More than 10 new car models launched in one day! Automakers go all-in during the 'golden September and silver October,' but is their direction wrong?

![]() 09/29 2024

09/29 2024

![]() 506

506

Competing on price is inferior to competing on value.

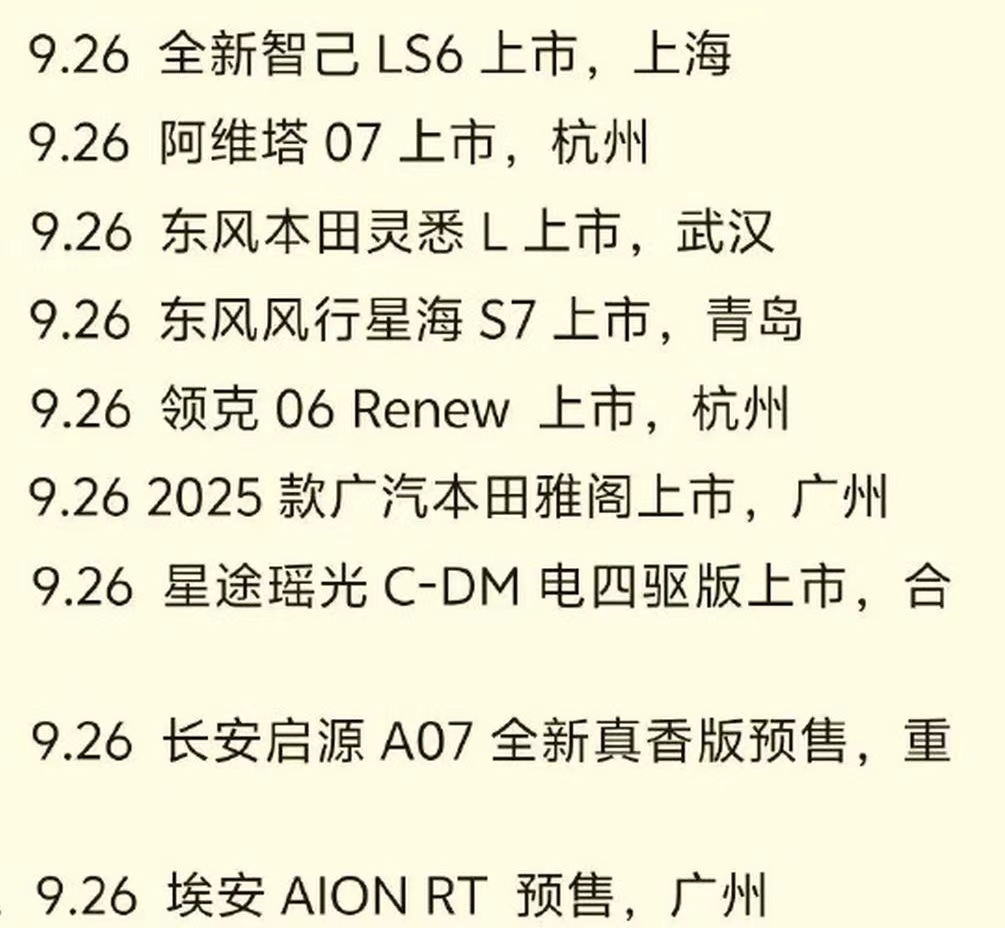

September 26th was just an ordinary day for most workers, but car media outlets were frantically busy as numerous new car models were either pre-sold or launched on this day.

According to incomplete statistics, at least a dozen new car models were released on September 26th, including the Zhidi LS6, the only new car in its class boasting a 'digital chassis' and 'four-wheel steering,' introduced by SAIC Motor's sub-brand Zhidi Automobile. AVATR, the premium new energy vehicle brand under Changan, also launched its first extended-range electric vehicle model, the AVATR 07.

(Image source: Internet)

Other models like the GAC AION RT, Dongfeng Fengxing Xinghai S7, Chery Starway Yaoguang C-DM Electric Four-Wheel Drive, Changan Qiyuan A07, Lynk & Co 06 Renew/EM-P, and FAW Besturn V70/T90 Longyao Edition were also pre-sold or launched on this day, while Xpeng's popular G9 model introduced a new 650 4WD High-Performance Pro version.

As domestic automakers ramp up their efforts, joint venture automakers are not idle either. Honda jointly launched the Lingxi L with Dongfeng Motor and the 2025 Accord with GAC Motor, while Ford collaborated with Changan to introduce the 2025 Mondeo.

It wasn't just September 26th; the entire month of September saw automakers hustling. Huawei held consecutive press conferences, first introducing the Askey M9 five-seater version and subsequently the Zhiji R7. Automakers like Lantou, Lanvin, Qiyuan, BYD, and Great Wall also held new product launches, with approximately 50 new car models entering the market throughout the month.

Although automakers have launched numerous new products in previous months, September saw an unprecedented influx of new cars, with over a dozen models debuting on the same day. What drives automakers to introduce new cars in such a burst?

New cars flood the market during the 'golden September and silver October'

September and October, with their mild weather, see a significant uptick in consumer spending across various industries, earning them the moniker of 'golden September and silver October.' Automakers collectively launch new cars in September primarily to boost sales during the peak season by offering upgraded models.

However, the timing of the golden and silver months is merely the superficial reason. The underlying cause lies in intensifying industry competition, compelling automakers to introduce hardware-upgraded, price-stable, or discounted new cars to compete with their peers. As evident from the September 26th launches, while some gasoline-powered vehicles were still present, the focus was primarily on new energy vehicles. Even AVATR, previously focused solely on pure electric vehicles, embraced extended-range technology to enhance product competitiveness.

(Image source: Zhidi Automobile)

Around 2020, Tesla and BYD emerged as dominant players, with other new energy automakers pushing for mass production. The industry transitioned from the 'PPT era' to the 'intense competition era.' Tesla's Model 3/Y faced numerous complaints and protests due to repeated price cuts. BYD's Champion and Glory editions offered more features at the same price, leaving early adopters regretful and attracting new customers.

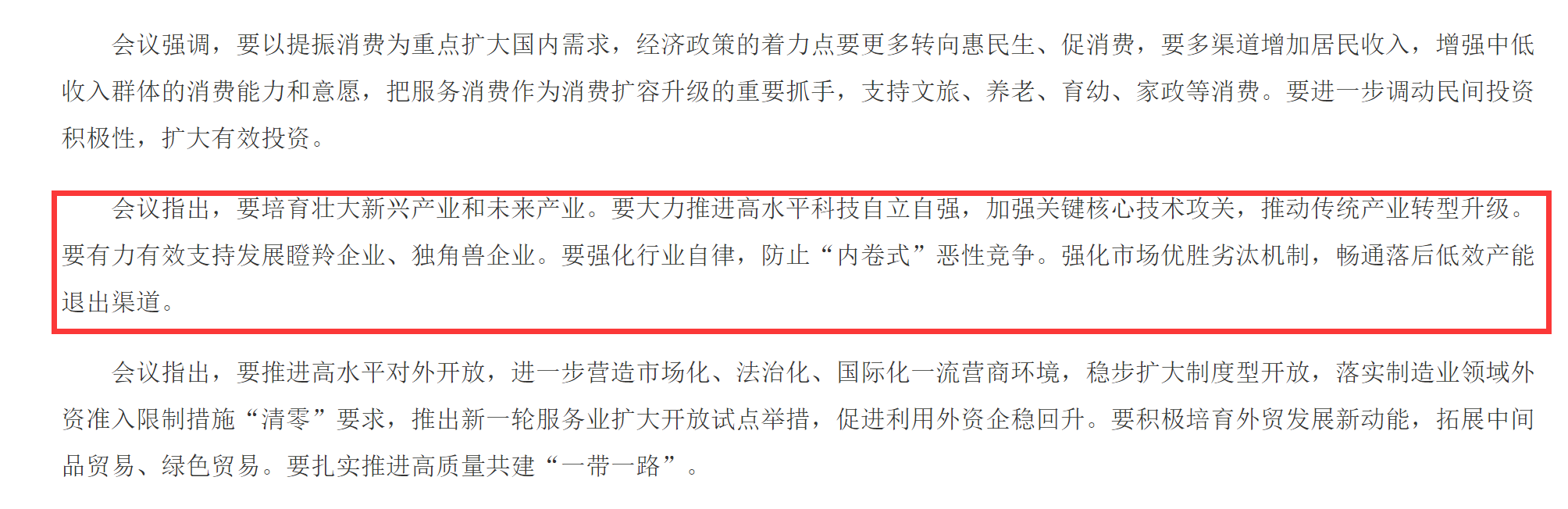

Since late 2023, voices opposing intense competition within the automotive industry have grown louder. Executives like Yu Chengdong (CEO of Huawei's Intelligent Automotive Solutions BU), Li Shufu (Chairman of Geely), and Zeng Qinghong (Chairman of GAC Motor) have denounced price wars, advocating for competition based on value rather than price. Relevant authorities have also issued notices urging an end to such competition.

(Image source: China Government Network)

In July last year, 16 automakers, including BYD, Tesla, and SAIC Motor, signed the 'Commitment to Maintain Fair Competition in the Automotive Industry Market Order,' pledging not to disrupt market competition with abnormal pricing. Ironically, the day after signing, one automaker discounted a model by up to RMB 37,000 for promotional purposes.

Competing on value requires substantial resources for R&D of new technologies and features. Price cuts, however, offer the simplest and fastest route to enhance product competitiveness. Ultimately, automobiles are transportation tools, with smart cockpits and autonomous driving as added bonuses.

(Image source: FAW Toyota)

Automakers continue to invest in R&D, with advancements in battery technology, fast charging, and autonomous driving. Many new energy vehicles are updated annually, yet price cuts remain crucial for sales. This trend extends to gasoline-powered vehicles as well.

During the gasoline-powered era, joint venture automakers dismissed domestic cars. Not only were their prices higher, but some models even required additional payments for delivery. Today, the domestic automotive market is no longer dominated by gasoline-powered vehicles. According to the China Automobile Dealers Association, the penetration rate of new energy vehicles in China reached approximately 52.4% in August, exceeding 50% for two consecutive months.

Overseas automakers lag in electrification, hampered by gasoline-powered vehicle operations and upstream supply chain dependencies. Their new energy vehicles generally lack competitiveness compared to domestic ones, forcing joint venture gasoline-powered vehicles to lower prices to maintain sales and avoid further market share losses. For instance, the starting price of the 2020 Changan Ford Mondeo was RMB 192,800, while the 2025 model starts at just RMB 149,800.

While intense price competition benefits consumers by offering higher-spec models at lower prices, it has drawbacks for the industry's overall development. These drawbacks are temporarily masked by the rapid growth of the new energy vehicle sector but could explode once the sector reaches a critical market share.

The Heated Battle in the Automotive Industry: Competing on Value Over Price

At the Taizhou International Automobile Industry Expo on September 20th, Geely Chairman Li Shufu stated, 'As the price war intensifies, quality deteriorates, and service experiences worsen. If this continues, companies will collapse. Some companies have abandoned ethics and gone rogue, which won't last long. Geely won't follow suit.'

Li Shufu isn't the first to express this view. Chery Chairman Yin Tongyue echoed similar sentiments during the Starway Star Era launch, stating, 'I've always opposed price wars. There's always a limit to how low you can go. Price wars lead to cost-cutting, and when supplier prices hit their limit, quality suffers.'

In reality, the hardest hit by the intensifying price war aren't top automakers like Geely or Chery but rather 4S dealerships and used car dealers. According to the China Automobile Dealers Association, over 8,000 4S dealerships have closed from 2020 to 2023. In recent years, dealer groups like Yongao, Senfeng, and Baolide have faced financial troubles, with BMW dealers even banding together to demand an end to price cuts.

(Image source: BMW Brilliance)

For automakers, dealers are not just sales channels but also crucial for pressure relief. With expensive vehicles, each additional unit in inventory adds significant pressure. Requiring dealers to purchase and manage inventory significantly eases automakers' financial burdens.

However, with increasingly transparent car prices online and automakers continuously driving down costs, dealers' profit margins shrink. Coupled with the difficulty of selling cars amid fierce price competition, many dealers resort to borrowing from banks to fund car purchases. This vicious cycle leads to accumulating inventory and financial distress for weaker dealers, potentially resulting in the bankruptcy of tens of thousands of dealerships in the next five years.

The used car market faces similar challenges. Continuous new car price cuts, sometimes even below used car prices, deal a devastating blow. The Vice President and Secretary-General of the China Automobile Dealers Association, Xiao Zhengsan, bluntly stated that 92% of used car dealers in China have been operating at a loss in recent years. The consequences of 4S dealership and used car dealer losses are a drastic decline in service quality, as they struggle to make ends meet.

(Image source: ElecCarNews)

For automakers, as Li Shufu and Yin Tongyue have noted, reducing prices and costs inevitably compromises quality. Quality and service are the lifeblood of automakers, and their simultaneous loss has dire consequences. While financially strong automakers can absorb some profit losses, weaker ones risk collapsing along with their competitors.

At the Second Future Auto Pioneer Conference, Yu Chengdong acknowledged that BYD's strong cost control enables it to compete on price. In contrast, HarmonyOS Intelligent Vehicle focuses on competing on value, particularly in intelligent driving, which offers greater potential.

The phrase 'The first half of the new energy vehicle industry is electrification, and the second half is intelligence' is now ubiquitous in automaker conferences. However, not many companies possess Huawei's capability to deliver results in intelligence. Fortunately, competing on value isn't limited to intelligence. NIO's service and battery swap stations, Volvo's safety reputation, and other examples demonstrate the potential of competing on value and influence.

While competing on value, automakers should consider reducing model launches, abandoning the sea of car strategy, and focusing on quality and customer experience. Only when value is recognized by consumers can the mantra 'less is more' hold true—fewer models and costs lead to increased sales, revenue, and profits.

The September 26th scenario, with over a dozen new car models launching simultaneously, is perhaps better kept to a minimum.

The 'Post-New Energy Era' Arrives: Who Will Remain in the Game?

At the September 27th Xpeng MONA M03 launch event, CEO He Xiaopeng predicted that only seven automakers, both domestic and joint ventures, would emerge as mainstream brands in China over the next decade. Executives like Yu Chengdong, Yin Tongyue, Zero Run Chairman Zhu Jiangming, and HiPhi Chairman Ding Lei have echoed similar views.

(Image source: ElecCarNews)

By 2030, at least dozens of automakers in China will likely falter, with intense price wars accelerating the elimination of weaker players. Nonetheless, I remain optimistic about the domestic new energy vehicle industry's development. Despite fierce competition, 'life' will find a way.

BYD, with its extensive in-house capabilities beyond glass and tires, can confidently compete on price due to its robust financial and technological foundation. Brands like HarmonyOS Intelligent Vehicle, NIO, and Xpeng, while less adept at price competition, target high-end markets where consumers are less price-sensitive. These automakers, with their core competencies in intelligent driving, extended-range technology, battery swaps, and services, have the potential to become industry giants.

(Image source: NIO)

Zero Run, with its lower-priced positioning, reduces costs through in-house R&D and production. It has also partnered with global automotive giant Stellantis to jointly develop products for overseas markets, offering a viable path for other automakers.

Price competition is merely one means for new energy automakers to enhance product competitiveness amidst rising sales. While engaging in price wars, leading new energy automakers continue to push the boundaries of intelligent driving, fast charging, and smart control technologies, accelerating their market penetration and simultaneously competing on value.

As long as competition persists, price wars will endure. For automakers to advance, they must simultaneously compete on both price and value once the industry stabilizes. Therefore, consumers needn't be overly pessimistic about automakers' internal competition; it's a necessary step in industry development.

While some automakers may falter due to intense price wars, others will emerge victorious, maturing into global automotive giants after the dual crucible of price and value competition.

Source: Leitech