Bilibili still aims to be a respectable company

![]() 11/28 2024

11/28 2024

![]() 493

493

Editor's Note:

When the economy slows down and the pressure of reality mounts, some people choose to go with the flow, while others choose to retreat gracefully. However, Bilibili is still persevering and wishes to retain a semblance of respectability.

Since last year, as major internet companies have encountered growth bottlenecks and faced industry competition, 'focusing on the main business and returning to users' has become a consensus action. A year later, Tencent, JD.com, Alibaba, Bilibili, and others have all released their latest financial reports.

In Bilibili's third-quarter financial report this year, revenue, gross profit, and other financial indicators showed positive trends, and the company achieved its first single-quarter profit since going public. How should we view Bilibili's profitability this time? What business logic lies behind it?

In recent years, as Bilibili has seemingly expanded infinitely, from its initial status as a 'small, obscure site' to a comprehensive content platform, it has also faced questions from long-time users about whether its original otaku culture has disappeared and whether it has become overly commercialized. Coupled with the sluggish performance of games, which has dragged down overall results, the future of Bilibili has caused concern among outsiders.

What exactly is Bilibili?

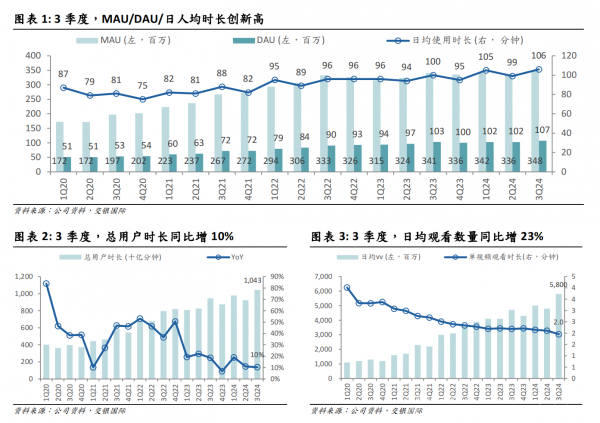

Through this third-quarter report, we find that Bilibili's community genes and core remain intact. The financial report shows that in Q3, MAU was 348 million, up 2% year-on-year and 4% quarter-on-quarter; DAU was 107 million, up 4% year-on-year, with DAU/MAU increasing to 30.7%; and average daily usage time per user was 106 minutes, up 6 minutes year-on-year and 7 minutes quarter-on-quarter.

(Image source: Company announcement, BOCOM International)

These data indicate that Bilibili remains the favorite of young people. Through continuous upgrades of high-quality content, it maintains its attractiveness and value perception among users, boasting a rich, diverse, and distinctive community culture.

Bilibili exclusively attracts a high-end, tech-savvy younger generation of consumers. They are intelligent and discerning but highly consumptive. Data shows that the penetration rate of Bilibili users among top-tier universities exceeds 82%, with active users mainly in first- and second-tier cities. There are 645 professors and scholars on Bilibili, with over 13 million users watching science popularization videos daily.

This steadily growing foundation constitutes the greatest confidence in Bilibili's business operations and is what Bilibili most wants to uphold. This is also why, when facing profitability pressure in recent years, Bilibili has not chosen aggressive expansion or overexploitation but has instead continued to delve deeply into its three main businesses and explore the most suitable business path for itself, based on community operations.

The financial data for this Q3 also once again proves that Bilibili's adherence to community experience has brought positive results to its business operations. In Q3 of this year, Bilibili's value-added services, advertising, games, and IP derivatives and other businesses contributed 38%, 29%, 25%, and 8% of revenue, respectively, presenting a healthy and diversified revenue structure that not only differentiates it from other content platforms but also becomes increasingly sustainable in the long term.

However, achieving such business goals is not easy for Bilibili; it has taken difficult steps to get here.

01 Advertising

First, let's look at Bilibili's advertising business. From the perspective of the internet industry, exchanging traffic resources for advertising fees is a 'quick and easy way to make money.' Under the pressure of profitability, many community products before Bilibili chose this path of easy money.

However, for a long time, Bilibili insisted on not accepting advertisements, even after commercialization, it remained restrained. It not only abandoned pre-roll ads, a stable source of cash flow, but also always strived to maintain a balance between the community and commerce, always harboring some idealistic naivety about dancing with shackles.

From the financial report data, Bilibili's advertisement load rate (AD load) has always been maintained at the lowest level in the industry. Compared to some other platforms that may insert a large number of advertisements, Bilibili pays more attention to user experience and does not over-advertise but moderately displays advertisements while ensuring the user viewing experience.

This also forces Bilibili to innovate more in advertising, such as introducing native advertising, improving infrastructure and ad matching efficiency, expanding dynamic search, and connecting marketing chains. Through the strategy of 'one horizontal and multiple verticals' and 'multiple screens and scenarios,' Bilibili upgrades its product infrastructure capabilities to provide more targeted industry solutions for customers.

In this quarter, Bilibili's advertising business not only achieved a year-on-year revenue increase of 28% but also demonstrated the potential for growth in its advertising business in various aspects such as ad types, business touchpoints, customer structure, and user characteristics. In the future, in addition to the information feed, Bilibili can also release more advertising inventory through live streaming scenes, player scenes, trending searches, and more, while ensuring user experience. At the same time, it will connect natural traffic with commercial traffic, providing sufficient support for the long-term growth of Bilibili's advertising business.

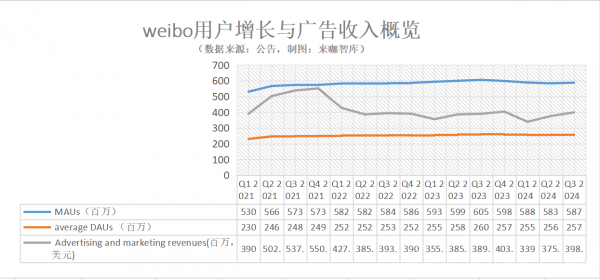

However, not all companies can exercise sufficient restraint against the temptation of making 'quick money' through advertising. Take Weibo as an example. In 2012, Weibo began its commercialization through advertising and paid services. There were some internal concerns at the time about whether commercialization would harm the user experience, but such prudence is now rarely seen.

Relying on the advertising business and pursuing higher revenue has led Weibo to sacrifice user experience and content quality, resulting in user churn and decreased advertising effectiveness. Since 2021, the growth of Weibo's DAU and average DAUs has stagnated. After a brief surge in Q3 and Q4 of 2021, advertising revenue fell from its peak of $550 million (quarterly revenue) and has since hovered mostly below the $400 million mark. Weibo's third-quarter report this year shows that advertising and marketing revenue reached $399 million, an increase of 2% year-on-year, accounting for 86% of total revenue. Monthly and daily active users decreased by 3% and 1% year-on-year, respectively.

Therefore, relying solely on advertising as the sole source of profit and excessively amplifying it can significantly increase revenue and profits in the short term. However, in the long run, excessive advertising will also affect community content, harm the user experience, and lead to overexploitation.

02 Value-added Services

Next, let's look at Bilibili's value-added services, whose revenue mainly comes from 'Premium Member' subscriptions and live streaming. This business now leads Bilibili's revenue.

As of the end of Q3, Bilibili had 21.97 million effective Premium Members, maintaining a steady growth trend, with over 80% being annual subscribers or auto-renewing members. As more high-quality content that differentiates Bilibili from iQIYI, Youku, and Tencent Video continues to be introduced, the payment rate is expected to continue to increase. Additionally, private domain paid content such as paid videos and charging by UP hosts have been a new source of revenue for Bilibili in the past year and are expected to become the main driver of growth in value-added services in the future.

At the same time, Bilibili continues to increase investment in high-quality OGV content such as documentaries and domestic animations. Through multiple initiatives such as the 'Searchlight Plan,' 'Stellar Plan,' and 'Bilibili Seeking Light,' it has gradually achieved more comprehensive coverage of various content categories and forms, boosting Bilibili's community activity and overall traffic.

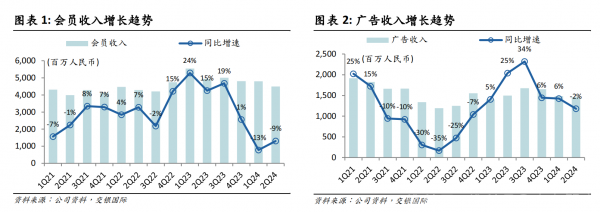

Bilibili's restraint in value-added services is not aimless. Online video platforms like iQIYI and Tencent Video, which also rely on membership fees and advertising to turn losses into profits, have been questioned by the outside world due to the lack of popular dramas, severe content homogeneity, and issues like varying membership fees to drive profitability.

The chaos of 'Russian doll-style' fees affects the user experience and causes user churn, which in turn leads to a decline in the revenue capacity of video websites. Taking iQIYI as an example, the company's membership revenue peaked in Q1 2023 and has since declined. The year-on-year growth rate has been declining continuously since Q3 2023. The financial report for Q3 of this year shows that iQIYI's total revenue and membership service revenue decreased by 10% and 13% year-on-year, respectively, highlighting the series of challenges facing the long-form video industry.

03 Games

Finally, let's analyze the gaming business. Games were once an important source of revenue for Bilibili, accounting for over 80% of revenue at one point. Facing external questions about its reliance on a single source of income and its mismatch with the video community's positioning, Bilibili planned to actively reduce the proportion of game revenue after going public. It dropped to 50% in Q3 2019 and has continued to decline since then, reaching 25% this quarter.

Bilibili's decision to reduce its reliance on games and increase investment in non-game businesses such as live streaming, advertising, and memberships is not wrong from a business perspective. However, plans can't always keep up with changes. When the industry entered an adjustment period in 2022, coupled with the suspension of game license approvals for an extended period, Bilibili's gaming business also went through a trough.

Soon, Bilibili realized this and attempted to overturn the existing impression of its gaming business among players and the industry with 'Three Kingdoms: Strategy and Ambition,' a game that is 'very un-Bilibili.' The result was a hit, becoming a blockbuster in the gaming industry this year. The strategy of reducing grinding and microtransactions also proved effective, demonstrating Bilibili's recovering game development capabilities and a stabilization and rebound in its gaming business.

If we look at it in the long term, Bilibili's model and approach to the gaming business are actually quite similar to Tencent's early days, mainly by attracting highly engaged users within the community to provide continuous support for the gaming business. However, the growth of the gaming business itself takes time and requires research and development and operating costs. To realize commercialization, Tencent initially relied more on simple copying, imitation, and quickly increasing user numbers by tying in with QQ. While Bilibili focuses on agency and investment, it still aims to develop its own games and even proposes to increase investment in self-research with the goal of creating high-quality products. This has led to the slow development of Bilibili's gaming business.

As a community with hundreds of millions of young users, Bilibili actually lacks its first blockbuster game, be it 'Journey to the West' or 'Honor of Kings.' 'Three Kingdoms: Strategy and Ambition' is not just the success of a single game but also an important manifestation of Bilibili's breakthrough in the gaming business, requiring more works and products for verification. For Bilibili, the expansion of younger genres and the transformation of game development thinking have also shifted its business focus to 'evergreen games' that can withstand the test of time and maintain long-term popularity. However, facing a highly competitive gaming market, Bilibili still needs to continuously optimize and adjust its gaming strategy in the future to maintain long-term competitiveness.

Conclusion

Setting aside the fact that Bilibili achieved single-quarter profitability this time, we may see that community culture is the core of Bilibili. The greatest value of the community lies not in directly selling traffic scale and efficiency but in commercialization based on community content, atmosphere, needs, and creativity. This kind of commercialization, along with the virtuous cycle and scale growth of the community, forms a positively correlated closed loop.

For Bilibili, this profitability is just a node in its long-term operations. The road ahead is still long. What matters is how to maintain and uphold its original intentions, allowing business growth to develop more healthily and sustainably. Maintaining its original intentions and respectability is far more important and meaningful than a few sets of revenue and profit figures.