NVIDIA's Thor Faces Hurdles, as Domestic Chips Seek to Reshape the Industry

![]() 04/24 2025

04/24 2025

![]() 403

403

On April 17, NVIDIA CEO Jen-Hsun Huang visited Beijing for the third time in three months. This visit was widely viewed as a "crisis management" mission. Earlier, the U.S. unexpectedly imposed an "indefinite export control" on NVIDIA's H20 chip tailored for the Chinese market, forcing NVIDIA to cancel a $5.5 billion order and witnessing a $1.3 trillion market value erosion in a single day. However, this was merely the tip of the iceberg. As a strategic market contributing 29% of NVIDIA's global revenue (based on data from the first three quarters of 2024), China serves as both the most dynamic testing ground for AI applications and the birthplace of the autonomous driving revolution.

Yet, NVIDIA's "China strategy" is encountering unprecedented challenges: the mass production of its flagship Thor chip has been postponed three times, while domestic automakers are accelerating their self-research efforts. Amid the looming threat of U.S. export control policies, domestic chip manufacturers like Horizon Robotics and Huawei Ascend are swiftly rising, making domestic chip substitution a tangible reality. Huang's visit sent a clear message: China is a "very important market" for NVIDIA, but his "crisis management" mission is essentially about striking a balance between the U.S. ban and the Chinese market.

▍Thor's Star Power Fails to Overcome Mass Production Hurdles

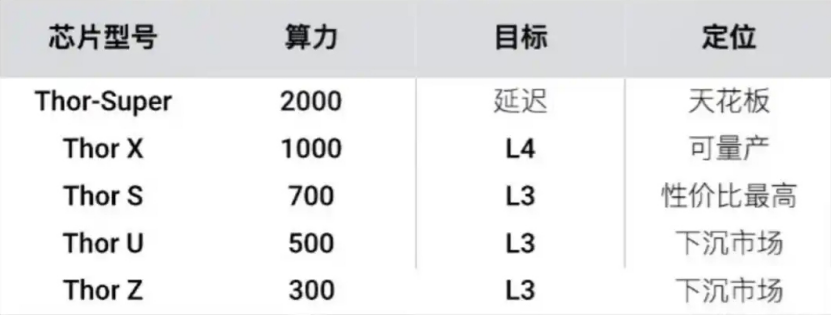

In 2022, NVIDIA introduced the Thor chip with a computing power of up to 2000 TOPS. Leveraging its Blackwell architecture, which integrates multi-domain functions like autonomous driving and cockpit interaction on a single chip, it was once hailed by automakers as the ultimate solution for the central computing platform. However, the mass production timeline for this "revolutionary chip" has been pushed back from the original plan of 2024 to 2026, and it might only offer a low-computing power version.

Thor's core competitiveness lies in its Blackwell architecture and 4nm advanced process. While the Blackwell architecture is specifically optimized for generative AI and large models, its highly integrated design has exposed flaws in automotive-grade verification: low yield rates of TSMC's 4nm process, inefficient heat dissipation due to the bare die design, and the complexity of automotive-grade functional safety certification, further hindering progress.

NVIDIA's ambition to "solve all problems with one chip" currently appears as a stumbling block on the path to mass production. To alleviate pressure, NVIDIA is even considering launching a performance-reduced B200A version and shifting to a smaller package design.

The escalating U.S. semiconductor export controls on China have also deepened the trust crisis between automakers and NVIDIA. Although Thor itself is not directly restricted, the policy uncertainty has prompted automakers to reassess supply chain security.

The China Association of Automobile Manufacturers publicly advised "cautious procurement of U.S. chips," while automakers like NIO and Xpeng, which initially planned to equip Thor, have turned to self-research or domestic substitution solutions. Despite Huang's repeated emphasis on China's strategic importance, the delays in Thor and the ban on H20 have compelled automakers to question their collaboration with NVIDIA.

▍Domestic Automakers Seek to Oust NVIDIA

In response to the delay of Thor, automakers have adopted varied strategies: some traditional automakers relying on NVIDIA's existing Orin-X chip for transition, such as BYD and GAC, support combined autonomous driving functions through a dual Orin-X combination solution; others opt for self-research solutions. Xpeng, which originally intended to equip Thor in its 2025 models, has shifted focus to its self-developed Turing AI chip, which will be the first to mass-produce in the Chinese market in the second quarter of this year. NIO is banking on the "Shenji NX9031," claiming its "one chip equals four" edge inference capabilities are already mass-produced and installed on the flagship model ET9. Li Auto has also unveiled its self-developed 5nm chip "Schumacher," targeting the next generation of end-to-end solutions.

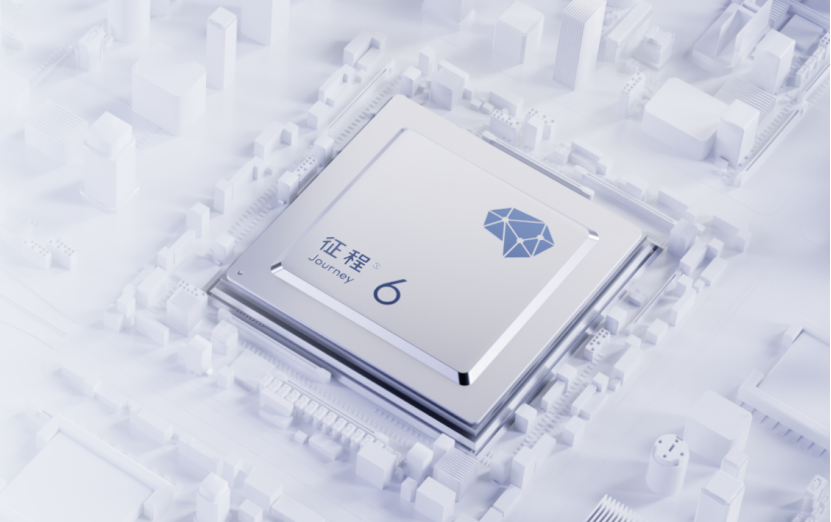

Notably, the newly released Horizon Journey 6P, with a computing power of 560 TOPS, is approaching Thor's performance and offers a significant cost advantage, making it the "Plan B" for most automakers. Tesla's case illustrates another possibility: through algorithm optimization and hardware architecture reconstruction (such as migrating ESP functions to the FSD chip), more autonomous driving functions can be achieved with lower computing power. Its 144 TOPS HW3.0 chip remains the benchmark for efficiency, providing the industry with an alternative path of "light computing power + heavy algorithms," compelling automakers to re-evaluate the relationship between computing power stacking and technological practicality.

Meanwhile, with its low-end version of 128 TOPS computing power and localized services, the Horizon Journey 6 chip has captured over 15% of the market share in the low-to-mid-end vehicle segment. Huawei Ascend 910B, through the MDC platform, is tied to brands like AITO and AVATR, and its 8-card server is priced similarly to H20 but offers a 20% improvement in energy efficiency. In the second half of 2024, Huawei and Sugon's share in the AI chip market has steadily increased to 25%, and the H20 ordering spree triggered by the U.S. ban (such as $16 billion orders from Tencent, Alibaba, and ByteDance) has accelerated domestic substitution.

Furthermore, automakers and technology companies are no longer content with passively accepting chip standards but are taking the initiative through self-research and ecosystem binding. Huawei's MDC platform leads the way in achieving commercial L3-level scenarios with its ADS 3.0 technology. The MDC810 chip equipped in models like AITO and Intelligent Auto boasts a computing power of 400 TOPS and delivers an "over-level experience" through software and hardware co-optimization.

GAC has jointly launched multiple automotive-grade chips with ZTE and Yutai Microelectronics, covering core areas such as central computing and high-bandwidth communication. Dongfeng's self-developed domestic MCU chip DF30 has broken through ASIL-D safety certification, directly targeting power control and chassis systems. These actions indicate that automakers are shifting from "passive procurement" to "ecosystem co-construction," aiming to gain a voice in the chip definition stage.

For the Chinese market, if Thor continues to face delays, domestic substitution will accelerate, and NVIDIA might lose the opportunity to define the next generation of intelligent driving standards. Conversely, vendors like Huawei and Horizon Robotics are poised to become rule-makers, leveraging policy dividends and localization advantages.

An industry insider told Auto Market Insight that the core of the current industry reshuffle has shifted from a "computing power race" to "ecological resilience," with Huawei and NIO leading the way through vertical integration. Horizon Robotics and others are occupying the mid-range market with an open ecosystem. Tesla's case proves that algorithm optimization and architectural innovation can also transcend hardware limitations. As they stated, "When computing power is no longer the sole barrier, the outcome of the chip war hinges on ecology and trust." Automakers are gradually forming two parallel paths in the balance between "self-research substitution" and "international cooperation": relying on NVIDIA's computing power advantages in the short term, building an autonomous chip ecosystem in the medium term, and achieving autonomous substitution in the long term.

Typesetting by Yang Shuo | Image Sources: NVIDIA, Horizon Robotics, Dongfeng Motor