Six major automakers besiege Model Y

![]() 09/26 2024

09/26 2024

![]() 375

375

As battery costs decline and technologies such as electric motors, batteries, and intelligence mature, domestic new energy automakers are inevitably facing off against Tesla's Model Y. It has become a consensus among automakers to launch new products before Model Y's replacement arrives.

Cover image source: Unsplash"

Which new energy vehicle model faces the most pressure in the 2024 market?

Judging from the first half of the year, this "honor" might go to Xiaomi SU7. Even before its official launch, the model was caught in a price war in the automotive circle, forcing CEO Lei Jun to lower the launch price. After its launch, it encountered targeted competition everywhere, and every time a new electric sedan model was released, it was inevitably compared to Xiaomi SU7.

Entering the second half of the year, the main target of the automotive circle's focus shifted to Tesla's Model Y.

In the past month, several automakers have publicly announced their intention to directly compete with or even surpass Tesla's Model Y in terms of product capabilities, including NIO's sub-brand Ledo's first model L60, Geely's all-new mid-size SUV Zeekr 7X, and HarmonyOS Smart Mobility's first pure electric coupe SUV Zhide R7.

If we also consider previous models in the same price range, such as BYD Dolphin and Xpeng G6, as well as the upcoming AITO 07, Lantu Zhiyin, and IM Motors LS6, Tesla Model Y faces no less competition in the Chinese market than Xiaomi SU7 did in the first half of the year.

1

All guns blazing at Tesla

On September 24, Zhide R7 was launched at Huawei's Autumn New Product Launch Event. The new car offers three range variants (667km, 736km, 802km) across four models, priced between 259,800 and 339,800 yuan.

At the launch event, Yu Chengdong bluntly stated, "Tesla Model Y is a very successful product in the pure electric SUV market, and it is excellent. The goal of Zhide R7 is to be even better than Model Y and to compete with it across levels, exceeding the specifications of Tesla Model X."

In addition, Yu Chengdong also revealed that Zhide R7 is being sold at a loss, stating, "We currently lose more than 30,000 yuan per vehicle sold. This year, we are definitely losing money, but we aim to break even after increasing production next year."

Unlike Yu Chengdong, who often makes surprising statements, NIO founder William Li Bin has not brazenly claimed to be "better than Model Y," but he has relentlessly positioned Ledo L60, NIO's sub-brand's first model, as a "deluxe and larger battery swap Model Y."

However, in an interview before the launch event, Ledo President Ai Tiecheng stated, "(Ledo L60) is a direct competitor to Model Y." On the day of the launch, he reiterated, "Ledo L60 has surpassed Model Y in underlying technology."

Apart from its deluxe and larger size, as well as battery swap capabilities, Ledo L60 also boasts strong market competitiveness in terms of pricing. Its standard range 60kWh battery version is priced at 206,900 yuan, while its long-range 85kWh battery version costs 235,900 yuan. With the BaaS battery rental service, the price of L60 drops to as low as 149,900 yuan, with the lowest monthly battery rental fee of only 599 yuan.

It is also worth mentioning that although both Zhide R7 and Ledo L60 are SUVs, they both adopt a fastback design similar to Model Y, demonstrating their tight competition with their rival.

In addition to HarmonyOS Smart Mobility and NIO, which bring their own traffic and topics, several other new energy automakers have recently launched mid-size SUV products, and they have unanimously chosen Model Y as their imaginary enemy.

Zeekr's recently launched 7X starts at just 229,800 yuan but abandons Tesla's fastback design, returning to a classic SUV shape. Zeekr CEO An Conghui said, "Building a car that is more Model Y than Model Y is not difficult. Chinese automakers have the engineering capabilities and cost advantages, but that's not Zeekr's choice."

In the next month, three more pure electric mid-size SUVs - AITO 07, IM Motors LS6, and Lantu Zhiyin - will officially launch. From a competitive standpoint, the 200,000-300,000 yuan pure electric SUV market is poised to witness an intense "six sects besieging Mount Guangming" scenario before the end of the year.

2

Why Model Y?

The reason why major automakers have targeted Tesla Model Y as the model to surpass lies in its remarkable sales performance in the Chinese market as a global model.

Over the past year (August 2023 to August 2024), Tesla Model Y sold a total of 518,276 new vehicles, leading the pure electric SUV market and outpacing the second-place BYD Dolphin by over 200,000 units.

In the monthly sales rankings of pure electric SUVs, Tesla Model Y continues to maintain a strong momentum, selling 45,330 new vehicles in China last month, maintaining a significant lead.

Even when expanding the sales scope to the entire pure electric vehicle segment, Tesla Model Y has been China's best-selling electric vehicle for a long time. This year, it has been the top-selling model in the entire automotive market for four consecutive months, until last month when it was narrowly surpassed by BYD Haiou in sales. However, in terms of pricing, Haiou's price is only about a quarter of Model Y's.

With its robust pricing and sales figures, Model Y's dominant market share has attracted the envy of other automakers. After all, over 500,000 annual sales translate to a substantial market share that several new energy automakers would be eager to capture.

It is also worth noting that automakers chose to launch their attacks on Model Y in the second half of the year, keenly aware of its product update gap.

In fact, since its launch, Model Y has not undergone any model changes or significant price adjustments. The current 2021 Model Y Standard Rear-Wheel Drive version is priced at 290,000 yuan, but its configuration is essentially the same as current models on sale, with only an upgrade to the Autopilot chip and a price reduction over the past three years.

In June this year, Elon Musk stated that Tesla would not introduce a facelifted Model Y this year. This means that automakers launching new vehicles in September or October can gain at least a three-month time advantage over the "old Model Y."

From a market perspective, the mid-size SUV segment and 250,000 yuan price range in which Model Y resides have been highly contested since the era of gasoline-powered vehicles. For domestic new energy automakers, penetrating this crucial market segment has long been part of their strategic plans. However, Model Y's overwhelming dominance kept them on the sidelines.

As battery costs decline and technologies such as electric motors, batteries, and intelligence mature, a head-to-head confrontation between domestic new energy automakers and Tesla Model Y is inevitable. Launching new products before Model Y's replacement arrives has become a consensus among automakers.

3

Hard times ahead for Tesla

In terms of product capabilities, while Tesla Model Y boasts impressive sales figures, it is not a flawless model. As domestic electric vehicle manufacturing standards continue to improve, some of Tesla's past product concepts and design styles can no longer win over all consumers.

For example, Model Y's minimalist interior, uncomfortable suspension system, limited storage space, and inflexible one-pedal driving mode could potentially sway consumers' final purchasing decisions.

For other automakers, differentiating themselves from Model Y's weaknesses can potentially help them capture a larger market share. The recently launched models, such as Ledo L60 with its battery swap and "deluxe" features, Zhide R7 with its intelligent driving system, Zeekr 7X with its spacious trunk design, and IM Motors LS6 with its "million-yuan-level chassis quality," are all tailored to address Model Y's shortcomings.

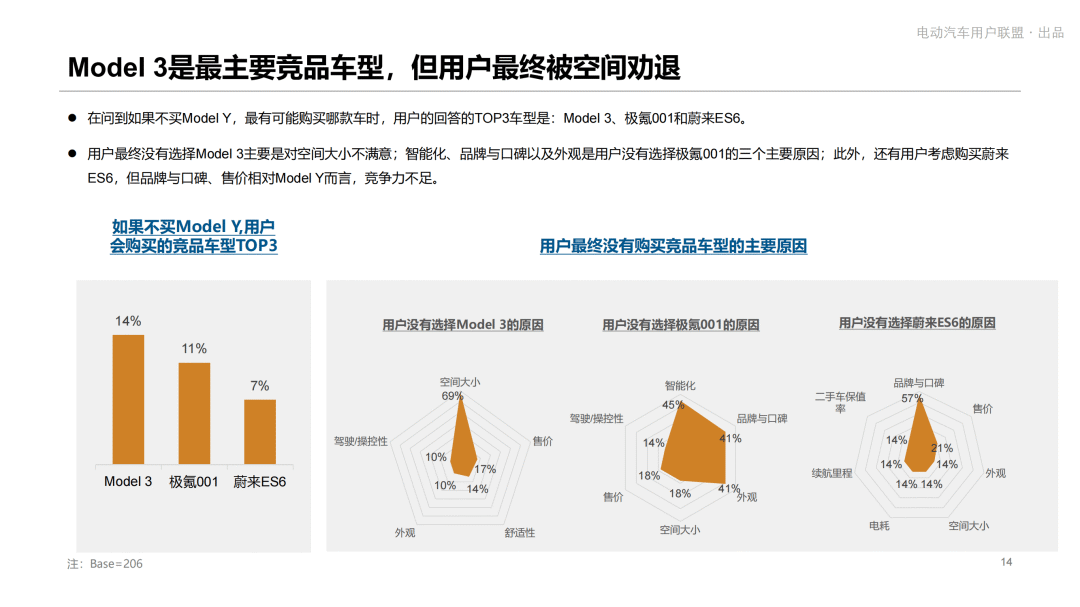

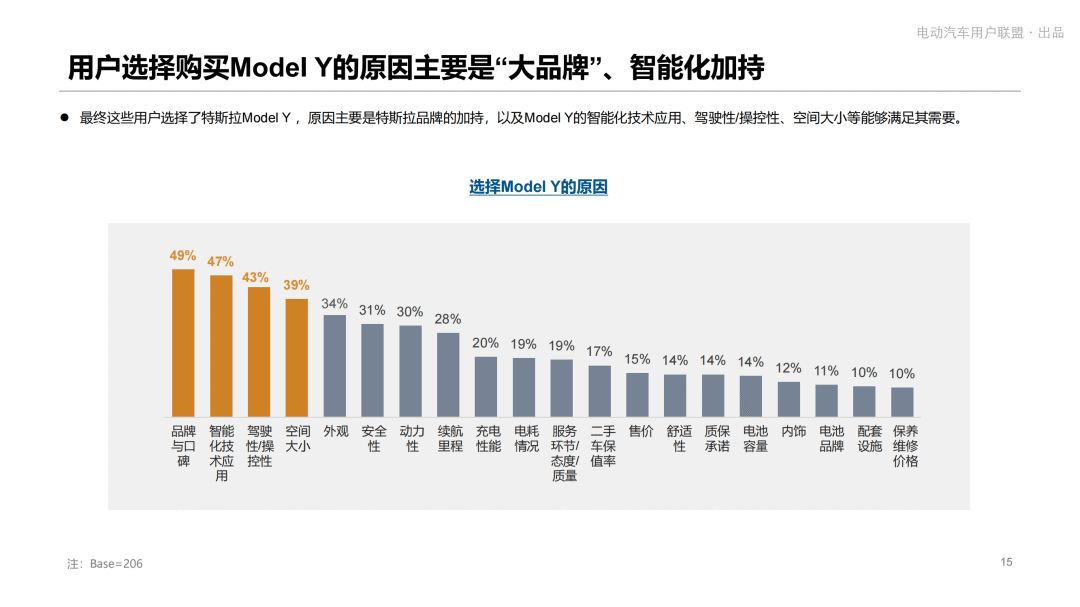

According to the "Tesla Model Y User Satisfaction Survey Report" released by the Electric Vehicle Users Alliance last year, the main reasons for users purchasing Model Y were its "big brand" status and intelligent features. The main competing model was Model 3, with users often being discouraged by Model 3's limited space.

However, in the context of the rising domestic new energy automakers, Tesla's strengths in brand power and intelligence are no longer as pronounced. Moreover, Model Y's so-called space advantage is only relative to its sibling competitor Model 3; compared to other electric SUVs in the same segment, Model Y's space is actually a significant weakness.

Judging from Model 3's past performance, its sales have inevitably suffered after domestic new energy automakers launched similar competing models. As the 2020 sales champion of new energy vehicles in China, Model 3 has fallen from grace in recent years, even resorting to price cuts to stimulate the market. With the increasingly strong performance of models like Xiaomi SU7 and Zeekr 001, Model 3 is no longer the sole standout in its segment.

As a result, Tesla's market share in China's new energy vehicle segment fell from 9.5% in the same period last year to 6.8% in the first half of this year.

It is worth noting that Tesla's Full Self-Driving (FSD) technology, a key project that Elon Musk has been vigorously promoting, may become an important factor in re-attracting consumers to the market when it enters China.

There have been reports that Tesla will launch FSD in China and Europe in the first quarter of 2025, but this has not been officially confirmed, and the specific timeline for its entry into China remains subject to regulatory approval.

It is foreseeable that before FSD arrives, Tesla may face a difficult period in the Chinese market as it is besieged by numerous competitors.