Porsche's Deliveries in China Nosedive 42% in Q1

![]() 04/09 2025

04/09 2025

![]() 342

342

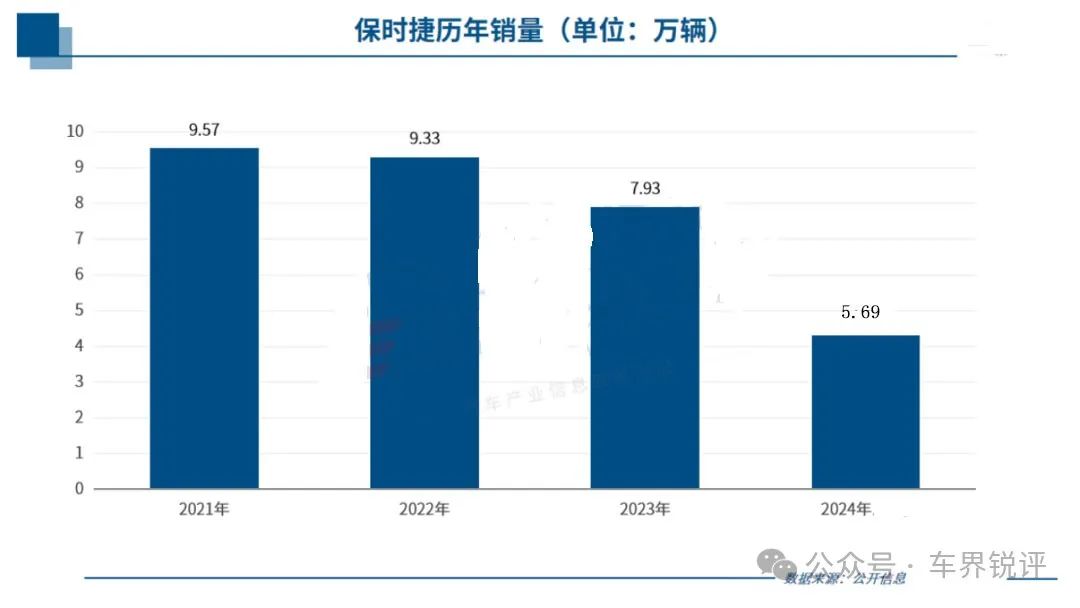

Just two years ago, Porsche was still the spotlight in the Chinese market, having maintained its status as "Porsche's largest single global market" for eight consecutive years, accounting for as much as 30% of its global sales.

However, since last year, the situation has taken a sharp downturn.

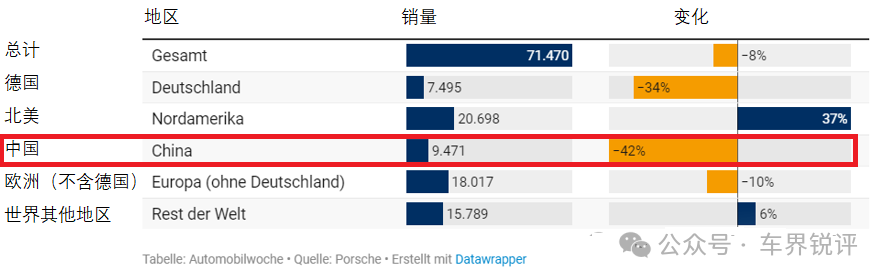

In 2025, Porsche's decline shows no signs of stopping. Data released on April 8 revealed that Porsche delivered a total of 71,470 new vehicles globally in the first quarter of this year, marking an 8% year-on-year decrease.

Of these, 9,471 vehicles were delivered in China, a stark 42% year-on-year decline.

It's worth noting that this is not the first time Porsche has experienced a decline in the Chinese market.

After reaching a peak of 95,700 deliveries in 2021, the brand's sales have been on a downward trajectory, with only 56,900 deliveries in 2024, representing a 28% year-on-year decrease. Consequently, the Chinese market has fallen from being Porsche's largest global market to the third.

This downward trend persisted in the first quarter of this year, with the decline far surpassing that of the global market, confirming Porsche's struggles in the Chinese market.

Despite Oliver Blume, Chairman of the Porsche Executive Board, previously stating that Porsche faces challenges in the Chinese market but has no intention of engaging in China's intense price war.

In reality, Porsche's price defense in the Chinese market has already crumbled.

Is the collapse of Porsche's sales solely due to the price war?

To understand this, we must delve into intelligence and China's new energy wave.

Currently, Chinese consumers' expectations for smart cabins and autonomous driving far exceed traditional luxury labels, an area where Porsche products lack competitiveness.

Concurrently, high-performance electric vehicles like the Zeekr 001 FR, Xiaomi SU7 Ultra, and Tesla Model 3 Performance Version are swiftly capturing market share, continuously compressing Porsche's market space. Many domestic independent brands continue to make breakthroughs, with their product and brand advantages gradually becoming prominent, attracting consumers who might have originally chosen Porsche.

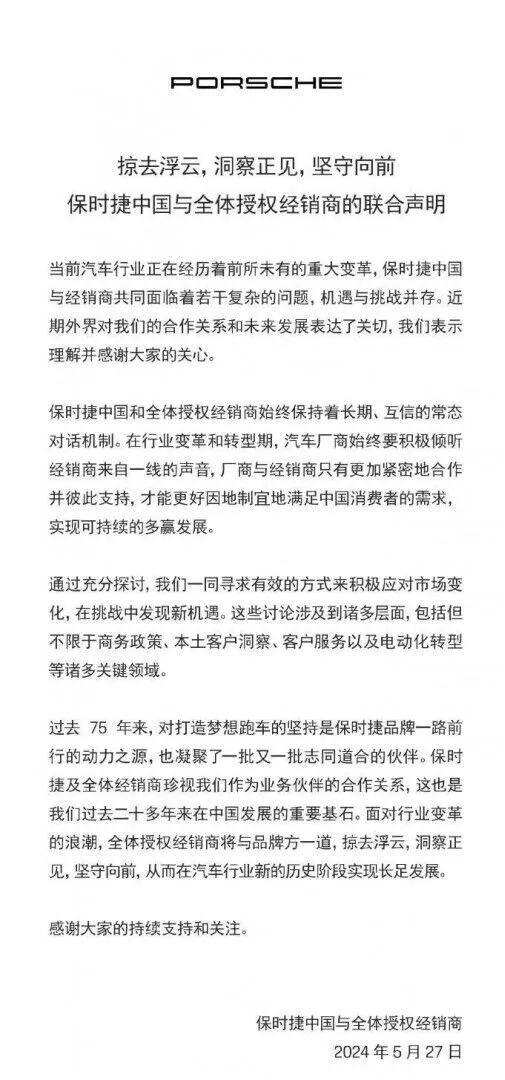

Moreover, Porsche's profit-first business philosophy has led to several "public relations incidents" in China in recent years. From the "steering column incident" to the "purchase of a Porsche for 124,000 yuan" and the "collective letter from dealers," Porsche has been criticized for its "arrogant attitude," which starkly contrasts with consumers' expectations of high-end brand services.

However, Porsche is also aware of its predicament.

Recently, reports have emerged that Porsche is collaborating with the Chinese intelligent driving company Horizon Robotics, focusing on the development of advanced autonomous driving technology. While Porsche officials have not responded positively, insiders have hinted that more details might be announced during the Shanghai Auto Show.

Facing competition from players like Huawei, XPeng, Li Auto, and others vying for technological and product high points, as well as established players like BYD reshaping industry logic.

Today's consumers are no longer solely focused on "face" but also on "value for money." After all, no one wants to be the one who "pays a lot of money for intelligence tax."

If Porsche wants to retain its position, relying solely on its brand aura is no longer sufficient. True competitiveness must return to products and technology. Merely emphasizing intelligent driving feels like a minimal change. Do you agree with the blogger's viewpoint?