Li Shufu Corrects Errors, ZEEKR Moves Forward with a 'Heavy' Burden

![]() 11/27 2024

11/27 2024

![]() 460

460

Introduction: Where will the 'new ZEEKR' go after the reorganization of the LYNK & CO brand?

Written by Li Ping | Produced by LiShi Business Review

1

Merger of the Gemini Brands

Geely, which has long been criticized for having too many scattered brands, has finally decided to focus on brand consolidation.

Recently, Geely Automobile announced that Geely Holding and Volvo Cars will sell their shares in LYNK & CO to ZEEKR. Upon completion of the transaction, ZEEKR will hold a 51% stake in LYNK & CO.

Specifically, Volvo Cars will transfer its 30% stake in LYNK & CO to ZEEKR for a consideration of RMB 5.4 billion. Geely Holding will transfer its 20% stake in LYNK & CO to ZEEKR for a consideration of RMB 3.6 billion. Additionally, ZEEKR will acquire an additional 1% stake in LYNK & CO through capital injection, costing RMB 367 million.

After the above transactions, ZEEKR will acquire a 51% stake in LYNK & CO for a total cost of RMB 9.367 billion, while the remaining 49% stake in LYNK & CO will continue to be held by a wholly-owned subsidiary of Geely Automobile. At the same time, Geely Automobile's shareholding in ZEEKR will increase to 62.8%, an increase of 11.3 percentage points from before. Henceforth, LYNK & CO will transition from being a subsidiary of Geely Automobile to being a subsidiary of ZEEKR, a subsidiary of Geely Automobile. Since Volvo will sell all its shares in LYNK & CO, LYNK & CO will completely lose its previously controversial 'joint venture' status.

Over the past decade, Geely has adopted external acquisitions and internal incubation to form a vast automotive brand matrix, including Geely, LYNK & CO, Proton, Reigan, Geometry, JLYQ, Volvo, ZEEKR, Polestar, Lotus, LEVC, RDAR, and more, covering various technological paths such as battery swapping, hybrid, and pure electric. In 2023, Geely Automobile sold 1.6865 million new vehicles, a year-on-year increase of 18%, with 487,500 new energy vehicles sold, an increase of over 48% year-on-year.

The multi-brand strategy has allowed the Geely Group to cover almost the entire automotive market segment, but it has also brought issues such as repeated investments in R&D and channels across brands, as well as inefficient supply chains. In 2023, Geely Automobile's gross profit margin was only 15.28%, lagging far behind competitors like BYD and Great Wall Motors, as well as new energy vehicle companies like Li Auto and Thalys.

In September this year, the Geely Holding Group issued the 'Taizhou Declaration,' clarifying that it will further clarify the positioning of each brand, reduce conflicts of interest and repeated investments, and enhance group operational efficiency. On October 9, Gan Jiayue, CEO of Geely Automobile Group, announced that Geometry would be upgraded from a new energy series to a brand, with Geely New Energy focusing on building the Geometry brand and merging Geometry into the Geometry brand, marking the first major move following the issuance of the 'Taizhou Declaration.'

Regarding this sudden brand integration, the Geely Holding Group stated on its official WeChat account that this strategic integration is a key initiative to implement the strategic framework of the 'Taizhou Declaration,' which will help streamline equity relationships, reduce related-party transactions, eliminate horizontal competition, and unwaveringly promote deep integration and efficient fusion of internal resources.

ZEEKR's predecessor was the electric vehicle business unit of LYNK & CO, and ZEEKR's first car, the ZEEKR 001, was previously the concept car LYNK & CO ZERO. Therefore, ZEEKR's reverse acquisition of LYNK & CO has been humorously referred to as 'the son taking over,' reflecting the higher status of LYNK & CO within the Geely Group compared to ZEEKR.

According to calculations by An Conghui, CEO of ZEEKR, both LYNK & CO and ZEEKR currently invest over RMB 10 billion each in R&D, and they can save RMB 2 billion to 4 billion annually in the future, with an expected 10%-20% reduction in R&D costs. Additionally, the integration of the two brands can achieve a 5%-8% reduction in supply chain costs and a 3%-5% increase in factory utilization rates.

Apart from repeated investments, brand competition and even vicious competition are key factors prompting the Geely Group to integrate its brands. For example, according to Geely's original plan, the LYNK & CO brand focused on gasoline and hybrid vehicles, while ZEEKR focused on pure electric vehicles. However, since 2024, LYNK & CO, which primarily focuses on hybrids, has launched the pure electric vehicle Z10, while the pure electric brand ZEEKR is also actively exploring extended-range technology.

The benefits of merging ZEEKR and LYNK & CO, such as avoiding internal competition and improving R&D and channel efficiency, seem obvious. However, the day after the announcement of the merger plan, ZEEKR's share price on the U.S. stock market fell by nearly 24%, erasing over RMB 10 billion in market value in a single day. So, why did ZEEKR's small and medium shareholders 'vote with their feet' against this seemingly win-win merger plan?

2

Moving Forward with a Heavy Burden

Geely Automobile has long adhered to a multi-brand, multi-channel development model, resulting in numerous brands within the group and severe internal competition for R&D and channel resources. However, under the group's internal horse racing mechanism, Geely's various sub-brands have also undergone genuine market tests, with ZEEKR and LYNK & CO achieving remarkable results.

ZEEKR was established in 2021, originating from the electric vehicle business group of LYNK & CO. In September 2021, the ZEEKR brand began independent operations, focusing on pure electric technology. From 2022 to 2023, ZEEKR delivered 72,000 and 142,900 new vehicles, respectively. In May 2024, ZEEKR successfully listed on the New York Stock Exchange, setting a record for the fastest time from brand launch to IPO for a new energy vehicle brand (37 months).

Li Shufu has always had a deep obsession with Geely's high-end transformation, and ZEEKR has become a crucial part of the group's brand upgrading strategy. With strong support from the Geely Group, ZEEKR has adopted a rapid iteration product strategy, with its ZEEKR 001, ZEEKR 7X, ZEEKR 009, and other products performing impressively in various market segments. Among them, the ZEEKR 001 became the first pure electric luxury model from a Chinese brand to achieve monthly deliveries exceeding 10,000 units, while the ZEEKR 7X became the second ZEEKR model to achieve monthly deliveries exceeding 10,000 units, with deliveries exceeding 20,000 units within 50 days of its launch.

In terms of financial data, from 2021 to 2023, ZEEKR generated revenues of RMB 6.5 billion, RMB 31.9 billion, and RMB 51.7 billion, respectively, with net losses of RMB 4.514 billion, RMB 7.655 billion, and RMB 8.264 billion, respectively. The cumulative loss over the past three years has reached RMB 20.433 billion, averaging RMB 6.8 billion per year.

It is evident that as new vehicle deliveries continue to grow, ZEEKR's revenue has maintained a high growth rate but has consistently been in a state of significant loss. One of the key factors contributing to this is the substantial increase in R&D expenses. Data shows that from 2021 to 2023, ZEEKR's R&D expenses were RMB 3.16 billion, RMB 5.446 billion, and RMB 8.369 billion, respectively, with year-on-year growth rates exceeding 50%. Over these three years, ZEEKR's R&D personnel increased significantly from 2,582 to 7,427, accounting for 44.6% of the total workforce.

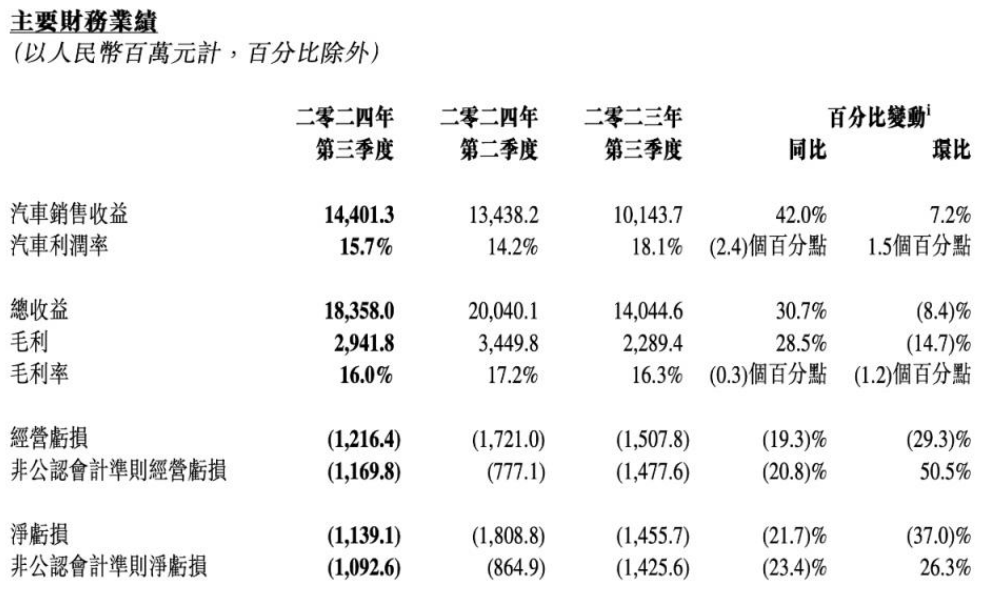

On the same day as the announcement of its controlling stake in LYNK & CO, ZEEKR released its third-quarter financial report. In the third quarter of this year, ZEEKR generated revenue of RMB 18.358 billion, a year-on-year increase of 30.7% and a quarter-on-quarter decrease of 8.4%; the net loss was RMB 1.139 billion, a year-on-year narrowing of 21.7% compared to the same period last year (net loss of RMB 1.456 billion). In the first three quarters of 2024, ZEEKR's cumulative net loss was still as high as RMB 4.97 billion. In terms of sales, ZEEKR sold a total of 168,000 vehicles in the first 10 months of 2024, a year-on-year increase of 82%.

The LYNK & CO brand was born in 2016 as a joint venture between Geely Automobile and Volvo, with its main products covering hybrid and gasoline vehicles in the price range of RMB 100,000 to RMB 250,000. According to Geely Automobile's interim report, in the first half of 2024, the LYNK & CO brand generated revenue of RMB 21.3 billion, a year-on-year increase of 70%, with a net loss of RMB 250 million. In the first 10 months of 2024, LYNK & CO sold a total of 226,700 vehicles, a year-on-year increase of 38%.

It is evident that as the twin stars of Geely's internal incubation, both ZEEKR and LYNK & CO have maintained rapid growth in new vehicle sales. However, due to the intensifying price war in the domestic new vehicle market, both brands are currently in a state of loss. Therefore, ZEEKR, which is already deeply in the red, spending nearly RMB 10 billion to acquire another loss-making brand, will further exacerbate the deterioration of its profit margin at the financial level.

As of the end of the third quarter of 2024, ZEEKR's cash and cash equivalents amounted to RMB 5.64 billion, plus restricted cash of approximately RMB 8.3 billion. Since the acquisition of Volvo's 20% stake in LYNK & CO requires cash payment (RMB 5.4 billion), ZEEKR will also need to borrow from Geely Holding to complete this transaction, which will further deepen its debt burden.

In addition, ZEEKR's current business does not involve vehicle manufacturing but is entrusted to three factories under Geely Holding, including the Ningbo ZEEKR factory. Under this arrangement, ZEEKR only needs to pay Geely Holding for raw materials and processing fees, saving the huge amount of funds that would otherwise be required for investing in factories and production lines.

Currently, LYNK & CO has three production bases in China, located in Zhangjiakou, Hebei; Chengdu, Sichuan; and Yuyao, Zhejiang, producing models such as the LYNK & CO 02 and 03, LYNK & CO 01 and XC40, and LYNK & CO 01, respectively. Therefore, after this acquisition, ZEEKR will also own LYNK & CO's three manufacturing plants, transitioning from its original asset-light model to a normal OEM asset-heavy production model. As a result, ZEEKR's road to profitability, burdened with 'heavy' assets, will likely be even longer.

3

Integration is Not Easy

As mentioned earlier, one of the key factors driving the merger of ZEEKR and LYNK & CO is the impending brand competition and even vicious competition between the two parties. In September of this year, LYNK & CO, which primarily focuses on hybrids, officially entered the pure electric vehicle market by launching its first pure electric car, the Z10, priced between RMB 196,800 and RMB 288,800. However, due to its similarity in appearance and craftsmanship to the ZEEKR 001 and 007, the launch of the Z10 has once again raised questions in the market about 'sibling rivalry.'

According to available information, the LYNK & CO Z10, ZEEKR 001, and ZEEKR 007 are all based on Geely's HAO architecture. In terms of the three-electric system, the Z10 is equipped with the same 'Golden Brick' battery as the older ZEEKR 007 and the same rear-wheel drive motor as the older ZEEKR 001. In comparison, the new ZEEKR 001's single-motor version has increased its maximum power from 200 kW to 310 kW, while its four-wheel drive version has increased its combined power from 400 kW to 580 kW.

Due to the lack of sincerity and highlights in terms of technology and product strength, the total deliveries of the Z10 in the first two months after its launch were less than 5,000 units. In contrast, the ZEEKR 007, which is priced higher and smaller than the LYNK & CO Z10, delivered over 10,000 units in its first two months on the market. The sales failure of the LYNK & CO Z10 may be an important reason that prompted Geely's senior management to make a decision on brand integration.

According to An Conghui, CEO of ZEEKR, after the merger, ZEEKR and LYNK & CO will maintain a dual-brand strategy and remain relatively independent in the market. At the product level, ZEEKR is positioned as a luxury technology brand targeting the mainstream luxury market and focusing on medium and large models; LYNK & CO covers the mid-to-high-end market and focuses on small and medium models. In terms of powertrain options, LYNK & CO's small cars focus on pure electric, while medium-sized cars are hybrids; ZEEKR's medium-sized cars focus on pure electric, and large cars are hybrids.

It is evident that there is not much change in the brand positioning of ZEEKR and LYNK & CO before and after the merger. Among them, the trend for LYNK & CO to enter the pure electric market and ZEEKR to focus on hybrids remains the same, with only distinctions made based on model types, but these are merely one-sided internal distinctions. If both parties continue to adhere to the path of ZEEKR focusing on pure electric and LYNK & CO on hybrids, the mere adjustment of equity does not hold significant meaning.

Perhaps, after a transitional period for the dual-brand strategy of ZEEKR and LYNK & CO, abolishing the LYNK & CO brand would be a better choice. After all, in terms of sales and brand awareness, ZEEKR's influence in the high-end market is still far inferior to that of NIO, making it unnecessary to retain both brands.

On one hand, there are years of continuous losses; on the other hand, there are increasingly heavy assets; and on the third hand, integration is not easy. The future path for Geely's 'twin stars' is not an easy one. Apart from partial improvements in areas such as repeated investments and supply chain efficiency, issues such as brand competition, overlapping price points, and internal competition faced by ZEEKR are difficult to fundamentally change, which is also a deep-seated reason for the sharp drop in its share price.