Auto Companies' Foray into Humanoid Robots: A Leap of Innovation or Strategic Pivot?

![]() 03/13 2025

03/13 2025

![]() 422

422

During the 2025 Spring Festival Gala, Unitree Technology's humanoid robots captivated audiences with their dance performance, earning thunderous applause. At this year's National People's Congress and Chinese Political Consultative Conference, humanoid robots emerged as a hot topic among automotive industry representatives. Notably, embodied intelligence was included in the government work report for the first time, signaling that humanoid robot technology is transitioning from the lab to the limelight and becoming a pivotal direction for future technological advancements.

Amid intensifying competition in the electric vehicle space, price wars and technological stagnation continue to squeeze automakers' profit margins. Against this backdrop, companies like Xiaomi, XPeng, NIO, Tesla, and GAC have set their sights on the humanoid robot domain. According to incomplete statistics, nearly 20 automotive firms globally have ventured into this arena through in-house research or investments. This phenomenon has garnered significant attention both within and outside the industry, prompting questions about whether automakers are making a daring cross-industry move or undergoing a strategic transformation leveraging technological synergy and industrial chain integration.

▍From Autonomous Driving to "Embodied Intelligence"

As a forefront of emerging technologies, humanoid robots boast vast market potential and developmental prospects. Their applications extend beyond industrial manufacturing to encompass healthcare, household services, education, entertainment, and more. Consequently, automakers have turned their focus to this field, aiming to diversify their businesses and facilitate transformation and upgrading through cross-industry deployment.

The primary impetus behind automakers' foray into humanoid robots stems from the high degree of technological homology with smart cars at the foundational level. This homology not only minimizes research and development costs but also harbors the potential to open up a "second growth curve" for automakers through synergistic effects across the industrial chain.

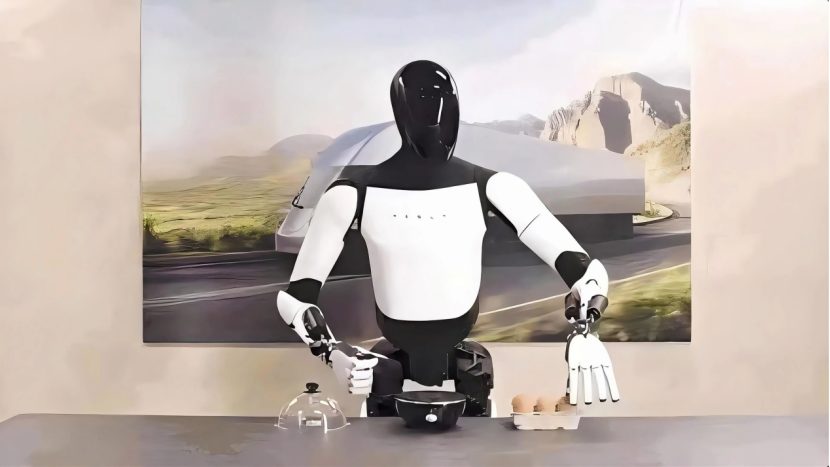

There is a substantial overlap in the technological chain of "perception-decision-execution" between humanoid robots and smart cars. For instance, Tesla's Optimus humanoid robot repurposes the visual neural network algorithm from its FSD (Full Self-Driving) system, achieving environmental perception and path planning through eight cameras, with an algorithm similarity of 60% compared to Tesla's Autopilot system. GAC Group's GoMate robot directly adopts its self-developed pure vision autonomous driving algorithms and integrates automotive-grade motor drive technology to enable dexterous manipulation and high-precision motion control. This technology reuse not only shortens the R&D cycle but also accelerates algorithm iteration and optimization through data sharing.

Furthermore, the synergistic effect of the hardware supply chain further lowers the entry barriers for automakers. Core components required for humanoid robots, such as sensors (LiDAR, cameras), chips (NVIDIA Thor system-on-chip), and power batteries, significantly overlap with the smart car supply chain. Taking Tesla's Optimus as an example, its battery pack directly utilizes the 2.3kWh power battery from the Model Y, and the bearings in its rotating joints are sourced from angular contact ball bearings and cross-roller bearings commonly used in automotive production lines. This "plug-and-play hardware" model enables automakers to swiftly launch products without reconstructing the supply chain.

During this year's National People's Congress and Chinese Political Consultative Conference, He Xiaopeng, NPC deputy and chairman and CEO of XPeng Motors, emphasized, "Humanoid robots represent a strategic integration of artificial intelligence, high-end manufacturing, new materials, and other technologies, and serve as a crucial starting point for China to develop new productive forces and nurture future industries." He predicted that over the next 5 to 20 years, humanoid robots are poised to become a race with the same potential as new energy vehicles.

China's robot industry stands at a similar juncture to where new energy vehicles were a decade ago. He suggested following the market cultivation experience of new energy vehicles and implementing special subsidy policies for Level 3 humanoid robots (capable of independent operation but requiring human supervision) to focus on supporting large-scale applications in scenarios such as factory assembly and logistics coordination. Data reveals that XPeng's self-developed AI robot IRON has already participated in the production of P7+ models at its Guangzhou factory, leveraging its 720° environmental perception technology derived from autonomous driving algorithms.

GAC's third-generation humanoid robot GoMate features dual-mode wheel-foot drive, and its pure vision navigation system repurposes GAC's ADiGO intelligent driving algorithm, capable of handling tasks like component sorting and equipment inspection in the automotive aftermarket scenario. This logic of "technological feedback" underscores the core advantage of automakers' cross-industry efforts. Both the data sharing of Tesla Optimus's FSD system and BYD's research and development in gait control for bipedal robots confirm the technological homology between autonomous driving and robots.

Looking ahead, automakers' ambitions extend beyond the industrial sector. XPeng aims to mass-produce Level 3 household robots by 2026, while GAC's GoMate targets healthcare and companionship scenarios, and Tesla's Optimus is geared towards home care. This shift from positioning robots as "tools" to "partners" distinguishes automakers from traditional robot companies.

▍Triple Hurdles of Cost, Technology, and Demand

While automakers exhibit unique advantages in the humanoid robot race, their development still confronts multiple challenges, encompassing breakthroughs in core technologies and the feasibility of commercialization.

Currently, the high cost of humanoid robots remains a primary obstacle hindering mass production. Tesla's Optimus is estimated to have a selling price of $20,000 to $30,000 (approximately RMB 140,000 to 210,000). Although Musk asserts that the cost can be reduced to $10,000 in the future, this goal heavily relies on the localization of core components. For instance, high-precision reducers, torque motors, and other key components are still dominated by companies like Harmonic Drive from Japan and ABB from Switzerland, and the process of localization substitution necessitates time. Additionally, the precision requirements for motors in humanoid robots far surpass those of automotive components; for example, Optimus's linear joints need to achieve an error of 0.01 millimeters.

Humanoid robots are still in their nascent functional stage. He Xiaopeng candidly stated that current products are only equivalent to Level 2 autonomous driving, and it will take 5 to 10 years to achieve breakthroughs towards Level 4 general-purpose intelligent robots.

Industry insiders identify three major technological shortcomings that need addressing: First, insufficient human-like perception capabilities, such as tactile feedback and dynamic balance control in complex environments, particularly in motion control, perception interaction, etc. Achieving more natural and smooth motion imitation, more precise and efficient environmental perception, and more humanized interaction experiences represents a current technological challenge. Second, the limited generalizability of AI algorithms, as existing models largely rely on training in specific scenarios and struggle to cope with the randomness of the open world. Third, low energy efficiency. Taking Optimus as an example, its endurance is approximately 4 hours, far from meeting the demand for all-weather operation.

Although the humanoid robot market is projected to reach a size of $13.8 billion by 2028 (with a compound annual growth rate of 50.29%), current demand is concentrated in industrial testing and scientific research fields, and the consumer market has yet to form a rigid demand. Some industry insiders express concern that the influx of automakers may lead to bubble risks.

Industry insiders caution that if technological breakthroughs lag behind capital investment, the industry will face the dual pressures of overvaluation and overcapacity. Moreover, the proliferation of humanoid robots may give rise to social issues such as rising unemployment and data privacy breaches. Balancing technological innovation with ethical boundaries will become a long-standing challenge for automakers.

Automakers' foray into the humanoid robot race is not merely a cross-industry attempt but a strategic transformation leveraging technological homology and industrial chain synergy. By repurposing autonomous driving technology and automotive supply chain resources, automakers can swiftly tap into this trillion-dollar market and establish an ecological network encompassing smart cars, humanoid robots, and smart cities. However, the success of this transformation hinges on automakers' ability to surmount cost and technological barriers and strike a balance between market demand and ethical constraints.

Typesetting by Yang Shuo | Image Sources: Tesla, XPeng Motors, Shutterstock