"Besieging" Model Y, are domestic brands sounding the rallying call?

![]() 09/27 2024

09/27 2024

![]() 419

419

Written by Sandian

As China's new energy passenger vehicle retail penetration rate surpassed 50% again in August, the tide of electrification transformation is becoming increasingly intense. At this point, if a friend asks you, how should one choose if they want to buy a pure electric SUV with a budget of 250,000 yuan?

As the top-selling model in China's SUV market, Tesla Model Y should be on the list of alternatives, perhaps even the top choice. However, with the launch of numerous domestic brand models, Model Y's dominant position seems to be facing unprecedented challenges.

In fact, the domestic version of Model Y was launched at the beginning of 2021, which is quite remarkable given the rapid pace of new model launches today. Yet, it has consistently maintained its market position over the years, which speaks volumes about its product strength.

From Leadway L60, Zeekr 7X, AVIDA 07, IM Motors LS6, to XPeng G6, NIO ES6, JiYue 01, Hyperion HT, Denza N7, IM Motors R7, domestic brands have continued to launch new models over the past three years, presenting a scenario reminiscent of the "Six Sects Besieging the Bright Summit" and launching a full-scale attack. Facing such a situation, Tesla also has a countermeasure, as a new Model Y is set to be launched soon.

So, after Model 3 stepped down from its pedestal, can Tesla's other classic model, Model Y, withstand the "group attack"? What new trends in the new energy automobile industry are reflected behind this phenomenon? Let's start by discussing the strengths of Model Y.

01 Why is Model Y so dominant?

Slogans like "Besieging Tesla" and "Besieging Model Y" have been around for years, not just this year. However, Tesla Model Y has not been significantly impacted.

In terms of sales, Model Y remains powerful in 2024, with domestic sales reaching 289,400 units in the first eight months, an increase of 3.9% year-on-year, and an average monthly sales volume of 36,200 units. Such a performance is enough to sustain some domestic brands, even with just a fraction of those sales. It's no exaggeration to say that this model has always firmly held the initiative in the mid-range pure electric SUV market.

So, it's only natural that competitors are envious.

However, the fact that Model Y continues to hold its ground also demonstrates its true strength. Firstly, Tesla's brand power remains strong, especially in lower-tier cities. Even Model 3, which seems to have been overshadowed by domestic brands, still sold over 18,000 units in August. This shows that the Tesla name still carries considerable market appeal.

Secondly, Tesla has explicitly stated that its Full Self-Driving (FSD) system will officially land in the Chinese market in Q1 next year, pending regulatory approval. Once FSD is successfully launched, its technological leadership could become Tesla's killer app, further strengthening its brand appeal and compensating for its shortcomings in intelligent driving.

From BEV to end-to-end autonomy, Tesla leads Chinese automakers in autonomous driving technology, a fact that must be faced. For example, at the end of last year, Tesla unveiled its end-to-end + large model FSD V12 system, and subsequently, more and more domestic companies began to abandon rule-based algorithms and shift to this new approach, including tech companies like Huawei, SenseTime, and Yuanrong Qixing, as well as automakers like NIO, XPeng, and Li Auto.

Lastly, the Model Y, which hasn't seen a significant update in several years, is about to undergo a mid-cycle refresh. NodeAuto speculates that the new Model Y will undergo significant improvements in areas such as chassis comfort, infotainment hardware, and intelligent driving hardware. Therefore, it won't be easy to truly dethrone Model Y.

However, this doesn't mean that domestic brands don't have a chance.

02 Who are the ones "besieging" Model Y?

Recently, domestic brands have intensified their attacks. On August 30th, Zeekr 7X was unveiled and will be launched on September 20th; on the same day, AVIDA 07 opened blind bookings, with its pure electric and extended-range versions set to launch in September; on September 10th, IM Motors R7, a collaboration between Huawei and Chery, opened pre-sales; and on September 19th, the first model from NIO's sub-brand, Leadway L60, will be officially launched.

These models share several commonalities, such as being pure electric SUVs, with lengths around 4.8 meters, wheelbases around 2.9 meters, price ranges between 220,000 and 300,000 yuan, and a focus on intelligence. They are all targeting the same market segment as Tesla Model Y.

The reason for this focus on Model Y is primarily due to the attractiveness of this market segment. With monthly sales of 30,000 to 40,000 units, even a small slice of Model Y's sales would be enough to propel a brand into the sales rankings.

But can these four new models steal a piece of the pie from Model Y? Let's take a look at their respective characteristics.

Zeekr 7X follows a premium route, with an entry-level configuration of a 310kW motor and a 0-100km/h acceleration time of 3.8 seconds, typical of Zeekr's style. In addition, the chassis configuration is top-notch, with adjustable steering, shock absorption, and suspension, providing a more agile driving experience compared to similarly-sized fuel SUVs.

Simply put, Zeekr 7X can be seen as a family-oriented version of Zeekr 007, with larger space but still maintaining high-level handling performance. Many believe it's the only model that can comprehensively compete with Tesla Model Y.

However, NIO's Leadway L60 doesn't necessarily agree. Many people like to compare Zeekr 7X and Leadway L60, but in fact, Leadway L60 is more economical compared to Zeekr 7X.

Leadway L60 is NIO's first "downmarket" product. Performance-wise, the entry-level configuration of Leadway L60 boasts a 240kW motor, achieving 0-100km/h acceleration in 5.9 seconds. While this performance is not superior to Zeekr 7X, intelligent driving technology is Leadway's strength, with all new models equipped with Qualcomm's 8295 chip and 60TOPS of AI computing power.

Moreover, Leadway L60 can directly share NIO's battery swapping system, with excellent design for household scenarios, meticulous consideration for both interior comfort and space practicality. Therefore, since its launch, Leadway L60 has garnered high market enthusiasm, which has led to an awkward scenario where everyone is shouting the slogan of "besieging Model Y," but it's actually Leadway L60 that's taking the brunt of the attack.

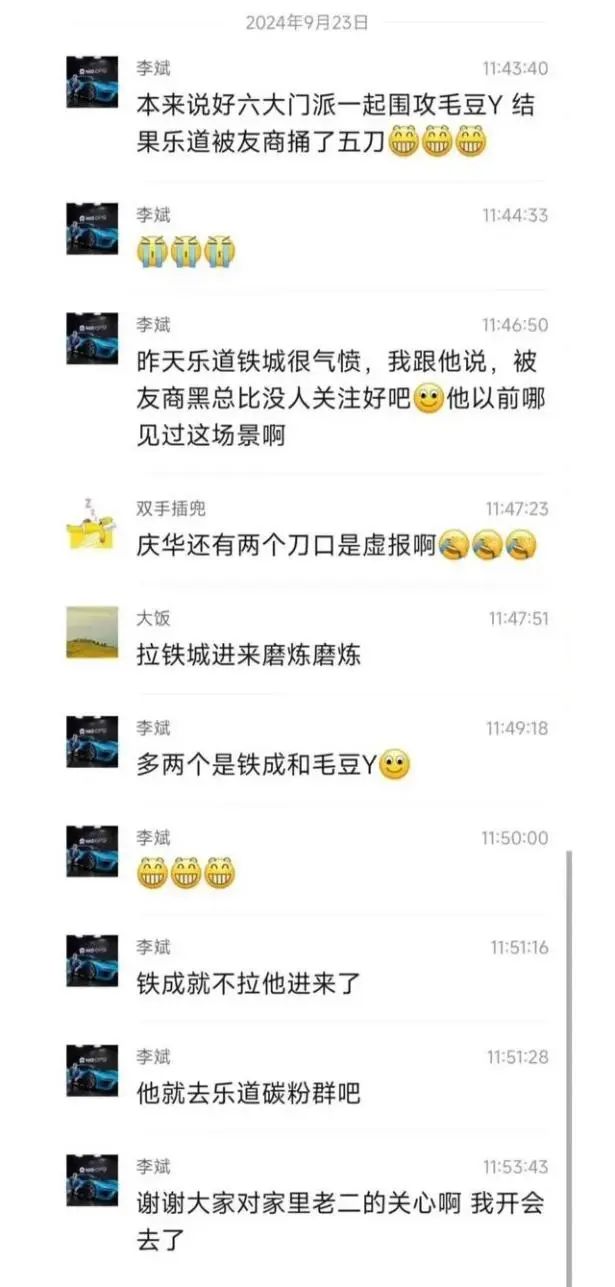

Just a few days ago, on September 23rd, NIO Chairman William Li complained in a group chat that the original plan was for six factions to jointly besiege Tesla Model Y, "but in the end, Leadway got stabbed in the back five times by competitors."

Perhaps, this is the essence of market competition.

Compared to the above two models, AVIDA 07 and IM Motors R7 can be collectively referred to as the "Huawei camp," incorporating a large amount of Huawei technology, such as the use of Huawei's Kunpeng Intelligent Driving ADS 3.0 system and Huawei's HarmonyOS cockpit. Under Huawei's aura, they have relatively strong market appeal.

IM Motors R7 is a standard coupe SUV, adopting a fastback design similar to Model Y, but with a nearly 200mm longer body length and 60mm longer wheelbase, making it slightly larger than Model Y. During the launch event, Yu Chengdong compared the car to Tesla's Model X, which sells for over 700,000 yuan, but R7's pre-sale price is only 268,000 yuan, just 20,000 yuan more than Model Y, clearly aiming for the "aim high, hit low" strategy.

In contrast, AVIDA 07 focuses on family use, continuing the previous design style but with a more neutral exterior that resembles a standard SUV. Its extended-range version will also be launched simultaneously, eliminating range anxiety compared to Model Y.

In addition to these recent models, many other domestic brands have joined the "besieging Model Y" camp, such as XPeng G6, IM Motors LS6, JiYue 01, Hyperion HT, Denza N7, etc. While the momentum is strong, can they really defeat Model Y?

03 Will Model Y be dethroned?

Currently, it seems unlikely that pure electric domestic brands can dethrone Model Y in the short term.

Unless extended-range SUVs are also considered, there might be a chance. For example, Lixiang L6, which is priced similarly to Model Y, sold 24,000 units in August; AITO M7 sold 11,000 units in the same month. While they still lag behind Model Y, they are at least closing the gap.

From Model Y's perspective, since its launch, Tesla's product has not undergone a significant refresh, and its price has not seen major adjustments, almost as if it's standing still and waiting for domestic brands. The 2021 Model Y Standard Rear-Wheel Drive variant had a guide price of 290,000 yuan, and compared to the current models on sale, there's no fundamental difference in configuration. In the past three years, only the driver assistance chip and battery have been upgraded, with a price reduction of 40,000 yuan.

It's difficult to predict what kind of market impact a major upgrade to Model Y would have, or whether it would once again leave domestic brands in the dust.

In fact, Model Y's dominance in the 250,000 yuan price range is closely related to the needs of consumers in this segment. Potential buyers in this price range tend to be the "hardest to please," seeking satisfaction in every aspect.

For example, they want a durable electric drive system, sufficient real-world range, mature intelligent experience, excellent driving feel, spacious interior, a positive brand image, convenient energy replenishment, a transparent purchasing process, efficient after-sales service, etc. Their mantra is "I want it all."

In this context, the test for automakers' products is that their comprehensive capabilities must be exceptional. Currently, among brands that meet these criteria, Tesla, as a pioneering electric vehicle leader, is naturally the most competitive. In contrast, while domestic brands have continued to launch competing models, they still need to work harder to comprehensively challenge Model Y at the 250,000 yuan price point.

Domestic brands shouldn't be discouraged, however. Elon Musk said in January this year: "Chinese automakers are the most competitive in the world and will achieve great success abroad. Frankly, if trade barriers are not erected, they will virtually eliminate most other automakers in the world."

Admittedly, Model Y remains dominant for now, posing a higher challenge for domestic brands. But as long as they continue to work hard and compete with top players, domestic brands will eventually overcome the hurdle of Model Y. Isn't this how China's automotive industry has progressed over the past few decades?