Which Auto Brand Will Be Eliminated Next? DeepSeek's Insightful Answer

![]() 03/06 2025

03/06 2025

![]() 364

364

February marks the traditional off-season for the domestic auto market. To stimulate sluggish sales, major automakers typically announce preferential policies such as "limited-time price reductions." This year, the trend has escalated, with an increasing number of automakers introducing the "one-price policy," especially among joint venture brands which are pulling out all the stops. Even the Land Rover Discovery Sport, with a guiding price of nearly 400,000 yuan, now offers a direct "one-price" of 169,800 yuan.

Behind the incessant price drops lies unpredictable sales pressure.

The "one-price policy" sparks price wars, leaving automakers under immense sales pressure.

Beyond Land Rover, even established joint venture brands like FAW-Volkswagen, GAC Toyota, and Dongfeng Nissan offer "one-price" discounts amounting to tens of thousands of yuan.

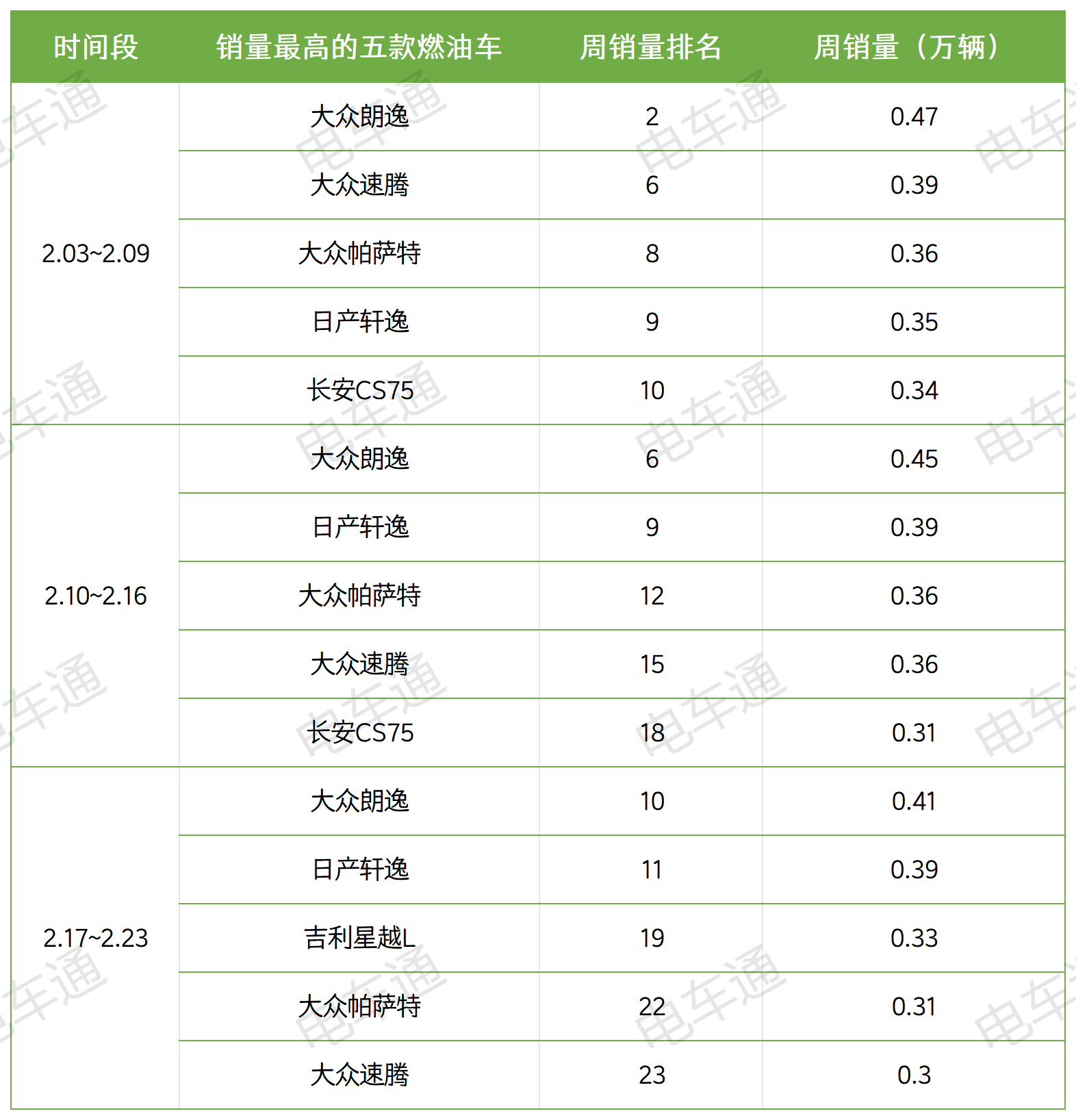

However, how much market recognition do these discounts garner? According to weekly sales data compiled by Diantong from third-party platforms, it is evident that the sales figures and rankings of these popular fuel vehicles have declined, including the Nissan Sylphy and Volkswagen Passat, which adopted the "one-price policy," and the Chang'an CS75, offering subsidies of up to 30,000 yuan.

Table: Diantong

This applies to top brands, and the market performance of non-top brands is naturally worse. Limited-time preferential policies like the "one-price policy" have played a limited role during the off-season.

An automaker's performance during the off-season not only reflects its resilience but also reveals the latest car-buying preferences of mainstream consumers.

Currently, the most "cold-resistant" products include urban commuting-focused pure electric cars like the Wuling Hongguang MINIEV and BYD Seagull, home cars with relatively low comprehensive costs such as Qin L, Song Pro, and Xiaopeng MONA M03, as well as Tesla models, Xiaomi SU7, and Lixiang L series, which have gained significant recognition in the high-end new energy market.

Source: Diantong Photography

According to data released by the China Passenger Car Association (CPCA), BYD's market share reached 16.2% last year, ranking first. Among the top ten automakers with the highest market share, four traditional joint venture brands showed varying degrees of year-on-year decline.

Diantong observed that new energy has become a crucial factor for automakers to boost sales. Apart from BYD, traditional domestic brands such as Geely, Changan, and Chery witnessed significant sales growth in their new energy segments last year. Tesla, primarily relying on the Model 3 and Model Y, even ranked tenth in the sales list.

Relying on new energy technology, the market concentration of domestic brands like BYD and Geely, as well as Tesla, is gradually increasing. However, joint venture brands that fail to capitalize on the new energy field are now in deep trouble.

Weak brands fighting a desperate battle

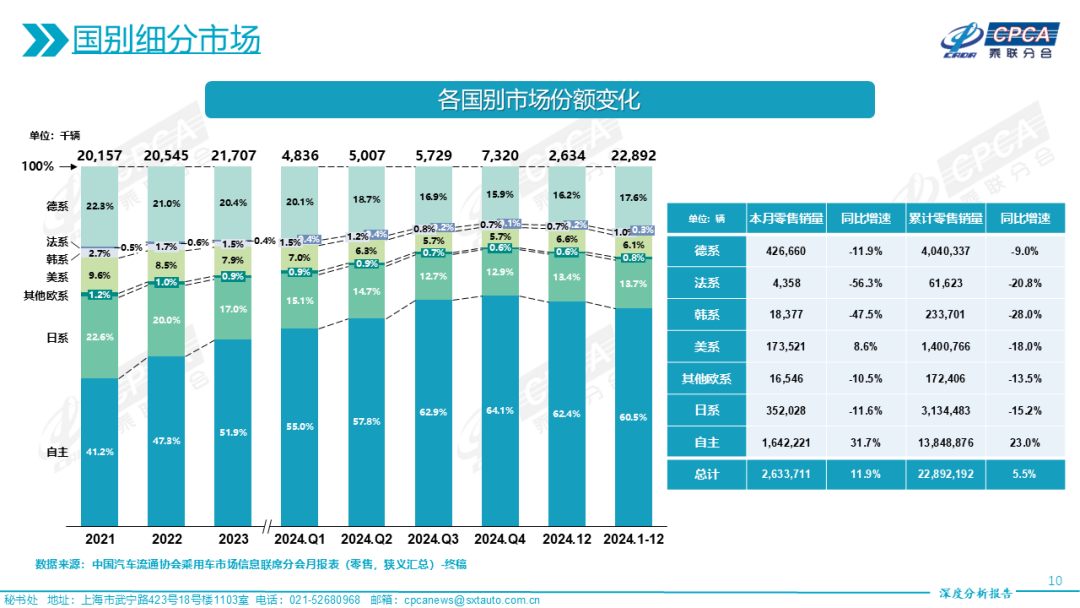

According to the "Changes in Market Share by Country" released by the CPCA, independent brands' market share exceeded 60.5% last year, with the remaining nearly 40% occupied by German and Japanese brands at 31.3%. Korean, American, French, and other European brands shared only the remaining 8.2% market share.

Source: CPCA

While German and Japanese brands' market shares have declined, they are far from being "weak brands." Brands like Changan Ford, Beijing Hyundai, and Yueda Kia, whose sales pale in comparison to the past, can be considered "weak."

A close analysis of these three joint venture brands' product strategies in recent years reveals a common trend of "high cost-effectiveness." Their best-selling models—Ford Mondeo, Hyundai Elantra, Kia Sorento, and Kia Cerato—adequately prove this point.

The Ford Mondeo, starting at less than 150,000 yuan, is inherently cost-effective, and the Hyundai Elantra has a starting guiding price of only 99,800 yuan. These two cars can even offer discounts of around 20,000 yuan in the terminal market.

The discounts for the Kia Sorento and Kia Cerato are even more significant. The Sorento, with a starting guiding price of 179,800 yuan, is offered by some dealers at a starting price of around 130,000 yuan, while the Cerato's terminal market price has dropped below 90,000 yuan.

It is evident that these joint venture brands have already reduced their profits to achieve the best possible sales figures. However, it should be noted that the high energy efficiency advantages of new energy have been recognized by more mainstream users. Joint venture brands' insistence on relying on traditional fuel power to attract consumers no longer works. The "trading volume for price" approach not only reduces brand profits but also leads to issues like decreased R&D investment and brand value.

Of course, "weak brands" are not oblivious. They recognized the importance of new energy early on and launched corresponding products during the new energy boom.

Ford launched the performance-oriented Ford Mustang Mach-E in 2021 and also introduced plug-in hybrid versions of the Ford Escape and Ford Territory, targeting the family market. Hyundai and Kia adopted similar product strategies, first following the "oil-to-electricity" technical route and then introducing exclusive new energy series such as IONIQ and EV.

Source: Diantong Photography

By 2025, these three "weak brands" have increasingly less sway in the new energy field. Since the early "oil-to-electricity" new energy vehicles failed to gain much user recognition, the later-stage performance sports cars, IONIQ, and EV series struggle to gain an advantage.

Although new energy is mainstream, consumers have too many better options with stronger reputations. It will be challenging for them to rely on new energy to regain their peak market share, let alone "overtake on the curve."

For "weak brands," the fact that they cannot adopt the new energy technical route has become a reality, forcing them to place more hope on their fuel vehicles. It is indeed helpless, but "trading volume for price" is currently their most profitable approach. As for their future prospects, it depends on whether they can seize the next opportunity to catch up with the trend.

Who will be eliminated this year? DeepSeek's surprising answer

The Matthew Effect intensifies, with consumers trusting brands with higher market shares more. Auto market resources will converge towards automakers with higher market shares. Just entering 2025, HeChuang Automobile announced its market withdrawal due to capital chain ruptures and inability to boost sales, becoming the first new energy brand to fall this year.

It is conceivable that the auto market's elimination race will not stop. So which automakers are likely to be eliminated by the market this year? Diantong specifically asked DeepSeek, and here is its answer.

Screenshot: DeepSeek

Overall, some of the answers are surprising. However, the reasons DeepSeek predicts these automakers may be eliminated are none other than two: unstable capital chains and insufficient market competitiveness.

DeepSeek's predicted answers mention well-known joint venture brands such as Beijing Hyundai and Changan Ford. Diantong believes the possibility of them exiting the Chinese market this year is low, as these brands have several products generating sales and stabilizing their capital chains. However, for Dongfeng Citroen and Skoda, Diantong is indeed uncertain, as these brands' market shares in China continue to shrink, and their brand positioning is relatively vague, posing a high market risk.

Regarding the prediction of which new force brands may be eliminated, DeepSeek's answer is slightly conservative, considering some new forces have already faced turmoil. In comparison, new forces such as Neta Auto and Jishi Auto face relatively higher market risks.

Source: Neta Auto Official Website

Among them, Neta Auto's total sales in January have dropped to three digits. Not only is it failing to become a mainstream new force brand, but it is struggling to return to last year's mid-year sales figures. Jishi Auto focuses on off-road scenarios with its extended-range SUV, and its product positioning is relatively niche, making it difficult to gain an edge in the fiercely competitive market.

Cars are bulk consumer goods, and today's consumers prefer products with high visibility or more advantageous prices, imposing stricter requirements on new force brands.

Lei Jun once predicted that only five automakers would survive in the future. Diantong believes that the auto market competition has not yet intensified to this extent, but the subsequent "elimination" speed will only accelerate. If they fail to seize the opportunity to create truly popular products, no one can guarantee they won't "suddenly collapse" like Geyue Auto.

(Cover image source: Diantong Photography)