Chery IPO: A 20-Year Wait

![]() 03/04 2025

03/04 2025

![]() 561

561

Introduction

Twenty years have passed in the blink of an eye.

On February 28, 2025, an application disclosed by the Hong Kong Stock Exchange marked the end of the longest IPO journey in the history of China's automotive industry—Chery Automobile officially submitted its application for listing on the Hong Kong Stock Exchange. This moment marks 21 years since Chery first initiated its listing plans.

"Chery should have gone public ten years ago." This sentiment expressed by Yin Tongyue, Chairman of Chery Holding, during the initial stages of mixed-ownership reform still echoes in our ears. In the blink of an eye, this "grey-haired teenager" has stood at the threshold of the capital market with sales of 2.6039 million vehicles and revenue of RMB 480 billion in 2024.

At this point, recalling Yin's words, "Chery is ready!" is not just a listing declaration but also a testament to Chery Group's transformation from a "humble beginning" in Wuhu to becoming the world's 11th largest passenger vehicle company, showcasing its technological prowess to the global market.

From "Humble Beginnings" to Capital Market

"Chery's trump card has never been capital but technology." Starting from a "humble beginning" in Wuhu in 1997, Chery ignited its technological faith with China's first self-developed engine.

However, despite its technological foundation, Chery has always maintained a somewhat distant relationship with the capital market.

In 2004, it first initiated listing plans but was stalled due to equity disputes, which nevertheless planted the seeds for capitalization. In 2008, Chery completed a share reform but suffered setbacks due to the global financial crisis. In 2016, its attempt to backdoor list through Hailuo Profiles was hindered, but this forced it to solidify its new energy qualifications. In 2019, mixed-ownership reform introduced Qingdao Wudaokou, which later invested in Luxshare Precision, injecting tens of billions of yuan to revitalize cash flow...

This tumultuous journey to listing is, in fact, a coming-of-age ceremony for "Technological Chery".

Additionally, in 2018, the resignation of Chery Automobile's General Manager Chen Anning during a critical period of mixed-ownership reform was one of the factors that further delayed the IPO plan. It was not until 2024, when Chery completed equity sinking and the Wuhu State-owned Assets Supervision and Administration Commission became the largest shareholder with a 21.17% stake, that the final obstacle to listing was cleared.

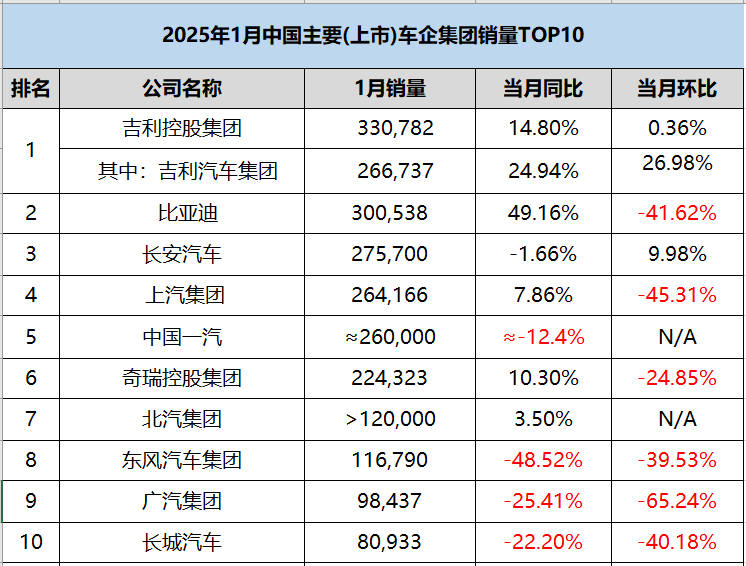

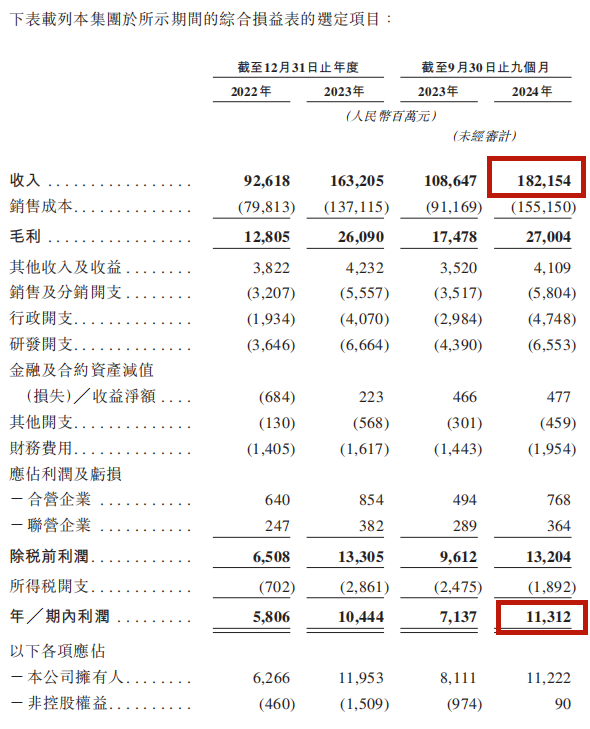

This 618-page prospectus announces the dawn of Chery Automobile's 21-year capital journey. It also reveals Chery's recent "comeback": from 2022 to the first three quarters of 2024, revenue jumped from RMB 92.6 billion to RMB 182.1 billion, and profits doubled from RMB 5.8 billion to RMB 11.3 billion.

Moreover, behind this impressive performance lies a foundation of globalization with an annual export volume of 1.14 million vehicles and 22 consecutive years as the top exporter of self-owned brands. Chery's market share ranks among the top three in Russia, Brazil, the Middle East, and other markets, with the average price of overseas vehicles increasing by 20.6% in three years. The Smart World R7, priced at over RMB 400,000 in Saudi Arabia, has shattered the "cheap tag" of Chinese cars.

At the same time, the overseas market, accounting for 48.7% of revenue, has become a profit engine. With a gross profit of RMB 16,000 per vehicle, it far exceeds domestic peers.

Another striking figure is that in 2024, Chery's cumulative patent applications exceeded 33,000, with over 20,000 authorized patents. Among its core technologies, engine thermal efficiency reaches 44.5%, and Kunpeng hybrid technology is on par with or even surpasses Toyota THS. Its technological strengths have become a passport to the capital market.

In fact, Yin Tongyue insists on continuous technological investment, with R&D expenditures totaling nearly RMB 17 billion from 2022 to 2024, fully establishing five technological moats: the Mars architecture, Kunpeng powertrain, Lion Smart Cabin, DaZhuo Intelligent Driving, and Galaxy Ecosystem. The cooperation with Huawei is seen as a key move for "Technological Chery", aiming to win the "second half" of the competition through intelligence.

"From overtaking on curves to overtaking on straightaways!" Yin Tongyue proclaimed in his New Year's address this year. It is this 62-year-old "science and engineering enthusiast" who has reshaped Chery from a "technologically biased student" into a "technologically well-rounded student".

In "The Grey-haired Teenager, Yin Tongyue", we also wrote, "Without attacking competitors or poking at others' weaknesses, but by doing everything possible to learn from others' strengths, Chery has grown by integrating the best of all. This is one of the secrets to Chery's rapid rise in this rapidly changing era and the magic weapon for its continuous growth against the wind for four years."

How Will the "Well-Rounded Student" Break Through?

Of course, the tests of the capital market will be even more stringent. Therefore, at the 2025 Annual Cadre Conference of Chery Group, Chairman Yin Tongyue once again emphasized that "the top priority is listing", demonstrating his extreme attention to this matter.

The background is that in 2025, Chery has four major tasks and four major reforms. These include striving to complete the four tasks of corporate listing, annual business objectives, key capability enhancement, and major technological breakthroughs, and implementing four reforms in brand building, comprehensive internationalization, management, and culture.

In fact, in 2023, when Exeed released the "Aurora 2025 Strategy", Yin Tongyue mentioned preparing for an IPO in 2025. At the same time, the information I obtained through multiple sources at that time was that an official IPO submission would take place at the end of 2024 or the beginning of 2025. Now, this timeline has been verified and is proceeding as scheduled.

At the end of 2023, after inquiring from multiple sources, a Chery insider told me, "We don't have specific news either, but the group has set up a dedicated IPO office, which does not release any information to the public. The group is leading this effort, and the person in charge is unfamiliar not only to us but also to you media."

Another point is that Jin Yibo, Assistant General Manager of Chery Automobile, responded to the public, "We have indeed been preparing, but there is no more information to provide."

Regarding Chery's unsuccessful attempts to go public over the years, an industry insider close to Chery at that time bluntly stated, "Chery is unwilling to let the outside world see the secrets inside the 'black box'." Long-term unclear financial reports, complex equity structures, and frequent executive changes have repeatedly hindered its listing process. Now, the submission of the IPO application indicates that these obstacles should have been resolved.

As for the use of funds, which is of utmost concern to Hong Kong stock investors, the prospectus reveals that Chery plans to use the funds raised for R&D, overseas expansion, and capacity upgrades. Hong Kong stock investors are more concerned about whether Chery can balance state-owned control with market-oriented operations.

After all, Luxshare Precision only holds a 16.83% stake, and the absolute discourse power of the Wuhu State-owned Assets Supervision and Administration Commission may become a double-edged sword. "Chery needs to prove that it is not just a 'local state-owned enterprise' but a truly global technology company," admitted an investment banker.

It should be noted that, in fact, judging from Chery's actions over the past two years, the now "unapologetic" Chery has broken away from the constraints of being a "local state-owned enterprise" and transformed into a technology platform led by state-owned capital with diverse capital participation.

Chery's capital layout is also quite aggressive: its holding subsidiaries such as BTR and Efort have already been listed on the A-share market, and the market value of Ruihu Mould has quintupled in three years. Luxshare Precision's 16.83% stake brings consumer electronics-level supply chain management experience. Strategic investments from IDG Capital and CATL have injected vitality into intelligence and battery technology.

Of course, the rise from a "humble beginning" to the world's top 500 companies has been fraught with challenges, but the capital market demands not only sentiment but also a sustainable profit model and a clear technological narrative. Although "Chery is ready!", when the "black box" is opened, whether Chery can truly "emerge from its cocoon" in transparency may be more worth anticipating than the IPO itself.

Three Core Competencies

After a 20-year marathon, Chery has proven the philosophy of "slow is fast" with its technology. Sales of 2.6039 million vehicles and revenue of RMB 480 billion are just the beginning. The billions of yuan raised through listing on the Hong Kong Stock Exchange will also be invested in deep-water areas such as next-generation CTC batteries, full-domain 800V, and L4 autonomous driving.

Moreover, Chery's listing is just the beginning. Yin Tongyue and Chery's ambitions extend beyond sales and listing. Their goal is for "Chery to become the Huawei of the automotive industry." Jointly developed with Huawei, the HarmonyOS cockpit and ADS2.0 autonomous driving system have been implemented in Exeed's Star Era models. CheryGPT's large model is in beta testing, with AI driving a 30% increase in R&D efficiency. The robot density at Wuhu's super intelligent manufacturing plant reaches 1,200 units per 10,000 employees, 20% higher than Tesla's Shanghai factory...

Under rapid technological iteration, there are 60 new models over five years, covering a vast product matrix of all power types, and an ironclad rule of "annual R&D investment growth not less than revenue growth". All of this requires ample capital.

However, since it is going public and the automotive market has already "convoluted" into the era of intelligent electric vehicles, Chery, which only started being "unapologetic" in the new energy sector in 2024, must build a stronger "long board" in new energy. Yin once said, "Chery got up early but arrived late in the new energy race." Now, under Yin's requirements, the team must become "early risers who catch the big market."

Previously, Chery was indeed slow in its new energy layout. Although it established Chery New Energy in 2010, it failed to seize the first-mover advantage and was gradually surpassed by several major competitors over the years. In the turning point year of 2023, its new energy sales were only 79,000 units, accounting for 4.9%.

In the "unapologetic" year of 2024, Chery experienced astonishing acceleration in the new energy sector: new energy sales reached 583,000 units, a year-on-year surge of 232.7%, with monthly sales exceeding 100,000 units for the first time in December. The Smart World brand, jointly developed with Huawei, saw its first SUV model, the R7, become the sales champion among pure electric SUVs priced above RMB 250,000 within two months of its launch, with an intelligent experience comparable to the Model Y.

In addition, the Kunpeng DHT hybrid system has been installed in over 200,000 vehicles, and the Fengyun series received over 30,000 monthly orders, demonstrating Chery's strategic resilience in advancing on the "fuel + hybrid + pure electric" fronts.

Of course, when benchmarking against BYD, Yin also admitted candidly at last year's summit, "We want to catch up with BYD, but the gap is widening." This IPO will give Chery a boost in its pursuit, fulfilling Yin's wish to "catch a glimpse of Wang Chuanfu's back."

Regarding Chery's IPO, I am also curious about the answer DEEPSEEK can provide. It summarizes it as, "IPO is the starting point, and systematic breakthrough is the key." The IPO will provide Chery with hundreds of billions of yuan in capital, but whether it can succeed depends on three core competencies:

1. Technological iteration speed: The proportion of R&D investment needs to be increased to above 5%, focusing on the three major tracks of hybrids, pure electrics, and autonomous driving.

2. Brand value reshaping: Through high-end products and global stories, reverse the label of "high sales but low premiums".

3. Risk management system: Establish a multi-dimensional risk hedging mechanism for geopolitics, exchange rates, and supply chains.

DEEPSEEK believes that Chairman Yin Tongyue's goal of transformation from "big to strong" is essentially a value leap from scale-driven to technology-driven. If Chery can leverage capital to achieve a systematic breakthrough, it may reshape the competitive landscape of Chinese automakers in the global market.

Yin Tongyue once said, "We have a floor but no ceiling." When the "humble beginning spirit" meets the east wind of the capital market, this automaker once regarded as a "technologically biased student" is now rewriting the valuation logic of Chinese automobiles with the posture of a global technology giant. The bell is about to ring, and Chery's capital story has only just begun.