Haike Rongtong's Change of General Manager to Jing Junru: Falling Performance Makes It a Liability for Tsui Wai Holdings

![]() 11/28 2024

11/28 2024

![]() 533

533

Written by|Yu Yuan

Source|Beiduo Finance

Recently, the People's Bank of China announced that Haike Rongtong's general manager had been changed to Jing Junru. Meanwhile, the legal representative of Haike Rongtong was also changed from Rong Hua to Jing Junru. Notably, this change occurred just over a year after the previous change in general manager and legal representative.

According to Tianyancha App, Haike Rongtong underwent a business change in June 2023. Meng Lixin stepped down as general manager and legal representative, and was replaced by Rong Hua. At the same time, Kuang Zhenxing, chairman of Tsui Wai Holdings, also resigned from the board of directors of Haike Rongtong.

According to Beiduo Finance, Haike Rongtong is a subsidiary of Tsui Wai Holdings. In December 2020, Tsui Wai Holdings acquired 98.2975% of Haike Rongtong's equity for 1.945 billion yuan through share issuance and cash payment. However, Haike Rongtong's performance has been unsatisfactory in recent years.

In addition, Haike Rongtong's internal control management also faces significant challenges.

On November 12, 2024, the People's Bank of China announced the approval of the change of Beijing Haike Rongtong's director and general manager from Rong Hua to Jing Junru. During the same period, the legal representative of Huake Rongtong on the Tianyancha app and Enterprise Credit Information Disclosure System was also changed from Rong Hua to Jing Junru.

Screenshot from the official website of the People's Bank of China

Public information shows that Jing Junru, like his predecessor Rong Hua, was promoted internally from vice president to president. Before joining Haike Rongtong, Jing Junru served as assistant general manager of China UnionPay's Xinjiang branch.

Beiduo Finance understands that the change in Haike Rongtong's general manager and legal representative occurred just over a year and four months after the previous change. On June 29, 2023, Kuang Zhenxing, who was also the chairman of Tsui Wai Holdings, stepped down as chairman of Haike Rongtong, and was replaced by Meng Lixin, the former general manager of Haike Rongtong.

At the same time, Haike Rongtong's legal representative and general manager were also changed from Meng Lixin to Rong Hua. Earlier, Haike Rongtong's legal representative and chairman was Liu Lei. After being acquired by Tsui Wai Holdings in 2020, Liu Lei and others stepped down, and were replaced by Tsui Wai Holdings faction members such as Kuang Zhenxing and Meng Lixin.

Before and after Jing Junru took office, Haike Rongtong held a general staff mobilization meeting. At the meeting, Su Fei, vice president of Tsui Wai Holdings, announced Jing Junru's appointment. At the same time, the meeting redefined the responsibilities of Haike Rongtong's management team.

According to media reports, facing various challenges and pressures from the market and the company, Jing Junru, as the new general manager, expressed his determination to work tirelessly with the company's management team and center heads to continuously promote the company's operations and facilitate a smooth transition.

Su Fei emphasized the importance of compliance management and risk awareness, stating that it is crucial to "ensure the company moves steadily and safely forward." Additionally, Su Fei called on all employees to unite and work together to achieve the company's annual goals.

It is evident that Haike Rongtong currently faces both challenges and potential opportunities. However, in terms of performance, during Rong Hua's tenure as general manager, Haike Rongtong's performance was unsatisfactory, with both revenue and profit significantly declining.

According to Tsui Wai Holdings' 2024 interim report, Haike Rongtong's revenue in the first half of 2024 was 729 million yuan, a decrease of 605 million yuan or 45.33% from the same period in 2023. Net profit was -132 million yuan, a decrease of 183 million yuan year-on-year, resulting in a loss.

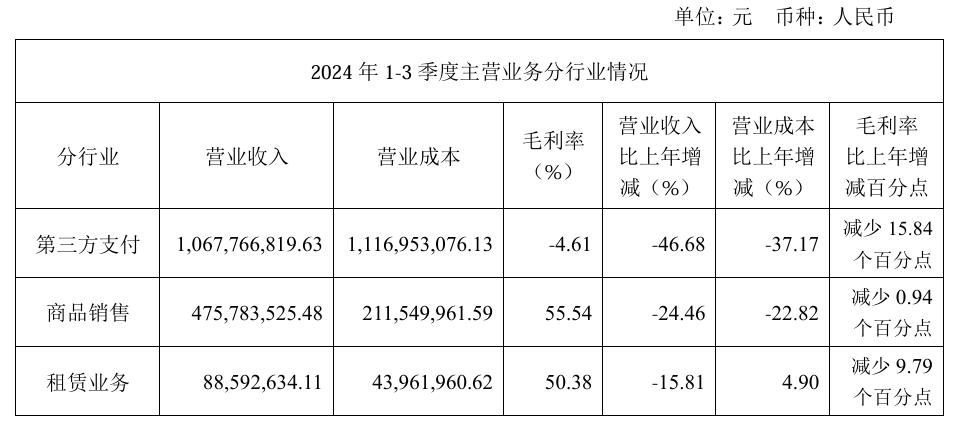

The downward trend in Haike Rongtong's revenue continued into the third quarter. According to Tsui Wai Holdings' operating data announcement for the first three quarters of 2024, Haike Rongtong's total revenue for the first three quarters was 1.068 billion yuan, a year-on-year decrease of 46.68%. Based on this calculation, Haike Rongtong's revenue in the third quarter was approximately 338 million yuan, a decrease of about 50% year-on-year.

Screenshot from Tsui Wai Holdings' operating data announcement for Q1-Q3 2024

In 2023, Haike Rongtong achieved a revenue of 2.586 billion yuan, a decrease of 454 million yuan or 14.94% from 3.04 billion yuan in 2022. Net profit attributable to shareholders was -310 million yuan, a year-on-year decrease of 12.39%. This was the second annual loss for Haike Rongtong since being acquired by Tsui Wai Holdings.

Even with the change in general manager, it may be difficult for Haike Rongtong to reverse its poor performance in the short term. The downward trend has persisted for several years, even before Tsui Wai Holdings acquired it.

Before acquiring Haike Rongtong, Tsui Wai Holdings was primarily engaged in traditional retail business. Due to fierce competition in the industry, Tsui Wai Holdings turned its focus to the third-party payment sector and ultimately acquired approximately 98.3% of Haike Rongtong's equity for 1.945 billion yuan in late 2020, establishing a dual-mainstay business model of "commercial retail + third-party payment."

However, before being acquired by Tsui Wai Holdings, Haike Rongtong had two failed acquisition attempts, and its market value had been declining for five years while searching for buyers. In December 2015, Yongda Group announced its intention to acquire 100% of Haike Rongtong for 2.969 billion yuan, but the deal was terminated 10 months later due to uncertainties in Internet finance industry regulation.

In October 2016, Xinli Finance disclosed its intention to acquire 100% of Haike Rongtong through a combination of cash and non-public issuance of shares. However, after two years of negotiations, the deal fell through as Haike Rongtong deemed the acquisition process too lengthy, the market environment had changed significantly, and there were uncertainties associated with the initial plan.

When Tsui Wai Holdings acquired Haike Rongtong in 2020, the latter's valuation had dropped from 2.969 billion yuan to 1.945 billion yuan, a decrease of over 1 billion yuan. However, the acquired Haike Rongtong did not seem to regain vitality through asset reorganization, and its valuation continued to decline.

According to Tsui Wai Holdings' 2023 asset appraisal report on Haike Rongtong, the recoverable amount of its shareholders' total equity as of the appraisal base date of December 31, 2022, was 1.663 billion yuan. After adjusting for fair value less disposal costs, the recoverable amount was determined to be 1.661 billion yuan, reflecting a decline in Haike Rongtong's market value to some extent.

Screenshot from Tsui Wai Holdings' announcement

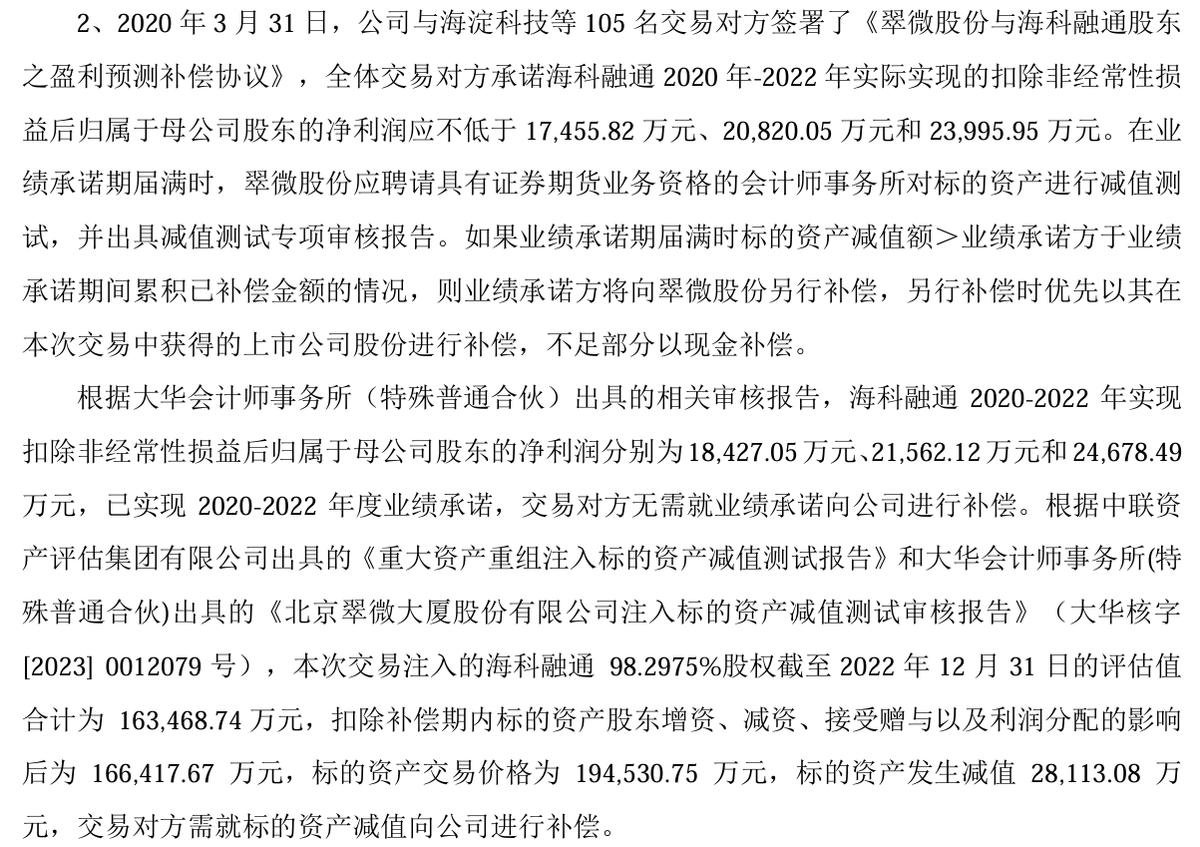

In addition to the unsatisfactory asset appraisal, Haike Rongtong barely met the performance commitments outlined in the three-year earn-out agreement signed with Tsui Wai Holdings at the time of acquisition.

In 2020, when Haike Rongtong was acquired by Tsui Wai Holdings, it signed a "Supplementary Profit Forecast Agreement." The agreement stipulated that Haike Rongtong's net profit after deducting non-recurring gains and losses for the years 2020, 2021, and 2022 should not be less than 175 million yuan, 208 million yuan, and 240 million yuan, respectively, otherwise, certain compensation would be required.

From 2020 to 2022, Haike Rongtong's net profits after deducting non-recurring gains and losses were 184 million yuan, 216 million yuan, and 247 million yuan, respectively, barely meeting the thresholds. However, beyond the earn-out agreement's requirements, Haike Rongtong's overall profitability was not optimistic.

Screenshot from Tsui Wai Holdings' 2023 annual report

In terms of revenue, from 2020 to 2023, Haike Rongtong's revenue was 2.841 billion yuan, 2.358 billion yuan, 3.04 billion yuan, and 2.586 billion yuan, respectively, with growth rates of -5.32%, -17.01%, 28.96%, and -14.94%. Except for 2022, Haike Rongtong's revenue showed a downward trend.

From 2020 to 2023, Haike Rongtong's net profits were 184 million yuan, 209 million yuan, -275 million yuan, and -310 million yuan, with year-on-year growth rates of -0.79%, 13.23%, -231.62%, and -12.73%, respectively. Only in 2021 did net profit increase, showing an overall downward trend.

In 2023, Haike Rongtong's net loss exceeded 300 million yuan, and the losses in 2022 and 2023 erased the net profits of 2020 and 2021. Additionally, the gap between Haike Rongtong's net profit and net profit after deducting non-recurring gains and losses in 2021 and 2022 is rarely seen in corporate financial reports.

After the earn-out agreement expired, Haike Rongtong's revenue and net profit both declined significantly, indicating that its performance growth still needs improvement. From this perspective, Tsui Wai Holdings' acquisition of Haike Rongtong was not worthwhile, with Shafeng New Materials serving as a cautionary tale.

When Jiaxian Co., Ltd. acquired Shafeng New Materials in 2020, the transferor promised that the net profit for 2020 to 2022 would not be less than 13.5 million yuan, 14.85 million yuan, and 16.33 million yuan, respectively, or a cumulative total of not less than 28.35 million yuan for the first two years and 44.68 million yuan for all three years. Shafeng New Materials met the first two years' performance commitments but only achieved a net profit of 817,200 yuan in 2023 after the earn-out, a decrease of over 90% from 2022.

As a result, Jiaxian Co., Ltd. incurred a goodwill impairment loss of 10.0361 million yuan, directly reducing its current profit, increasing its asset impairment, and significantly impacting its financial position.

Apart from Haike Rongtong's unreversible decline in operating performance, which makes it difficult for Tsui Wai Holdings to leverage, its continuous internal control risks have further embarrassed Tsui Wai Holdings. In 2023, Tsui Wai Holdings issued two announcements regarding Haike Rongtong's "rate jumping" incidents.

On April 20, 2023, Tsui Wai Holdings issued a cautionary announcement regarding a major event, revealing that Haike Rongtong had used preferential merchant transaction rates for some standard merchant transactions in its acquiring business and needed to refund the involved funds to pending accounts in batches according to relevant agreements.

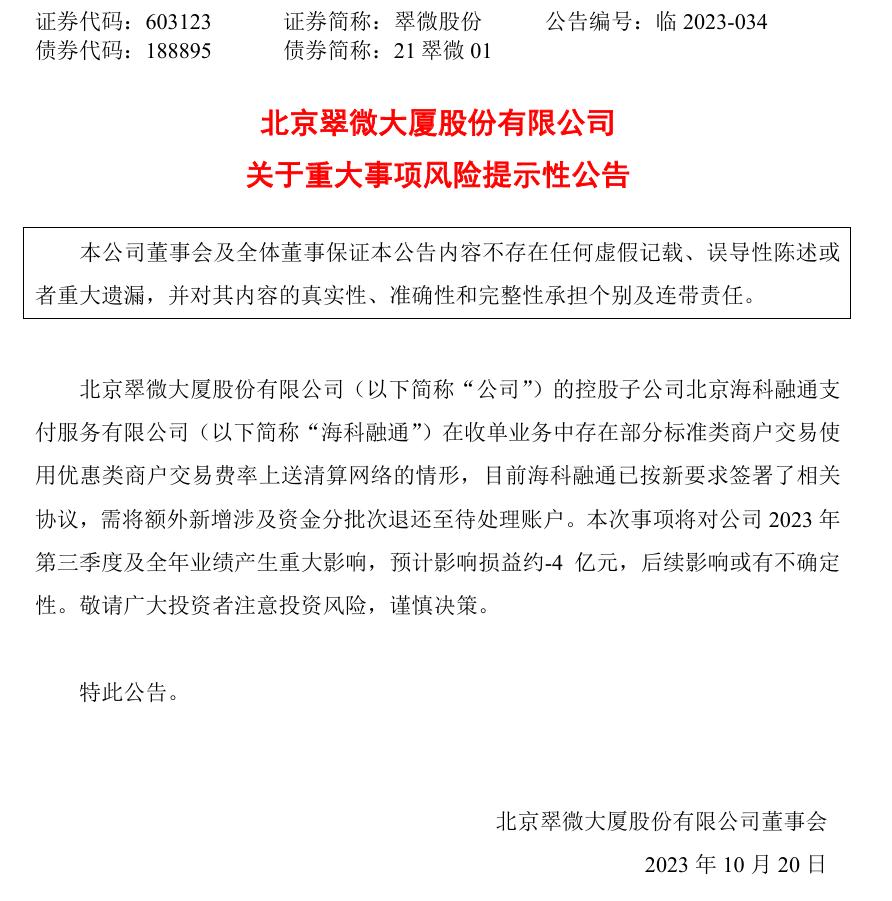

On October 20 of the same year, Tsui Wai Holdings issued another announcement regarding another "rate jumping" incident in Haike Rongtong's acquiring business and stated that this incident would significantly impact Tsui Wai Holdings' third-quarter and full-year 2023 performance, with an estimated impact of approximately -400 million yuan on profit and loss.

Screenshot from Tsui Wai Holdings' announcement

Ultimately, in its 2023 annual report, Tsui Wai Holdings disclosed that Haike Rongtong had returned additional funds to pending accounts in batches according to new requirements and had conducted accounting treatment, resulting in a 419 million yuan reduction in Tsui Wai Holdings' profit.

Haike Rongtong's negative impact on Tsui Wai Holdings continues. According to Tsui Wai Holdings' announcement on asset impairment provisions on April 30, 2024, it made an inventory write-down provision of 2.5437 million yuan in 2023, primarily for inventory purchased for its subsidiary's acquiring business.

In addition, Haike Rongtong has received an unusually high number of complaints on various complaint platforms. A search on the HeiMao Complaint Platform using the keyword "Haike Rongtong" yielded up to 112,900 complaints, while a search on the Xiaofeibao Platform yielded about 2,000 related complaints.

Screenshot from the HeiMao Complaint Platform's official website

As Haike Rongtong's revenue accounts for a significant portion of Tsui Wai Holdings' overall revenue, its business transformation has attracted the attention of Tsui Wai Holdings' investors. However, the payment industry has entered a mature market with a high base compared to the past, coupled with fierce competition in the acquiring industry, making it difficult for Haike Rongtong, which is in the midstream of the industry chain, to advance.

Nevertheless, deeply exploring customer needs, improving customer service quality, and expanding overseas markets are inevitable choices for almost all payment enterprises seeking continued development. Facing the severe situation, Haike Rongtong needs to formulate more proactive business transformation and strategic adjustments to overcome the difficulties.