Net profit declines by more than 90%, GAC Group embarks on 'second venture'

![]() 11/11 2024

11/11 2024

![]() 386

386

Produced | Tanking Travel

Art Editor | Qianqian

Reviewed | Songwen

At the end of October, Xiao Lin (pseudonym), who works at GAC Research Institute, was surprised to find that the words "GAC Research Institute" at the entrance had quietly changed to "GAC Group".

Xiao Lin wasn't exactly surprised by this change, but rather felt a bit melancholy. "Colleagues from the group headquarters suddenly moved from the CBD to the countryside."

In fact, the relocation of GAC Group's headquarters has long been no secret. Starting from early October, information about GAC Group's impending move from the CBD had already been circulating among the public.

On October 25, rumors of the relocation finally came to fruition. GAC Group issued a "Proposal on Management Mode and Organizational Structure Reform," announcing its agreement to shift the management mode of its independent brands from strategic control to operational control, and simultaneously implementing related organizational structural reforms to further reduce operating costs and improve management efficiency.

It is noteworthy that along with the organizational reform, the group headquarters also relocated en masse from the Zhujiang New Town CBD to the Panyu Auto City, where GAC Trumpchi, GAC AION, and GAC Research Institute are located.

According to GAC Group, the purpose of the management mode reform and relocation plan is to promote the concentration of all factors toward frontline operations.

GAC Group indeed needs to move closer to the frontlines.

Official production and sales bulletins show that from January to October this year, GAC Group's cumulative sales volume was 1.5208 million units, a year-on-year decline of 24.66%. Among them, new energy vehicle sales were 264,900 units, a year-on-year decline of 32.51%. New energy vehicle sales accounted for only about 20% of the group's total sales.

In terms of financial data, GAC Group has continued its loss trend this year, with net profit attributable to shareholders in the first three quarters falling by over 90% year-on-year, making it one of only two major automakers to experience such a decline.

For today's GAC Group, reform is not just a slogan; it is a necessary path to survival, born out of deep reflection on past difficulties.

1. Joy of relocation, but performance still lags

November 4, a new Monday.

The headquarters, which has relocated to Panyu Auto City and officially changed its name to GAC Group, welcomed the official move-in of headquarters staff.

A giant signboard with the "GAC Group" logo was prominently displayed at the entrance, grand and eye-catching. Keen-eyed GAC employees noticed that even the road signs at the intersection had been specially replaced with "GAC Group." Despite the relatively tight timeline for relocation, the preparations for the venue were quite impressive in all aspects.

(Photo / Unveiling of GAC Group's Panyu Headquarters)

On that day, many GAC colleagues shared a video titled "Creating New Glories" by GAC Group on their social media. However, today's GAC has no "glories" to speak of. Even the lively and festive atmosphere could not conceal the poor performance.

GAC Group's latest third-quarter report shows that the company's revenue for the first three quarters was 74.741 billion yuan, with a growth rate slowing by 23.88% year-on-year, and net profit attributable to shareholders fell by 97.34% to only 120 million yuan.

Since 2024, loss of momentum seems to have become a keyword for GAC Group, especially in the third quarter. Financial report data shows that GAC Group's loss in the third quarter reached 1.396 billion yuan, a year-on-year decrease of 190%, directly "erasing" the first half's profit of 1.516 billion yuan.

Behind this situation lies the overall business challenges—weak joint venture brands and independent brands unable to carry the load.

Data shows that in the first three quarters of this year, sales of the two major joint venture brands, Guangfeng and Guangben, both declined by double digits; sales of AION declined by over 35% year-on-year in the first three quarters.

Specifically, in the first three quarters of this year, GAC Group sold a total of 1.335 million new vehicles, a year-on-year drop of 25.59%. Among them, the ever-declining "two Toyotas" (Honda and Toyota) remained the mainstay of sales.

GAC Honda sold 309,200 units in the first three quarters, a year-on-year decrease of 29.06%; GAC Toyota sold 517,900 units in the first three quarters, a year-on-year decrease of 24.49%. Joint venture brands are still GAC's profit cows, but today's joint venture brands are no longer making easy money.

The situation of independent brands is not much better. GAC AION sold 226,700 units in the first three quarters, a year-on-year decline of 35.4%; GAC Trumpchi sold 277,000 units, a year-on-year decline of 6.4%, showing relatively stable performance.

In fact, the "demise" of GAC's joint venture brands is a cruel situation currently faced by the entire industry, but the decline of the two major independent brands is relatively rare.

In the first nine months of this year, the market share of China's independent brands in the passenger vehicle market has reached 63.4%, and it is expected that the annual share will stably exceed 60%, with a steady increase in market share.

This scenario, which runs counter to the overall market trend, also exposes the last "fig leaf" of GAC Group.

In the view of Zhang Xiang, Secretary-General of the International Intelligent Transportation Science and Technology Association, whether it is the transformation and development of joint venture brands or the product strength building of independent brands, GAC should now face and urgently address these issues.

2. Cost reduction and inventory clearance are priorities for survival

Whether GAC acknowledges it or not, based on the current sales and profit situation, GAC may continue to experience losses in the fourth quarter. Survival is the top priority.

Most directly, relocating from Zhujiang New Town CBD, the core area of Guangzhou, to Panyu Auto City is already the most direct manifestation of cost savings and efficiency improvement.

As early as last year, GAC Group, especially its joint venture brands, had already sensed the arrival of a "cold winter" in advance.

Last July, GAC Toyota initiated a large-scale layoff in the Chinese market, affecting over a thousand employees.

By the end of the year, GAC Honda also reported layoffs affecting about 900 employees. In May this year, GAC Honda announced another layoff of over 1,700 employees, bringing the cumulative layoff scale in the two rounds to about 20% of its employees in the Chinese market.

Perhaps affected by sales expectations in the Chinese market, in September this year, Honda announced the closure of two production lines in China, including GAC Honda's annual production line with a capacity of 50,000 units. The related costs incurred from closing this production line totaled over one billion yuan, which were collectively accrued as "one-time expenses" in the third-quarter report.

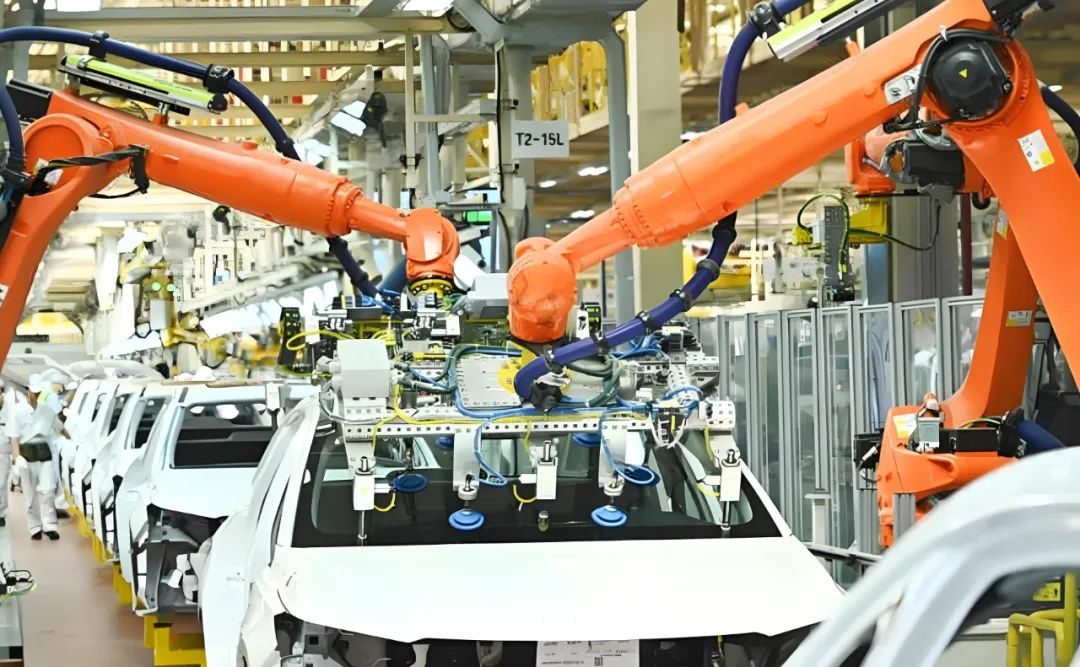

(Photo / GAC Group's official website)

Joint ventures are no longer the "evergreen tree" of GAC Group; instead, they have become a channel for cost reduction and efficiency improvement.

In the past, GAC Group owned multiple joint venture brands, including GAC Honda (Acura), GAC Toyota, GAC Fiat Chrysler, and GAC Mitsubishi, which can be considered the most in the industry. However, with the exception of GAC Honda and GAC Toyota, which still maintain their respective volumes, the other three brands have become a thing of the past.

Today's pressures are incomparable. GAC has reluctantly begun to "cut" into the two Toyotas (GAC Toyota and GAC Honda).

In addition to a series of cost reduction measures on the production side, promotional and inventory clearance activities on the terminal side have also become more frequent.

Previously, Tanking Travel visited multiple GAC Honda and GAC Toyota 4S stores and found significant discounts at the terminals. The GAC Honda Accord, with a guide price starting at 179,800 yuan, had a final price as low as around 120,000 yuan at the terminal, with a discount of nearly 60,000 yuan; GAC Toyota's prices were relatively firm, with discounts of over 30,000 yuan for its main sales model, the Camry.

Regarding GAC AION, according to Tanking Travel's understanding, the AION Y Plus 510 version, with a guide price of 121,800 yuan, can be as low as about 86,000 yuan in Guangzhou after a local trade-in subsidy of 14,000 yuan and an official direct discount of about 20,000 yuan.

It is reported that GAC has actively taken measures to clear inventory. In the first three quarters, the company's wholesale sales volume was 1.335 million units, while terminal sales volume was 1.433 million units, consuming about 100,000 units of inventory.

3. Transformation requires hardship

GAC, a giant in the automotive industry, did not suddenly "fall from grace."

The problems caused by eating off the dividends of joint venture brands and the slow progress of independent brands have long existed and have been constantly eroding this automaker.

Under such circumstances, financial report information shows that despite an increase in sales and administrative expenses in the first three quarters of this year, GAC's research and development expenses decreased by 300 million yuan compared to the same period last year, which is particularly rare in today's R&D-oriented environment.

While internal R&D investment has decreased, the group has instead frequently "bet" on external investments. According to incomplete statistics from Tanking Travel, GAC has frequently invested in high-end intelligent driving upstream and downstream companies in recent years, including Horizon Robotics, RoboSense, and Black Sesame Intelligent (a Chinese autonomous driving company).

In Zhang Xiang's view, early investments can indeed save GAC Group a lot of technology investment costs, but under the circumstances of slow progress in its main business, external investments appear quite awkward.

Today's GAC should clearly focus more on the development and transformation of its own business.

It is reported that GAC has internally pointed out the need to comprehensively learn from BYD and SAIC Motor for cost reduction, calling on in-house component enterprises to give up profits first to ensure the survival of the entire vehicle.

This is bound to be a comprehensive reform from the inside out.

According to Tanking Travel's understanding, while closing gasoline vehicle production lines, GAC Honda's new energy vehicle production plan has taken shape, with an annual production capacity of 120,000 new energy vehicles planned to be put into production by the end of the year. At the same time, the electrification plans of the "two Toyotas" have also accelerated accordingly. GAC Honda's Ye product series will be unveiled at the Guangzhou Auto Show, and GAC Toyota's new generation of pure electric vehicles are also being promoted.

However, it needs to be clarified that while the transformation of joint venture brands is underway, the release of results is far from as rapid as imagined. Multinational automakers always face the problem of being "too big to turn around."

In comparison, GAC needs more direct and effective changes brought about by the transformation of independent brands.

In fact, as one of the earliest traditional automakers to internally incubate new energy brands, GAC Group has invested a lot in AION and enabled its rapid growth and expansion.

Since its establishment in 2017, GAC AION has been deeply engaged in the pure electric vehicle market and, in just six years, has become the fastest enterprise to surpass one million cumulative production and sales of pure electric vehicles.

However, market changes are rapid and profound, and core competencies such as product competitiveness, new product launch speed, and intelligent driving are putting GAC AION through market tests far exceeding those of the past.

(Photo / GAC Group's official Weibo account)

Even in terms of the speed of new product launches alone, it is evident that GAC AION's pace has slowed down, seemingly out of sync with the market. In terms of product strength, the failure to achieve premiumization also makes AION's brand power lack recognition in the market.

At the beginning of this year, Gu Huinan, General Manager of GAC AION, admitted in an interview with the media that in order to support the development of the premium brand Hyperion, AION had not launched a new car in nearly two years. It was not until the second half of this year that the AION V Bully Dragon was officially launched, signaling the beginning of AION's new car replacement.

However, with the accumulation of two years, AION has already missed out on too much of the market.

According to reports, during this reform, GAC Group also stated that under the new management mode, each model of the independent brands will set market sales targets based on product positioning from the research and development stage, making product development more market-oriented.

Today's GAC has finally realized the critical nature of marketization.

Identifying the right product positioning and meeting user pain points are essential to truly get consumers to buy. For GAC, it is necessary to truly adapt to the times and make good products to survive.

When GAC Group relocated to its new site, Chairman Zeng Qinghong, General Manager Feng Xingya, and other leaders pulled up a banner with the words "Embark on a Second Venture, Compete for the Lead, and Rush Ahead," demonstrating their determination for reform.

And indeed, GAC Group has reached a critical juncture for its second venture.

The group's announced sales target for 2024 was 2.75 million units. As of the first three quarters, GAC Group's cumulative sales volume was only 1.335 million units, achieving only 48.5% of the expected target.

Today's GAC is the time to make changes.