Nezha Auto's Darkest Hour: Triple Collapse in the Survival Game of New Forces

![]() 04/15 2025

04/15 2025

![]() 419

419

As the "Demon Child Descends" into a "Struggle for Survival," Nezha Auto, having incurred losses of 18 billion yuan in three years, has reached a critical juncture.

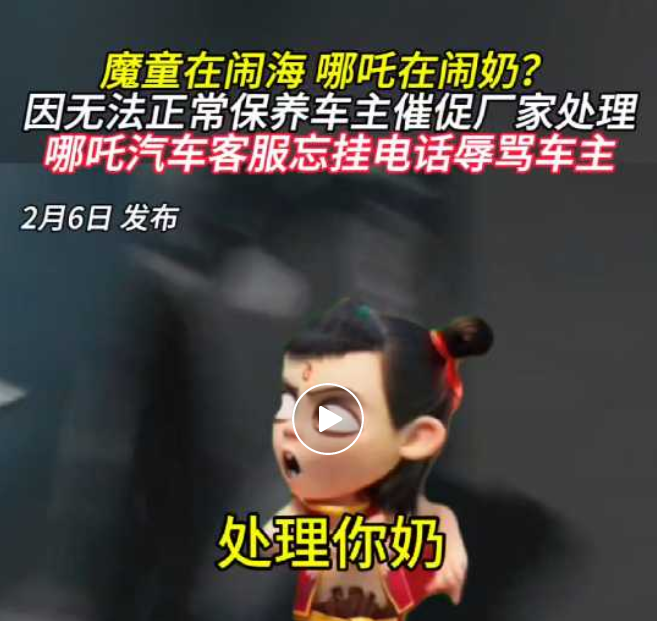

In April 2025, a photo of a car owner holding a banner in front of a 4S store went viral online: "Nezha Offline, Car Owners Panicked." This nationwide car infotainment system failure incident plunged the automaker, once atop the sales list of new forces, into an unprecedented trust crisis.

From monthly sales exceeding 10,000 to retail sales plummeting by 98%, from a darling of capital to being burdened with debt, Nezha Auto's downfall has torn open a bloody industry scar.

01 Trust Avalanche

A fatal chain reaction behind the loss of technology control

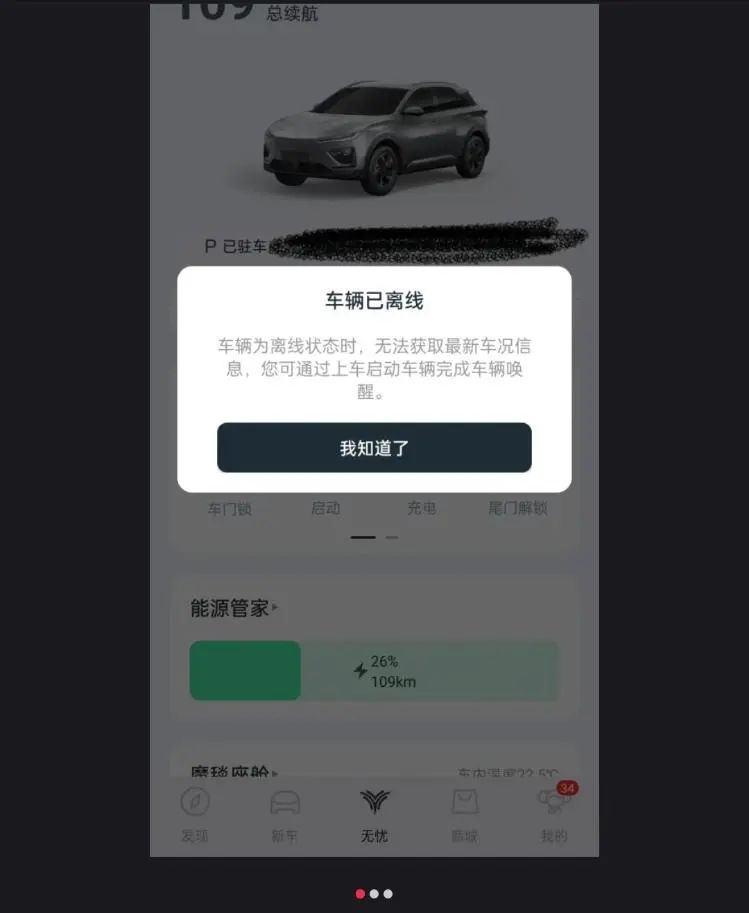

When car owners discovered that the navigation positioning on their car infotainment screens suddenly disappeared, they could not have imagined this was just the beginning. The nationwide outbreak of network disconnections plunged Nezha Auto's user experience to freezing point: Bluetooth keys failed, rendering vehicles unable to start, remote control via the app became meaningless, and even basic navigation functions became a luxury.

This crisis had been foreshadowed. In January 2025, Nezha's official website and car infotainment system went down for 72 hours due to "maintenance and upgrades," with the official citing "server overload." However, in the following months, network disconnection issues recurred like ghosts until they fully erupted in April.

The technical team had to admit that the cheap servers used to reduce costs had long been unable to support the concurrent demands of millions of users.

The death spiral of capital depletion. The root cause of the technical paralysis points directly to the capital quagmire in which Nezha Auto is mired. Sales data showed that its sales plunged by 40% year-on-year in 2024, and domestic retail sales in January 2025 were only 110 vehicles, a sharp decrease of 97.76% year-on-year. More critically, the cumulative loss over three years exceeded 18 billion yuan, supply chain disruptions led to factory shutdowns, and frozen equity deterred partners. When server maintenance costs became a "luxury," the collapse of the technical system was only a matter of time.

Rebuilding trust is harder than climbing to heaven.

In a car owner forum, a message from a Nezha S owner was heart-wrenching: "I once recommended Nezha to 20 friends, and now it has become the biggest joke." For new energy vehicles, the intelligent experience is the core moat, and frequent network disconnections directly shattered users' faith in "tech-driven travel." An industry analyst bluntly stated: "This trust collapse will take at least three years to repair, but Nezha may not make it to that day."

02 Strategic Confusion

Self-destruction from the "Sales Champion Myth" to the "Premium Illusion"

In 2022, Nezha Auto topped the list of new forces with sales of 152,000 vehicles, with the Nezha V and Nezha U, two models priced at around 100,000 yuan, making significant contributions. However, a sudden strategic shift drove the automaker into a dangerous bend.

Premiumization Trap: Pursuing dessert before stabilizing the main course. In 2023, the Nezha S and Nezha GT, two models priced above 200,000 yuan, were launched with great fanfare, attempting to replicate the premiumization path of Li Auto and NIO. However, the reality was brutal: the Nezha S's 400V charging architecture and 80TOPS computing power chip lagged behind competitors of the same period by two generations; the Nezha GT became a niche toy due to exaggerated range claims and laggy infotainment systems, with monthly sales consistently below 100 units. More critically, the diversion of research and development resources towards premium models led to stagnation in the upgrading of main models, allowing competitors such as BYD's Seagull to seize market share.

Curse of the "Cheap" Label. Over 60% of sales relied on the B-end ride-hailing market, shackling Nezha Auto with the label of "exclusively for ride-hailing." A dealer revealed: "The first thing many private car owners say when they enter the store is 'Isn't this car for ride-hailing?'" The low-price strategy created a financial black hole where "selling one car loses 45,000 yuan," with greater sales leading to deeper losses. When premiumization attempts failed and the low-end market was besieged by competitors, Nezha fell into a quagmire of strategic unfocus.

Industry Warning: Lessons from HiPhi and Jiyue. Nezha's predicament is not an isolated case. In 2025, HiPhi Auto ceased production due to a broken capital chain, and Jiyue Auto experienced a sales halving and layoffs.

These cases expose three fatal flaws of new forces:

- Blind premiumization: Transforming without technical accumulation and brand recognition is like building a skyscraper on the beach;

- Uncontrolled fund management: Once the burn-money-for-market strategy is hindered by financing difficulties, the supply chain and service chain collapse instantly;

- Fragile user trust: Technical failures, after-sales supply disruptions, and other issues directly impact the user experience, and the cost of rebuilding trust is extremely high once it collapses.

03 Desperate Survival

Can Globalization and IPO Turn the Tide?

Facing life and death, Nezha Auto launched a combination of "globalization + IPO," but each step was fraught with danger.

1. Southeast Asian Breakthrough: Opportunities in a Tight Spot

In 2025, Nezha announced that it had obtained a credit line of 10 billion Thai baht (equivalent to 2.1 billion yuan) from Thailand, planning to radiate Southeast Asia through KD factories and restart export operations from the Nanning base. However, the Thai market was already surrounded by strong competitors: BYD's ATTO 3 had long occupied the sales champion position, and Great Wall Motors' ORA brand had been deeply entrenched for many years. The pricing strategy of models such as the Nezha GT in the local market could neither match the persona of the "king of cost-effectiveness" nor support a premium positioning, leaving it in an awkward situation.

2. Debt Resolution Dilemma: 3 Billion Yuan Financing is Only a Life-saving Pill

In March, Nezha reached a "debt-for-equity" agreement with suppliers, converting 70% of debts into equity and repaying the remaining 30% in installments. Although a 3 billion yuan financing was forthcoming, its use was strictly limited to production and research and development, rather than repaying old debts. More severely, Qichacha data showed that founder Fang Yunzhou was restricted from high-consumption nine times in 2025, and the total amount executed by the parent company, Hozon New Energy, exceeded 160 million yuan, with capital chain pressure hanging like the sword of Damocles.

3. Strategic Contraction: The Cost of Cutting Off Limbs to Survive

To survive, Nezha Auto began painful cost reduction and efficiency enhancement measures: closing direct stores, optimizing the intelligent driving team (shifting to cooperation with Huawei/Baidu), and shifting overseas markets to an asset-light model. However, the reduction in R&D investment may further weaken product competitiveness, forming a vicious cycle of "cost compression - degraded experience - declining sales."

04 What Does "Long-termism" Look Like for New Forces?

Nezha Auto's crisis reflects a turning point in the entire new energy vehicle industry, from "blindly rushing ahead" to "rationally returning." As market penetration exceeds 40% and incremental space narrows, Tesla's price cuts and BYD's "same price for oil and electric vehicles" have already sparked a fierce battle.

For new forces:

- Technology-oriented: Autonomous control over core intelligent and electric technologies, rather than relying on suppliers for "assembly." NIO, XPeng, Li Ideal, and Huawei are industry success stories.

- User-centric: Shifting from "car manufacturing" to "car operation" and building a full life cycle service system, such as BYD's car manufacturing model.

- Financial health: Balancing expansion and profitability to avoid the unsustainable model of "losing money on every car sold." Successive traffic accidents involving new energy vehicles from Xiaomi and others have taught users a lesson with lives.

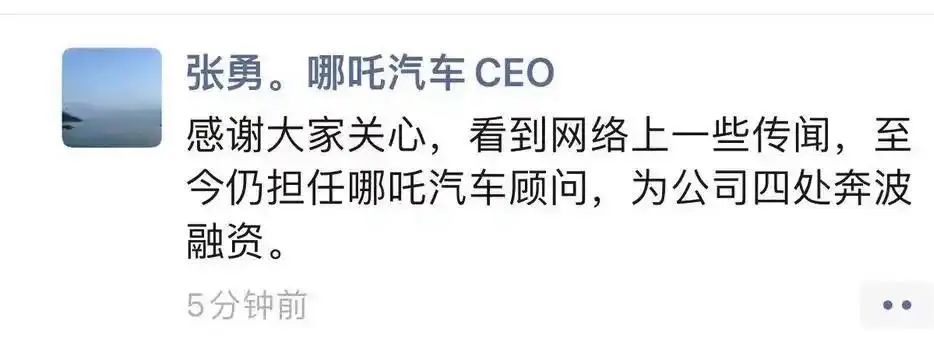

Zhang Yong lamented the anxiety of "running around for financing" in his WeChat Moments, which is actually a collective microcosm of the entire industry. If Nezha Auto fails to seize the "debt resolution" window to achieve a rebirth in product strength, it may follow in the footsteps of WM Motor and HiPhi, becoming another discarded pawn in the new energy wave. For the industry, this crisis has once again sounded the alarm: only by respecting the market and laws can one survive in the elimination game.