The Surprising Third Largest Mobile Phone Brand: Not Xiaomi, but Another Domestic Player?

![]() 04/25 2025

04/25 2025

![]() 507

507

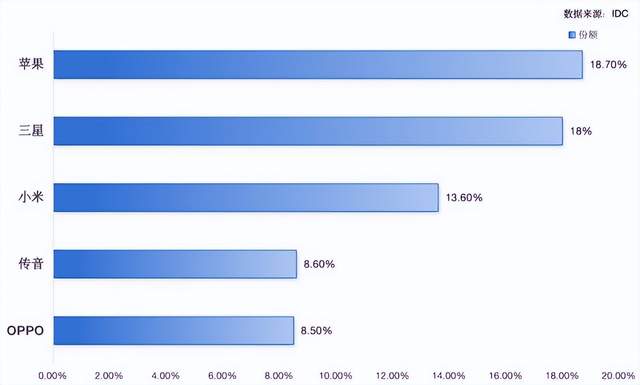

In general perception, the global mobile phone market is seemingly set in stone: Apple and Samsung securely hold the top two spots in the high-end market, followed by Xiaomi, OPPO, and vivo, leveraging their localization advantages.

TECNO, on the other hand, experiences fluctuations in ranking, sometimes landing in fourth, fifth, or sixth place, making a top-three position seem improbable.

However, when we broaden our focus from just the smartphone market to the entire mobile phone industry, a revelation unfolds—combining feature phone and smartphone sales, TECNO consistently ranks as the world's third-largest domestic mobile phone brand, not Xiaomi.

The 'Hidden Rule' Behind Smartphone Rankings

Currently, mobile phone rankings default to smartphones as the primary statistical dimension. Market research firm data indicates that global smartphone shipments in 2024 totaled approximately 1.24 billion units, with Samsung, Apple, and Xiaomi occupying the first, second, and third positions, respectively, followed by TECNO, OPPO, and vivo.

This ranking logic stems from the industry consensus that the feature phone market is gradually declining. In an era of rapid advancements like 5G and foldable screens, feature phones appear to be a 'sunset industry,' primarily used by a minority in developing countries and specific demographics.

Yet, what many overlook is that annual global sales of feature phones still exceed 300 million units. This means that for every four mobile phones sold globally, one is a basic model supporting only calls and text messages.

Particularly in regions like Africa, South Asia, and Latin America, feature phones remain the primary entry point for many into mobile communications, with TECNO dominating this 'hidden battlefield.'

The Underestimated Empire of Feature Phones

When combining feature phone and smartphone sales, the true landscape of the global mobile phone market comes into view: Samsung retains its top position with annual sales exceeding 300 million units (including approximately 80 million feature phones), Apple ranks second with 230 million pure smartphone sales, and TECNO surges ahead of Xiaomi with a total sales volume of 190 million units (including approximately 80 million feature phones), firmly establishing itself as the third largest globally.

This achievement is not a coincidence—in Africa, TECNO's feature phone market share has long surpassed 50%; in India, its feature phone brand itel consistently tops sales charts; even in markets like Bangladesh and Pakistan, TECNO's feature phone shipments far outstrip local smartphone sales.

Why Feature Phones Support Half of TECNO's Business? The Answer Lies in Africa and Rural Areas. Addressing challenges such as unstable power grids, numerous carriers, and limited consumer budgets in Africa, TECNO has developed feature phones with ultra-long battery life, quad-SIM support, and sweat and dust resistance, priced as low as $10. Critically, it has minimized costs through localized production—in an Ethiopian factory, the production cost of a feature phone is less than $5, yet it meets local users' core needs for 'durability, affordability, and ease of repair.'

From 'King of Africa' to a Global Challenger

TECNO's rise serves as a model for Chinese manufacturing going global. In 2006, Zhu Zhaojiang, TECNO's founder, left Bird Mobile and established TECNO Mobile in Shenzhen. Avoiding China's competitive market, he targeted Africa, a region neglected by giants: with a population exceeding 1.3 billion, a mobile phone penetration rate below 30%, and challenges like linguistic diversity and infrastructure lags.

TECNO's breakthrough strategy was to understand Africa better than local brands—optimizing beauty algorithms for users with darker skin, introducing high-power speaker feature phones tailored to musical culture, and even developing smart voice assistants capable of recognizing multiple African dialects.

Today, TECNO's footprint spans over 70 emerging market countries, with a feature phone to smartphone sales ratio of approximately 1:1. However, the company hasn't rested on its 'King of Feature Phones' laurels: In Africa, its smartphone brands TECNO and Infinix hold over 40% market share; in Pakistan, TECNO's smartphone shipments surpassed Samsung to rank first; in Bangladesh, its market share exceeds 25%. Notably, TECNO is breaking into the mid-range market, with its $150 5G smartphone launched in 2024 sparking a buying frenzy in multiple African countries.

'Another Path' for Domestic Mobile Phone Brands

While domestic manufacturers compete fiercely with Apple and Samsung in the high-end market, TECNO has embarked on a distinct globalization path: eschewing parameter stacking and marketing gimmicks, it instead pushes 'localized innovation' to the extreme.

This 'grassroots innovation' is translating into substantial commercial returns. In 2024, TECNO achieved revenue of 68.7 billion yuan and a net profit of 5.5 billion yuan, with a gross profit margin far surpassing that of domestic peers.