Breaking 200 billion! BYD overtakes Tesla

![]() 11/05 2024

11/05 2024

![]() 573

573

A decade ago, Tesla CEO Elon Musk was asked about his view on 'BYD becoming a competitor to Tesla.'

In response to the question, Musk asked, 'Have you seen BYD's cars? I don't think BYD has any good products,' with a hint of disdain in his tone.

However, 13 years later, BYD has overtaken Tesla.

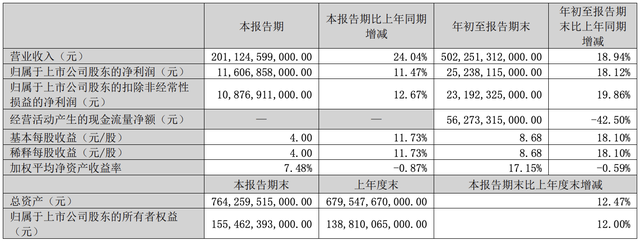

According to BYD's third-quarter financial report, the company achieved revenue of 201.125 billion yuan in Q3 this year, a year-on-year increase of 24.04%, with quarterly revenue exceeding 200 billion yuan for the first time. In contrast, Tesla's third-quarter revenue was $25.182 billion, equivalent to approximately 179.743 billion yuan.

In other words, BYD surpassed Tesla in revenue in the third quarter, marking a turning point and a signal.

However, this does not mean BYD can rest easy. According to the financial report, although BYD surpassed Tesla in quarterly revenue, a gap still exists. In terms of net profit, BYD reported a net profit attributable to shareholders of the parent company of 11.607 billion yuan in Q3, while Tesla reported a net profit attributable to shareholders of the parent company of $2.167 billion, equivalent to approximately 15.432 billion yuan. This indicates that there is still a distance between BYD and Tesla in terms of net profit.

Moreover, from a market capitalization perspective, as of the latest closing, Tesla's total market capitalization was $779.5 billion, equivalent to approximately 5.5405 trillion yuan, while BYD's market capitalization was 888.8 billion yuan, only about one-sixth of Tesla's. Therefore, it is not easy for BYD to catch up with Tesla overall.

Scale Advantages Becoming More Apparent

For BYD, it may not be surprising that its revenue surpassed Tesla.

Since the beginning of 2024, BYD has already surpassed Tesla in sales.

Specifically, from January to September this year, BYD sold a cumulative total of 2.7479 million vehicles, a year-on-year increase of 32.13%, with 419,400 vehicles sold in September. In comparison, Tesla sold a cumulative total of 1.848 million vehicles globally from January to September, a year-on-year increase of 40%, with 88,321 vehicles sold in September, a year-on-year increase of 66%.

From the sales data, whether cumulative or monthly sales, BYD has taken a significant lead.

Behind the revenue and sales surpassing Tesla, what deserves more attention is the scale advantage that BYD has built up.

Since the beginning of this year, the continuous increase in BYD's sales has been largely attributed to the "price war." Early in the year, BYD reduced prices and promoted sales for several of its models.

From the perspective of average sales price per vehicle, BYD's average sales price in the first half of this year was 142,000 yuan, a year-on-year decrease of 25,000 yuan, showing a clear strategy of "trading price for volume." However, due to scale advantages, BYD's cost per vehicle also decreased by 24,000 yuan in the first half of the year. In other words, despite a significant price reduction, BYD's profit per vehicle only decreased by approximately 1,000 yuan. Compared to the substantial sales growth, BYD's strategy of "trading price for volume" has undoubtedly been quite successful.

Furthermore, from a profitability perspective, despite implementing the strategy of "trading price for volume," BYD's profitability indicators have increased rather than decreased due to its scale advantages. In the first three quarters of this year, BYD's gross margin and net profit margin were 20.77% and 5.23%, respectively. In comparison, from 2021 to 2023, BYD's gross margins were 12.97%, 15.89%, and 19.79%, and its net profit margins were 2.27%, 3.73%, and 5.29%, respectively, showing a year-on-year increase in profitability indicators.

Breaking it down by product, we can more intuitively see how significant the scale advantage is for improving profitability in the automotive business. As of the first half of this year, BYD's "automobiles, automobile-related products, and other products" segment achieved revenue of 228.3 billion yuan and a main operating profit of 54.65 billion yuan, with a gross margin of 23.94%. For comparison, from 2021 to 2023, BYD's gross margins for "automobiles, automobile-related products, and other products" were 19.53%, 16.3%, and 20.67%, respectively.

Overall, with increasing sales, BYD has built up a sufficiently strong scale advantage, which is where it leads Tesla. However, despite leading in sales and revenue, there is still a considerable gap between BYD and Tesla, which must be acknowledged.

Where is the Gap?

Although they are in different capital markets, the huge difference in market capitalization reflects the current gap between BYD and Tesla.

So, where exactly is the gap between BYD and Tesla? Why is it that, as automakers, BYD's revenue and sales have surpassed Tesla, yet its market capitalization is only one-sixth of Tesla's?

Kanjian Caijing believes that the biggest gap between BYD and Tesla lies in intelligence.

Previously, media analysis suggested that Tesla's greatest innovation was realizing software-defined vehicles, not only developing its in-vehicle operating system but also streamlining the distributed architecture composed of dozens of ECUs into a domain-based centralized architecture, controlling most functional modules of the vehicle without relying on suppliers. Musk previously stated that in the future, Tesla could sell cars at "zero profit" and earn money through software services such as autonomous driving. It is evident that while domestic automakers like BYD are still focused on earning money from car sales, Tesla already views cars as a platform and plans to earn money through software services.

Of course, earning money through software services like autonomous driving may seem relatively distant, but it is undeniable that as the competition in the new energy vehicle industry enters its second half, intelligence will become increasingly important, and this is a relative weakness for BYD.

Taking intelligent driving technology as an example, BYD's intelligent driving technology is mainly used in its high-end brands priced above 200,000 yuan, especially Denza. In August 2023, BYD launched the Denza N7 equipped with its self-developed intelligent driving system "Tian Shen Zhi Yan," featuring a top-end computing power of 254 TOPS and up to 33 sensors. According to official statements, the Denza N7 is "two generations ahead in intelligent driving." However, the Denza N7 still could not escape the fate of a high opening and low closing. Nowadays, sales are sluggish, and the new N7 has been directly reduced by 60,000 yuan for promotion. Its biggest selling point, intelligent driving, with nationwide high-speed NOA, has a delivery time locked in at "the fourth quarter of this year at the earliest."

For BYD, the lag in intelligent technology has triggered a series of chain reactions, forcing its high-end brands Fangchengbao and Denza to reduce prices for promotion. In terms of brand image, consumers' stereotype of BYD is still that of a high-cost-performance domestic car. As evidenced by the strong sales of the BYD Qin, consumers value BYD's cost-performance ratio. Most importantly, an increasing number of low-priced vehicles are now equipped with advanced intelligent driving functions. For example, Xpeng's MONA boasts the slogan of being "the only advanced intelligent driving vehicle within 200,000 yuan," which will undoubtedly have a certain impact on BYD.

Previously, Wang Chuanfu mentioned in public that the first half of the new energy vehicle era is electrification, while the second half is intelligence. Relying on its excellent performance during the electrification period, BYD has achieved a significant increase in sales and successfully surpassed Tesla in revenue. However, if BYD wants to surpass Tesla in profitability or market capitalization, it clearly still has a long way to go.