When Intelligent Driving Becomes Standard, Carmakers' Undercover Competition Escalates | 2025 Shanghai Auto Show

![]() 04/26 2025

04/26 2025

![]() 484

484

The 2025 Shanghai Auto Show, where intelligence is omnipresent, returns to its core purpose of selling cars.

After two days of intense exploration at the exhibition, Guangzhui Intelligence's most striking impression is that this year's auto show prioritizes pragmatism over flashy attention-grabbing.

Reflecting on the three pivotal auto shows in the era of smart cars, the 2023 Shanghai Auto Show was brimming with carmakers' imaginative visions of intelligence; the 2024 Beijing Auto Show saw industry leaders "visiting each other" and vying for the right to speak on high-level intelligent driving. In contrast, this year's Shanghai Auto Show has made "selling goods" the central theme of car industry players' promotions.

At the Wenjie brand booth, the most notable difference from others is a circle of store new media salespeople vigorously introducing the purchasing benefits of the Wenjie M8 to the live stream. With over 50,000 orders just four days after its launch, Thalys clearly aims to capitalize on the auto show's buzz.

Xiaomi's booth was the most visited in the morning, with over 4,000 visitors by 11 a.m. Why did viewers insist on revisiting a model (Xiaomi SU7) that had been released for over a year? It turns out Xiaomi was distributing limited edition baseball caps priced at 129 yuan on its official website to attract viewers' attention.

This year's auto show also featured film and television stars invited by carmakers, such as Huang Bo, Ma Dong, Chen Daoming, Sa Beining, and Fan Zhendong, promoting products. Car industry leaders were equally busy, with Li Bin cosplaying as a "fisherman" at the Ledo L90 launch event, He Xiaopeng using robots as "car models," and Li Xiang finding someone to demonstrate "dropping" the MEGA car door. Additionally, some individuals "rode on" the auto show's popularity, like Zhou Hongyi, who once again "dressed in a red robe" and visited booths of GAC, Xiaomi, BAIC, etc., even buying a BJ40. However, it's evident that the "red-robed uncle who stirred up the waves" at last year's auto show garnered significantly less attention this year.

Why is this year's Shanghai Auto Show slightly subdued? The primary reason is that the intelligent transformation of automobiles has reached the stage of popularization. Whether it's consumers, carmakers, or technology suppliers, intelligence is now widely seen as a standard feature for smart cars.

Especially the foreigners who came to "steal ideas" on-site. Their descriptions of China's smart cars this year are less about "Amazing" and more about systematic observations. In front of the Zero Run booth, Guangzhui Intelligence even heard foreigners "doing the math," trying to understand how this product priced at $15K (Zero Run B10) came into being.

In the era of equal rights for intelligent driving in 2025, carmakers can achieve L2-level assisted driving on vehicles through various methods such as independent research and development, cooperative research and development, and procurement of solutions. To enhance cabin intelligence, carmakers can collaborate with internet giants to launch "exclusive" version apps, develop independent operating systems, and find cabin intelligence suppliers for adaptation. With the trend of AI agents liberating users' hands from operating smart terminals, cars can now order coffee for you with just one command.

When intelligence enters the BOM list for carmakers' product design, the result is that almost every new car at the auto show comes standard with decent intelligent functions. Regardless of a carmaker's strength in intelligent technology or their strategy of launching a new product matrix all at once, they can freely "mix and match" desired intelligent functions like building blocks.

"All players in the industrial chain must perform their respective duties to achieve better cooperation and create better products."

Faced with the current product creation model demonstrated by smart cars, Guangzhui Intelligence interviewed a series of leading carmakers and intelligent manufacturers such as Horizon Robotics, Black Sesame Technologies, Momenta, Wenjie, and Zeekr. Almost all staff gave similar answers.

At the 2025 Shanghai Auto Show, we witnessed China's smart car industry chain becoming more mature, with a new round of automotive intelligence technology emerging accordingly.

Intelligent driving capability is the key differentiator between smart cars and general new energy vehicles (or traditional fuel vehicles). As regulatory departments such as the Ministry of Industry and Information Technology have tightened the propaganda guidelines for intelligent driving, Guangzhui Intelligence observed at this auto show that previously "overhyped" high-level intelligent driving has become much more "low-key".

At the Huawei Qiankun booth, we could see a simple slogan for Huawei ADS4.0: "Towards a New Era of Intelligent Driving." Just the night before the auto show, Huawei's Car BU CEO Jin Yuzhi stated at the Intelligent Technology Conference that ADS4.0 has undergone 600 million kilometers of high-speed L3 simulation and verification in the cloud world engine, preparing for the mass production and commercialization of high-speed L3.

At other intelligent driving supplier booths, Guangzhui Intelligence also noticed that intelligent driving promotions have all been adjusted to the term "assisted driving." In place of previous City NOA (or various "door-to-door intelligent driving" claims), Black Sesame's high-level intelligent driving is now called "high-level assisted driving"; Horizon Robotics refers to it as the "Urban Assisted Driving System"; Momenta calls it "Intelligent Assisted Driving"; and SenseTime Absolute Zero labels it "Assisted Driving".

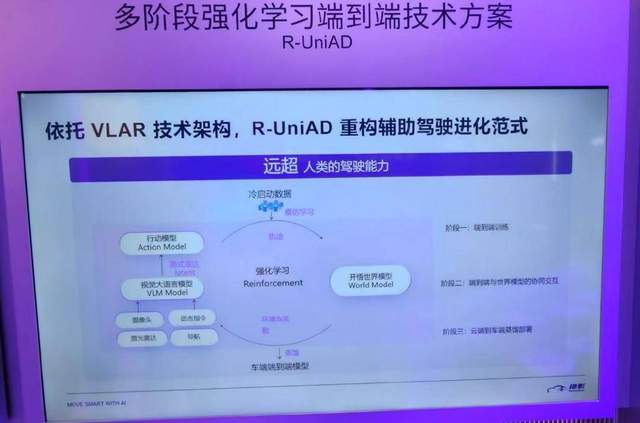

However, behind this low-key promotion, intelligent driving technology is ushering in a new generational upgrade. Before this auto show, Guangzhui Intelligence learned that the latest technology in intelligent driving research and development has been upgraded from "end-to-end" to a solution of "larger models + world model training + reinforcement learning + cloud distillation".

Currently, players that have or are preparing to adopt this new technology route include XPeng, SenseTime Absolute Zero, Momenta, Lixiang, Horizon Robotics, Huawei, etc.

The concept of this technology route roughly involves using world models in the cloud to perform larger-scale simulations, then conducting reinforcement learning based on the results, and finally placing the cloud-trained models onto the vehicle side through distillation.

The fundamental reason why intelligent driving needs to be upgraded from "end-to-end" to a world model solution is that "end-to-end" only learns human operations. For intelligent driving to be safer, it cannot be limited to imitating humans. AI must have the ability to face dangerous scenario data that is difficult to collect in the "end-to-end" era and ensure driving safety in special scenarios.

The differences primarily lie in each manufacturer leveraging their own "strengths" within this system.

For example, XPeng believes that combining past experience in writing a large number of intelligent driving rules can provide a higher lower limit of capability for the new intelligent driving model. SenseTime, which specializes in large models, has the advantage of more reasonable AI-generated training scenarios. At the SenseTime Absolute Zero booth, we could see that although both sets of generated scenarios had traces of AI generation, the comparison effect on the left side obviously did not conform to real-world laws (cars on the road were driving backwards).

However, this new training paradigm also presents quite a few challenges.

For instance, the vehicle side needs greater computing power to "fit" larger intelligent driving models. Using NVIDIA's latest Thor chip, each one costs tens of thousands of yuan. Not to mention that products with dual Thor chips and computing power of up to 1400 TOPS (Zeekr 9X) have already appeared on the market.

Moreover, from a commonsense logic perspective, the idea of world models + reinforcement learning is essentially still focused on scenario-based reinforcement training and cannot be said to completely solve the long-tail problem.

Regarding this issue, a staff member from SenseTime Absolute Zero responded, "Our goal is definitely to be safer than drivers. Previously, end-to-end solutions addressed most human driving scenarios, and now it's about supplementing capabilities beyond human driving data. The advantage of this solution is that if a never-before-encountered accident occurs in reality, the world model can learn the response plan at the fastest speed. This efficiency in solving problems is beyond what was imagined in the past."

Interestingly, many intelligent driving players paid tribute to Deepseek at the new generation of intelligent driving technology launch events. Perhaps the world model for intelligent driving is "retracing" the path taken by Deepseek in the bit world within the embodied physical world.

With the evolution of AI large model technology, automotive intelligence technology is also iterating accordingly.

The iteration of automotive intelligence is highly correlated with the development of AI large models.

"The explosive development of AI is driving automotive intelligence into deeper waters. The architectural innovation of intelligent assisted driving has evolved from a rule-based traditional architecture to an 'end-to-end' architecture that integrates perception and decision-making, not only reducing information loss but also having stronger generalization."

Reviewing the past iterations of automotive intelligent driving technology, Tang Daosheng, Senior Executive Vice President of Tencent Group and CEO of the Cloud and Smart Industries Group, summarized the development trajectory in this way.

In recent years, we have witnessed the significant leap of large models from "generative" to "multimodal," and now to AI agents. AI is increasingly able to "understand" the real world. As automotive intelligence manufacturers gain a deeper understanding of AI, today's automotive intelligence has also undergone monumental changes.

In the past, large automotive models were strictly used for cabins.

Why not apply them at the intelligent driving level? The main reason is the need to "align" the intelligent driving cloud model with the vehicle-side model. "Based on the current mainstream vehicle-side chips, the size of the vehicle-side model is generally between 100 million and 500 million," said Li Liyun, Vice President of XPeng Automobile's Autonomous Driving Department. A model that doesn't even reach the scale of 1 billion is hardly worthy of being called "large".

For intelligent cabins that truly use large models, the implemented intelligent functions in the past were also relatively limited. In 2023, carmakers began to consider how to bring ChatGPT on board and use access to cloud-based large language models to solve the problem of ambiguous instructions. In 2024, combining the multimodal capabilities of large models, users can "operate" the in-car screen from a distance.

Nowadays, with the continuous release of AI Scaling Law and Deepseek's verification of the next evolution path for large models through distillation + reinforcement learning, AI large models have once again rewritten all aspects of automotive intelligence.

On Huawei's ADS4.0, it's the large model on the vehicle side that introduces full-modal sensing capabilities for sensors. With the joint sensing of various types of sensors, Huawei's World Action Model connects driving (vision), cabin (hearing), and chassis (touch). With the large model's comprehensive understanding of the world, smart cars are like "living beings" that can self-perceive and self-adjust.

To install larger models on the vehicle side, automotive intelligence hardware manufacturers are also prepared.

"We can accommodate the world models currently proposed," a Black Sesame staff member introduced the capabilities of the latest Huashan A2000 series chips. When Guangzhui Intelligence asked if they were concerned that self-developed chips couldn't keep up with the development trend of large models, this staff member was quite confident, saying, "Compared to using NVIDIA chips, the biggest advantage of our self-developed IP is that it can change at any time and can be modified very quickly."

Under the latest application trend of AI agents for large models, the design logic of intelligent cabins is also evolving. The most significant change is that, compared to last year's focus on functionality, the intelligent cabins at this year's auto show are more concerned with commercialization and ecology.

At the SenseTime Absolute Zero booth, we saw a driver state monitoring system that integrates the capabilities of multiple sensors. This system can detect a driver's gaze, blink frequency, whether they have been drinking, and a series of other indicators. Regarding the reason for launching this system, a staff member from SenseTime Absolute Zero introduced, "It is primarily to meet European standards, with the goal of going overseas."

On the intelligent cabin ecology front, Guangzhui Intelligence found that internet giants have already shown a trend of "encircling each other's territories."

In terms of major advancements, this year's intelligent cabins have incorporated AI agents, mirroring the agents introduced in the mobile phone industry towards the end of 2024. These agents primarily operate within defined scenarios. For instance, Banmax Intelligent Travel has developed a system-level agent for invoking other functions, complemented by 10 platform-level application agents covering travel, navigation, local life, and more.

It is noteworthy that at the Banmax Intelligent Travel booth, numerous demonstrations of "Alibaba-affiliated" apps were on display. Just a day prior to the auto show, Tencent announced at its Smart Mobility Technology Open Day the implementation of AI agents on the vehicle side, integrating content and services such as WeChat Mini Programs and Tencent Maps.

Regarding the presence of these apps, a Banmax Intelligent Travel representative explained to Guangzhui Intelligence, "This is primarily due to Alibaba's resource inclinations." When asked about the timeline for integrating other mainstream apps, the representative candidly stated, "Other large companies may consider numerous factors. They might provide an interface to call the app, but for more intricate collaborations, they will weigh whether it is worthwhile."

In summary, the evolution of AI large models has propelled the overall development of automotive intelligence. With larger models being integrated into vehicles, smart cars are inching closer to the ultimate goal of "full-vehicle intelligence."

When the concept of smart cars first emerged, the centralized automotive electronic architecture was envisioned as the pinnacle of automotive intelligence. This design aimed to reduce costs by consolidating computing tasks onto a single central platform, thus minimizing automotive production costs (such as wiring harnesses and controllers) and facilitating software updates via OTA. Additionally, as more components became intelligently controlled, a high-powered centralized computing platform could address all intelligent computing needs simultaneously.

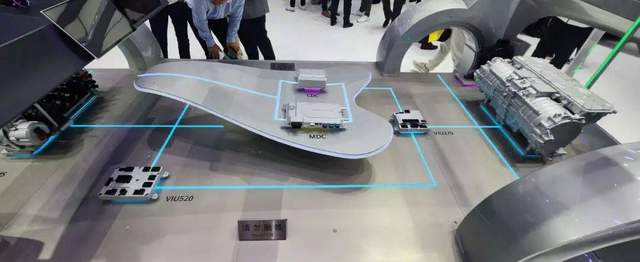

Consequently, as the automotive industry advanced, the intelligence of vehicles evolved towards centralization, coinciding with the updating of automotive electronic architecture. This year, cutting-edge players like Leapro and Qualcomm collaborated to integrate intelligent driving and cockpit chips onto a single "board" on the B10. At Huawei's Qiankun booth, it was evident that Huawei's approach to automotive intelligent architecture favors "fewer computing nodes." Similarly, at the Black Sesame booth, staff informed Guangzhui Intelligence that the Wudang C1200 chip is ready for cockpit-driving integration, capable of handling tasks with just one chip.

The evolving trends in automotive intelligent architecture underscore the expanding "business scope" of automakers and automotive intelligent suppliers. In other words, the technological barriers across the entire intelligent automotive industry chain are significantly increasing.

A notable example is the controversy last year when Horizon Robotics' founder, Yu Kai, invited OEM experts to experience SuperDrive. Some experts "pointed out" that Horizon Robotics was encroaching on automotive chassis tuning. Conversely, Huawei has developed an intelligent chassis based on intelligent driving and cockpits, optimizing the driving experience and collaborating on luxury models like the Wenjie M9, Xiangjie S9, and Zunjie S800.

At this year's Shanghai Auto Show, Guangzhui Intelligence inquired with multiple automotive intelligent manufacturers and found that each is conducting more detailed and in-depth research. For instance, Momenta announced that the first batch of driverless Robotaxis is expected to commence trial operations by the end of 2025. Their confidence in mass-producing Robotaxis stems from the cost reduction achieved through reusing mass-produced sensors and computing units for intelligent driving.

For automakers, the focus is on self-researching every aspect of automotive intelligence to gain a comprehensive understanding. As Li Bin, founder, chairman, and CEO of NIO, stated at this year's auto show, "The new three core components of intelligent automobiles are intelligent driving chips, domain operating systems, and intelligent chassis. These new core technologies determine the upper limits of intelligent automobile experience and safety." Self-researching "domain-wide" intelligence may become the next competitive frontier for automakers.

Among these components, the efficacy of intelligent driving chips hinges on their ability to leverage the capabilities of the "new" intelligent driving large model. Utilizing self-developed chips and loading self-developed software represents a synergy of hardware and software. In the realm of intelligent chassis, referring to examples like Huawei's Tuling chassis and BYD's Cloud Cruiser, a chassis that can "see the road for itself" directly contributes to a "smooth and stable" driving experience.

The benefits of a domain-wide operating system can be understood by examining Lixiang's recent announcement of Xinghuan OS. The primary value of a domain-wide system lies in creating an efficient data interaction and communication platform for intelligent automobiles, thereby resolving the contradiction between millisecond-level deterministic data transmission and the limited computing power and storage space of the automotive central electronic architecture. In other words, on the software level, intelligent automobiles also need to transition from the original "distributed" architecture to a centralized one.

"Ultimately, it all leads to the same destination," summarized Huang Junjun, head of NIO's digital architecture. Intelligent driving chips, domain-wide operating systems, and intelligent chassis are manifestations of automakers' platform capabilities. "For the company, the reuse of platformization significantly reduces the cost of digital development for each vehicle. This is why we can simultaneously deliver so many vehicles across three brands in one year."

After attending this year's Shanghai Auto Show, Guangzhui Intelligence is deeply impressed. Compared to previous A-class auto shows in China's intelligent automobile era, this year's Shanghai Auto Show might not seem particularly novel or exciting, with products being launched and sold in an orderly manner. However, beneath the surface, it hints at a new level of competition among automakers.

As intelligence ceases to be a mere "gimmick" for selling cars, automakers must now compete in an era of "hand-to-hand combat," focusing on cost, product capabilities, and engineering expertise.