Net Profit Plummets 70%: Unraveling Carlos Tavares' Resignation from Stellantis

![]() 03/07 2025

03/07 2025

![]() 426

426

New CEO Appointment Expected in the First Half of 2025

Author | Liu Yajie

Editor | Qin Zhangyong

At last, we have clarity on Carlos Tavares' resignation from Stellantis.

The financial report released by Stellantis revealed all – a staggering 70% drop in net profit for 2024.

In the second half of last year, Stellantis even incurred direct net losses, mirroring Nissan's predicament to some extent. However, Stellantis operates on a larger scale, with even more intricate internal dynamics.

As the world's fourth-largest automotive group, Stellantis once boasted an impressive profit margin, managing 14 automotive brands.

But turning a large ship is no easy feat. Following the abrupt departure of its first CEO, Carlos Tavares, Stellantis has been in a state of flux, with its future path unclear.

01 Dual Blow to Profits and Stock Prices

This 2024 financial report exposes the myriad issues plaguing Stellantis. Let's delve into the numbers.

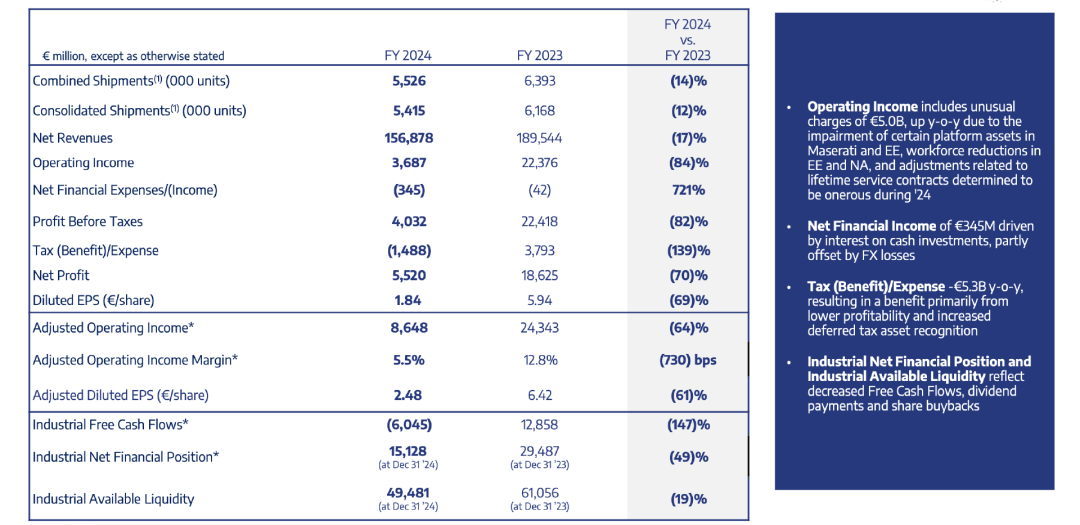

Last year, total net revenue stood at 156.9 billion euros (approx. RMB 1.2 trillion), a 17% decline year-on-year. Adjusted operating profit amounted to 8.6 billion euros (approx. RMB 65.547 billion), a 64% drop.

The adjusted operating profit margin hit 5.5%, the lower limit of the company's guidance range, a sharp contrast to the 12.8% recorded in the same period last year.

Net profit plummeted by 70% year-on-year to 5.5 billion euros (approx. RMB 41.919 billion), falling short of analysts' expectations of 6.4 billion euros.

The steep decline in net profit can be traced back to a significant sales drop.

Last year, Stellantis' sales fell by 12%, with declines observed in key markets. For instance, annual sales in the United States declined by 14.6% year-on-year, while European sales fell by 7.3%, with January 2024 sales down 16%.

In 2024, its adjusted operating profit in the North American market tanked by 80%. During the second half of last year, Stellantis incurred an overall net loss of 127 million euros, with an adjusted profit of just 185 million euros, a far cry from the 10.217 billion euros recorded in the second half of 2023.

Furthermore, in 2024, Stellantis embarked on a transformation towards automotive intelligence and electrification, investing heavily in model platform and intelligent driving system development.

As early as September last year, Stellantis issued a profit warning, forecasting lower-than-expected sales in "most regions" during the second half of 2024. The company anticipated an adjusted operating profit margin of 5.5% to 7% for the full year of 2024, significantly lower than the previous "double-digit" expectations.

Moreover, over the past 12 months, Stellantis' share price has halved.

To navigate these challenges, Stellantis resorted to layoffs, plant closures, and frequent personnel adjustments.

On October 10, 2024, Stellantis appointed former China Chief Operating Officer Doug Ostermann as Chief Financial Officer, replacing departing Natalie Knight. Concurrently, Jeep brand CEO Antonio Filosa was appointed to concurrently serve as Chief Operating Officer of the North American region, replacing Carlos Zarlenga.

Subsequently, Stellantis laid off 1,100 workers at a Michigan plant and closed a test site; it planned to lay off around 1,100 workers at a factory in Toledo, Ohio, responsible for producing the Jeep Gladiator; it also laid off 400 workers at a Detroit parts plant and intended to close a van plant in Luton, UK.

While these swift actions yielded short-term results, they also widened the rift between then-CEO Carlos Tavares and the board.

A source close to the situation told Reuters that the board believed Carlos Tavares acted too hastily, prioritizing short-term solutions to salvage his reputation over the company's best interests.

The rest, as they say, is history. Due to his aggressive layoffs and strategic disagreements with the board over stemming sales and stock price declines, Carlos Tavares resigned in December 2024, before his term expired.

Despite the turmoil among senior executives and unappealing financial data, Stellantis' leadership remains optimistic. The group has pledged that under the new leadership team, the company will restore positive cash flow and revenue growth.

Since Carlos Tavares' departure, Stellantis Chairman John Elkann has reorganized the leadership and alleviated inventory pressure in the United States.

It's worth noting that Stellantis plans to launch 10 new models and a more flexible product mix this year. In preparation, Stellantis introduced models based on the new-generation STLA multi-energy platform in 2024. The company is also actively deploying in AI, collaborating with Mistral AI to develop an in-vehicle assistant system and unveiling its first self-developed autonomous driving system, STLA AutoDrive 1.0.

The company asserts that these efforts will facilitate revenue growth in 2025 and achieve an adjusted operating profit margin of "mid-single digits".

02 The Search for the Next CEO

As everyone knows, the position of Stellantis CEO remains vacant. As the world's fourth-largest automotive group, Stellantis manages 14 automotive brands across multiple market segments. The sheer number of brands under its umbrella inevitably leads to internal conflicts.

For example, brands like Jeep and Ram are the cornerstones of the group in the North American market. In contrast, Chrysler and Dodge sales pale in comparison, with neither brand reaching 150,000 sales in the United States last year.

Dodge's product line has been reduced to just one muscle car, the Charger, along with one sporty crossover and one SUV. However, due to their influence in the US market, they are not easily merged.

Moreover, both DS and Alfa Romeo are positioned as premium brands but have failed to establish differentiated competitive advantages in the market, intensifying internal competition. In 2024, Alfa Romeo and DS's market share in Europe was just 0.3%, trailing behind competitors like Audi and BMW.

While Maserati is Stellantis' sole super-luxury brand, its market performance falls short of expectations, directly dragging down the group's financials.

Worse still, compared to rivals like Volkswagen or Toyota, Stellantis' visibility is not as high. Taking the European market as an example, Stellantis is the second-largest automaker after Volkswagen. However, its best-selling Peugeot brand had a market share of just 4.9% last year, ranking eighth overall.

In light of this situation, some have suggested that Stellantis merge some brands to reduce redundancy. However, Stellantis does not seem receptive to this idea. In a statement, it emphasized that each brand has new product plans, and recent organizational changes are designed to support their implementation.

The company further stressed its commitment to leveraging the rich history and unique characteristics of its 14 brands to offer customers more choices.

Given this corporate landscape, balancing the brand value and sales of each brand is a critical challenge for the next CEO. Beyond aggressive cost-cutting and excessive layoffs, Carlos Tavares' departure was also attributed to his inability to navigate the intricate internal relationships within the alliance.

So, what kind of CEO does Stellantis need to replace Carlos Tavares?

While the specific list of candidates has not been announced, John Elkann has made it clear that the new CEO must possess a solid background in brand strategic planning and electrification transformation. Elkann also revealed that he is currently interviewing CEO candidates and expects to appoint the new CEO in the first half of 2025.

To stabilize the market, John Elkann assured that they can find exceptional candidates, whether from within or outside the company.

Bloomberg previously reported that Antonio Filosa, head of Stellantis' US subsidiary, is considered one of the most competitive CEO candidates. He boasts extensive management experience within the group, particularly in the North American market. Similarly, Stellantis' former Chief Financial Officer (CFO) Richard Palmer has also been suggested as a potential CEO.

Although Carlos Tavares negotiated a cooperation with Zero Run Automobile before stepping down to advance electrification, the new CEO still faces immense challenges amid the ongoing electrification revolution. Each brand has its loyal following, making it difficult to abandon any automotive brand.

While managing 14 automotive brands is a unique privilege for Stellantis, it also poses a significant burden to some extent.