Is Tesla Being 'Dragged Down' by the New Tariff Policy?

![]() 04/08 2025

04/08 2025

![]() 575

575

Introduction

An invisible, omnipotent force looms over this American new energy vehicle company.

In the recently concluded first quarter, Tesla delivered a set of disappointing results.

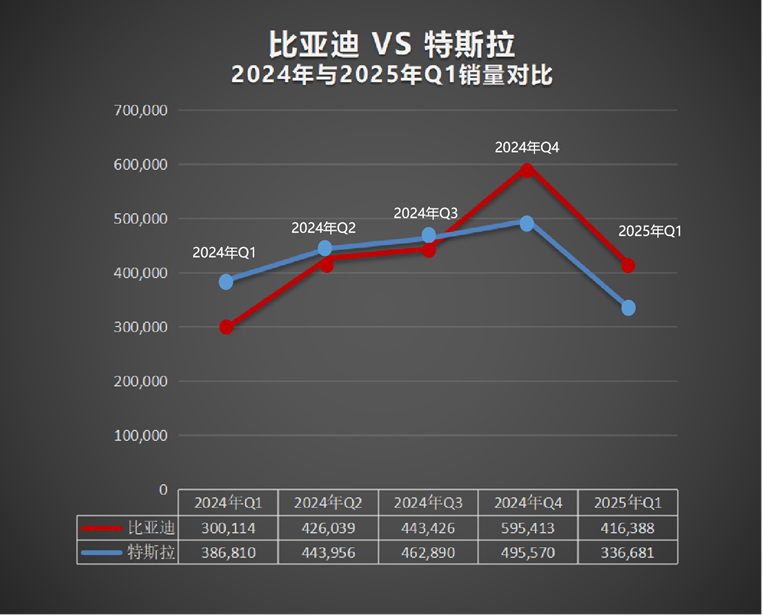

Specifically, global deliveries totaled only 336,600 units, a year-on-year decline of 13% and a month-on-month drop of over 30%. This performance marks the worst interim results in nearly three years. Many readers may now be curious about what has transpired.

The answer to this question has been delved into in previous articles: "On one hand, external competition has intensified, leaving Tesla somewhat encircled. However, the primary issue lies in its leader Musk's single-minded pursuit of politics, which has distracted him from management and brought troubles to the entire company. Especially in Europe and the United States, people's aversion towards him and even the entire Tesla has peaked, leading to numerous protest activities. Ultimately, all of this has negatively impacted sales."

In other words, the leader is causing troubles, and the company is forced to bear the blame.

Last week, amidst Tesla's fluctuating performance, BYD, its largest competitor, announced its sales figures for the past 90 days.

Specifically, in the pure electric segment, BYD sold 416,400 new vehicles globally, marking a year-on-year increase of 38.74%. When combined with the contribution of the plug-in hybrid segment, total sales surpassed the one million mark.

Building on this success, BYD once again claimed the title of "global quarterly electric vehicle sales champion" from Tesla, following the fourth quarter of last year.

Furthermore, according to predictions by market research firm Counterpoint Research, BYD is poised to become the "global electric vehicle sales champion" with a market share of 15.7% by 2025.

It is evident who is ascending and who is descending.

Extending this trend, when examining the 2024 financial report, BYD also achieved a significant revenue overtake of Tesla.

Simultaneously, its gross margin of 19.44% surpassed Tesla's 17.86%. In 2024, BYD's automotive business gross margin reached 22.31%, while Tesla's stood at 18.4%.

Regarding R&D investment, BYD invested over 20 billion yuan in 2024.

Although Tesla still maintains a lead of approximately 10 billion yuan in net profit after conversion, extending the timeframe reveals that the gap between the two in this dimension has been rapidly narrowing since 2022.

Given the performance in the first quarter, it is questionable whether Tesla can achieve positive year-on-year sales growth in 2025. Conversely, BYD has ambitiously set its sales target at 5.5 million vehicles.

Within this ongoing 365-day period, it may be determined who truly holds the title of "the world's largest new energy vehicle company." Without much suspense, BYD is likely to secure this honor.

To put it bluntly, BYD not only sells more cars but also makes more money.

The fundamental reason behind this success is that BYD firmly embraces the concept of "right time, right place, and right people." On one hand, it leverages the enormous demand in the Chinese auto market, laying a solid foundation while actively exploring favorable overseas markets. On the other hand, it boasts enviable supply chain richness, vertical integration capabilities, and cost control abilities. Furthermore, with a sufficiently large team, it provides continuous momentum in research and development, product development, marketing, and other aspects.

After more than a decade of ups and downs, and even once on the brink of collapse, BYD has finally rebounded, identified opportunities, seized them, and taken action, ushering in sweet rewards after enduring bitterness.

Certainly, luck plays a certain role, but overall, BYD's success still relies heavily on its own efforts and transformation.

As a witness, applying similar standards to Tesla, as mentioned at the beginning of this article, after a prolonged period of frantic activity, this American new energy vehicle company is now hindered by various obstacles in its progress.

For instance, the "disharmony" caused by Musk's single-minded pursuit of politics and the "unfavorable ground" resulting from the cooling attitude towards new energy vehicles in the United States are almost inevitable.

This week, with Trump's "tariff axe" suddenly falling, indiscriminately affecting all companies, a storm of turmoil has once again swept globally.

Instantly, all stock markets plummeted in response.

Continuing to focus on Tesla with a slightly negative sentiment, although it appears to be less affected compared to other automakers, the surge in production costs in the United States is still evident.

Looking deeper, in the eyes of many, the subsequent chain reactions pose even greater risks that Tesla must vigilantly address. For example, how China will respond with "countermeasures."

After all, considering the first-quarter results, the strategic importance of the Shanghai Gigafactory in this American new energy vehicle company's global layout has soared to an unprecedented height. It is no exaggeration to say that Tesla's outcome in 2025 will largely depend on its strong performance in China.

Should there be unexpected deviations due to top-level geopolitical games, the resulting costs will also be unbearable for Tesla.

Perhaps for this reason, Wall Street has chosen to be bearish on Tesla's uncertain future. There are even voices suggesting that the stock price and market value will continue to shrink severely.

At this juncture, what Tesla has lost is not merely the title of "global electric vehicle sales champion." To some extent, it has also lost its once-proud "career luck" and the "sharp blade" that helped it slice through obstacles.

Of course, there are rumors that Musk will choose to "resign" and return home to retake the helm of the company in May. If this news proves true, it may be one of the few positive developments for this American new energy vehicle company recently.

However, the bigger challenge lies in whether this leader alone can pull Tesla out of the quagmire of "wrong time, unfavorable ground, and disharmony."

Personally, I am not overly optimistic. An invisible giant hand is slowly hovering over Tesla, and it cannot be ruled out that it may become a "sacrifice" in the rivalry between giants.

In this century-long great transformation, whether willingly or not, since Musk all-in supported Trump, Tesla has been coerced and tied to this reckless high-speed train.

Its future path is fraught with uncertainties. Reality is far more daunting than imagined. The fall of the "tariff axe" is merely an appetizer.

After all, once people go crazy, there is no bottom line.

Just like last night, Trump's latest tweet threatened to impose an additional 50% punitive tariff from the 9th and terminate negotiations if China does not withdraw its 34% retaliatory tariff today.

Every day, we are witnessing history.

Responsible Editor: Cui Liwen, Editor: He Zengrong