The 'Great Battle' of the auto market in 2025 begins early: price wars intensify, fierce competition in intelligent driving, and knockout rounds accelerate

![]() 12/04 2024

12/04 2024

![]() 423

423

On November 24, the 2024 Guangzhou Auto Show, which marked the end of the annual auto market battle, officially came to a close. Compared to last year's Guangzhou Auto Show, this year's event was subtly influenced by changes in the automotive market. Significant shifts were observed in participating brands and models, as well as in the technological concepts exhibited and future strategies announced by automakers. Through this Guangzhou Auto Show, one can gain a glimpse of the auto market trends in 2025.

Technologically, in 2025, competition among major brands will intensify in plug-in hybrid and extended-range technologies. Additionally, the race for intelligent driving systems will heat up, with prices expected to drop significantly.

On the market front, the price wars in the auto market over the past year have been shocking. With the exposure of leading domestic automakers demanding a 10% price reduction from suppliers, it signals that the price war for 2025 is already brewing.

In the current auto market, many automotive brands exist in name only. NIO, a leading new-energy vehicle (NEV) brand, has clearly stated that the next two years will be a "battle for survival." A series of indications suggest that the knockout rounds in the auto market will continue to accelerate, and the "Great Battle" of the auto market in 2025 has already arrived early.

01

Plug-in Hybrids and Extended-Range Vehicles Gain Momentum

In recent years, NEVs have been a highlight at China's top three auto shows. The latest technologies showcased, the number of models exhibited, and changes in their proportion at these shows have all witnessed the rise of the domestic NEV market. This was also evident at this year's Guangzhou Auto Show.

Among domestic brands, BYD, Xiaomi, Thalys were the most popular. GAC Aion, Roewe R Flying, MG, and IM Motors also showcased their latest NEV technologies. NIO introduced its new brand Ledao, and JiShi, another NEV brand, made its debut at the Guangzhou Auto Show.

Foreign brands, which have been slower to transition, also cautiously showcased their latest electric vehicle achievements. Mercedes-Benz introduced the all-electric G-Class SUV G 580, Audi unveiled its first model in collaboration with Huawei, the Audi A5L, and GAC Honda presented its first Ye brand model, the Ye P7, based on a new dedicated electric platform. Additionally, other NEV products such as the ARIYA, Toyota bZ3, and SAIC Volkswagen ID. series were also on display.

In 2014, China's NEV sales were less than 100,000 units, with a penetration rate of only 0.32%. By 2024, the penetration rate of NEVs in the first ten months had reached nearly 40%, with a single-month penetration rate for passenger vehicles exceeding 50%, marking significant progress. However, after a decade of rapid growth, the NEV market has begun to diverge. While pure electric vehicles (BEVs) still dominate, plug-in hybrids (PHEVs) and extended-range electric vehicles (EREVs) are currently outpacing BEVs in momentum.

According to data from the China Passenger Car Association, sales of PHEVs and EREVs grew by 74.7% and 99.2%, respectively, from January to October this year, significantly higher than the 19.9% growth rate of BEVs. Moreover, the cumulative retail sales of PHEVs and EREVs reached 3.533 million units, accounting for over 40% (42.4%) of total NEV sales, indicating their increasing importance. It was precisely due to the high growth of PHEVs and EREVs that the domestic NEV passenger vehicle market achieved a 41% growth rate in the first ten months.

The brilliance of PHEV and EREV technologies was fully demonstrated at this year's Guangzhou Auto Show. Chinese brands such as BYD, Chery, Changan, Haval, Tank, Lynk & Co, Wuling, GAC Trumpchi, Dongfeng Aeolus, and Geely Galaxy showcased their PHEV models, while NIO, Wenjie, Leap Motor, Avatar, Changan, and Deep Blue presented their EREV models. Currently, the competition in these two segments is primarily among Chinese brands, with joint venture brands having a low presence.

02

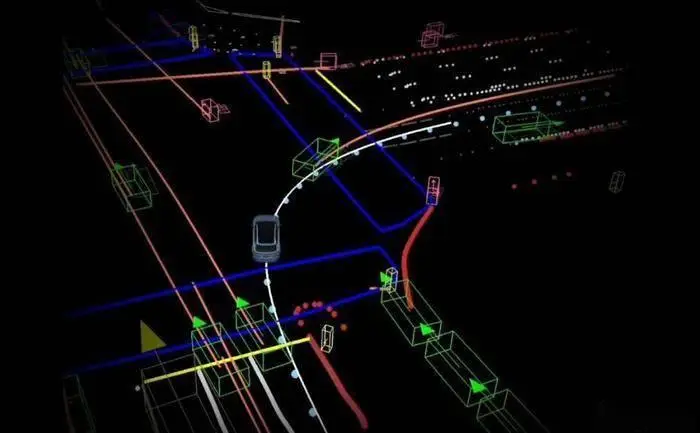

Intense Competition in the Intelligent Driving Sector

In addition to NEVs, intelligent driving was another keyword at this year's Guangzhou Auto Show. This sector is widely regarded as the next phase of competition in the auto market. Therefore, many automakers showcased their intelligent driving assistance systems based on artificial intelligence and 5G technology at the show.

At this year's Guangzhou Auto Show, we saw AI-powered smart cockpits, all-domain intelligent fast-charging platforms, full-field human-machine interaction systems, self-developed high-performance smart chips, pure vision city navigation without HD maps, and the most intuitive user experiences through AR and VR technologies. This has become a regular highlight at China's top three auto shows in recent years.

At the Guangzhou Auto Show, automakers introduced the latest advancements in their intelligent driving technologies. Xiaomi unveiled four intelligent chassis technologies; NIO showcased the latest research and development results of its new-generation intelligent driving technology architecture, the end-to-end + VLM dual system; XPeng introduced its new P7+ model, which comes standard with advanced AI-driven intelligent driving features; and Great Wall Motors announced the nationwide launch of full-scenario Navigation on Autopilot (NOA), marking a significant breakthrough in its intelligent driving technology.

While intelligence is a hallmark of NEVs, as the automotive industry upgrades and transforms, more and more fuel-powered vehicles are also moving towards intelligent technology. This stage is primarily dominated by foreign brands that have been slower to transition to electrification.

GAC Honda unveiled its new-generation intelligent and efficient dedicated electric platform, Architecture W; BMW announced that it will equip its 2025 mass-produced models with V2X vehicle-to-infrastructure communication technology; GAC Toyota was the first joint venture brand to adopt L2++ high-level intelligent driving technology; and the 2025 GLC Coupe SUV uses Mercedes-Benz's latest third-generation MBUX intelligent human-machine interaction system, equipped with the first Qualcomm 8295 smart cockpit chip in its class. Foreign brands are striving to convey a message to the public: intelligence is not exclusive to electric vehicles; traditional fuel-powered vehicles can also excel in intelligence.

Through the intelligent driving research and development achievements and future layouts showcased by domestic and foreign brands, we can see that competition in the intelligent driving sector is becoming increasingly fierce. As the automotive industry transforms and upgrades, the competition in this sector will intensify.

03

Market Knockout Rounds Accelerate

While the Guangzhou Auto Show welcomed new brands and faces, many familiar ones were absent, including well-known joint venture brands such as Chevrolet, Jaguar Land Rover, and Jetta.

As a regular at China's top auto shows, Chevrolet entered the Chinese market 20 years ago and became the preferred automotive brand for young Chinese consumers during the rapid growth of the domestic auto market. At its peak, it sold nearly 800,000 new vehicles a year. However, in recent years, it has struggled amid the rise of domestic Chinese brands, with current monthly sales averaging only around 3,000 units. This has led to rumors that it may soon exit the Chinese market.

As a second-tier luxury brand, Jaguar Land Rover once dominated the Chinese luxury car market. During its peak, customers had to pay a premium of 100,000 to 200,000 yuan on top of the list price to take delivery of a vehicle. However, in recent years, with the collapse of its pricing system, it has fallen into a development dilemma in the Chinese market. Its cumulative sales for the first three quarters of this year were only 71,921 units, a year-on-year decline of around 11%. Its absence from the Guangzhou Auto Show underscores its difficulties in the domestic market.

The Jetta brand has seen decreasing market attention due to its limited product line, lack of new technologies, and the decline of its parent brand Volkswagen amid competition from Chinese brands.

With the rise of Chinese brands, third- and fourth-tier foreign brands have become increasingly marginalized. Acura, Suzuki, Mitsubishi, Renault, JEEP, and Fiat have successively exited the Chinese market. There has been ongoing speculation about which foreign brand will be the next to leave China, and clues from the Guangzhou Auto Show seem to provide some indications. Through these clues, we can understand the situation of foreign brands in the Chinese market and sense the differentiated treatment of the Chinese market by different brands. It is believed that in the near future, all questions will have their answers.

It is worth mentioning that on the occasion of NIO's 10th anniversary, a 70-minute internal speech by its founder, William Li, was exposed. In it, he mentioned that the next two years would be crucial for NIO's survival. As a leading new-energy vehicle brand, NIO already has a strong sense of crisis, let alone third- and fourth-tier marginalized brands.

What is even more indicative is an internal email suspected to be from a leading domestic automaker that recently circulated online. The email mentioned that competition in the NEV market will intensify in 2025, entering a "Great Battle" and "knockout rounds." Therefore, the leading domestic automaker is demanding a 10% price reduction from suppliers starting from January 1, 2025, with the reduced prices to be reported to the automaker through the SRM system by December 15.

If this email is authentic, it undoubtedly sends a message to the outside world: NEVs will accelerate their internal competition in 2025, leading to further intensification of competition across the entire industry. At that time, the domestic auto market is likely to undergo a new round of reshuffling, and it remains uncertain whether brands lacking market competitiveness will survive 2025.