Wall Street sentiment heats up, Meta's earnings add fuel to the fire

![]() 08/06 2024

08/06 2024

![]() 395

395

After Meta's earnings report, Wall Street investors should feel some "comfort".

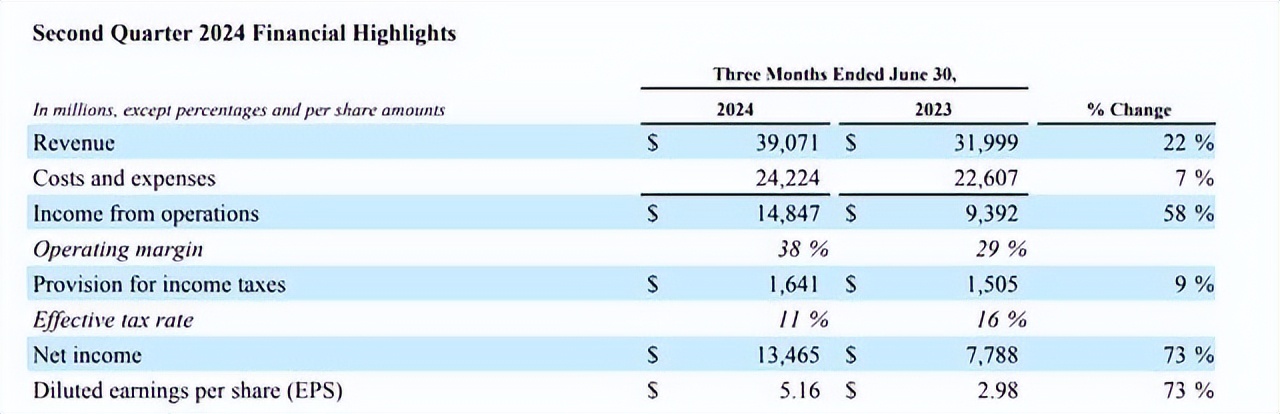

On July 31st, EDT, Meta released its second-quarter earnings report for fiscal year 2024, ending June 30th, with significantly improved key operating indicators: revenue of $39.071 billion, up 22% year-over-year; net profit of $13.465 billion, up 73% year-over-year; earnings per share of $5.16, exceeding analysts' expectations of $4.72.

The stock market responded positively, with Meta's share price rising 2.51% to $474.83 per share by the close on July 31st, with a total market value of $1.2 trillion. Meta's growth "good news" slightly dispelled the gloom of uncertainty among investors regarding AI spending.

Looking back, the share prices of the "Big Seven" US stocks suffered a collective plunge at the end of July, partly due to tech giants' failure to meet investor expectations for AI monetization. However, Meta's earnings report exceeding expectations seems to confirm to the capital market that AI is truly driving businesses towards profitability.

In terms of revenue sources, Meta's earnings this quarter were still driven by its advertising business, which generated $38.329 billion in revenue, up 22% year-over-year.

Behind this growth, favorable industry factors continue to emerge. According to media investment company Magna, global media advertising revenue is expected to grow 10% to $927 billion in 2024, with growth mainly concentrated among "pure digital players" such as Google, Amazon, and Meta.

Focusing on the company itself, the introduction and application of AI technology may further empower business development. This quarter, Meta leveraged AI to further improve its platform's digital advertising targeting and delivery systems, resulting in a 10% increase in both ad impressions and average cost per ad.

As Mark Zuckerberg said, "With generative AI, we'll soon enter a new phase. Today, most of the content users see on Instagram is recommended by the system, created by others, and matched to users' interests." AI is significantly transforming Meta's development landscape.

Notably, Meta is making many preparations to promote AI adoption. This quarter, Meta continued to advance AI research and product development, achieving technical milestones such as releasing the latest open-source AI model, Llama 3.1, primarily used to power chatbots.

This was accompanied by an expansion in spending. The earnings report revealed that Meta's R&D expenditure for the second quarter was $10.537 billion, up from $9.344 billion in the same period last year.

However, cost-cutting measures across other areas of the company are still being implemented, stabilizing profit levels. As of June 30th, Meta's headcount decreased 1% year-over-year to 70,799 employees.

Yet, in the long run, Meta's investments in AI will only increase due to fierce market competition and significant business upgrade demands. Meta stated, "The company is continuing to refine its plans for next year and expects capital expenditures to increase significantly in 2025 as we invest in supporting AI research and product development." Meta has adjusted its capital expenditure forecast to $37 billion to $40 billion, up from the previous range of $35 billion to $40 billion.

This, however, could raise concerns among investors as the driving force of AI for business development remains uncertain in a complex and volatile market environment, making significant investments inherently risky.

Yet, Meta sees the necessity of continued investment. Zuckerberg commented, "Overspending is justified because the disadvantage of falling behind is that you'll be at a disadvantage in the most critical technologies for the next 10 to 15 years."

Some market voices echo this sentiment. Max Willens, an analyst at market research firm eMarketer, stated, "Any doubts investors may have had about Meta's spending on AI and the metaverse may be alleviated by this quarter's results. Given Meta's substantial profit margins, investors should feel reassured about the company's significant investments in its future plans."

While predicting Meta's future development accurately is challenging, it is undeniable that Meta has consistently been a "trendsetter," embracing new trends from the metaverse to AI. In this current AI race, it's a test of endurance. As Meta doubles down, investors will pay closer attention to actual results at critical junctures.