Intelligent Driving Equality War in Cities: Demanding Huawei's Performance with Tesla's Cost

![]() 04/10 2025

04/10 2025

![]() 470

470

Author | Zhang Lianyi

"The biggest obstacle to popularizing intelligent driving is the high price. Good technology should be accessible to everyone, so BYD aims to achieve universal intelligent driving." At the beginning of this year, BYD swiftly launched the "Universal Intelligent Driving Offensive", instantly escalating intelligent driving from a localized war in the high-end auto market to a "world war" involving various auto market segments.

Subsequently, automaker groups such as Geely, Chery, Changan, and GAC quickly followed suit, joining the battle, and high-speed NOA became nearly universally available, becoming a standard feature across the board.

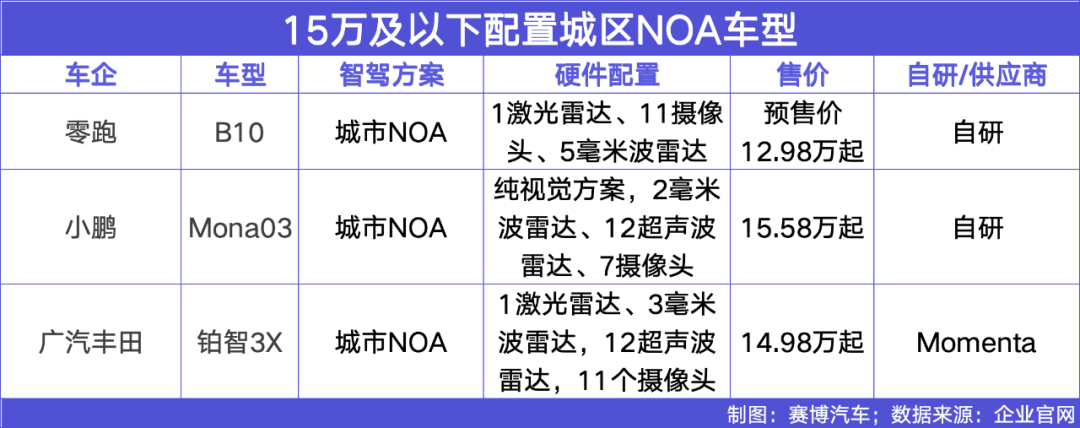

Meanwhile, Leapmotor, with a presale price of RMB 129,800, offers standard lidar, 200 TOPS+ computing power, end-to-end intelligent driving models, and scenario-free NOA, lowering the price of high-level intelligent driving models equipped with lidar to a new low.

As the era of intelligent driving equality intensifies, automakers and intelligent driving suppliers are collectively preparing for battle. With the escalation of the universal intelligent driving war and the rapid penetration of high-level intelligent driving, who will be the biggest beneficiary?

01

The Second Upgrade of the Intelligent Driving War: City NOA Has Dropped to the RMB 150,000 Range

The opening of a new battlefield is naturally driven by demand.

Up until last year, intelligent driving, even if it only included high-speed NOA, was still a good selling point for "having what others don't."

Who would have expected the "universal intelligent driving" of 2025 to roar in, and after most automakers have completed the deployment of high-speed NOA, high-speed NOA is no longer competitive. Many say, "Everyone having it equals no one having it," because it is still difficult to prove "others have it, but I have it better." Automakers have discovered that competing on "others have it, but I have it better" has become a red ocean, and it is better to quickly roll out "having what others don't."

City NOA, with a higher threshold and better user experience, has become the true breakthrough point in intelligent driving competition. This year, led by automakers such as BYD, XPeng, and Leapmotor, the price of models standard with City NOA has even reached RMB 150,000. In the second half of this year, more models equipped with lidar, City NOA functionality, and priced at RMB 150,000 or below will be launched, accelerating the high-level intelligent driving market and facing an outbreak.

02

Automakers Need to Calculate the Economic Costs of Adopting City NOA, with Cost Advantage Becoming a Killer Move

Although domestic intelligent driving has been developing for more than a decade, only three forces remain with mature mass production solutions for City NOA: a handful of self-developed automakers represented by Li Auto and XPeng, Huawei, and Momenta. Other intelligent driving suppliers and a considerable number of automakers' self-developed efforts have almost all failed in the City NOA battlefield. Since 2021, no new intelligent driving companies have been established in the market, which is also a selection of survival of the fittest under market competition.

Looking at the three camps: The self-developed camp, led by new forces such as Li Auto and XPeng, replicates Tesla's FSD path, using intelligent driving capabilities as the core selling point, rapidly pulling away from traditional automakers.

Huawei mainly leverages its brand advantage, establishing the "AITO" benchmark, and its latest intelligent driving technology is mainly supplied to several "AITO"-branded models. Another supplier with a mature mass production solution, Momenta, appeared on BYD's Tian Shen Zhi Yan and multiple Japanese models such as Bozhi 3X earlier this year.

Through full-stack self-development, Huawei's full-scenario intelligent driving capabilities have always been far ahead in China. However, this also creates an unavoidable problem: high costs. Huawei's high-level intelligent driving hardware costs exceed RMB 15,000, so the inclusion of Huawei technology in high-level intelligent driving models priced below RMB 300,000 is almost zero.

On the one hand, automakers pursue Huawei's performance, and on the other hand, they benchmark Tesla, calculating the economic costs. Due to adopting a pure vision solution, Tesla can discard expensive lidars and rely on powerful model computing power, supporting FSD with only eight cameras. According to insiders' teardowns, the current cost of the FSD suite is only around USD 1,000. In contrast, the high cost of Huawei's intelligent driving solution stands out.

Especially as City NOA rolls out to RMB 150,000 models, automakers must grasp the selling point of City NOA and rally the troops; on the other hand, they have to strike a balance and strictly control costs. A currently feasible strategy is to replicate Tesla's FSD by removing expensive equipment such as lidars and adopting a pure vision solution. For example, XPeng's Mona03 and BYD's Tian Shen Zhi Yan C both align with FSD in terms of cost.

Momenta undertook a large number of high-level intelligent driving models with OrinX chips in the early stage and is the most mature supplier in terms of mass production capabilities on OrinX chips. After its software capabilities were recognized, Momenta began to deploy hardware, planning to consolidate its advantages through self-developed chips. Industry sources revealed that Momenta's self-developed chips have a computing power exceeding OrinX's 254 TOPS, with a cost of only 30% of OrinX, giving automakers a cost-competitive solution against Tesla. If Momenta's intelligent driving solution enters a software-hardware integration mode, it will be more beneficial for automakers to control costs while enhancing the City NOA experience, further strengthening product competitiveness.

03

The Knockout Stage Begins, with the Stronger-gets-stronger Effect Becoming Increasingly Apparent

From intelligent driving on vehicles to intelligent driving equality, a new round of larger-scale intelligent driving battles has arrived, and competition in the intelligent driving circle will intensify. Over the past few years, the pricing landscape for high-level intelligent driving functions has undergone significant changes.

In 2022, led by companies such as Huawei and Momenta, the integration of intelligent driving technology into vehicles was seen as a symbol of enhancing the prestige of models, successfully establishing a series of new smart auto brands including AITO, IM Motors, and BYD look up at , competing with NIO, XPeng, Li Auto, and Tesla.

Driven by this, in 2023, the intelligent driving market showed a stepped differentiation. On the one hand, it extended to flagship models priced above RMB 500,000 to strengthen the technological benchmark position. At the end of the year, AITO M9, called by Yu Chengdong as the "best SUV within RMB 10 million," was launched with a price range of RMB 469,800 to 569,800. It has been the sales champion for luxury cars priced above RMB 500,000 in China for consecutive months, also showing the premium ability of intelligent driving. On the other hand, it quickly sank to the mainstream range of RMB 200,000 to 250,000, with the mass production of City NOA functionality becoming one of the core competitiveness. In June of that year, XPeng G6 was launched, priced from RMB 209,900, including the MAX version with high-level autonomous driving functionality priced from RMB 229,900. This model also became the sales champion of domestically produced pure electric SUVs in the RMB 200,000 range, with a clear boost from intelligent driving value.

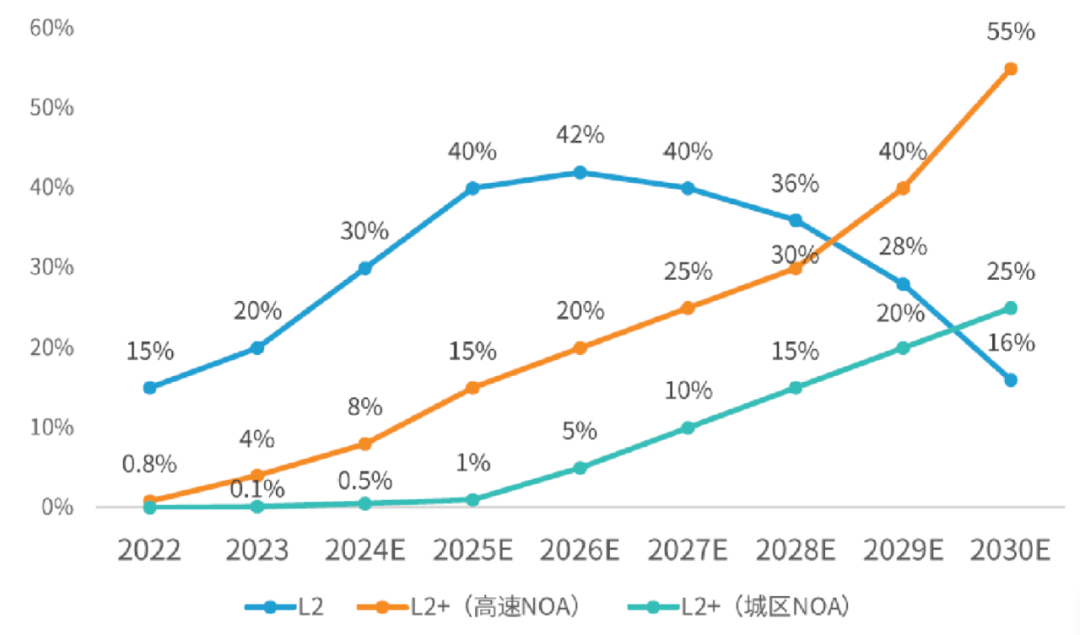

Entering 2024, intelligent driving has become a "regular" at automaker launches, with the saying "No intelligence, no launch." It is also in this year that with the support of technologies such as map-free navigation and large models, as well as the initial emergence of economies of scale, high-level intelligent driving continues to sink and accelerate its penetration. According to data from ZoZo Research, in January 2024, the City NOA installation rate for cars priced between RMB 200,000 and 250,000 was only 2.1%; by October 2024, this value had risen to 24.7%. This change marks the accelerated popularization of City NOA, and the RMB 200,000 to 250,000 price range has become the frontline of competition for automakers and third-party intelligent driving suppliers.

The penetration rate of L2+ level intelligent driving is expected to steadily increase. Data Source: ZoZo Research

At the beginning of 2025, the battle begins. With the continuous efforts of major automakers and third-party intelligent driving suppliers in intelligent driving equipment and technology, the number of low-price models equipped with high-level intelligent driving will further increase in 2025. And since this segment of models has a large market share, the intelligent driving market is expected to usher in an outbreak.

Based on this, intelligent driving suppliers will also experience industrial differentiation, with leading enterprises enjoying the dividends brought by technology implementation, while the living space for small and medium players will be further compressed. Ultimately, a stronger-gets-stronger situation will emerge. On the one hand, the first-tier mass production camp will continuously iterate algorithms to solidify its advantages, with the scale effect of intelligent driving becoming more significant. It can not only reduce hardware costs through economies of scale but also reduce hardware dependence and enhance user experience through data iteration algorithms. Once the scale effect, cost reduction, and data iteration, and the algorithm flywheel start a positive cycle, it will gradually expand the leading edge. On the other hand, affordable intelligent driving will intensify camp differentiation, with affordable intelligent driving becoming more popular. The expanding gap in vehicle inventory between different camps leads to more significant differences in data acquisition.

Clearly, the battle for intelligent driving equality is also a knockout stage for intelligent driving. For suppliers, opportunities and challenges coexist, and time will tell who will emerge victorious.