BYD, Stop!

![]() 11/28 2024

11/28 2024

![]() 441

441

01

BYD has once again put itself in the spotlight.

Last week, BYD's founder Wang Chuanfu just shared the company's 30-year successful entrepreneurial history, and the 10 millionth new energy vehicle officially rolled off the production line.

However, this week, this leading new energy vehicle company has gained notoriety due to its strong and rigid stance towards suppliers.

02

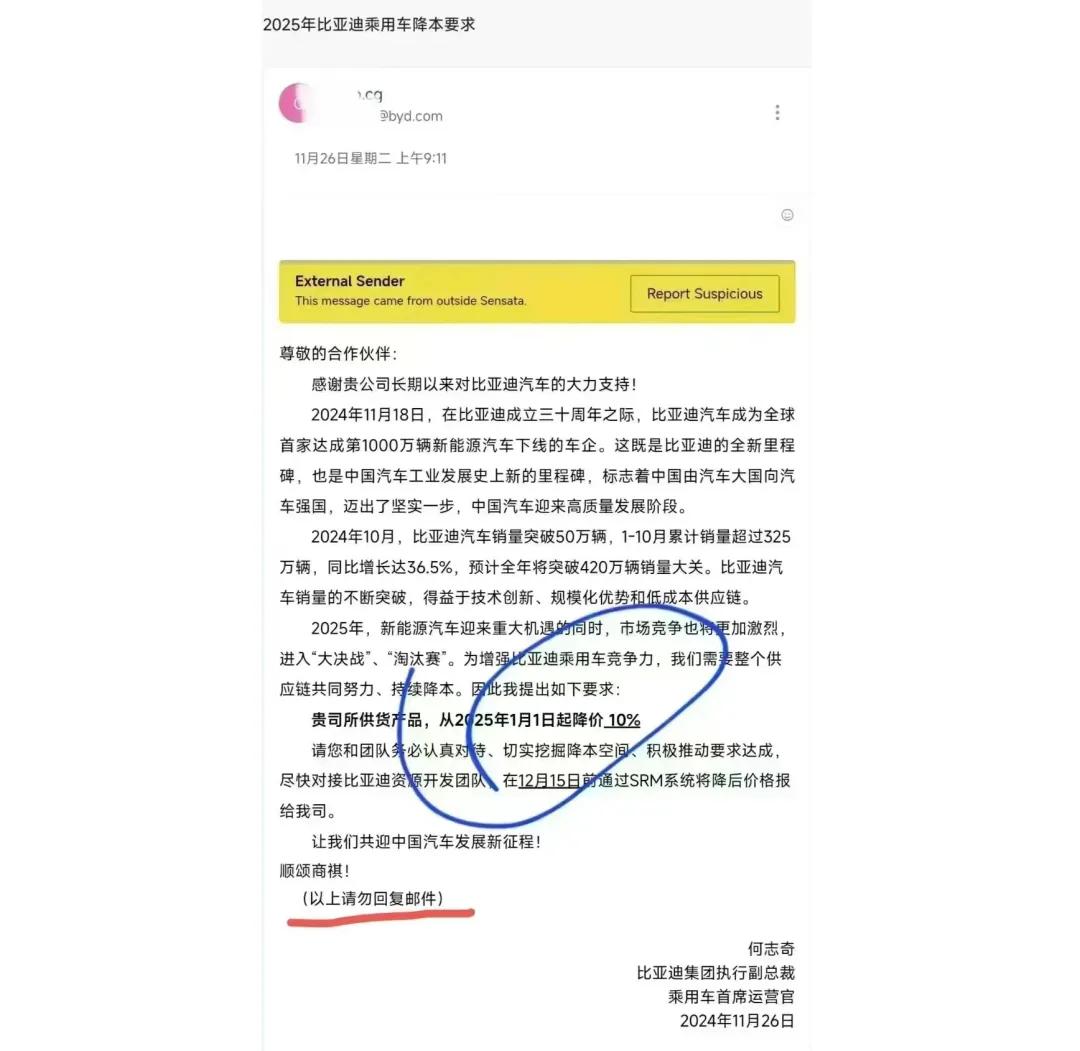

Recently, an email with the subject "BYD Passenger Car Cost Reduction Requirements for 2025" was leaked.

The email states that BYD's sales breakthrough is attributed to technological innovation, economies of scale, and a low-cost supply chain. BYD is requesting a 10% price reduction for products supplied by relevant suppliers from January 1, 2025.

Subsequently, a suspected reply from a supplier to BYD circulated online, expressing strong dissatisfaction with BYD's actions. The reply believes that while BYD expands into the international market with its extreme cost-cutting and low-price strategy, it has laid the groundwork for potential tariffs and comprehensive boycotts from developed countries.

Once the price competitive advantage is lost, the so-called "success" will instantly vanish, and all the squeezed profits and value will ultimately benefit other countries' economic development. This short-sighted behavior not only ruins BYD itself but also drags down the entire industrial chain, sacrificing the long-term interests of workers and enterprises.

The "reply" also calls on BYD to focus on long-term development and stop the relentless squeezing model for short-term gains.

03

In response to the growing public opinion, Li Yunfei, General Manager of BYD's Brand and Public Relations Department, responded on social media at noon on November 27.

He stated that "annual price negotiations with suppliers are a common practice in the automotive industry." BYD proposes price reduction targets to suppliers based on large-scale bulk purchases, but these are not mandatory requirements, and negotiations can be conducted.

According to Jiemian News, automakers routinely reduce costs at the beginning of each year, with a 5% reduction being the median for auto parts. The suppliers affected by BYD's 10% cost reduction may involve intelligent driving, glass, wheels, tires, and other fields. Under the pressure of price wars, there is little room for auto suppliers to reduce prices further.

04

It is worth noting that BYD has earned the nickname of "price butcher" in the past two years.

At the beginning of this year, BYD launched the slogan "Electricity is cheaper than oil" and priced plug-in hybrid models below 80,000 yuan, proactively firing the first shot in the 2024 auto market price war. Following this, many automakers such as SAIC-GM-Wuling, Geely, Changan, and Nezha had to follow suit and reduce prices. The first half of the year witnessed an unprecedented brutal price war in the industry.

Besides reducing the price of entire vehicles, BYD has driven round after round of price adjustments in the industry.

05

This time, BYD's controversy stems from the intensifying "elimination round" in the new energy vehicle market. To avoid being eliminated, manufacturers can only continuously intensify price wars, transferring the pressure to upstream manufacturers.

An employee in the automotive chip industry told Yidu Pro that automakers' price wars can only continuously compress the profits of upstream supply chains, leaving many suppliers with less and less room to survive. Some suppliers have to accept price reductions to maintain cooperation with automakers, even at the expense of their profits.

Taking the battery industry player Farasis Energy as an example, it has been losing money for several consecutive years, with a loss of 304 million yuan in the first three quarters. In its mid-year report, Farasis Energy also mentioned that if the automakers' price war intensifies further and the company's cost reduction is less than expected, it will bring risks of revenue and profit decline.

06

The fierce competition in the new energy vehicle market does not believe in tears. BYD's toughness can be seen as a microcosm of responding to market competition. This price war in the automotive industry is crucial for the survival of enterprises, and no one dares to withdraw voluntarily.

However, a brutal price war is not conducive to the healthy and sustainable development of an industry. Facing the industry's "price war," Wei Jianjun, Chairman of Great Wall Motors, and Li Shufu, Chairman of Geely, have both expressed doubts. Li Shufu stated, "Excessive internal competition and reliance solely on price wars may lead to issues such as product quality decline, counterfeiting and fraud, and disorderly competition."

Under the "price war" in the new energy vehicle industry, profit margins are decreasing. Data from the China Passenger Car Association (CPCA) shows that the industry's overall profit margin was only 4.6% in the first nine months of this year, far below the industrial average of 6.1%. In addition, the profit per vehicle is even lower, with data showing that the profit per vehicle in September was only 11,000 yuan, a new low.

07

The low-price war in the e-commerce industry over the past two years has actually served as a reminder to the new energy vehicle industry.

Pinduoduo, which has always adhered to a low-price strategy, has recently been criticized by several well-known entrepreneurs. The low-price system, they say, "is a huge harm to Chinese brands and industries."

Forced low-price competition can lead to a prisoner's dilemma of vicious competition and even damage the reputation of "Made in China."

Pinduoduo has also realized this, and in the third quarter, it began to support upstream merchants, placing more emphasis on the long-term value brought by ecological investment.

08

As a leader in the new energy vehicle industry, while striving to compete for market share and profits, BYD must also realize that the prosperity and development of automakers should not solely rely on their own glory but should deeply care about the stability of the supply chain and the survival status of suppliers.

Only by building a fair, transparent, and sustainable cooperative ecosystem that ensures every link can share the fruits of growth can BYD, its suppliers, and even the entire new energy vehicle industry achieve longer-term development.

Images are from the official website and will be removed upon request.