Overview of China's Auto Exports in the First Half of 2024 - From Trade Exports to Industrial Exports

![]() 07/15 2024

07/15 2024

![]() 416

416

Half of 2024 has passed for China's auto industry, and the intense competition within the sector has left everyone feeling a chill amidst the summer heat. OEMs are not making profits, supply chains are struggling, and workers are facing overtime, pay cuts, and layoffs.

Amidst these challenges, the automotive industry generally believes that one promising opportunity lies in overseas expansion. Let's take a look at the overview of China's auto exports in the first half of 2024 based on the recent data released by the China Association of Automobile Manufacturers (CAAM).

Total Exports in the First Half of 2024

Exports of New Energy Vehicles and Fuel Vehicles

Top 10 Chinese Auto Exporters by Volume

Top 10 Destinations for Chinese Auto Exports

Current Status and Outlook for Chinese Auto Exports

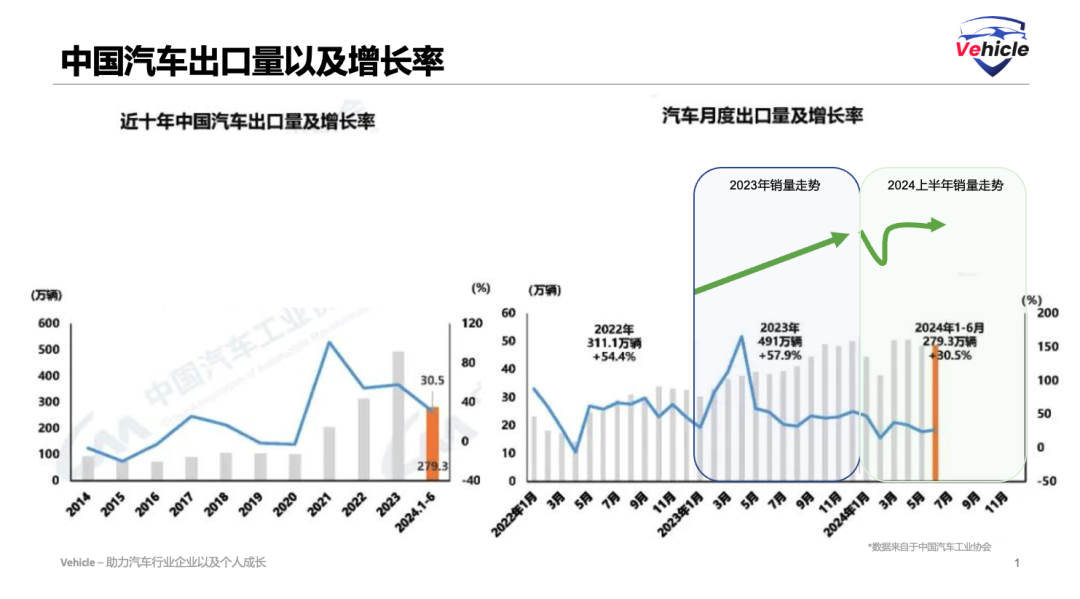

In the first half of 2024, China exported a total of 2.793 million vehicles, representing a 30.5% increase from the same period last year. Among them, 2.339 million were passenger vehicles, up 31.5% from the first half of 2023, while 454,000 were commercial vehicles, up 25.7%.

Overall, there is growth, but if we look at the growth rate, it is declining. Furthermore, monthly exports have fluctuated or even remained flat in the first few months. Compared to last year's data, which showed steady growth, it appears that China's auto exports may have reached a bottleneck.

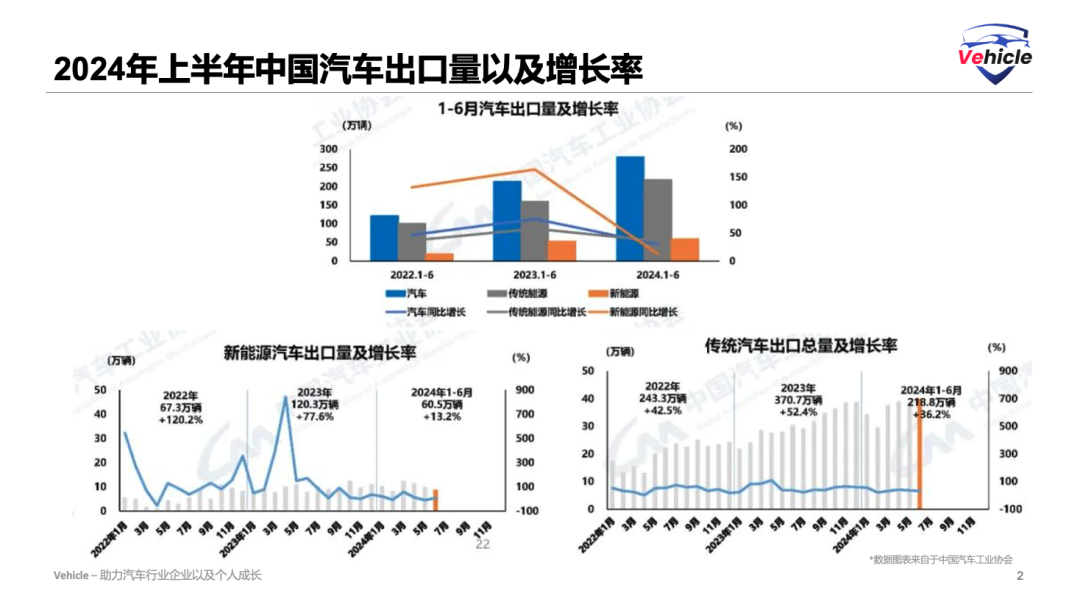

Analyzing exports by fuel type and new energy vehicles:

In the first half of this year, 2.188 million traditional fuel vehicles were exported, an increase of 36.2% year-on-year.

Meanwhile, 605,000 new energy vehicles were exported, up 13.2% year-on-year.

While both categories showed year-on-year growth, the growth rate for fuel vehicles was slightly lower, and the growth rate for new energy vehicles experienced a significant decline.

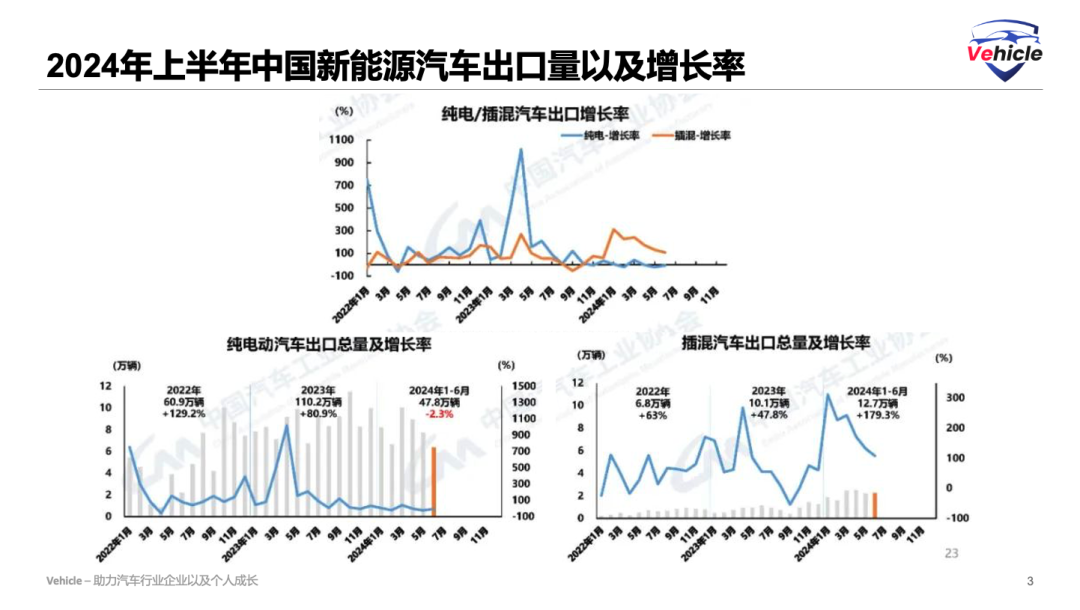

Breaking down the new energy vehicle export data further, we find that in the first half of 2024:

478,000 were pure electric vehicles, a 2.3% decrease from the same period last year.

127,000 were plug-in hybrids, a bright spot with a 1.8-fold increase.

Generally, pure electric vehicles are exported to relatively developed countries in Europe, suggesting that the EU's tariff increases have had a significant impact on China's pure electric vehicle exports.

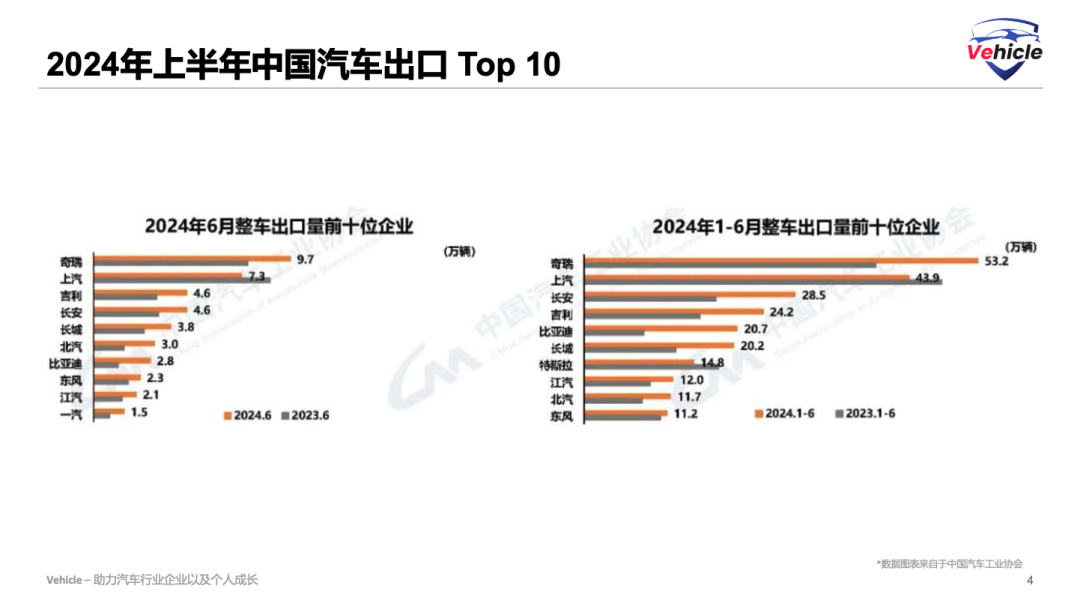

The top 10 Chinese auto exporters in the first half of the year were:

Chery, with 532,000 vehicles exported, ranking first and accounting for nearly one-fifth of China's total auto exports, experiencing rapid growth.

SAIC Motor, with 439,000 vehicles exported, ranking second but seeing a decline from the same period last year, indicating a significant impact from the EU's tariff increases.

Changan, with 285,000 vehicles exported, experiencing faster growth of over 60% compared to last year.

Geely, with 242,000 vehicles exported, also achieving growth of around 50%.

BYD, with 207,000 vehicles exported, experiencing the fastest growth rate of approximately 160%.

Great Wall Motor, with 202,000 vehicles exported, achieving a 62.6% increase.

Tesla, with 148,000 vehicles exported, experiencing a decline due to production at its German factory, and its exports have fallen out of the top 10 based on June data.

JAC Motor, with 120,000 vehicles exported, Beijing Automotive Group (BAIC) with 117,000, and Dongfeng Motor with 112,000, all experiencing growth rates of around 30% on average.

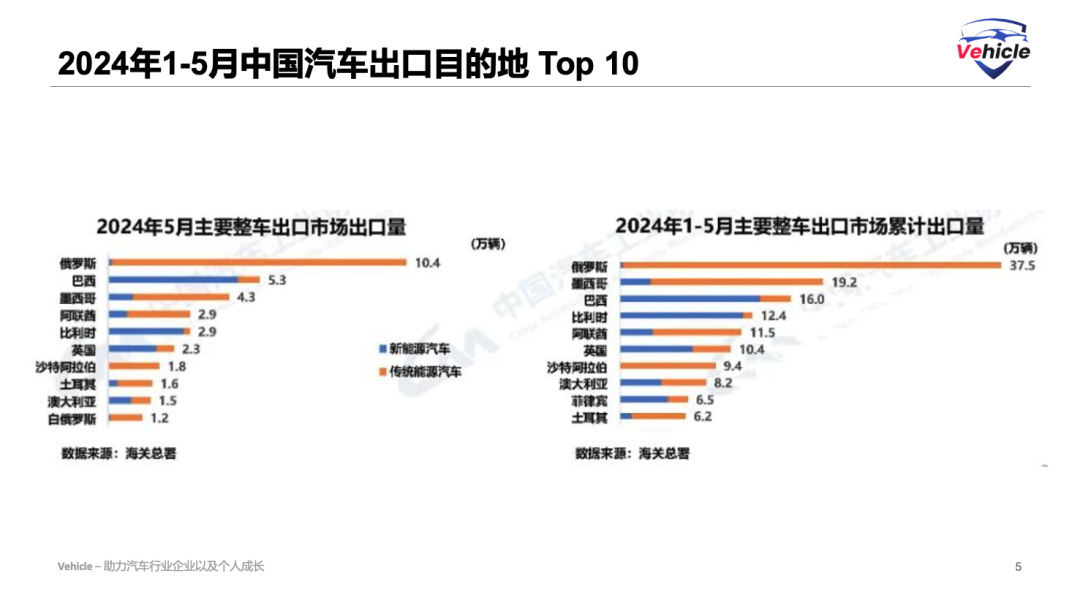

Based on the latest data from January to May 2024, the top 10 destinations for Chinese auto exports were:

Russia, with 375,000 vehicles exported, where traditional fuel vehicles dominate. Following the Russia-Ukraine conflict, European, American, and Japanese automakers withdrew from Russia, leaving a significant market opportunity for Chinese automakers. Initially, Russian exports were primarily handled by traders, but policy changes have led to direct exports by major automakers.

Mexico, with 192,000 vehicles exported, 80% of which are fuel vehicles, mainly Chinese-made vehicles under General Motors brands.

Brazil, with 160,000 vehicles exported, 80% of which are new energy vehicles, benefiting from the country's supportive policies for new energy vehicles. BYD and Great Wall Motor dominate the Brazilian market for new energy vehicles.

Belgium, with 124,000 vehicles exported, over 90% of which are pure electric, located within the EU.

The United Arab Emirates, with 115,000 vehicles exported, 75% of which are fuel vehicles. As a major oil producer in the Middle East, the UAE is also actively embracing Chinese industries.

The United Kingdom, with 104,000 vehicles exported, 60% of which are new energy vehicles. Currently, the UK imposes a 10% tariff on Chinese vehicles, but there are rumors that it may follow the EU's lead in imposing additional tariffs, although no decision has been made.

Saudi Arabia, with 94,000 vehicles exported, virtually all of which are fuel vehicles.

Australia, with 82,000 vehicles exported, 60% of which are fuel vehicles.

The Philippines, with 65,000 vehicles exported, 70% of which are new energy vehicles. In late 2022, the Philippines announced a 0% tariff on new energy vehicles, significantly stimulating imports of such vehicles.

Turkey, with 62,000 vehicles exported, 80% of which are traditional fuel vehicles.

For new energy vehicle exports, the focus remains on developed Europe and countries with favorable new energy policies such as Brazil and the Philippines.

Current Status of China's Auto Exports:

According to data from the General Administration of Customs, China exported 5.221 million vehicles in 2023, surpassing Japan by nearly 1 million vehicles and ranking first globally.

However, the automotive industry is characterized by long supply chains and heavy assets, making it a commodity closely tied to local employment and industrial development. It is unlikely that any country or region will allow this commodity to remain solely in the commodity trade stage. Currently, tariff increases imposed by Europe, the US, and other regions on Chinese vehicles are a countermeasure against our trade exports.

Therefore, China's auto exports will inevitably evolve from the 1.0 stage of solely exporting complete vehicles to the 2.0 stage of comprehensive industrial exports encompassing talent, technology, management, and supply chains.

However, this comprehensive industrial export will also encounter more challenges, as it entails greater risks and requires significant investments and long-term efforts. A deep understanding of local consumer and industry needs, as well as a clear grasp of local policies and laws, is essential.

Currently, BYD is building factories in Hungary and Turkey, Chery has acquired Nissan's factory in Spain, Leapmotor has basically confirmed the use of Stellantis' factory in Poland, and SAIC Motor has announced plans to build a factory in Spain. Europe, with its mature markets, friendly policies towards new energy vehicles, and well-established legal systems, serves as a bridgehead for China's automotive industry to expand overseas.

Finally, Vehicle, in collaboration with local chambers of commerce and electric vehicle associations in Belgium, France, Hungary, Germany, and the UK's Mason Exhibitions, is planning a European automotive delegation event in October 2024. We welcome automotive supply chain and investment enterprises interested in expanding into Europe to reserve seats.

*Reprinting and excerpts are strictly prohibited without permission - Reference Material:

CAAM Data Release Conference in June 2024 >>>>