Why Volkswagen Stalled in China

![]() 11/05 2024

11/05 2024

![]() 375

375

Introduction

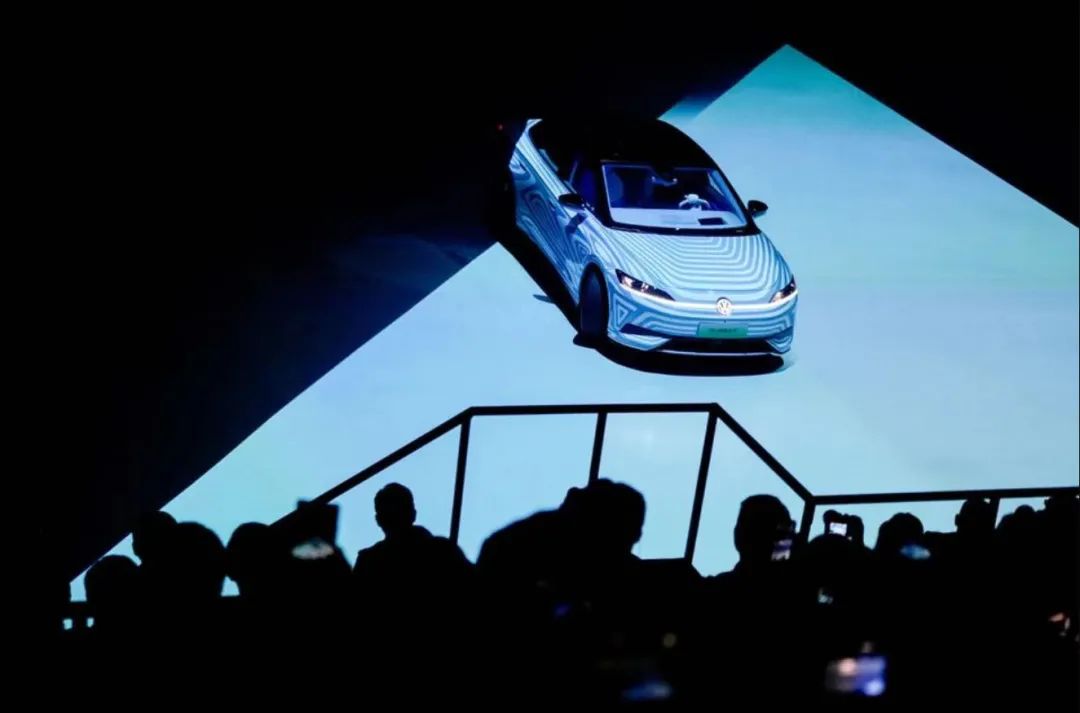

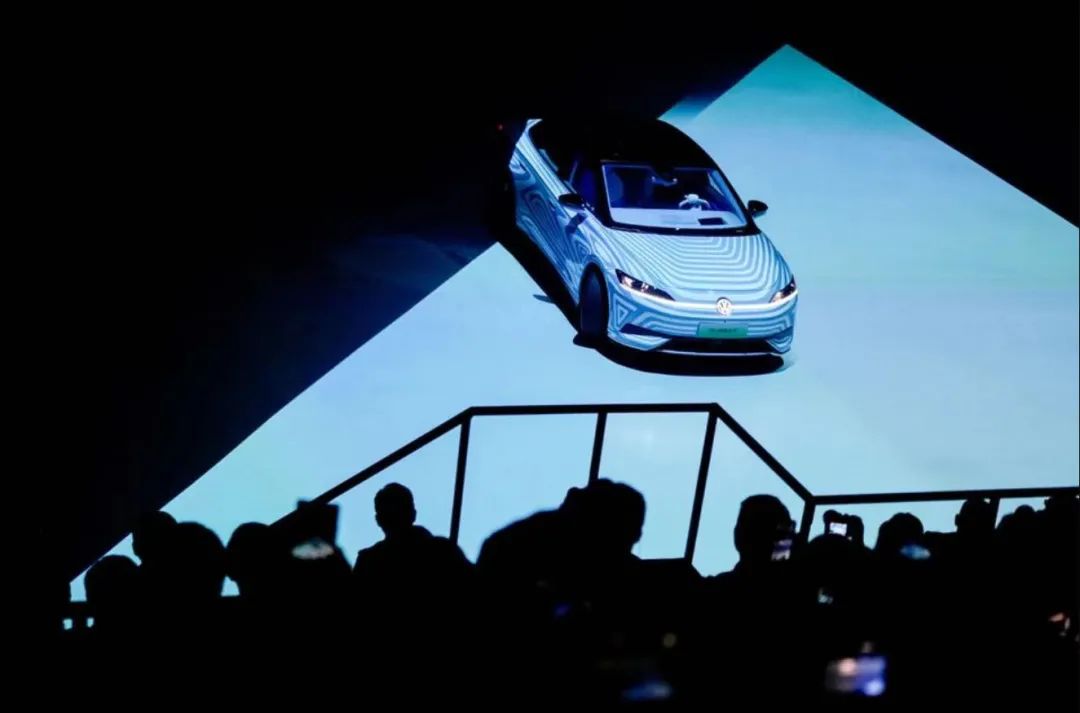

This is a decisive moment in Volkswagen's history.

In China, Volkswagen has become the 'King of Yesterday'.

The latest special report by The New York Times, titled 'How Volkswagen Lost Its Way in China', provides a detailed analysis of Volkswagen's predicament in the Chinese market. The term 'stalled', when applied to an automotive giant like Volkswagen, is rarely seen in English.

'Chinese consumers disdain Volkswagen and prefer products from local brands, which are fresh and attractive.' Volkswagen, which once dominated the global automotive industry and was the envy of manufacturers worldwide, is now seeing its position and market share in China gradually replaced and eroded by competitors.

Over the past 40 years, Volkswagen has been one of the leaders in the Chinese market. Especially in 2017, when China's total automobile sales reached 28 million units, making it the world's largest automobile production and sales country, Volkswagen Group's annual sales in China also exceeded 4 million units, accounting for 40% of the Group's annual sales.

In the first three quarters of this year, Volkswagen's automobile sales in China declined by 10.2%, erasing all the gains from sales growth in other regions of the world. Moreover, Volkswagen's plight in China is affecting the global market, with declining sales across the Group and a significant drop in profits as a direct result.

Over the past nine months, Volkswagen's sales in North America increased by 4%, and in South America by 16%. However, these gains were offset by a 1% decline in Western Europe and a 12% decline in China. According to Volkswagen's latest forecasts, the Group will deliver approximately 9 million vehicles globally this year, a decrease of about 240,000 vehicles compared to 2023.

Where did Volkswagen go wrong?

China is Volkswagen's largest market outside of Europe, but the competition here far exceeds the imagination of the Group's board of directors.

Taking Chinese rival BYD as an example, over the past three years, BYD has rapidly expanded its sales of pure electric vehicles, forcing Volkswagen to make a huge bet on the pure electric segment last year. However, as the market changes, BYD's strategic shift earlier this year caught Volkswagen off guard again—

The company began aggressively selling plug-in hybrid vehicles, but Volkswagen, on the other hand, has almost no product offerings in this segment. According to plans, Volkswagen's product gap in this segment will not be fully filled until next year.

Senior executives at Volkswagen in Europe believe that the company has lost significant market share in China by refusing to join the price war.

'Electric vehicle manufacturers in China have various subsidies, allowing them to sell new vehicles at prices below manufacturing costs. Electric vehicles are being pushed into the Chinese market at discounts of up to 50%. We made the wrong judgment earlier, thinking that Volkswagen should not get involved in this.'

The impact of the price war is only superficial. On the one hand, there is the willingness to join the price war; on the other hand, the cost of the price war must also be considered.

As early as over a decade ago, European manufacturers including Volkswagen and BMW began selling electric vehicles, but these German companies missed the opportunity to control battery costs. In contrast, Chinese competitors, benefiting from good control over battery costs, can sell cars at very low prices.

Geopolitics has exacerbated Volkswagen's predicament.

In the past year, the European Union has imposed higher tariffs on such vehicles imported from China. However, unlike other manufacturers, Volkswagen refused to provide the European Commission with 'sufficient information' for the so-called 'sample survey'.

Volkswagen CEO Oliver Blume's stance has been clear. He has proposed on multiple public occasions that the EU should reassess its plan to impose tariffs on electric vehicles imported from China and instead take measures to encourage electric vehicle companies manufactured in China to invest in Europe.

The outcome is clear. Companies that did not cooperate with the EU's 'sample survey', such as Volkswagen, were informed that they face tariffs of up to 37%.

It is reported that Volkswagen is working to reduce its tariffs to 21%. If Volkswagen's 37% tariff is confirmed, any electric vehicles imported from China may face a long-term disadvantage in the European market.

'My family has abandoned me.'

This week, Volkswagen proposed new cost-reduction measures, including a 10% salary reduction for all employees and a suspension of wage increases in 2025 and 2026. This decision is undoubtedly a heavy blow to Volkswagen employees. Moreover, Volkswagen also plans to close at least three German factories, affecting tens of thousands of layoffs.

'A decisive moment in corporate history.'

This is the first time Volkswagen has officially confirmed cost-cutting measures to address declining sales, setbacks in the Chinese market, and overcapacity at its factories. For Volkswagen, with profits at their lowest point in three years, this is the only way to maintain the Group's competitiveness.

In the West, since the outbreak of the COVID-19 pandemic, the European automotive market has shrunk by about 2 million vehicles, and Volkswagen's annual sales have decreased by about 500,000 vehicles. Even more terrifying is that Chinese competitors have begun establishing factories in Europe.

In China, Volkswagen's market share has also been affected by the overall economic slowdown. In particular, local automakers such as BYD, NIO, Xpeng, and Li Auto have surrounded and blocked joint venture players like Volkswagen with more cost-effective and intelligent products.

Not only Volkswagen, but also the other two established German automakers, BMW and Mercedes-Benz, are facing similar issues:

Sales in China are no longer robust, and this market, which is the largest automotive market in the world and once a cash cow for European automakers, is now in decline. Like Volkswagen, BMW and Mercedes-Benz have also reported a decline in sales in China in the third quarter due to weakening overall demand for luxury vehicles and the rise of Chinese automakers.

As mentioned earlier, 2017 was Volkswagen's peak year in China. Since 2018, Volkswagen's sales in the Chinese market have fluctuated and declined, from 4.202 million units in 2018 to 3.234 million units in 2023.

On November 1, Volkswagen China Chairman and CEO Ralf Brandstätter responded to cost reduction and efficiency enhancement measures. 2024 and 2025 are critical years for the Group's transformation. Although facing difficulties and challenges, the Group is fully prepared—

'We predicted last year that aggressive pricing and fierce competition in the electric vehicle market would continue. We decided to prioritize profitability over market share at all costs. It is very difficult to make a profit in the electric vehicle business. We must actively optimize our cost structure to ensure that the Group remains profitable even in the most severe competitive environment.'

Reuters conducted a set of statistics, and Volkswagen plans to maintain a 15% share of the Chinese automotive market by 2030—

Last year, this figure was 14.5%, but in 2017, Volkswagen's market share in China accounted for 18%, and its operating profit in China accounted for 28% of its global total profit. The management team in Europe may not have anticipated that China, which once played a decisive role in Volkswagen's global performance, has now become the market with the largest decline in global sales.

'We cannot maintain our leading position at present.'

In April this year, Oliver Blume, CEO of the Volkswagen Group, admitted in an interview with German media that the company is still catching up in the Chinese market, at least in the field of electric vehicles.

According to statistics from the China Automobile Dealers Association, due to the rise of domestic vehicles and the acceleration of localization of international brands, China's automobile imports have continued to be sluggish in recent years. Among them, the sales of imported Volkswagen vehicles have also declined significantly, with a drop of nearly 55%, making Volkswagen the manufacturer with the largest year-on-year decline among imported brands in the first half of the year.

This also means that once the domestic price war 'burns' into the imported car market and erodes profits in this segment, layoffs are bound to occur in the imported car business. The layoffs at Volkswagen China in October mainly involved the imported car business, with nearly 100 layoffs.