Selling cars in China and aiming for a hit? Don't focus on luxury

![]() 09/30 2024

09/30 2024

![]() 546

546

Due to the surge in the stock market, many sales figures have been inflated, and the competition against Model Y is not accurately reflected in the short-term results.

Over the past three years of the pandemic, the traditional 'golden September and silver October' car sales season has gradually faded, but it has returned since 2024. Suddenly, three new models priced below 200,000 yuan emerged, targeting high-end autonomous driving and young families' first cars. Meanwhile, five competitors to Model Y have emerged. With the booming stock market, the trend is clear: the extra income from interest rate cuts and quantitative easing policies will flow into the consumer market, either in real estate or other consumer goods.

From the latest five Model Y competitors, we can discern short-term consumer trends.

"In September 2024, it seemed that Li Bin broke his own rule." Previously, he had always avoided disclosing order numbers after new car launches, preferring to focus on other aspects. However, after the launch of the Ledo L60, he announced that orders had exploded, with server capacity urgently increased fivefold to accommodate the influx. Specific numbers were not mentioned, but the implication was clear. Six days later, this rule was broken as expert interviews revealed that as of September 24th morning, Ledo L60 had received 65,000 orders with a 70% lock-in rate, translating to 45,000 firm orders in just six days and over 9,000 cars sold daily, a staggering figure.

In just two weeks, four additional new models of similar size, price, and technological features to the Ledo L60 were launched, all aiming to challenge Model Y. Their order numbers are as follows:

Multiple sources indicate that ZEEKR 7X surpassed 10,000 locked-in orders within 72 hours of its launch;

Officially announced, the Zhide R7 surpassed 6,000 firm orders within 24 hours of its launch;

Officially announced, AITO 07 surpassed 11,673 firm orders within 20 hours of its launch;

Officially announced, IM Motor LS6 surpassed 6,000 firm orders within 12 hours of its launch.

In terms of order numbers, the ranking is Ledo L60 > AITO 07 > IM Motor LS6 > Zhide R7 > ZEEKR 7X. Price-wise, the ranking is Ledo L60 < AITO 07 < ZEEKR 7X < IM Motor LS6 < Zhide R7. However, judging sales performance solely based on price is not scientific.

Conclusive trend: Overreliance on extended-range electric vehicles (EREVs) is misguided

Official data shows that the reduction in existing mortgage interest rates by banks is expected to benefit 50 million households and 150 million people, reducing household interest expenses by approximately 150 billion yuan annually. Coupled with the interest rate cut in the US, more global capital is considering and planning to invest in China.

To explain the market conditions after the launch of these five new models, the theoretical basis aligns with the shift in consumer attitudes over the past five years: strong product features coupled with reasonable pricing drive rapid sales growth. With quantitative easing injecting funds into the consumer market, automakers with strong products in the automotive sector stand to benefit. However, not everyone will truly reap the rewards under the new status quo.

A prime example is Ledo, led by Li Bin.

"What attracts most buyers to Ledo now is not battery swapping," feedback from Ledo dealerships defies conventional industry wisdom and escapes the jargon of current marketing battles. The truth is, Ledo's current sales surge stems from its rationality.

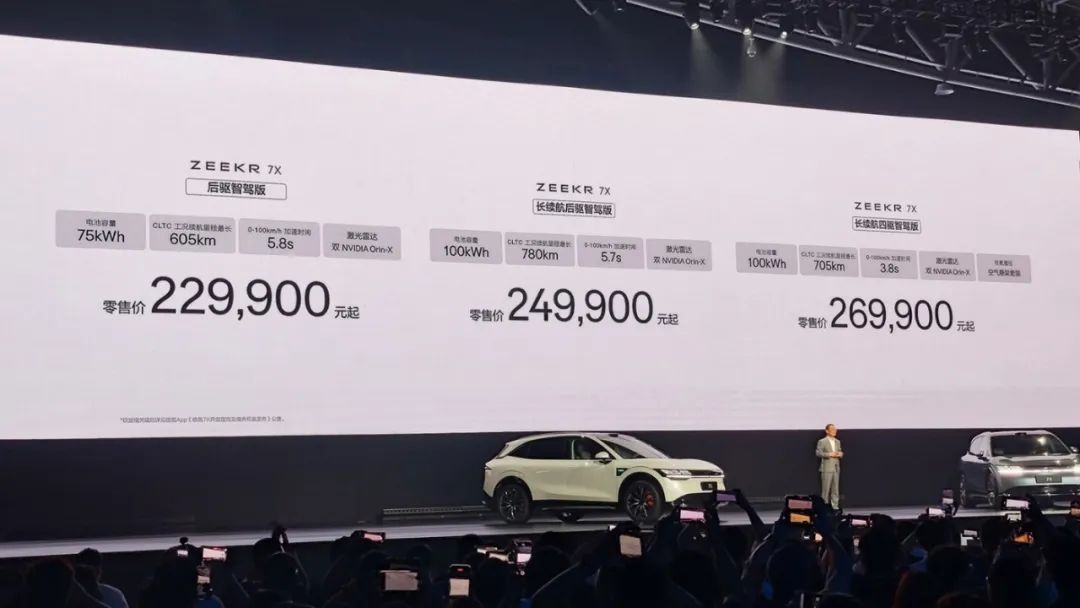

In terms of pricing, the Ledo L60 ranges from 206,900 to 255,900 yuan, AITO 07 from 219,900 to 289,900 yuan, ZEEKR 7X from 229,900 to 269,900 yuan, IM Motor LS6 from 239,900 to 302,900 yuan, and Zhide R7 from 259,800 to 339,800 yuan.

Beyond prices, there are hidden differences in actual purchase costs. In terms of pre-order benefits, Zhide R7 offers a 3,000 yuan discount, IM Motor LS6 a 23,000 yuan discount (2,000 yuan deposit deducted from a 25,000 yuan purchase price), and gifts range from a maximum of 48,800 yuan worth of packages for IM Motor LS6 (including numerous optional extras) to 12,000-22,000 yuan for Zhide R7, 17,000-19,000 yuan for ZEEKR 7X, and finally AITO 07 with no specific mention of gifts.

In terms of charging benefits, Ledo offers 20 battery swap experience vouchers worth 1,350 yuan, while other brands do not.

Taking into account actual purchase benefits, the five new models offer varying perceptions to consumers. Excluding Ledo L60, which offers a BAAS (Battery as a Service) model, the actual purchase price ranking is: IM Motor LS6 < AITO 07 < ZEEKR 7X < Zhide R7. IM Motor LS6 brings the entry-level price below 200,000 yuan, AITO 07 starts slightly above 200,000 yuan, ZEEKR 7X slightly above 210,000 yuan, and Zhide R7 starts at over 240,000 yuan.

However, price is just one aspect. Differences in product features and consumer decision-making vary among the five models.

ZEEKR 7X and IM Motor LS6 share many similarities, emphasizing versatility. ZEEKR 7X places more emphasis on safety and luxury, while IM Motor LS6 focuses on driving dynamics and intelligence. In terms of autonomous driving, ZEEKR 7X's NOA (Navigate on Autopilot) for urban areas will be delivered on a large scale by the end of the year, while IM Motor LS6 began deliveries concurrently with its launch.

Therefore, in terms of completeness, there is a certain gap between these two models and the remaining three. NIO and Huawei's NOA for urban areas have been available for a long time, so doubts about Ledo L60, AITO 07, and Zhide R7 in this regard are minimal.

Considering pricing, purchase benefits, and order ratios, the differing market performances of similar models are more about whether they engage in homogeneous or differentiated competition.

The recent trend of multiple automakers abandoning pure electric vehicles in favor of extended-range models faces a similar competitive landscape. In other words, overreliance on extended-range technology is misguided in terms of boosting sales.

Is traditional luxury now accelerating its decline?

The reason why overreliance on extended-range technology is misguided is that this market is also highly competitive.

Looking at the five Model Y competitors, the two models with the best sales performance – Ledo L60 and AITO 07 – are engaged in differentiated competition. Ledo L60 stands out from other pure electric SUVs due to its battery swapping, battery rental, NIO technology integration, and low energy consumption from its 900V system.

This differentiation goes beyond its starting price of 149,900 yuan, transcending traditional automotive market competition logic. For example, rather than dwelling on criticisms of its MacPherson front suspension, Ledo spends more time enhancing consumer awareness of battery swapping and rental. Ai Tiecheng's comparison of Ledo L60's monthly battery rental fee of 599 yuan to the cost of filling a 60-liter fuel tank with 92 octane gasoline effectively convinces customers in Ledo showrooms.

In other words, battery rental is an acceptable option for car buyers. A simple comparison to the cost of filling a fuel tank four times a month effectively illustrates the cost savings. A core differentiator is NIO's logic of future-proofing batteries and minimizing losses during car sales or exchanges. Consequently, over 70% of initial orders for Ledo L60 within 72 hours of its launch opted for the BAAS battery rental model.

AITO 07, with over 10,000 orders and currently ranking second among this round of new models, follows a similar differentiated competition strategy. In this type of competition, extended-range technology accounts for only a certain proportion and is not the decisive factor.

Equipped with Huawei's lidar, ADS 3.0 autonomous driving system, and the industry's best extended-range engine system, along with a 20,000 yuan discount for high-end autonomous driving features, AITO 07 is currently the most competitive model with Huawei technology in the market. Compared to AITO M5 models with similar features, AITO 07 offers a price advantage of over 10,000 yuan for its extended-range version and over 20,000 yuan for its pure electric version. With a closer launch date, its 192-line lidar also surpasses the 126-line lidar of AITO M5, creating tangible differences.

Therefore, whether compared to Lixiang L6, AITO M5, AITO M7, or Model Y, AITO 07's product performance justifies its order numbers.

Having advanced technology, reasonable SKUs and usage costs, and pioneering a differentiated competitive arena are the keys to success in today's market. In contrast, Zhide R7, IM Motor LS6, and ZEEKR 7X, from a pure product and brand reputation perspective, are still fighting in the same market, facing fundamentally different pressures compared to differentiated competition.

Another example is IM Motor LS6, which initially positioned itself as a new luxury SUV in 2023 but has since downplayed this aspect, resulting in impressive order numbers.

Unlike the other three, Yu Chengdong emphasized quality during the Zhide R7 launch, stating that he was willing to sell each car at a loss of 30,000 yuan to allow more people to experience high-quality vehicles. An Conghui, CEO of ZEEKR, set the tone for the ZEEKR 7X launch by stating that it would not follow Model Y's path but instead rely on luxury and quality to succeed.

Emphasizing luxury and quality is undoubtedly correct, but given the current market conditions, the sustainability of this strategy is questionable. When luxury and quality become standard buzzwords in product launches, it becomes increasingly difficult to refresh consumer perceptions through these attributes alone.

It was best to have a budget of 5 million a few years ago, redefining luxury within 10 million, and now, many features of luxury cars costing millions are no longer unique. The R7 of Zhide is often developed based on the logic of Rolls-Royce, so the frequency of mentioning million-yuan luxury cars at the press conference is high.

However, in a subsequent press conference, Aion further applied the features of traditional million-yuan luxury cars to family cars costing less than 150,000 yuan. The original million-yuan fuel-powered luxury cars have been gradually eliminated by the rise of new energy vehicles. Almost all new energy vehicles, from 100,000 to 500,000 yuan, mention luxury in a homogenized manner. In such a scenario, people's perception of luxury is actually vague.

Of course, the sales performance mentioned above needs to be further observed, as it involves production capacity and different delivery speeds among companies. AITO 07, IM Motors LS6, and Zeekr 7X, which are backed by traditional major manufacturers, were delivered immediately after their launch. Letao L60 began delivery shortly after its launch, while Zhide R7 will not be delivered until October. In fact, Zhide R7 is not yet available in all HarmonyOS Smart Experience Stores nationwide, so many people haven't seen the actual car yet and are placing orders and waiting.

Final Thoughts

In addition to these, many traditional automakers that emphasize luxury are gradually figuring out how to transform. As new cars were launched in clusters, BMW quietly unveiled the new prices and features of the second mid-cycle facelifted 3 Series and i3. Starting at 319,900 yuan, the biggest change is that while the pricing of the new cars has been lowered, a significant amount of technological and intelligent configurations have been added. The 330Li has become the main sales model, priced directly at the original position of the 325Li, with hands-free voice control, iDrive 8.5, and active cruise control all becoming standard equipment. As the first joint venture company to achieve a controlling interest in China, BMW has obviously invested more in China, and its speed of transformation may naturally serve as a learning case for other automakers.

Therefore, more sales and consumption trends indicate that traditional and luxury thinking patterns are seeing declining sales dividends. Of course, this does not mean that doing so is wrong, but rather that its importance in consumers' perception is declining.