Japan launched an 'atomic bomb' at China's auto industry with solid-state batteries, signaling the end of China's new energy vehicle (NEV) heyday?

![]() 12/02 2024

12/02 2024

![]() 503

503

While Japanese automakers have reaped the benefits of fuel-efficient vehicles in the global market, they now face their sternest test in the era of NEVs, where extreme energy efficiency and ultra-high intelligence are insurmountable peaks.

As Japanese automakers seem on the verge of being ousted from the Chinese market, Honda recently unveiled its solid-state battery demonstration line with a total investment of 43 billion yen, covering electrode material weighing/mixing, coating, rolling, battery and module assembly, and other processes.

Prior to this, Toyota and Nissan had also officially announced their solid-state battery production plans. The solid-state battery is like an 'atomic bomb' launched by Japanese automakers at China's auto industry, aiming to level the playing field for China's auto industry.

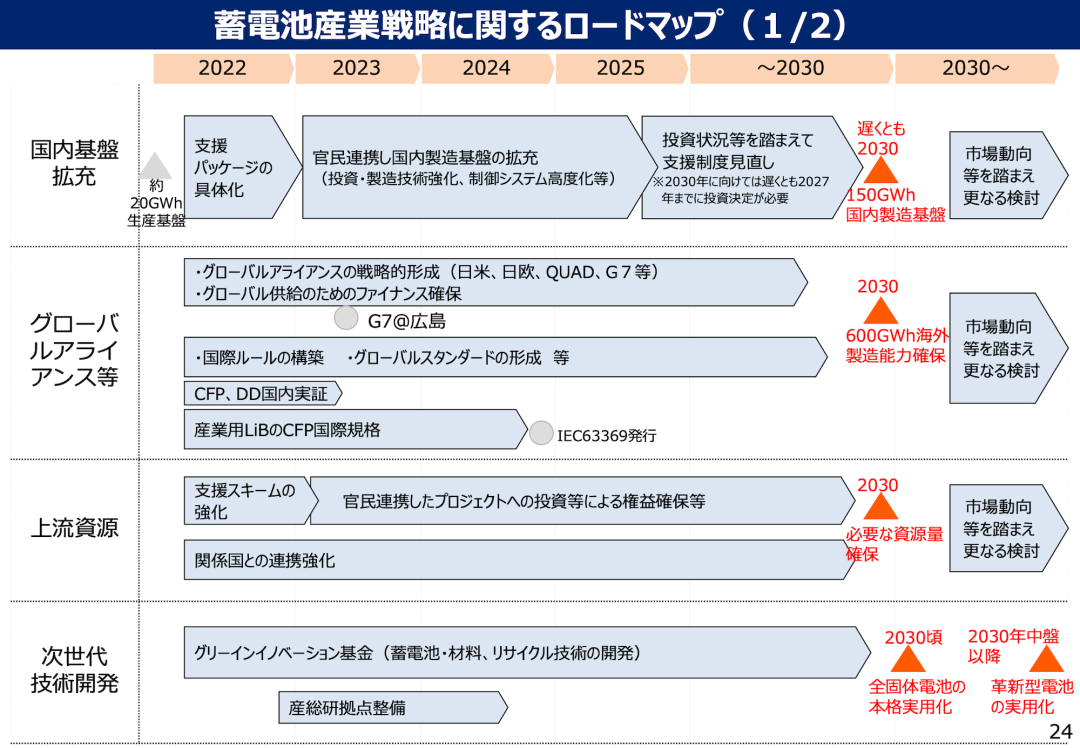

Accompanying the 'atomic bomb' of solid-state batteries is Japan's nationwide effort to build a powerhouse of NEV batteries.

As China's auto industry grows at an unprecedented rate to become the world's largest NEV market and accelerates its global expansion, Volkswagen, once ambitious in the NEV market, has shifted focus, partnering with XPeng and SAIC to develop exclusive electric smart cars for the Chinese market.

Caught between the fierce competition between BYD's lithium iron phosphate batteries and CATL's ternary lithium batteries, Japanese automakers, knowing they have little chance of winning, have integrated them into their supply chains but only as a trial run. They harbor ambitions to overtake in a curve and reclaim the glory of Japan's auto industry.

Japan once led the global lithium battery market by a wide margin. Now, the application of lithium batteries in the auto industry has become crucial for Japan's auto industry to withstand global challenges, potentially determining its survival.

In Japan's battery plans for electric vehicles, solid-state batteries from Toyota, Honda, and Nissan are the focus of industry attention, all striving for commercial launch in 2027. However, it is their overall lithium battery production capacity planning that should alarm the global auto industry.

By 2030, Japan aims to have an annual production capacity of 100 GWh for automotive batteries domestically and 150 GWh overall, with a global annual production capacity reserve of 600 GWh. Meanwhile, solid-state batteries will become ubiquitous, positioning Japan for global leadership.

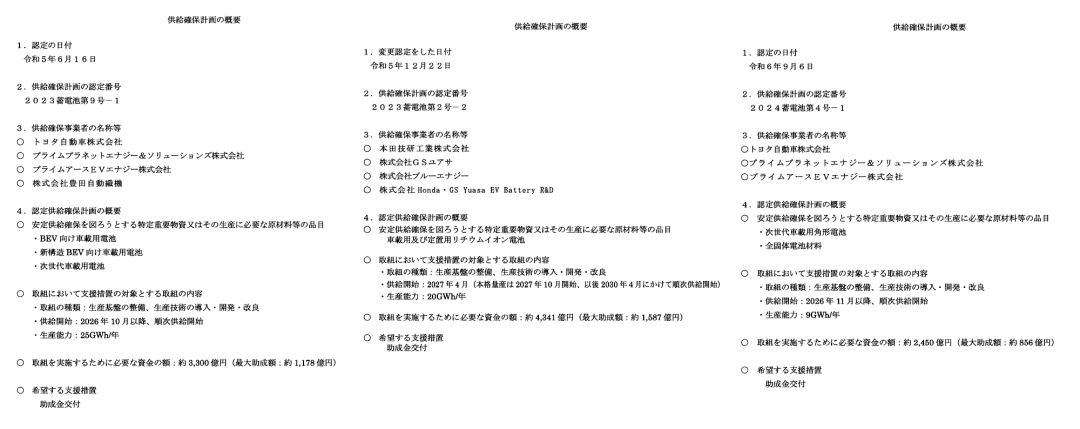

Japan's Ministry of Economy, Trade, and Industry's "Battery Supply Assurance Plan" outlines the country's short- to medium-term battery plans for the auto industry. From 2025 to 2028, annual production capacity is expected to increase by 81.5 GWh, with a total investment of 1.7087 trillion yen, including 602.5 billion yen in government subsidies.

1. Mazda (Panasonic): Cylindrical lithium batteries for vehicles, with an annual production capacity of 6.5 GWh, starting production in July 2025, at a total investment of 83.3 billion yen and government subsidies of 28.3 billion yen.

2. Toyota: Batteries for BEVs, new BEVs, and next-generation vehicles, with an annual production capacity of 25 GWh, starting production in October 2026, at a total investment of 330 billion yen and government subsidies of 117.8 billion yen.

3. Toyota: Square batteries and solid-state battery materials for next-generation vehicles, with an annual production capacity of 9 GWh, starting production in November 2026, at a total investment of 245 billion yen and government subsidies of 85.6 billion yen.

4. Honda (GS Yuasa): Lithium batteries for vehicles and energy storage (stationary), with an annual production capacity of 20 GWh, starting production in April 2027, at a total investment of 434.1 billion yen and government subsidies of 158.7 billion yen.

5. Nissan: Batteries for new BEVs, with an annual production capacity of 5 GWh, starting production in July 2028, at a total investment of 153.3 billion yen and government subsidies of 55.7 billion yen.

6. Subaru (Panasonic): Cylindrical lithium batteries for vehicles, with an annual production capacity of 16 GWh, starting production in August 2028, at a total investment of 463 billion yen and government subsidies of 156.4 billion yen.

As the world's largest NEV manufacturer, BYD sold 3.0244 million NEVs in 2023, with a total installed capacity of batteries and energy storage systems of 150.909 GWh. From January to November 2024, it sold 3.7573 million NEVs, with a total installed capacity of batteries and energy storage systems of 171.21 GWh.

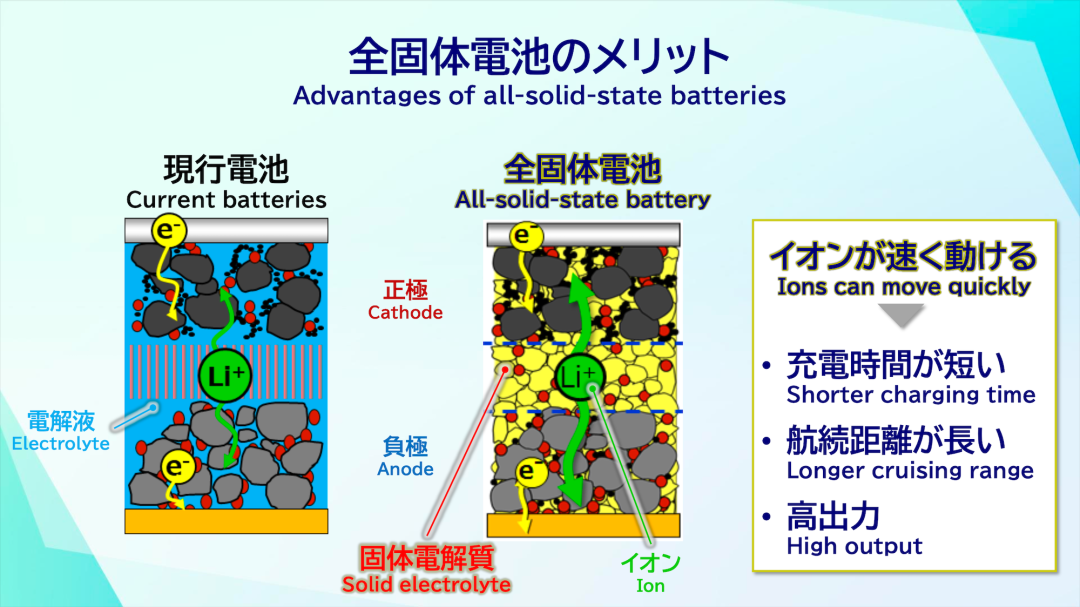

As ternary lithium batteries power NEVs globally, Japanese automakers are racing against time to secure a foothold in solid-state batteries, seeing it as another global opportunity after gasoline and hybrid vehicles. They refuse to lag behind China in this market.

As the crown jewel of the NEV industry, solid-state batteries will initially come at a high cost. Japanese automakers' pride in high quality, robust manufacturing technology, and craftsmanship gives them an edge over global competitors.

While safety has become the ultimate luxury in NEVs, and automakers tout zero spontaneous combustion, we must not forget that spontaneous combustion remains a Damocles' sword hanging over China's NEV industry. This issue will also be crucial to the success of solid-state batteries.

Although we won't see BYD's solid-state battery plans until 2025, CATL, Dongfeng, GAC, and other companies have already announced their plans. They are racing against time to be the first to launch solid-state batteries, maintaining China's lead in NEVs.

The competition between BEVs and gasoline vehicles spans industries, while solid-state batteries will reshape the auto market, particularly impacting leading NEV manufacturers like Tesla and BYD. Japanese automakers hope to regain their leading position in this field.

With charging times as short as 10 or even 5 minutes, solid-state batteries could eliminate the last barrier to NEV adoption. However, this is just part of Japan's auto industry's grand plan.

Whether it's hydrogen fuel cell technology or hybrid technology, solid-state batteries will revolutionize these two prized Japanese automotive powertrain technologies, significantly enhancing performance and energy efficiency.

Before solid-state batteries enter commercial use, Toyota will launch a new super engine and battery in 2026, designed for the electric era and potentially replicating BYD's DM-i super hybrid innovation.

Leveraging plug-in hybrids, ternary lithium, and lithium iron phosphate batteries, China's auto industry took over a decade to overtake global competitors, who largely surrendered. However, the solid-state battery era will restore global competition, with 2027 just around the corner.

Faced with Japan's 'atomic bomb' of solid-state batteries and its formidable lineup, China's auto industry cannot sit idly by, though its once-sizeable lead may no longer exist.

Unlike China's NEVs, which grew from scratch, Japanese automakers' solid-state batteries will enter the global market at a high level, bypassing the arduous development path.

Toyota and Honda achieved price parity between their hybrid and gasoline vehicles through global scale, earning industry-leading profitability. This formidable strength is likely to reemerge in the solid-state battery era.

China's auto industry has only a few million-vehicle manufacturers like BYD, Geely, and Chery. Even if solid-state batteries enter commercial use in 2026, ahead of Japanese automakers, they will still need a long development process. This is compounded by the heterogeneous stagnation effect caused by the rapid growth of the ternary lithium and lithium iron phosphate battery markets.

Whether unburdened by history or with an established global market and massive scale, the resurgent Japanese auto industry aims not to replicate China's NEV curve overtaking but to destroy China's NEV industry from the outset.

Japan's bet on solid-state batteries mirrors China's all-in approach to NEVs, which has yielded remarkable results.

As global automakers watch China's NEV industry grow, gaining unsurpassable technological, market, and brand advantages, they can no longer remain indifferent or accept being overshadowed.

China's auto industry must not be complacent as the iteration of solid-state battery technology offers no window period or second chances. This is a future that global automakers must secure, especially with the looming final battle over hydrogen fuel cell technology.

China should not rely solely on its current NEV 'shield' to withstand Japan's 'atomic bomb' of batteries but should build a powerful 'anti-missile system' of solid-state batteries to counterattack. Only then can China's auto industry protect and continue its 70 years of great achievements.