2025 14th Week Sales of New Energy Vehicles: XPeng Regains Top Spot, Hongmeng Zhixing Set to Overtake Lixiang This Month

![]() 04/14 2025

04/14 2025

![]() 548

548

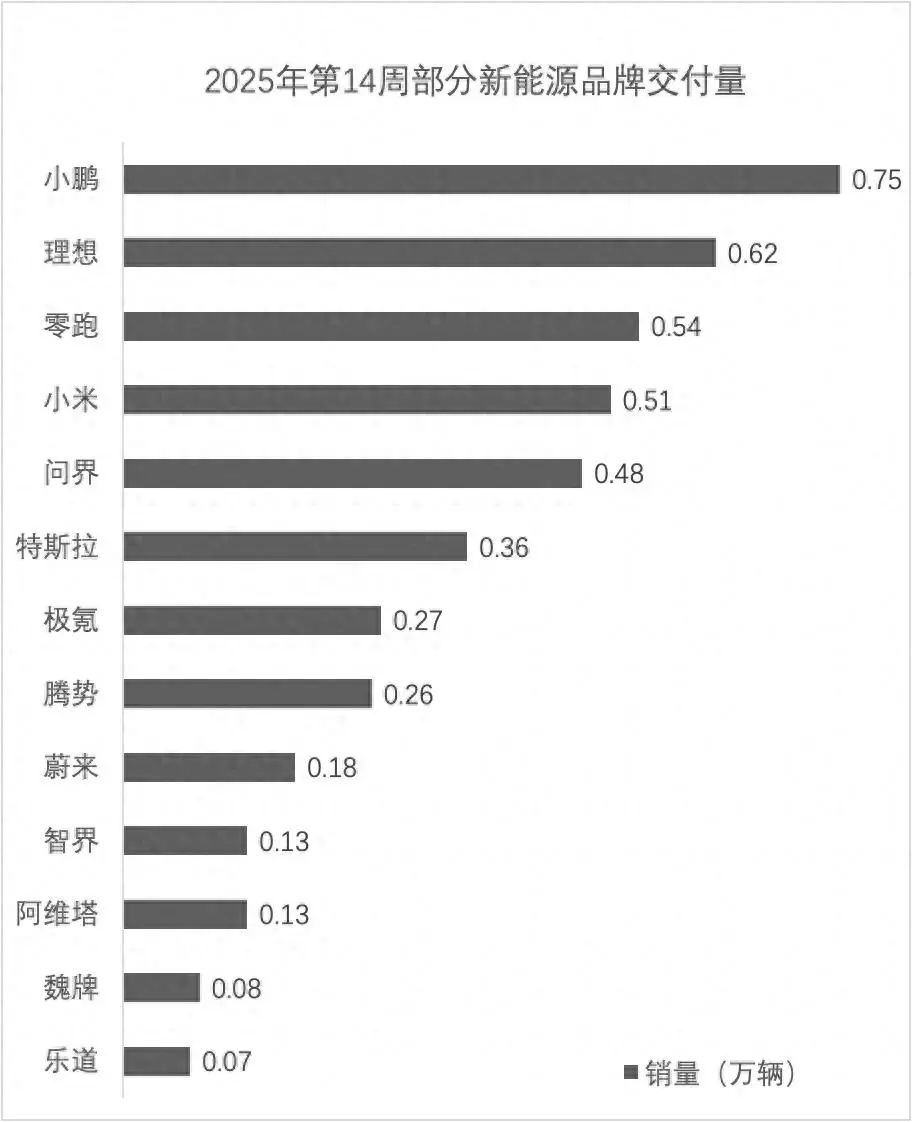

How did XPeng manage to turn the tables? I'd say it's all down to their product prowess! According to the latest data, XPeng reclaimed the top spot in new energy vehicle sales for the 14th week, delivering 7,500 vehicles and maintaining its dominance for two consecutive weeks!

These figures are truly remarkable – despite a general decline of 43.11% in overall auto sales during the Qingming holiday, XPeng managed to sustain such a high delivery volume... They've clearly got some tricks up their sleeve!

Models like the Mona M03, P7+, and G6/G9 have indeed reached a new level of intelligence, and their pricing is quite competitive. Additionally, I've heard that the revamped X9 is on its way, and they've really hit their stride!

1. Hongmeng Zhixing: Backed by Huawei, Who Can Rival Them?

Hongmeng Zhixing secured the second spot with 6,400 vehicles, and there's a lot to unpack behind these numbers – Wenjie contributed 4,800 vehicles, Zhijie 1,300, along with sales from Xiangjie. Just the Wenjie M9 sold about 2,700 vehicles, accounting for nearly half of the total sales! Is the car selling so well thanks to that Huawei brain?

Even more impressive? The Wenjie M8 has over 100,000 pre-orders! With this car set to launch this month, and given the popularity of its extended-range version, it's a forgone conclusion that Hongmeng Zhixing will surpass Lixiang!

Should Lixiang be worried now?

2. Lixiang and Xiaomi: One Struggling, One Supply-Constrained

Lixiang only managed to come in third this time, with 6,200 vehicles, which is honestly not ideal (haha, pun intended). The L series is clearly facing inventory clearance pressure, and despite across-the-board discounts, without new models to support it, sales growth is naturally sluggish. They've restructured their sales system into five "war zones," presumably in preparation for upcoming intelligent driving renewal models and the pure electric i8.

While Xiaomi Motors ranked fifth with weekly deliveries of 5,100 vehicles, this is entirely due to capacity constraints! They have a backlog of over 100,000 orders! If production capacity ramps up, there's no doubt they'll shoot straight to the top...

However, that explosion incident was quite embarrassing. So far, it doesn't seem to have affected deliveries, but new orders will likely take a hit, right?

3. The Up-and-Comers: Lingpao, Zeekr, and NIO

Lingpao did well, ranking fourth with 5,400 vehicles. The key is that pre-sales of the B10 were incredibly hot – over 30,000 orders in 48 hours. What does that mean? After its launch on April 10, sales are bound to soar.

Zeekr and Tengshi both hovered around the 2,500-2,700 vehicle mark. Zeekr was clearly overshadowed by Xiaomi SU7, which was a bit embarrassing...

NIO? Alas, it's always been a challenge – the main brand only sold 1,800 vehicles, barely reaching 2,500 vehicles when combined with Letao. NIO now finds itself like a trapped beast in the high-end market, stuck in an awkward position.

Aviata had an average performance with 1,300 vehicles, but pre-sales of the 06 model have already begun. Let's see if it can break the monthly sales record of 10,000 vehicles!

4. Who Will Emerge Victorious? Look to the Product Cycle!

Competition in the new energy vehicle market, quite frankly, hinges on who has the stronger product cycle!

The new energy vehicle landscape is clearly undergoing intensified differentiation – XPeng and Hongmeng Zhixing are leading the way with new products; Lixiang and NIO are facing the pain of transformation; Xiaomi and Lingpao are emerging as up-and-coming players.

I predict that after the launch of Wenjie M8 and Lingpao B10, the market landscape will shift once again... Especially with over 100,000 pre-orders for Wenjie M8, Lixiang's second-place position is at risk!

What do you think? How will the new energy vehicle market play out? Can Hongmeng Zhixing leverage its strength to alter the entire market landscape? Feel free to leave a comment and join the discussion!