The Fiercer the Price War, the More Profitable the Top Automakers

![]() 04/09 2025

04/09 2025

![]() 446

446

Introduction

China's auto market is revealing its increasingly brutal side.

Not long ago, an article titled "China's Auto Market, Only Recognizes Price" sparked heated discussions. It highlighted that in 2025, the trend of "price-only" competition in China's auto market is becoming increasingly evident, and the detested "price war" among automakers is far from over.

Behind this phenomenon lies a crucial question: "Why is this fierce competition happening?"

Broadly speaking, the answer is that as the wave of electrification intensifies, the pricing system of the traditional fuel vehicle era is being overturned, necessitating the establishment of a new order in the new energy vehicle era. This reshaping of the landscape inevitably leads to intense competition.

More specifically, some automakers are inherently skilled at selling electric vehicles, while others struggle to adapt. Faced with a tempting yet limited market share, the former are determined to snatch every bit from the latter. The price war has become their sharpest weapon.

Given this backdrop, as long as the seating arrangement in China's auto market remains unsettled, the competition will inevitably intensify.

In the just-concluded first quarter, it seemed that the top-tier leaders were still cautiously testing each other's strength. Even so, many weaker brands felt the pinch. Looking ahead to the ongoing second quarter, I boldly predict that another round of fierce competition is imminent.

So, why make this judgment? It is mainly related to three "giants" in the industry.

First, there's BYD, which is currently the absolute bellwether of the market. In February, after unveiling its robust intelligent driving capabilities, it essentially kicked off a disguised price war. However, considering the March performance report, end consumers were not overly impressed.

With 370,000 new vehicle sales, although in line with expectations, it wasn't a surprise. Especially considering that the annual target is 5.5 million vehicles, only 1 million were achieved in the first quarter, leaving considerable pressure for the subsequent nine months.

Perhaps due to this backdrop, BYD chose to go all in. At the beginning of the month, it suddenly announced a limited-time fixed-price promotion for non-intelligent driving models under the Dynasty and Ocean networks.

Specifically, the starting price of the Qin L DM-i was reduced by RMB 10,000 to RMB 89,800, and that of the Song L DM-i by RMB 16,000 to RMB 119,800. Conversely, the latest starting price of the 2025 Tang DM-i is RMB 169,800, and that of the Han DM-i is RMB 155,800.

The Song PLUS DM-i saw a price cut of RMB 16,000 to RMB 119,800, the Sea Lion 06 DM-i by RMB 10,000 to RMB 89,800, and the Sea Lion 07 DM-i by RMB 10,000 to RMB 129,800.

After this series of "combination punches," it has clearly ratcheted up the competition in China's auto market. In my view, such operations are more like an "appetizer" to clear inventory.

In contrast, the all-new MPV Xia, which has been on the market for less than three months, offers a factory trade-in subsidy of up to RMB 22,000, which can be combined with a national trade-in subsidy of RMB 20,000, resulting in a comprehensive subsidy of up to RMB 42,000. This is an even more terrifying signal.

"Does this mean that BYD is targeting its true main force?"

After all, based on the current gross profit margin per vehicle of this giant, there is ample room and confidence to initiate a new round of "trading price for volume."

After discussing BYD, the second player is Tesla.

Without exaggeration, hindered by various unfavorable factors, this American new energy automaker faced a "bad start" in the first quarter. Global deliveries of new vehicles totaled 370,000, a year-on-year decrease of 13%, which has sounded an alarm bell for the company.

Taking advantage of this situation, Tesla's increased focus on the volatile markets in the United States and Europe has further heightened its reliance on China's auto market.

From eagerly introducing "0% interest for 5 years" for the entire Refreshed Model 3 lineup to unprecedentedly offering "0% interest for 3 years" and "low interest for 5 years" for the recently released Refreshed Model Y lineup, it's evident that Tesla is in a hurry.

However, the fierce competition in this segment far exceeds imagination. To retain orders, maintain market share, and consolidate its foundation, it's not ruled out that this American new energy automaker will once again participate in a price war.

It's possible that Tesla will suddenly unleash a killer move in the second quarter.

As for the third player, it's AITO, which has Huawei's endorsement.

It must be admitted that throughout the first quarter, in terms of terminal performance alone, limited by factors such as generational shifts, the output was somewhat disappointing, with a significant decline.

However, as an observer, it's clear that the downtrend is only temporary. With the launch of many new products, AITO will eventually return to the right track. For example, the large-scale delivery of the 2025 AITO M9 has largely helped AITO regain its footing.

The true trump card in its hand is the M8, with a pre-sale price starting at RMB 368,000. In terms of vehicle size and parameter configuration alone, it can be regarded as a "youth version" of the M9.

Currently, according to officially disclosed data, it has easily secured 100,000 "small orders."

After its official launch this month, the M8 will definitely further penetrate the market. To a certain extent, AITO undoubtedly hopes to use an irresistible price to attract as many potential customers as possible in the same segment.

Coincidentally, the Enjoy S9 Extended Range version, with a starting pre-sale price of only RMB 318,000, actually adopts a similar strategy and may even enter the market below RMB 300,000 after its launch.

In 2025, HarmonyOS Smart Mobility is directly showing its most ambitious side in pursuit of extremely high sales targets, with the underlying message being: "I'm not hiding anything anymore."

The two products set to enter the market in the second quarter have already kicked off their "price war."

At this point, after separately elaborating on the mindset and situation of the three "giants," what have you learned from it? For me personally, it's still the same sentence: "Another round of fierce competition is imminent."

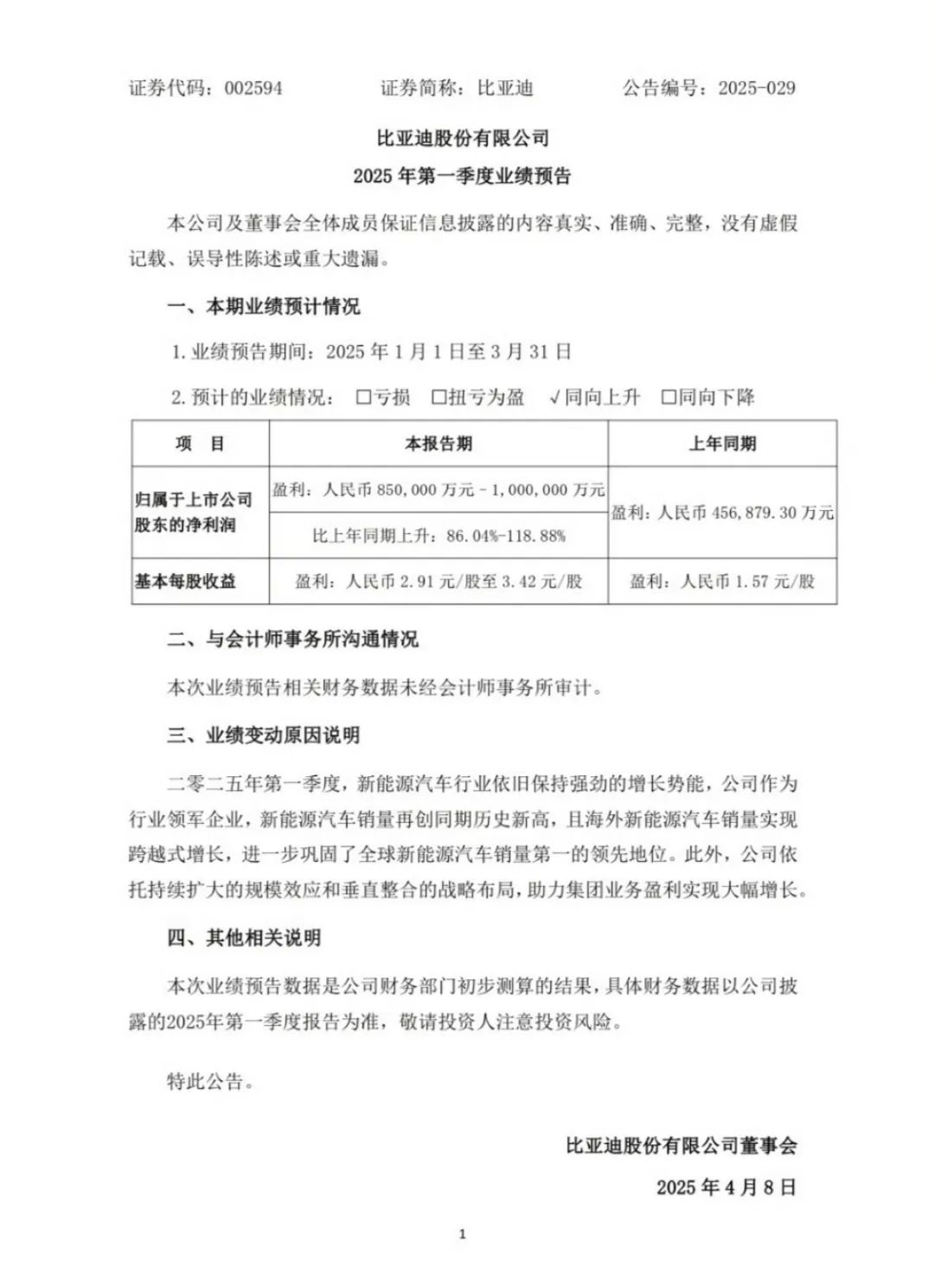

And while writing this article, BYD released its first-quarter performance guidance.

Combining key information, it is expected to achieve a net profit attributable to shareholders of listed companies of between RMB 8.5 billion and RMB 10 billion, an increase of 86.04% to 118.88% year-on-year.

In a somewhat sarcastic tone in the announcement, BYD stated: "In the first quarter of 2025, the new energy automobile industry continued to maintain strong growth momentum, and the company's new energy vehicle sales hit a new record high for the same period. As a leading enterprise in global new energy vehicle sales, its market share continues to expand, especially in overseas markets, where sales have achieved leapfrog growth."

It added: "Relying on the continuously expanding scale effect and strategic layout of vertical integration, BYD has effectively reduced production costs and improved operational efficiency, thereby driving a significant increase in the Group's business profits. This model not only enhances BYD's competitiveness in the industry chain but also lays a solid foundation for its future sustainable development."

Does this break your perception that "the more price wars, the less money anyone makes"?

The leaders headed by BYD are benefiting from the advantages of the supply chain, cost control, and scale effects, making huge profits.

Whether you accept it or not, the title of today's article is the most heart-wrenching fact.

This fierce competition is indeed the sharpest dagger for the top tier, gradually enabling them to achieve both sales and profit growth.

And their proactive moves are bound to trigger a chain reaction among mid-tier and low-tier automakers. Although most pursuers detest the "price war" with their mouths, they are all clear in their hearts that "not participating forcibly means only one path: death."

Even if they know it is a "chronic poison."

Responsible Editor: Cui Liwen

Editor: He Zengrong