Porsche Sales Plunge 42%: A Crisis Unfolds

![]() 04/16 2025

04/16 2025

![]() 378

378

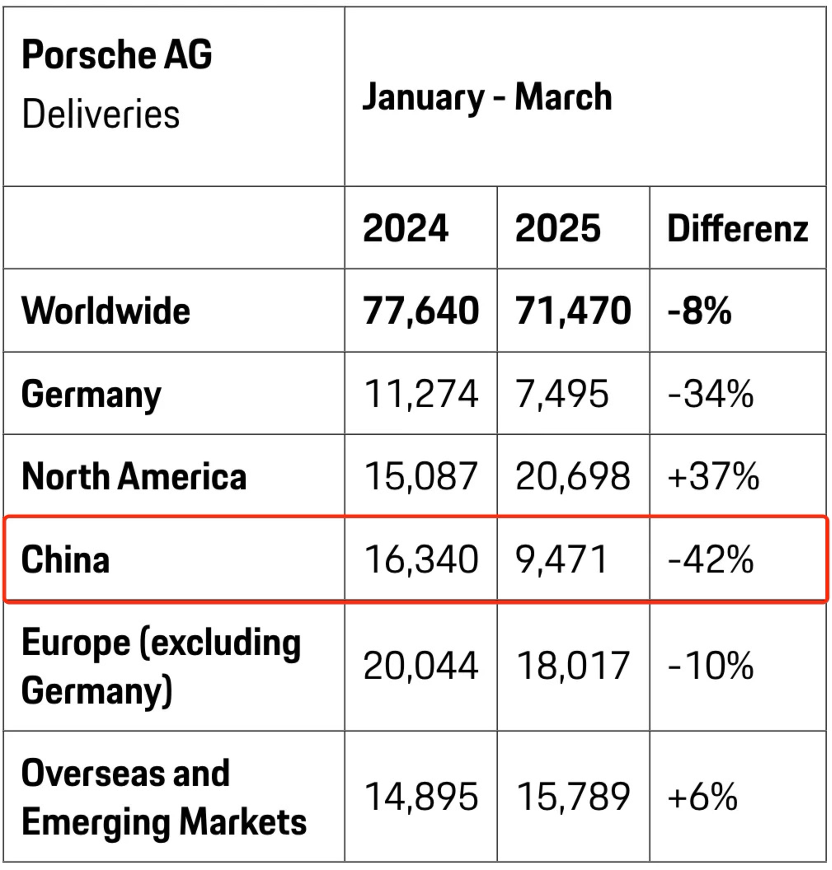

Recently, Porsche unveiled its first-quarter delivery report for 2025, revealing a concerning trend. Global deliveries totaled 71,470 units, marking an 8% year-on-year decline. Notably, both the German and Chinese markets suffered significant drops, with China experiencing an alarming 42% decrease, nearly the steepest fall in a decade.

Analyzing the sales data, Porsche observed declines across several key markets. Specifically, German domestic sales fell 34% year-on-year to 7,495 units, while European sales dipped 10% to 18,017 units. Conversely, overseas and emerging markets saw a 6% increase to 15,789 units. Porsche's largest single market, North America, reported a robust 37% increase to 20,698 units, significantly outpacing the Chinese market. Sales in China amounted to just 9,471 units, accounting for 13.25% of global sales, indicating that Porsche's market position in China is facing unprecedented challenges.

This marks the third consecutive year that Porsche has lost its position as the largest single market globally. Since peaking in 2021, Porsche's sales in China have been declining annually. From 2021 to 2024, sales plummeted from 95,700 units to 56,900 units, a 28% year-on-year decrease. China dropped from being Porsche's largest global market to the third, and this downward trend persisted into the first quarter of 2025. Porsche's financial results are equally disheartening. The company's 2024 financial report, released on March 12, revealed sales revenue of approximately 40 billion euros, a 1.1% year-on-year decrease, and net profit of 3.6 billion euros, a 30.3% drop from the previous year. High costs and weak demand in the Chinese market, which directly hindered progress in its electric vehicle strategy, contributed to this decline.

It's worth noting that Porsche had previously committed to delivering over 80% of its vehicles as pure electric by 2030. However, due to market underperformance, Porsche has had to adjust its market transition strategy. In early 2025, Porsche announced the postponement of its goals and increased investment in gasoline and hybrid models, planning to restart gasoline models and relaunch a limited edition classic 911 model from the 1970s. This strategic shift could be seen as self-sabotage in China's booming electric vehicle market, where new energy vehicles are becoming the norm, and domestic brands like NIO and Li Auto are rapidly capturing the high-end market with their cost-effective and intelligent offerings.

Domestic consumers' car-buying preferences have shifted from the prestige of luxury logos to practical intelligent experiences. Furthermore, emerging luxury brands in China offer acceleration performance and intelligent configurations comparable to million-yuan luxury cars at prices ranging from 300,000 to 500,000 yuan. Despite Porsche's strength, its starting price of one million yuan is steering younger generations towards domestic new forces offering "refrigerators, TVs, and large sofas" in their vehicles.

Moreover, China's independent auto brands have risen significantly in recent years. According to the China Passenger Car Association, luxury car retail sales in March reached 250,000 units, a 7% year-on-year decrease but a 68% month-on-month increase. Luxury brands' retail share was 12.9%, a 3 percentage point decrease year-on-year. While the overall sales of emerging luxury brands in China are not yet known, the sales growth of brands like XPeng (267.9% year-on-year increase), Li Auto (26.7% increase), and Zeekr (18.5% increase) indirectly confirms that domestic emerging high-end brands are gradually increasing their sales and encroaching on the market share of traditional luxury brands. Porsche is not alone; many traditional luxury brands are facing challenges in the Chinese market.

Sales data for the first quarter of 2025 shows that the traditional luxury car trio represented by BBA (BMW, Benz, Audi) all had cumulative sales of around 110,000 units. Sales of Audi, Mercedes-Benz, and BMW fell by 19.7%, 25.9%, and 11.4%, respectively. Second- and third-tier traditional luxury brands face even greater challenges in the Chinese market due to their smaller market size and shrinking market share. Second-tier luxury brands such as Lincoln and Infiniti are at risk of withdrawal from the market.

In response to the increasingly competitive Chinese market, Chinese auto companies have leveraged intelligent driving technology to encroach on the business of overseas luxury brands. To combat this, luxury brands are actively equipping themselves with "new weapons," primarily focusing on intelligence. On March 11, FAW-Volkswagen Audi announced that all five new models planned for 2025 will be equipped with a high-level intelligent driving assistance system developed jointly by Audi and Huawei. Additionally, they will cooperate with IM Motors' electric vehicle platform to develop new pure electric models. On March 17, BMW China and Huawei Terminal announced a cooperation agreement to launch diversified intelligent applications and functions based on HarmonyOS NEXT. Mercedes-Benz and Geely will jointly develop a new hybrid engine for the Chinese market, collaborating on the research and development of a new-generation CLA hybrid model. Latest reports indicate that Porsche has already partnered with Horizon Robotics in intelligent driving research and development, with specific details expected to be announced during or after this year's Shanghai Auto Show.

However, whether this established luxury car brand can regain the favor of Chinese consumers depends on its ability to truly humble itself and understand the evolving needs of the new affluent. In an era where "standard equipment for the rich" is synonymous with "intelligence tax," any brand that fails to adapt may be left behind by the times.

(Images sourced from the internet. Remove if infringing)