The present and future of China's automotive market after annual production of new energy vehicles surpassed 10 million

![]() 11/25 2024

11/25 2024

![]() 589

589

The news that annual production of new energy vehicles has surpassed 10 million has become a catalyst for recent market focus on the automotive industry. Since October, the recovery of the consumer market has driven enthusiasm for automobile consumption, and the successive auto shows and promotional activities have also increased attention to the new energy vehicle market. Recently, the release of third-quarter financial reports by various automakers has also attracted capital attention from automakers on the capital market.

Looking back at the year 2024, which is coming to an end, it may have been a relatively tumultuous year for new energy vehicles. At the beginning of the year, there was a trend of slowing sales. In the second quarter, the automotive industry caught up with the wave of going overseas. In the third quarter, it faced suppression and restrictions on China's automobile exports in overseas markets, as well as the ongoing fierce competition among domestic automakers. The market is turbulent, making its prospects somewhat uncertain.

What kind of environment is the current domestic new energy vehicle market in? How did well-known brands perform in 2024? Looking ahead, what opportunities and challenges will the new energy vehicle industry face? This article will briefly analyze the above content to explore the current state of the new energy vehicle market at this point in time.

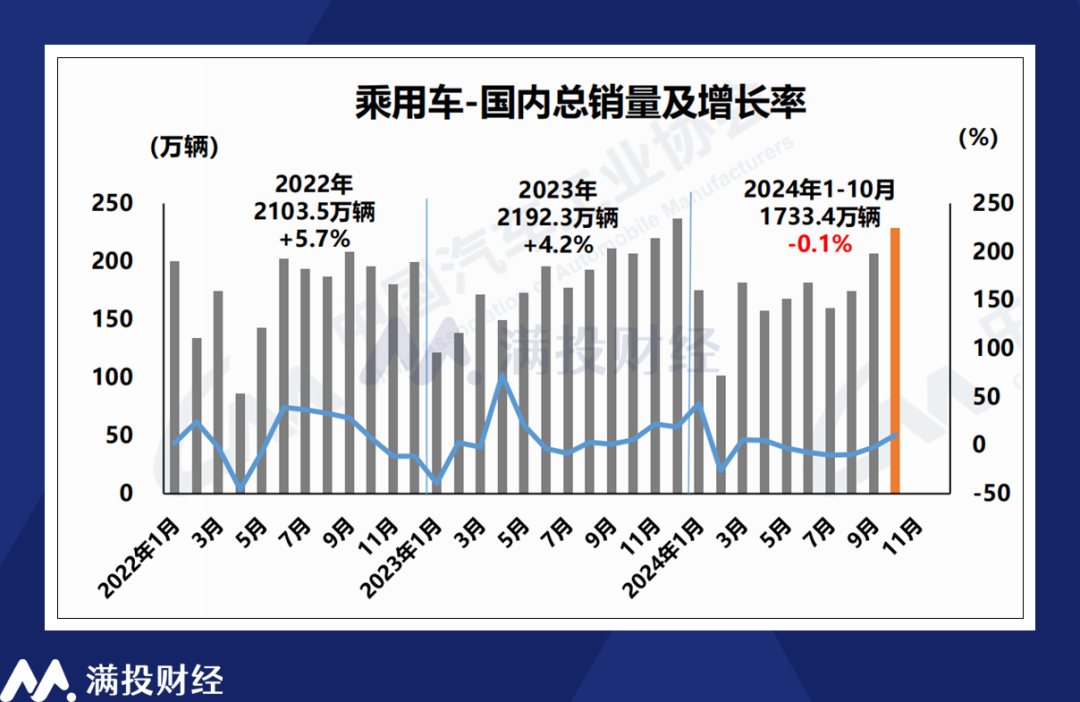

Judging from the market sales data from August to October, domestic passenger cars regained market demand in the fourth quarter, shaking off the previous negative growth under pressure. According to the China Association of Automobile Manufacturers, domestic passenger car sales in October were 2.289 million units, with a year-on-year and month-on-month increase of 10.7%. However, from a full-year perspective, domestic passenger car sales from January to October were 17.334 million units, a year-on-year decrease of 0.1%. Among them, sales of domestic traditional fuel passenger cars were 9.046 million units, a year-on-year decrease of 20.5%, which was the main reason dragging down overall automobile market sales.

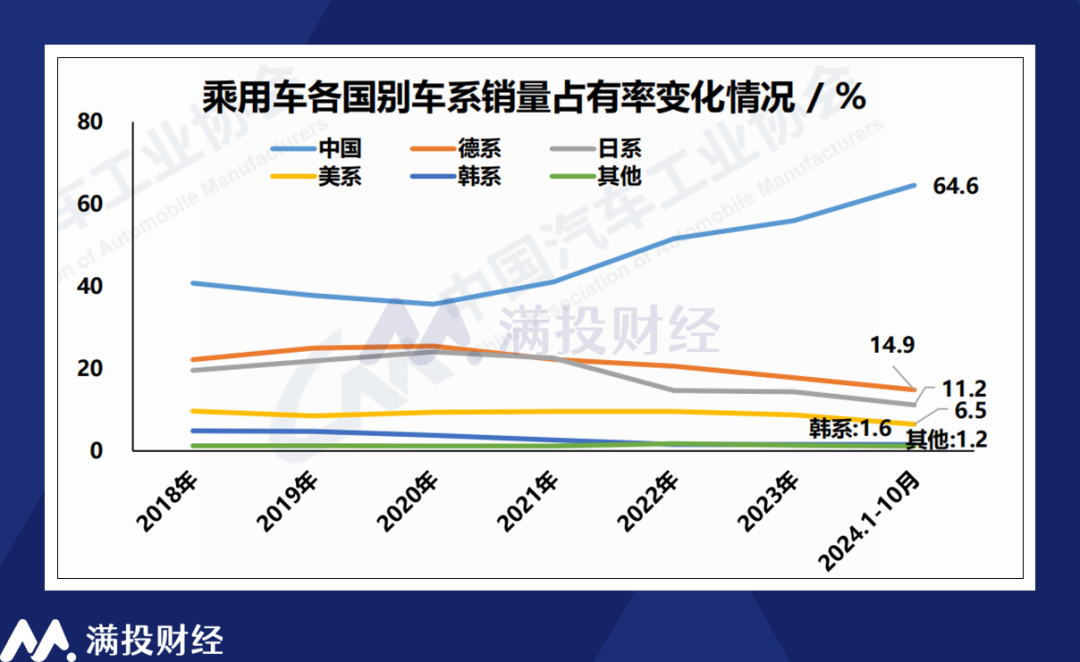

Thanks to the rise of the domestic automotive supply chain, the market recognition of domestic brand passenger cars has risen rapidly in recent years, and the sales gap with imported brand passenger cars has gradually widened. From January to October 2024, sales of Chinese brand passenger cars reached 13.849 million units, a year-on-year increase of 21.2%, accounting for 64.6% of total automobile sales, an increase of 9.3 percentage points from the same period last year. Correspondingly, the sales share of imported brands, especially Japanese brands, has declined significantly, which has also put pressure on the performance of some domestic enterprises.

Looking solely at new energy vehicle sales, domestic new energy passenger car sales from January to October were 8.288 million units, a year-on-year increase of 38.6%, accounting for 47.8% of domestic automobile sales. Since August 2024, the penetration rate of new energy vehicles in overall passenger car sales has exceeded 50% for three consecutive months, setting a new record high for six consecutive months, which is also regarded as a milestone moment for the new energy vehicle industry. If we delve into the reasons, subsidy policies may have played a significant role.

In August 2024, the Ministry of Commerce issued the "Notice on Doing a Good Job in Related Work Regarding the Trade-in of Old Cars for New Ones," increasing subsidies for purchasing new energy vehicles/fuel vehicles with scrapped old cars to RMB 20,000/RMB 15,000, doubling the previous subsidies. After the subsidy funds were allocated in August, the sales penetration rate of new energy vehicles began to exceed 50%, and domestic passenger car sales also showed a significant recovery, demonstrating the effectiveness of the trade-in policy. According to recent news, this policy will continue in 2025.

Judging from export data, from January to October, China's automobile exports reached 4.855 million units, a year-on-year increase of 23.8%, of which passenger car exports were 4.1 million units, a year-on-year increase of 24%. Breaking down the categories, 3.798 million units were traditional fuel vehicles, and 1.058 million units were new energy vehicles. It can be seen that although the export growth rate of new energy vehicles has indeed slowed down due to policy guidance in some European and American countries, its overall scale is still on the rise.

According to information disclosed by the General Administration of Customs, as of September, the top three export markets for Chinese automobiles were Russia, Mexico, and the United Arab Emirates. Focusing on the new energy vehicle market, the top markets were Belgium, Brazil, and the United Kingdom. Although there is market opinion that Chinese automobiles face policy restrictions from overseas markets, many countries also welcome Chinese exported automotive products. In future automobile export strategies, compared to breaking down barriers in European and American markets, developing more new international markets may be the direction automakers will choose.

Overall, the domestic passenger car market is relatively saturated, and the incremental space of the overall market is limited. The growth of new energy vehicles is also based on the substitution effect of traditional fuel vehicles. Because the domestic "cake" is only so big, enterprises existing in the market will fall into increasingly fierce competition. Stock competition is always cruel. Relatively speaking, although overseas markets are hindered, the incremental space is still worth looking forward to. If Europe and the United States are not an option, there is still the Middle East, Latin America, Asia, and even Africa. The export of independent automobile brands is still a major trend, and there is no need to be overly concerned about the impact of short-term policies.

At the corporate level, with the recovery of the automotive market atmosphere from August to October, most new energy automakers delivered remarkable production and sales reports and financial statements in the third quarter. With the support of subsidy policies, new energy automakers have delivered impressive results in terms of production, sales, and gross profit. Among them, the larger BYD and Geely Automobile may have been affected by the market, with their gross profit margins underperforming those of new carmaking forces on a quarter-on-quarter basis.

Among the listed new energy vehicle enterprises, two companies are noteworthy. The first is NIO Auto (09863.HK), whose third-quarter deliveries increased significantly, setting new delivery highs for several consecutive months. The October delivery data even reached 38,177 units, a year-on-year increase of 109.7%. The gross profit per vehicle in the third quarter reached RMB 9,000, the best level in history. Although the adjusted profit is still negative, its sales volume is remarkable in terms of scale and growth rate.

The second is the news of the merger of Lynk & Co and Zeekr under Geely Automobile (00175.HK), which has sparked speculation in the market about brand consolidation trends. As the competition in the new energy vehicle market enters the second half, the number of automotive brands on the market is decreasing significantly. Geely Automobile's integration of the Zeekr and Lynk & Co brands this time may mean that electric vehicle brands in the market will undergo further consolidation and contraction, gradually approaching a situation where a few leading companies stably occupy market share, similar to the smartphone market.

In terms of risk factors, NIO is a representative of the new carmaking forces that did not perform well in the third quarter. From a performance perspective, its third-quarter revenue and gross profit showed certain quarter-on-quarter improvements, but corresponding promotional expenses and R&D expenditures also increased simultaneously, resulting in limited profit improvement. The company's sales guidance for the fourth quarter was also slightly lower than expected. Considering that NIO's current strategy tends to "bet on new models" and "reduce costs and increase gross profit," the company's profitability may face more challenges in the future.

From the perspective of traditional automakers, their performance is affected by the results of their going overseas strategies and new energy transformation. There are cases like Great Wall Motors (02333.HK) that have doubled profit growth by transforming products to new energy and increasing exports to drive profitability. There are also cases like GAC Group (02238.HK) where poor performance of independent brands and losses caused by joint venture brands have led to amplified losses. It can be said that the performance differentiation in the automotive industry is mainly concentrated in traditional automakers.

It is worth mentioning that in October 2024, BYD (01211.HK), the industry leader in new energy vehicles, achieved monthly sales exceeding 500,000 units, and BYD also welcomed the offline production of its 10 millionth new energy vehicle on November 18 of this year. As a representative enterprise transforming from a traditional fuel vehicle manufacturer to a new energy electric vehicle manufacturer, BYD's achievements mirror those of China in the field of new energy vehicles. Enterprises or countries that are slightly slower in this regard will require more costs and a longer transition period.

Looking ahead to the future of the new energy market, most automakers actually know the standard answer: intelligent driving and going overseas. With the electrification of automobiles basically mature and battery endurance already meeting the needs of most markets, the intelligent driving capabilities of automobiles will be the key for automakers to stand out.

Judging from the past L1-L5 level classification of intelligent driving systems, the intelligent driving systems of most domestic brands currently do not reach the L3 level. Among the existing intelligent driving systems, Huawei HarmonyOS Intelligent Driving has a clear advantage in the field of intelligent driving. It has built a full industrial chain layout from chips to operating systems to applications, and the replicability of its cooperation model has also been verified. Judging from the results, Huawei's intelligent driving has fed back into automobile sales, which has been reflected in the sales performance of automotive brands such as AITO and HiPhi. In the layout of subsequent models, it has also brought greater competitive pressure to traditional "new carmaking forces."

As for "NIO, Xpeng, and Li Auto," their continuous investment and first-mover advantage in intelligent driving ensure that they are still in the first tier of the intelligent driving field. Xpeng and NIO's accumulation in full-scene intelligent driving makes their intelligent driving performance on par with HarmonyOS Intelligent Driving. Li Auto started late in the field of intelligent driving, but as the only profitable company among the three swordsmen, Li Auto has more advantages in investment in AI and intelligent driving, and its catch-up speed in intelligent driving is also relatively fast. Judging from recent financial report meetings, all three companies have increased their investment in intelligent driving to ensure their leading edge.

In my opinion, traditional automakers have achieved remarkable results in their transformation of new energy brands during the period from 2023 to 2024. The brands competing in the new energy vehicle market are quite different from the past. Brands such as AITO, Zeekr, Lantu, AVIATAR, and SL03 all have "backers," while relatively pure "new carmaking forces" such as "NIO, Xpeng, and Li Auto," Nezha, or Xiaomi have become the minority.

When technological iteration slows down, it is relatively easy for traditional automakers with traditional automaking industry and resource accumulation to catch up with new forces. The cooperation model of HarmonyOS Intelligent Driving also significantly shortens the first-mover advantage of "new carmaking forces" for traditional automakers in terms of intelligent driving. For new carmaking forces, it is difficult to compete with traditional automakers on cost in such an environment. What they can do is probably to further improve technology and innovation to stabilize their moat with product strength.

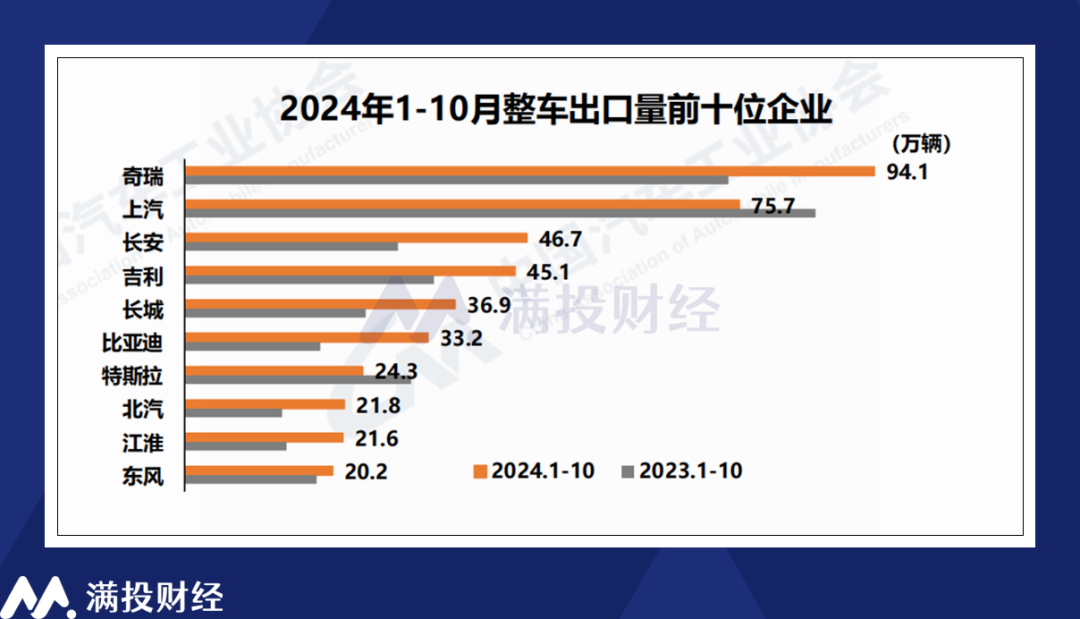

Besides intelligent driving, the overseas export of automotive products is another way out, as can be seen from the previous text. However, going overseas requires enterprises to have sufficient capital costs to support a series of sunk costs such as international trade, overseas factories, and local sales channels. Judging from the current domestic automakers, it is mainly traditional automakers with relatively strong financial strength that have achieved remarkable results in this regard. From January to October 2024, Chery, SAIC, and Changan were the three enterprises with the largest export volume, while BYD, BAIC, and Changan were the automakers with the fastest export growth.

On November 23, the factory jointly established by Chery and the Spanish company Ebro officially announced the start of production, opening a new chapter in capacity exports. Although the current trade barriers facing going overseas are increasing, capacity exports are still a must for Chinese automakers. The transformation from "exporting" to "going overseas" is also a necessary path for the Chinese automotive industry, just like the rise of Japanese and Korean car series in the past.

Whether it is going overseas or pursuing intelligent driving, it will increase the cost pressure on enterprises. Although many new carmaking forces have achieved the ability to make positive profits in terms of gross profit, increased investment still keeps them in a state of long-term net loss. For automakers that have recently accelerated overseas factory construction and built an overseas matrix, increased expenses may also be inevitable.

Looking ahead, automakers that have passed the construction period still have unlimited imagination space. In terms of the market, it is worth paying attention to whether the scale and penetration rate of new energy vehicles in the overall automotive market can be further improved. For overseas enterprises, the proportion of their overseas revenue is a symbol of their achievements. After achieving stable profits in overseas markets, the company's profits and valuation are expected to increase step by step.