special user groups.

It can also be seen from the increasingly large automaking camp that there is little gold left in this technological competition. Public information shows that Dreame, which makes robotic vacuum cleaners, and Dyson, which sells hair dryers, are both eager to enter the automotive industry. Even mature automakers are gradually losing the "craftsmanship spirit" of automaking.

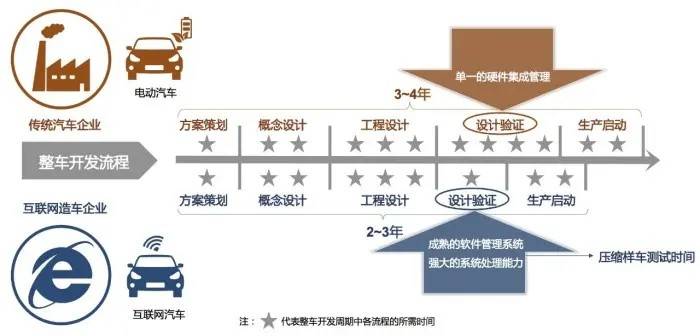

Data shows that in the era of fuel vehicles, a brand-new generation of a product usually required a research and development cycle of 5 to 6 years. German brands, renowned for their craftsmanship, had a development cycle of about 5 to 7 years. However, in the new energy era, some models have compressed their development cycle to only 9 to 12 months.

Manufacturing 'luxury cars' is even easier. Xiaomi, a consumer electronics company with mobile phones as its main business, announced its entry into automaking in 2021 and launched the 800,000-yuan Xiaomi SU7 Ultra in 2024.

Of course, there is not necessarily a direct relationship between the automaking cycle and car quality, but the noisy drama of manufacturing luxury cars only satisfies automakers' egos in the short term. In the long run, there are more cases where dreams turn into bubbles. The declining sales of BYD U8 are an example, and the sales of another million-yuan luxury car, the GAC AION Hyper SSR supercar, were only 1 unit in November last year.

Automakers may realize that there is still a significant gap between them and true luxury car brands and are striving to establish brand awareness. BYD U8 appeared at the Bister racing event, and Chery participated in the Goodwood Festival of Speed held in the UK this year, where Lamborghini and Ferrari were also present.

Luxury goods in the consumer market have always been closely related to the stories and values behind the brands, and cars are no exception.

In fact, some automakers have achieved minor success in brand building. Taking NIO as an example, data from the first half of 2024 shows that the resale value of the NIO ES6 once surpassed that of the Tesla Model Y, Audi Q5L, and BMW X3. The one-year resale value of the NIO ET5 was 74%, surpassing the Tesla Model 3, Audi A4L, and Lincoln Z in the 300,000 to 400,000 yuan luxury midsize car market.

But can these support a brand's high-end dreams? Obviously not. Automaking requires sincerity, and manufacturing luxury cars requires even more.

Dao Zong Youli, formerly known as Waidaodao, is a new media outlet in the internet and technology circle. This article is original. Any form of reprint without retaining the author's relevant information is prohibited.