This year's 618 has become a transitional period for e-commerce, with disputes over pricing power emerging between platforms and merchants.

![]() 06/27 2024

06/27 2024

![]() 423

423

Platforms are choosing to side with users and shift the burden onto merchants.

The smoke of the 618 battlefield has not yet dissipated, and several players are eager to start the next round.

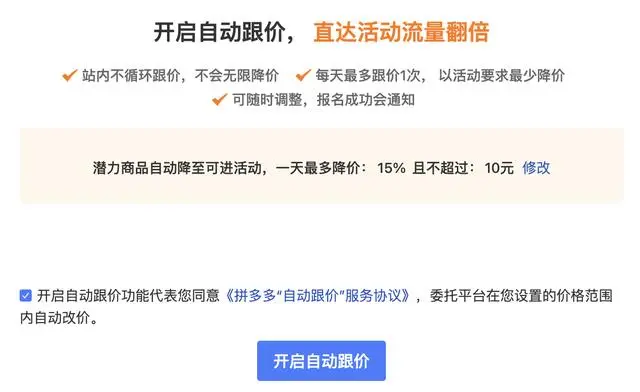

On June 24, news emerged that Pinduoduo had recently adjusted its previously launched "Automatic Price Matching" service agreement. According to the latest agreement, for merchants who have enabled the "Automatic Price Matching" function, Pinduoduo's platform can modify the prices of all their products, while previously the platform could only modify the promotional prices of the merchants' promotional products. The new agreement is expected to officially take effect on June 28.

Source: Pinduoduo

Coincidentally, JD.com is also engaged in a price war.

On the afternoon of June 23, multiple users received text messages from JD.com, reminding them not to use any third-party price comparison tools or plugins and suggesting they change their passwords. Otherwise, accounts suspected of being maliciously exploited will continue to be restricted. Naturally, this move has been questioned as being concerned that third-party price comparison tools will guide users to other e-commerce platforms, leading to a loss of orders.

In comparison, Pinduoduo is straightforward and simple, while JD.com appears to be much more euphemistic.

In recent years, the increasingly sensitive term "price" is becoming the main focus of competition among platforms. Behind these two operations are the different results brought about by different roles, but the common point is that after this 618, the competition for pricing power is likely to become increasingly fierce.

01

Platform price comparison, both merchants and users suffer

Actually, before the platforms introduced new pricing mechanisms, vicious competition among merchants had already eroded merchants' living space.

"A clothing company mainly sells women's shoes and clothing, belonging to a top white label brand. It usually sells hundreds of thousands a day through live streaming, with a return rate of 40% and a relatively deep inventory. A few days ago, there was a new style that suddenly exploded. A new anchor sold 1 million in 2 hours, and other anchors followed suit and sold 3 million. In one day, nearly 5 million were sold. The boss immediately found a factory to increase orders. Who knew that within 3 days, a competitor produced the same style, selling at half price with precise targeting to steal their fans. As a result, their customers returned the goods in droves. After calculating the final accounts, the boss said that they were originally making money, but ended up losing 3 million." This is a story that happened around me. Xiao Mai, who sells women's clothing on Pinduoduo, speaks quite excitedly.

At the end of May, the launch of Pinduoduo's "Automatic Price Matching" function added yet another piece of wood to the fire.

When inquiring about the situation, Xiao Mai said that for small and medium-sized merchants, the automatic price matching introduced by Pinduoduo at the end of May has caused them much distress. "My purchase price is 80 yuan, and I sell clothes for 95 yuan. But its intelligent price reduction feature suggested that I sell them for only 26 yuan!"

Xiao Mai told us that during this year's 618 period, limited by the sudden launch of the "Automatic Price Matching" function, she not only didn't earn any money but was also forced to reduce prices and sell off her inventory to reduce losses.

Source: Screenshot from the Pinduoduo merchant version

"A friend of mine who sells flowers originally sold them for just over twenty yuan, but the system suggested he sell them for 4.5 yuan, and he would even have to pay an additional 10 yuan for shipping. What's the difference between this and robbery?" When asked if she could refuse to enable this function, she said that after refusing, the store's sales plummeted, "and the platform stopped promoting it directly."

Sellers are unhappy, and buyers are also dissatisfied.

Here's a buyer's comment: "I bought two pairs of identical shoes on Pinduoduo in early June, with a price difference of 20 yuan. Out of curiosity, I bought both pairs, but then found out that the cheaper pair was worn, with the shoebox flattened and the paint peeling off."

Another buyer said that after buying a can of soft candy on JD.com and shortly after payment, they found that Pinduoduo was promoting an identical product with a newer date and a cheaper price. "I had to apologize to the seller and buy from this one instead."

Relevant personnel直言道 that the result of price wars among peers is that they have to choose materials of increasingly poor quality. "One of our peers is engaged in a price war, changing factories six times in a week. Finally, they couldn't find anything cheaper, so they switched from imported materials to domestic materials and then to recycled waste. Consumers think that the same item has been discounted, but in reality, the materials have been replaced with the worst ones. The same price buys much worse products than before, and some are several times cheaper in quality."

On the one hand, price wars between platforms like Taobao, JD.com, Pinduoduo, and Douyin have compressed merchants' profits once, and the main competition among merchants through price wars has further eroded a portion of their space. Now, under the passive adjustment of system pricing, merchants are losing profits again.

On the other hand, for buyers, transaction decisions are prolonged by repeated system reminders, and the quality of products they enjoy is also affected. Even buyers who do not deliberately pursue low prices have to face repeated "low-price inquiries." As a result, lower prices and poorer quality have become the general trend. This leads to a "double loss" outcome where both merchants and buyers are unhappy.

Ultimately, merchants and buyers naturally point their fingers at the platforms, which is definitely not a sight that the platforms want to see.

02

Two methods, with pricing power as the only goal

Reflecting on the data, this 618 has seen an increasingly apparent "triple loss" situation.

On June 23, statistical data showed that the total sales of this year's 618 across the entire network reached 742.8 billion yuan, a year-on-year decrease of 7% compared to last year. In particular, the combined sales of Tmall, JD.com, and Pinduoduo decreased by 6.9%, which undoubtedly poured cold water on traditional platforms that have been constantly shouting about "returning to users" and "users first" before this.

Source: Star Chart Data

After the unhappy 618 ended, platforms need to grasp pricing power more than ever before, leading to the scene at the beginning.

At the consensus level, price is now the core element of traffic allocation on e-commerce platforms, and traffic倾斜s towards lower prices is the underlying logic. This has become the default criterion on both JD.com and Pinduoduo.

However, in terms of platforms' demand for pricing power, JD.com has exhibited a path that is not entirely the same as Pinduoduo. This is mainly due to the different roles played by both sides.

As a platform where the concept of low prices has long been ingrained in people's minds, Pinduoduo has always played the role of a referee providing the "venue" in transactions. As a pure platform, Pinduoduo's core challenge is how to attract consumers through reasonable pricing. Therefore, helping merchants formulate more competitive pricing strategies through data analysis and market insights is the only thing that should be done and can be done without any burden. After all, if the price is not low enough, it will not receive traffic weight倾斜. If merchants are not satisfied, Pinduoduo can always say, "If you don't sell, someone else will."

With pricing power in hand, Pinduoduo can not only support lower-priced products but also enjoy the benefit of "double deductions."

For example, after a customer buys a product from the first store, the platform deducts a handling fee and a promotion fee from the merchant and then recommends a cheaper product from a second store to the customer. After the customer refunds, the platform can not only deduct a certain "punishment fee" from the first company but also continue to charge the second company's handling fee and promotion fee, and so on...

From JD.com's perspective, the "text message reminder" appears to be much more "gentle," which is a result of JD.com's long-standing role as both a referee and a player.

As the pioneer of the self-operated model in China's e-commerce market, JD.com once relied on its unique self-operated model to have more autonomy in pricing. However, as a "player," JD.com can indeed achieve more competitive prices through internal cost control, but as a "referee," it also needs to maintain platform fairness and merchant interests. Any slight carelessness could easily lead to a public relations crisis.

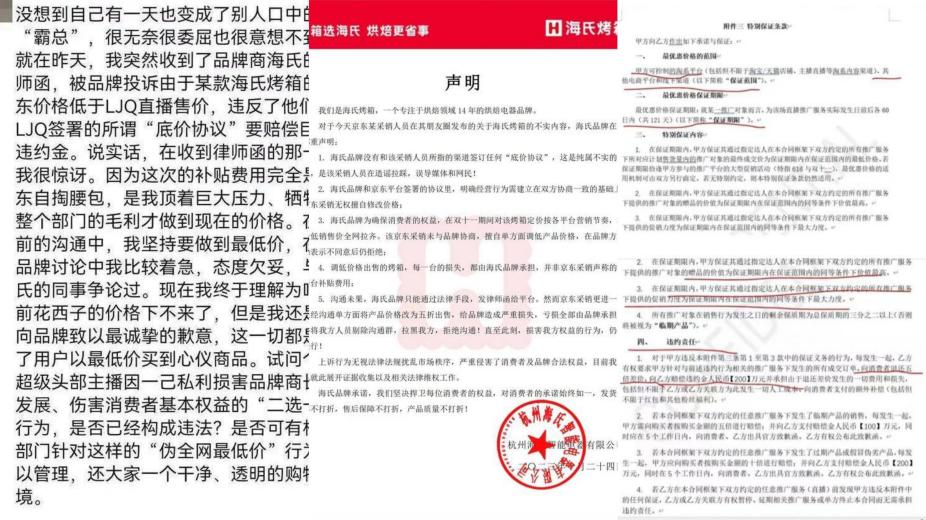

For example, in October last year, there was a dispute between JD.com and Li Jiaqi. Although the so-called "bottom price agreement" seemed to make the incident confusing, essentially, it was a result of the self-operated model allowing the platform to directly intervene in product pricing.

Source: Dispute between JD.com and Li Jiaqi over the "bottom price agreement"

However, last year's Double 11 situation was not as urgent. By this year's 618, the pace has clearly accelerated, and JD.com has been exposed to incidents such as undercutting publishers' bottom prices to sell books and setting uncommunicated coupons to sell Jueyan products at low prices, leading to protests.

Inevitably, some of the consequences of these controversies will be borne by both buyers and sellers.

Soon, Taobao, Tmall, Douyin, and Kuaishou e-commerce platforms are likely to follow suit...

03

Final Thoughts

Behind the dismal 618, platforms are obviously hoping to take matters into their own hands and administer drastic measures to solve the problem.

However, price comparison is certainly not unlimited.

In May, the State Administration for Market Regulation issued the "Interim Provisions on the Prevention of Unfair Competition," which requires e-commerce platforms not to impose unreasonable restrictions on the prices of goods. This provision will come into effect on September 1.

E-commerce platforms are taking advantage of the interim period before the implementation of this regulation to intervene more and earlier, seeking to find a path for future competition. However, how to balance the rights and interests of platforms, merchants, and users remains a more long-term proposition.