Q1 Sales Plunge 13%, Share Price Falls 8%: The Aftermath of Musk's Political Role

![]() 04/07 2025

04/07 2025

![]() 484

484

Volatile Share Price

Author | Wang Lei

Editor | Qin Zhangyong

Last night, Tesla unveiled its first-quarter 2025 delivery figures, and the results were grim.

Global deliveries totaled 336,000 units, marking a year-on-year decline of 13% and hitting the lowest level since the second quarter of 2022.

Not only did this fall well short of Wall Street's consensus expectation of 370,000 units, but it also missed even the most pessimistic projections from investment institutions (353,000 units).

Moreover, Tesla lost significant ground in multiple overseas markets in the first quarter, with the European market experiencing a comprehensive collapse. Market share plummeted from 17.9% to 9.3%, and sales in some regions even dropped by over 50%.

The capital market reacted swiftly. As of press time, after the U.S. market closed on Wednesday, Tesla's share price had fallen by over 8%, trading at $260 per share.

Even Dan Ives, an analyst at Wedbush who has long been bullish on Tesla, couldn't help but complain:

"We knew the first quarter wouldn't look good, but these figures are worse than we feared. We're not wearing rose-colored glasses - this is a disappointment across all indicators. While it can be attributed to the transitional period brought about by product updates, the real crisis lies in the erosion of brand trust."

01

Lack of Domestic Support

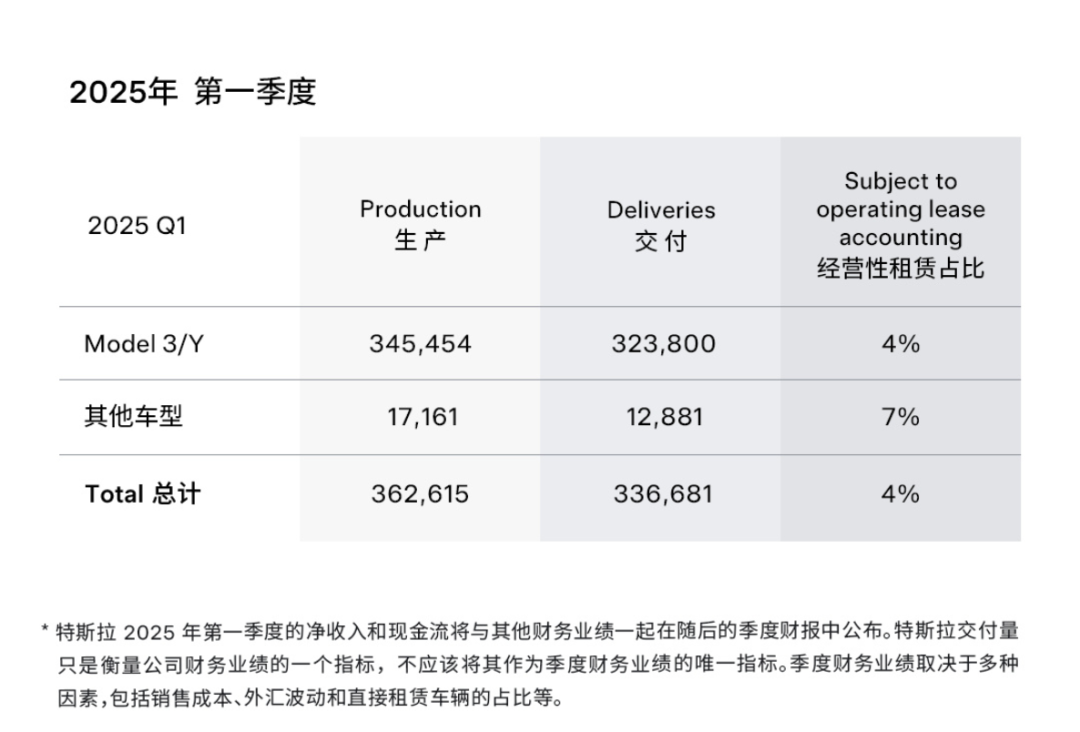

Specifically, Tesla's total deliveries in the first quarter of 2025 amounted to 336,000 units, with a total production of 362,000 units, both severely below the market estimate of 412,000 units of production capacity.

Tesla explained that the Model Y production lines at four of its factories needed to be upgraded, resulting in the loss of several weeks of production capacity in the first quarter, which adversely affected production and deliveries.

Among them, Model 3/Y production reached 345,000 units, with 324,000 units delivered, while production of other models (including Model S/X, Cybertruck) was 17,000 units, with only 13,000 units delivered.

It is evident that Model 3/Y are the absolute sales leaders, which also suggests that the first quarter, as a transitional period for the Model Y, did indeed have an impact on Tesla's overall performance.

However, the reason cannot be entirely attributed to the Model Y's awkward period. An indisputable fact is that Tesla has started to lose steam in the European market.

As early as a few days ago, news emerged of a sharp decline in Tesla sales in Europe. According to data tracked by the EU-EVs website, Tesla's market share in 15 European countries has fallen from 17.9% in the first quarter of last year to 9.3%.

Particularly in EU countries, sales in the first two months of the first quarter were almost halved, currently accounting for only 1.1% of market share.

For example, in the Netherlands, according to data released by the Dutch Automobile Dealers and Garage Owners Association, Tesla sold a total of 1,546 vehicles in March 2025, a sharp drop of 55.3% compared to March 2024.

In the first three months of this year, Tesla sold only 3,445 vehicles in the Netherlands, a decline of nearly 50% compared to the first quarter of last year. Moreover, it is worth noting that the electric vehicle market in the Netherlands grew by 7.9% in the first quarter, reaching 32,459 vehicles. Under these circumstances, Tesla sales actually fell sharply.

Not only in the Dutch market, Tesla sales almost plummeted in other European markets. In France, Tesla registered only 3,157 vehicles in March, a decrease of 36.8% compared to a year ago. Tesla registrations in Denmark also fell 65.6% year-on-year to 593 units, and sales in Sweden fell 63.9% year-on-year to 911 units.

The CEO of research firm New AutoMotive once said: "Tesla's weak sales in Europe are due to various reasons. On the one hand, the company has failed to launch more price-competitive models; on the other hand, Musk's position in American politics is alienating European consumers."

Not only alienating European consumers, the most crucial point is that even fellow Americans are no longer supporting Tesla.

Since Musk "took office" at the Department of Government Efficiency, his remarks and staff layoffs have sparked numerous public protests. Many Americans have begun to boycott Tesla due to Musk, and protests targeting Tesla stores and vehicles are increasing, with the scale and noise escalating.

Even Musk himself previously admitted, "Serving in the U.S. government is detrimental to me... My company is suffering losses because I serve in the Department of Government Efficiency."

02

Is Resignation Imminent?

As the saying goes, when the West is dark, the East shines.

In this quarter, the main reason for Tesla's severe decline in deliveries was due to the cooling market overseas and in its home base, but in the Chinese market, Tesla sales were booming.

In the first quarter of 2025, the Shanghai Gigafactory delivered over 172,000 Model 3 and refreshed Model Y vehicles, contributing 51.3% of global total deliveries. Domestic sales reached 137,200 units, setting a new record for the first quarter since 2022.

Looking at March alone, according to data from the China Passenger Car Association, Tesla delivered over 78,800 vehicles, with weekly sales reaching 21,000 in the last week of March, setting a new record for the highest weekly sales in 2025 for five consecutive weeks.

Moreover, since the delivery of the refreshed Model Y, it has consistently held the top spot in domestic passenger car sales, with no "car" able to shake its position. According to data retweeted by Musk, sales of the refreshed Model Y reached 43,000 units in March.

This underscores that without the Chinese market supporting it, Tesla's sales for this quarter would have been even more dire amidst "overseas public indignation".

Of course, Musk may soon leave this "troubled land" of the White House.

A few days ago, U.S. media reported that Musk would resign from his current government position within the next few weeks due to dissatisfaction with Musk's unpredictability, viewing him as a political burden.

But this was subsequently denied by officials, stating that Musk and Trump had long ago publicly stated that when Musk completes his work at DOGE, he will leave public office as a special government employee.

Interestingly, as soon as news of Musk's departure from the White House spread, Tesla's falling share price surged instantly, closing up over 5%. However, after the release of Tesla's Q1 data, the share price turned from up to down after-hours, with a decline of over 8% as of press time.

Since Musk, the "most expensive civil servant" worth over $200 billion, took office, Tesla has been paying the price in real money. Its share price has continuously declined by a cumulative 33%, and its market value has shrunk by over $370 billion from the December high of $1.2 trillion.

However, even if Musk stays away from politics in the future, in the view of Colin Langan, an analyst at Wells Fargo, Tesla's share price should continue to move closer to the bank's target price of $130 per share. This implies that Tesla's share price could fall by over 50% from current levels.

Colin Langan also reiterated their "underweight" rating and listed five major issues facing Tesla, including declining deliveries in Europe, China, and the United States, a potential 25% decline in earnings per share, issues with the low-cost model, unattractive valuation, and potential problems with autonomous driving technology.

Do you think Tesla's share price will rise or fall in the future?