Apple and Alibaba Form AI Alliance, Heightening Competition for JD.com and Pinduoduo

![]() 02/13 2025

02/13 2025

![]() 408

408

On February 12, as markets closed, Alibaba's Hong Kong stock price surged an additional 8.48%, signaling a promising future outlook.

(Source: Baidu Gushitong screenshot)

Jack Ma, who has been absent from public view in China for an extended period, also returned to Alibaba's Hangzhou headquarters, beaming with joy.

The reasons behind Jack Ma's return to Alibaba's Hangzhou headquarters and the surge in Alibaba's stock price are intrinsically linked to Apple. According to a report by tech media outlet The Information, Apple will collaborate with Alibaba to develop AI capabilities tailored for Chinese iPhone users.

Given that iPhones typically launch around September each year, the fourth quarter generally marks the peak sales period for Apple phones. However, Apple's financial report revealed that iPhone sales declined year-on-year in the fourth quarter of 2024, with revenue in Greater China dropping by 11.08%. Research agencies and media attribute this decline to the delay in the launch of Apple Intelligence, which is the primary upgrade feature for new iPhones in the Chinese market.

Domestic phone manufacturers have not only promptly integrated AI into their underlying system architectures but Huawei, Honor, OPPO, and other companies have swiftly announced the integration of DeepSeek-R1 into their AI assistants following its popularity. Even Samsung has partnered with Zhipu Qingyan to provide AI services to Chinese users. AI has emerged as a pivotal factor influencing consumers' purchasing decisions.

Apple has been actively pushing for the launch of AI capabilities in China, with CEO Tim Cook personally visiting the country to discuss the matter. However, Apple appeared hesitant about which internet giant to partner with. With the original launch date for Apple Intelligence in the Chinese market approaching by April, Apple's window to select a partner is narrowing, making Alibaba a highly likely final choice.

After considering numerous options, why does Apple prefer Alibaba?

In overseas markets, Apple Intelligence collaborates with OpenAI, but domestic access to ChatGPT is restricted, prompting Apple to seek a new partner. Speculation abounded regarding which AI company Apple would partner with, with domestic internet giants Baidu, ByteDance, and Tencent all rumored to be in talks with Apple.

The Information also reported that Apple considered partnering with DeepSeek, a highly popular AI company in China recently, but ultimately decided against it due to the company's lack of experience and capability in serving large enterprises.

(Source: DeepSeek)

When selecting a partner for Apple Intelligence, Apple's primary considerations are stability and the capabilities of the AI large model.

In the public perception, Alibaba's business primarily revolves around consumer-end scenarios such as e-commerce, food delivery, and mobile payments. While some users may use Alipay for financial management or Gaode Maps for navigation, they may not be familiar with Alibaba's business-end operations.

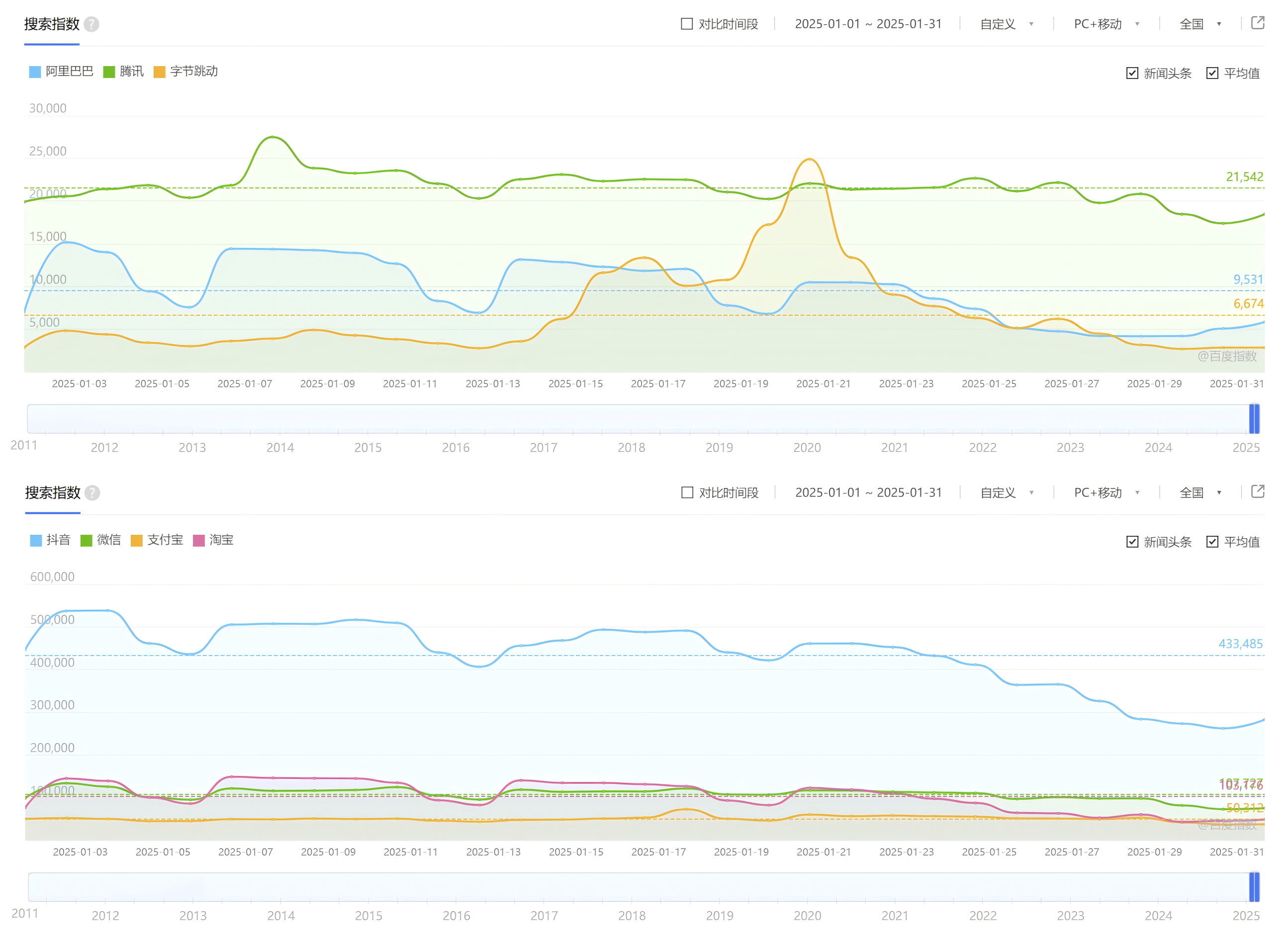

Baidu Index shows that in January this year, Alibaba's search index was lower than that of Tencent and on par with ByteDance. In terms of the search index of the core apps of these three companies, Douyin is far ahead, while Taobao and WeChat were once on par but eventually the latter surpassed. Due to low traffic, the outstanding performance and strength of Alibaba's other businesses have been overlooked by netizens.

(Source: Baidu Index screenshot)

Canalys data indicates that in the second quarter of 2024, Alibaba Cloud ranked first in the domestic cloud services industry with a market share of 36%, followed by Huawei Cloud with 19% and Tencent Cloud with only 16%. The combined market share of the second and third places is equivalent to that of Alibaba Cloud.

Recently, DeepSeek has frequently experienced server congestion due to its small data center scale, providing limited computing power to users. Alibaba, with its extensive data centers and profound experience in B2B services, can provide a robust foundation for Apple Intelligence, preventing server overload during peak traffic periods.

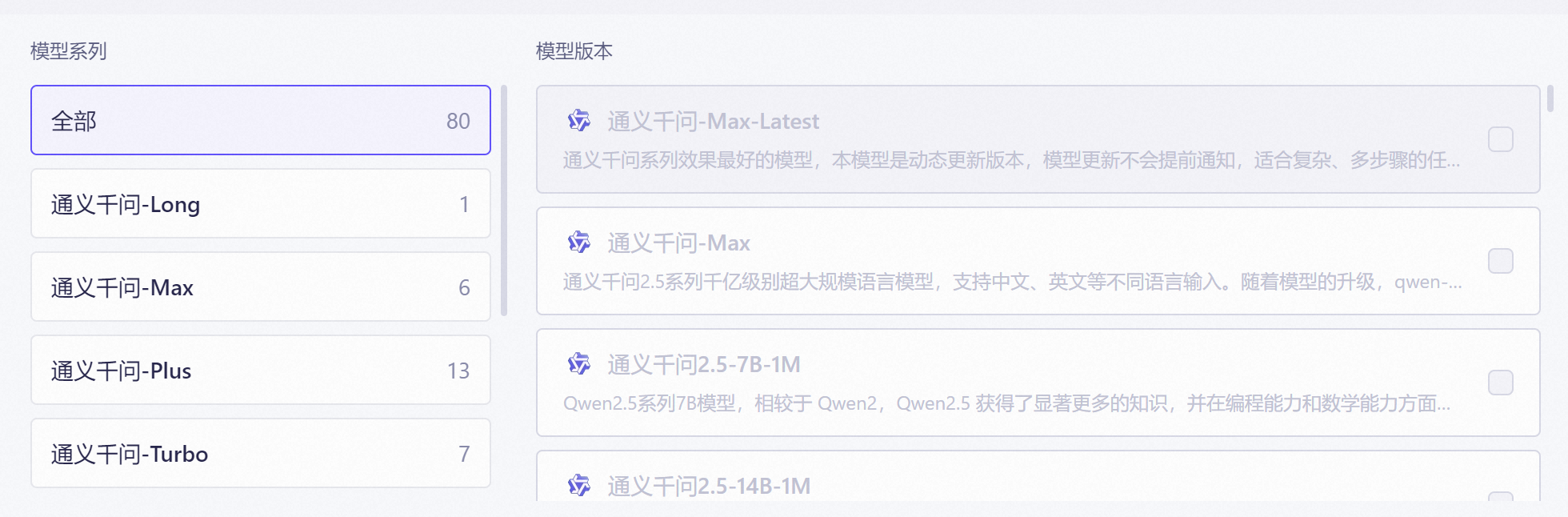

Furthermore, Alibaba's technical prowess in the field of AI cannot be underestimated. Before the emergence of the DeepSeek-V3 model, Alibaba's Tongyi Qianwen Qwen model was a leader in the open-source model domain.

The recently released Qwen 2.5-Max ranked seventh in the blind test list on the third-party benchmark testing platform ChatbotArena, outperforming models such as DeepSeek-V3 and o1-mini, and ranking first in mathematics and programming capabilities. The global number of derivative models of Tongyi Qianwen Qwen has surpassed 90,000, exceeding the Llama series open-source models developed by American internet giant Meta.

(Source: Alibaba Cloud screenshot)

With its extensive data centers, strong technical foundation, and vast experience in B2B services, Alibaba is undoubtedly the optimal partner for Apple's AI business in China.

Companies like Tencent, Baidu, and ByteDance also possess the strength to collaborate with Apple. However, Tencent has had multiple disputes with Apple due to the Apple tax issue, and ByteDance is also sensitive due to the TikTok issue. Baidu, which does not face these issues, was unable to reach an agreement with Apple regarding data usage, and Apple has reportedly paid Baidu up to $100 million.

The collaboration between Alibaba and Apple will expedite the launch of Apple Intelligence in China and enhance the competitiveness of iPhone models that support AI features, such as the iPhone 16 series and iPhone 15 Pro/Pro Max. Collaborating with a Chinese AI company has long been a given for Apple, but the company has been contemplating and hesitating about which company to choose. Alibaba stands to gain significantly from this collaboration.

By leveraging Apple's influence, will Alibaba experience a resurgence?

Examining the financial report, Alibaba's total revenue for fiscal year 2024 (April 1, 2023, to March 31, 2024) reached 941.2 billion yuan, a year-on-year increase of 8.34%, with a net profit attributable to shareholders of 79.741 billion yuan, a year-on-year increase of 9.97%, indicating a promising development trajectory. However, looking at the data of Taobao and Tmall Group, the revenue for the fourth fiscal quarter was only 93.22 billion yuan, a year-on-year increase of 4%. The single-quarter revenue gap with Pinduoduo is gradually narrowing, and the revenue growth rate has been outpaced by Pinduoduo.

The domestic e-commerce industry is still experiencing rapid growth, but impacted by competition from JD.com and Pinduoduo, the revenue growth of Taobao and Tmall has significantly slowed down. The reason is that with Pinduoduo focusing on low prices and JD.com on digital electronics and high-end services, Taobao and Tmall have been surrounded, greatly affecting their influence and exposure.

(Source: mockup shell)

A secondary benefit of collaborating with Apple for Alibaba is to increase revenue from Alibaba Cloud services. The key lies in Alibaba's ability to leverage Apple's brand influence to promote Taobao, Tmall, and Alipay.

Moreover, the essence of integrating AI into mobile phones is to make it easier and more convenient for users to operate their phones and complete tasks. For instance, Zhao Ming, the former CEO of Honor, used the AI assistant YOYO to order 2,000 cups of Luckin Coffee at the Magic 7 series launch event. After Alibaba's AI large model is integrated into Siri, when users utilize the AI assistant to search for or purchase certain products, Taobao can be prioritized, thereby increasing the open rate of Taobao and the likelihood of users purchasing products from Taobao.

According to market research firm QuestMobile, there are approximately 250 million iPhone users in China, and in the future, these users may upgrade to iPhone models that support AI features, entering Alibaba's sphere of influence.

(Source: Apple)

Once hundreds of millions of iPhone users develop the habit of using AI assistants to select and purchase products or order takeout, the market share of Taobao, Tmall, and Ele.me also has the potential to soar significantly.

Of course, the premise for users to develop a dependency on AI assistants is to train a large model with rich and powerful functions and ensure seamless integration and function calls with third-party applications, enabling access to secondary, tertiary, or even higher-level menus within apps and making changes through voice commands, thereby optimizing the shopping and takeout ordering experience for iPhone users.

Achieving this functionality is not trivial, nor is it easy to cultivate users' dependency on AI assistants. However, with advancements in AI technology and enhanced understanding of natural semantics by AI large models, it is believed that this day will inevitably arrive.

With the assistance of iPhone's brand influence and user base, Alibaba is expected to return to a fast development track, altering the unfavorable situation where the low-end market is being eroded by Pinduoduo and the high-end market is dominated by JD.com.

Alibaba Joins Forces with Apple: A Textbook Win-Win Situation

The reason I emphasize the impact of the collaboration between Alibaba and Apple on Alibaba is that Apple will inevitably collaborate with a Chinese AI company, and the significance of this collaboration has been analyzed by numerous agencies and media.

The collaboration will incentivize iPhone users to upgrade to models that support generative AI, such as the iPhone 15 Pro/Pro Max, iPhone 16 series, and iPhone SE 4. Especially the lower-priced iPhone SE 4, which is expected to be launched as early as next week, will significantly reduce the cost for consumers to purchase AI-enabled iPhones.

(Source: Lei Technology production)

Research firm Counterpoint Research indicates that 59% of respondents plan to upgrade to a phone that supports generative AI within one year, and 69% believe that the primary value of generative AI lies in saving time, assisting users in writing documents, summarizing content, and conducting online research, demonstrating the appeal of AI to consumers. Apple Intelligence, combined with the lower-priced iPhone SE 4, may help Apple reverse the three-year decline in sales and achieve growth in 2025.

With the support of 250 million iPhone users, Alibaba is also expected to increase its influence in the consumer market and the open rate of apps such as Taobao, Alipay, and Ele.me, further enhancing the core competitiveness of its consumer business and breaking out of the encirclement by Pinduoduo and JD.com. No other company can achieve the same effect as Apple in collaboration with Alibaba.

The collaboration between Apple and Alibaba is of immense significance to both parties, making it a quintessential example of a mutually beneficial situation. This collaboration will also intensify the pressure on other phone manufacturers, e-commerce platforms, and food delivery platforms. Amidst this storm, more intense competition in the mobile phone industry and among e-commerce platforms is gradually unfolding.

Source: Lei Technology