Thriving! The Year's Largest Automotive IPO: Valued at RMB 204.2 Billion

![]() 04/10 2025

04/10 2025

![]() 468

468

Thalys, a Chongqing-based automaker founded in 1986, leveraged Huawei's "Smart Selection Model" to make a remarkable transition from a traditional fuel vehicle manufacturer to a leading new energy enterprise.

In 2024, after four consecutive years of losses totaling nearly RMB 10 billion, Thalys recorded a revenue of RMB 145.176 billion, a non-deductible net profit of RMB 5.573 billion, and a year-on-year revenue increase of 305%, positioning itself as the fourth profitable new energy automaker globally.

Behind this triumph, the AITO M9 model sold over 10,000 units monthly, maintaining the top sales position in the luxury SUV segment priced at RMB 500,000 for 11 consecutive months, contributing to annual sales of 426,900 new energy vehicles.

Recently, Thalys announced plans for an IPO in Hong Kong, potentially becoming the "largest automotive IPO globally" this year.

- 01 -

A Partnership with Huawei

Zhang Xinghai, the founder of Thalys Group Co., Ltd. (hereinafter referred to as Thalys), was born in Shapingba, Chongqing, in 1963.

In 1986, Zhang Xinghai established Phoenix Electric Spring Factory with an initial capital of RMB 8,000. By reducing the price of imported springs from USD 1 to RMB 1 through technological advancements, he swiftly captured 90% of the domestic washing machine spring market, amassing his first fortune.

In 2003, he seized the opportunity presented by Dongfeng Motor's joint venture and founded Dongfeng Xiaokang to enter the mini-car market, ranking among the top three in the industry with a vehicle parc of 4 million. However, during the fuel vehicle era, he felt the sting of being "left behind" by Nissan off-road vehicles due to technological shortcomings. His son traveled to Silicon Valley in 2016 to establish a new energy R&D center, but poor sales of the SF5 model plunged the company into a challenging period of cumulative losses nearing RMB 10 billion over four consecutive years.

The turning point arrived in 2019. By forging a deep partnership with Huawei, Thalys launched the AITO series of models equipped with the HarmonyOS cabin and Huawei's intelligent driving system.

Beyond products, Huawei also contributed through its extensive channels. Over 700 stores contributed to the sales of 426,900 vehicles, and the AITO M9 emerged as the top-selling luxury SUV priced at RMB 500,000 (2024).

- 02 -

Annual Revenue of RMB 145.176 Billion, a Surge of 305.04%

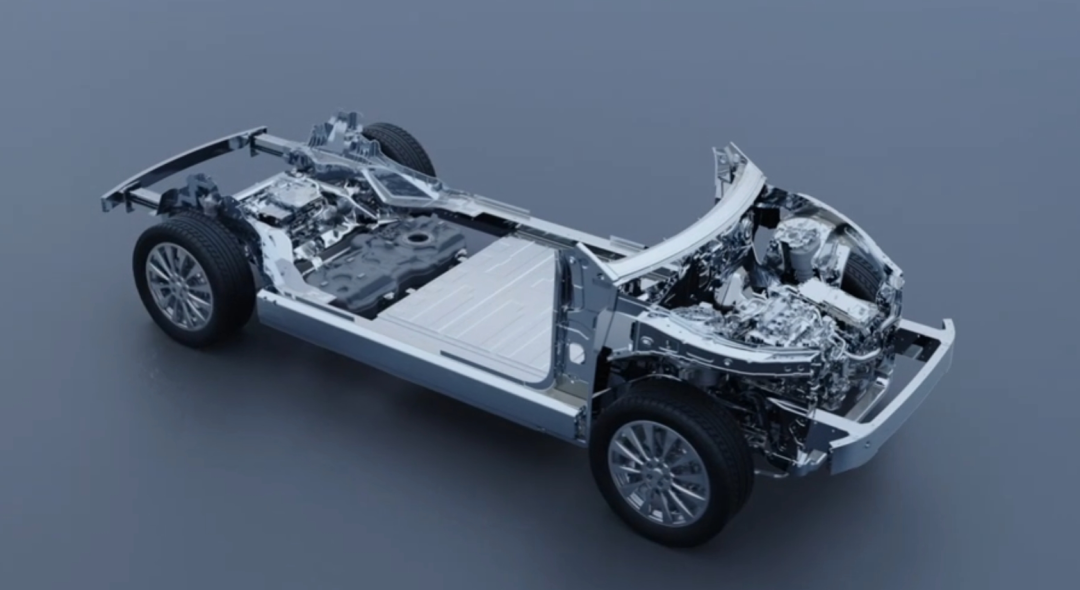

Unlike Tesla's closed ecosystem or BYD's full-industry chain coverage, Thalys adopts a unique symbiotic model of "technology enterprise + manufacturing giant".

Huawei is deeply involved in R&D across 12 major technological fields, spanning from chips to the cloud, while Thalys transforms its 20 years of automotive manufacturing expertise into a "dark factory" with a global automation rate of up to 98%.

Thalys aims to redefine the relationship between humans and vehicles. It utilizes Huawei's ADS 3.0 intelligent driving system to alleviate "steering wheel anxiety," eliminates the need for phone mounts with HarmonyOS, and mitigates "charging wait times" through a full-domain 800V high-voltage platform.

At the end of last month, Thalys released its 2024 annual financial report. Its annual revenue reached RMB 145.176 billion, marking a year-on-year increase of 305.04%, setting a new record high.

Within this, the new energy vehicle business contributed RMB 135.491 billion, accounting for 93.33% of total revenue. Annual sales amounted to 426,900 vehicles, a year-on-year increase of 182.84%; gross profit was RMB 37.97 billion, and the gross profit margin of new energy vehicles increased to 26.21%. Non-deductible net profit was RMB 5.573 billion, a year-on-year increase of 215.71%, successfully turning a profit and positioning Thalys as the fourth profitable new energy automaker globally.

From a spring workshop by the Yangtze River to an imagined trillion-yuan valuation on the Hong Kong stock market, Thalys has showcased another possibility for Chinese manufacturing: it doesn't have to be a disruptor but must become an irreplaceable connector.

According to the 2024 Forbes China Rich List, Zhang Xinghai and his family ranked 239th with a wealth of RMB 20 billion. As of the date of publication, Thalys' market value in the A-share market reached RMB 204.2 billion.

- 03 -

Extreme Contrasts: Who Can Break Through?

Today, the survival landscape of new energy automakers has silently bifurcated into extreme contrasts.

On one hand, Tesla and BYD have fortified their positions with profits in the tens of billions; on the other, emerging forces like HeChuang and WM Motor teeter on the brink of financial collapse.

In the new energy battlefield of 2025, reshuffling and reconstruction are unfolding at an even more ruthless pace.

Data indicates that China's new energy vehicle market is redrawing the global industrial landscape with exponential growth. According to the Ministry of Industry and Information Technology, sales of new energy vehicles exceeded 12 million in 2024, but the market concentration rate (CR10) has climbed to 77.9%, signifying that the survival space for trailing enterprises is severely compressed.

Leading players harvest the market with technology premiums, while mid-tier enterprises are trapped in price wars where "electricity is cheaper than oil." Tail brands await bankruptcy liquidation amid a quagmire of less than 20% capacity utilization.

Moreover, after the industry penetration rate surpassed 46%, growth decelerated, and the market shifted from "incremental expansion" to "survival of the fittest."

Amidst the smoke of price wars, automakers' profit margins have been squeezed to a freezing point of 4.3%. Emerging forces like NIO struggle in the quagmire of losses, while the electrification counterattacks of traditional giants Volkswagen and Toyota have further crowded the racetrack. In 2024, 227 models witnessed price reductions (with an average price drop of 9.2% for new energy vehicles), but only leading enterprises such as BYD and Tesla achieved profitability through annual production exceeding 400,000 units. Small and medium-sized automakers are trapped in a deadly cycle of "losing RMB 60,000 per vehicle sold."

Concurrently, the industry is constrained by technological bottlenecks (like chip dependency and solid-state battery costs), infrastructure lags (low charging pile coverage), and price wars following the fading of policy incentives. In 2024, the number of enterprise registrations experienced negative growth for the first time, and market competition shifted from "incremental expansion" to "survival of the fittest."

The root cause lies in the waning policy incentives that have exacerbated enterprises' technological anemia, the reckless growth spurred by capital leaving behind hollowed-out R&D, and the short-sighted strategy of "emphasizing marketing over innovation," which has plunged the industry into a trap of homogeneity with piled-up configurations.

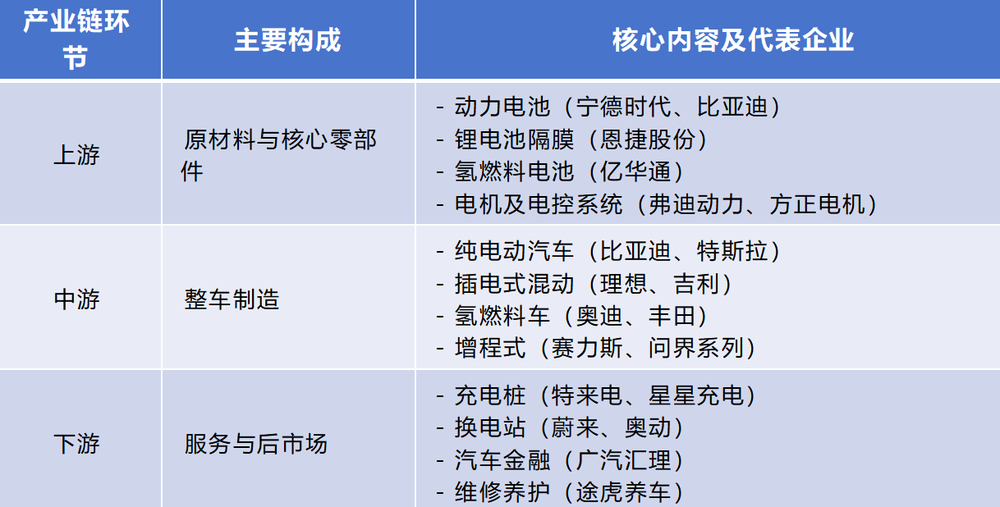

Attachment: New Energy Vehicle Industry Chain Structure Diagram

Upstream: Focusing on technological barriers, power batteries occupy the commanding heights of the industry, with Chinese enterprises dominating the global supply chain.

Midstream: Presenting a diversified competitive landscape, pure electric and hybrid vehicles develop in parallel, with leading enterprises achieving high-end breakthroughs relying on intelligent driving technology (such as Huawei's ADS 3.0).

Downstream: Supporting the scaled development of the industry through an ecological closed loop of "charging + battery swapping + services," forming the world's largest new energy vehicle industrial belt in the Yangtze River Delta and Pearl River Delta.

The content of this article is for reference only and does not constitute any investment advice. This article refers to relevant content from sources such as Auto Observer Station during its creation, and we express our gratitude here. Images are sourced from WeChat.