Halfway through the fiscal year, Japanese automakers face different challenges

![]() 11/11 2024

11/11 2024

![]() 561

561

Introduction

The Chinese market has become a "required course" for the top three Japanese automakers.

Early November each year marks the date when Japanese automakers release their second fiscal quarter (July to September 2024) results for the March 2025 fiscal year (April 2024 to March 2025).

A longitudinal examination of Japanese automakers' financial reports over the past few years reveals a mixed picture of success and struggle. This is because, for most of the time, even when several automakers fell short of expectations, Toyota, as the leader of Japanese automakers, could still maintain a strong foothold in key areas like profit, helping the Japanese automotive sector "turn the tide."

However, this time around, even Toyota has experienced a year-on-year decline of up to 55% in net profit. Looking at the data, other Japanese manufacturers are also grappling with their own set of challenges. Notably, Nissan announced a 20% reduction in global production capacity and 9,000 layoffs following the release of its financial report.

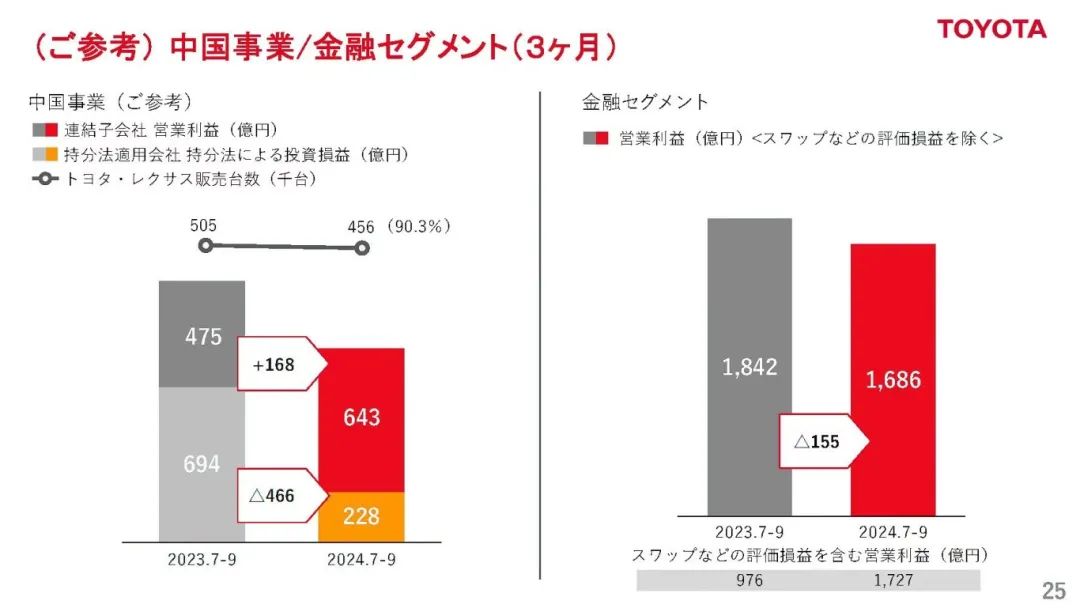

Toyota: Just a minor scratch

Toyota's operating revenue for July to September was 11.44 trillion yen, roughly the same as the previous year, with an operating profit of 1.16 trillion yen, a 20% decrease year-on-year. The most significant fluctuation was in net profit, which totaled 573.7 billion yen, halving from the 1.28 trillion yen recorded in the same period last year.

Particularly noteworthy is the operating profit, which fell 20% year-on-year in this quarter, missing market expectations. This marked the first time in two years that Toyota experienced a quarterly decline in operating profit.

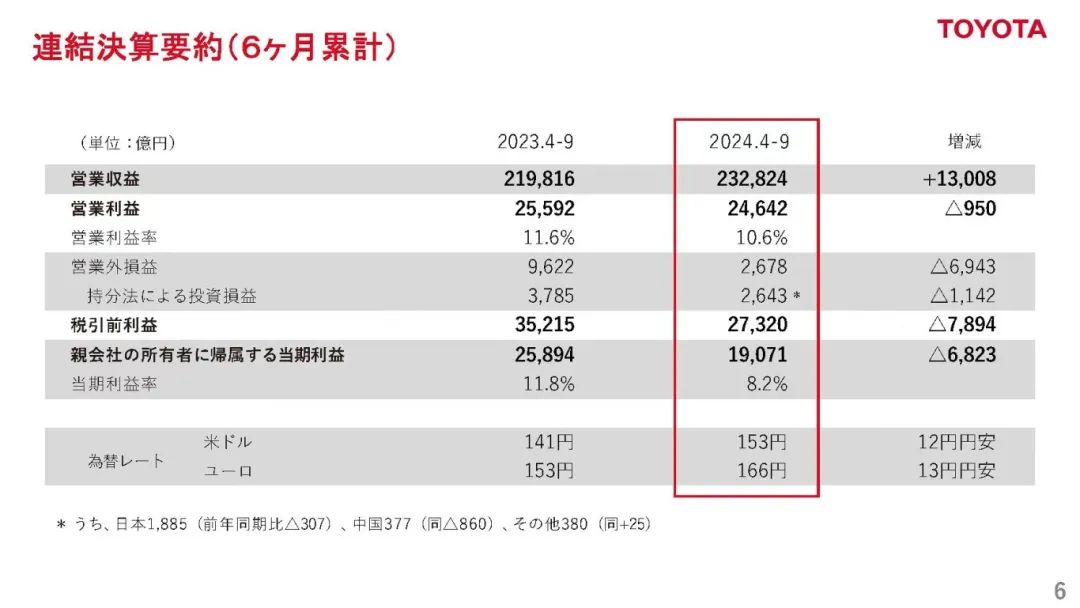

For the half-year period (April to September 2024), Toyota's operating revenue reached 23.28 trillion yen, an increase of 5.9%; operating profit was 2.46 trillion yen, a decrease of 3.7%; and net profit was 1.9 trillion yen, a decline of 26.4%.

Nevertheless, Toyota's operating profit for the first half still exceeded 2 trillion yen. Despite the decline, this performance is still commendable, coming in second only to last year's record-high profit.

Moreover, as the world's most profitable automaker, Toyota's profit per vehicle remains as high as 226,000 yen, with a gross profit margin exceeding 20%.

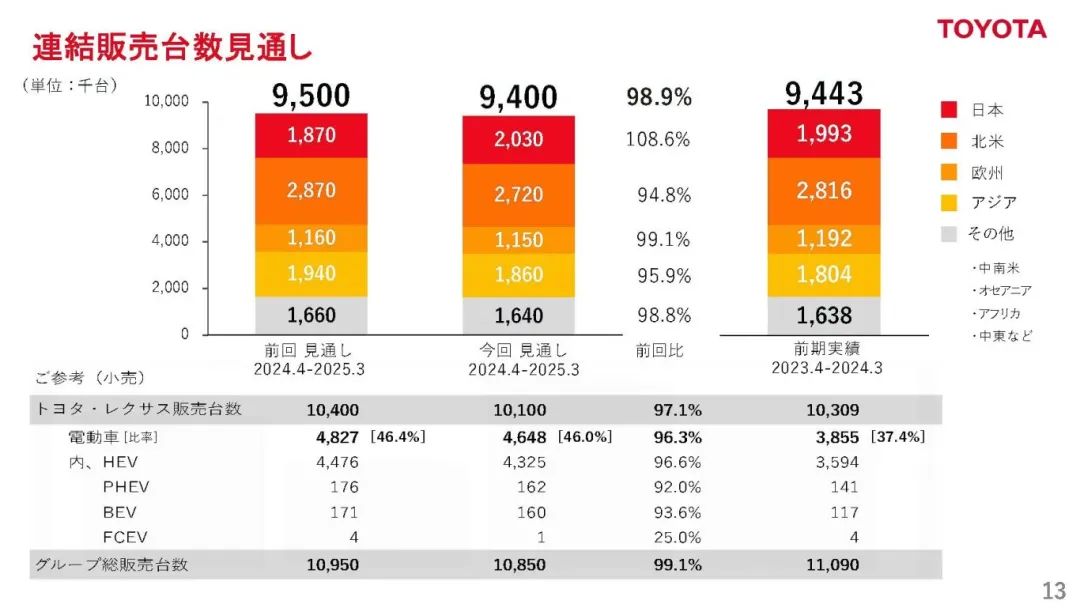

In terms of sales, Toyota sold 4.556 million new vehicles globally in the first half, a 4% decrease from the same period last year. Notably, the sales proportion of electrified models (including hybrids and pure electric vehicles) increased from 35.3% last year to 44.4%.

Quarterly global sales for July to September were 2.537 million vehicles, a slight decline of 3.6% from the 2.634 million vehicles sold in the same period last year.

In terms of production, Toyota's global output declined for the first time in four years in the first half, with a total of 4.71 million vehicles produced, a decrease of 7% from the record 5.06 million vehicles produced in the same period last year.

Toyota Executive Vice President Yoichi Miyazaki revealed at the financial report press conference that the significant drop in net profit was mainly due to production stoppages caused by certification violations. Earlier this year, Toyota's subsidiary Daihatsu was exposed for falsifying data and violating regulations, directly impacting Toyota's subsequent production and shipments.

"In response, Toyota needs some time to re-examine its manufacturing environment and culture. In the next half of the fiscal year, the company will leverage Toyota's unique manufacturing foundation and product advantages to restore normal production," Miyazaki said.

In Japan, the production of popular models like the Yaris Cross and Corolla Fielder was temporarily halted due to certification violations. Additionally, the global sales of Toyota were affected by the Prius recall in the U.S. market.

However, according to official information, the profit decline in the past quarter was just a "minor scratch," and Toyota remains confident in its overall fiscal year performance.

Considering real-world factors, Toyota has revised downward its production forecast for the March 2025 fiscal year by 300,000 vehicles, from the previously projected 10 million to 9.7 million. Despite this, Toyota maintains its operating profit forecast of 4.3 trillion yen for the entire year and has increased its full-year dividend forecast from 75 yen last year to 90 yen.

Nissan: The tough battle continues

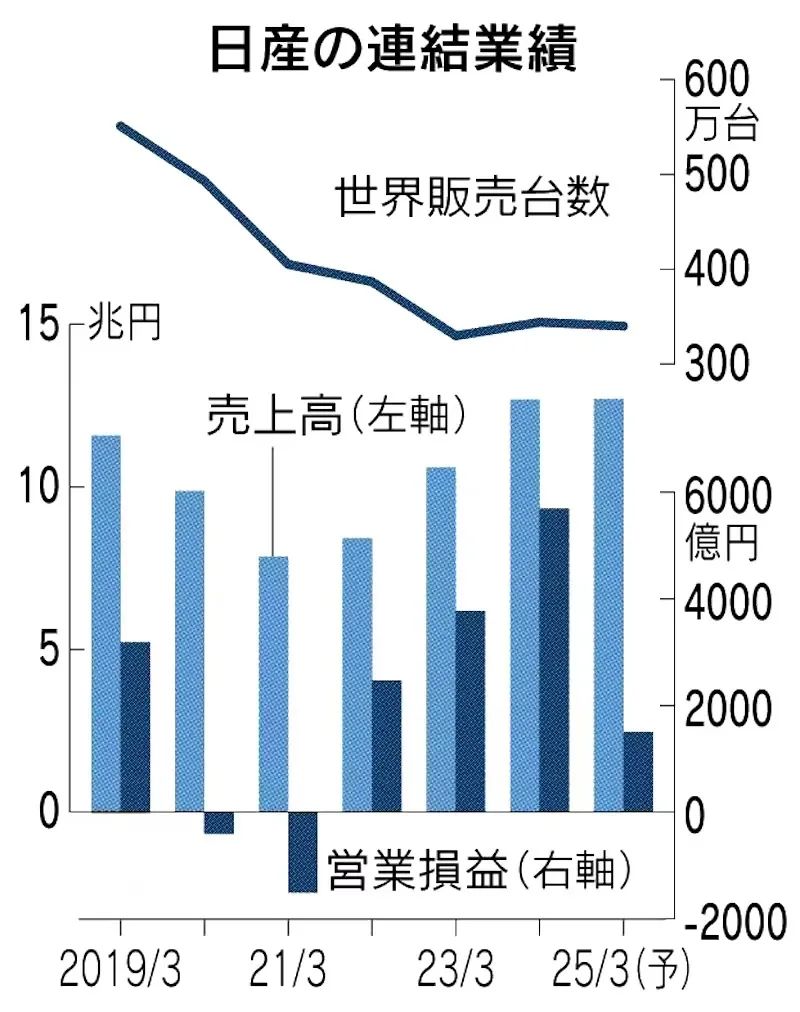

Four years ago, amidst the COVID-19 pandemic, Nissan embarked on a series of business reforms following a major management reshuffle. Facing financial deficits during difficult times, the Yomiuri Shimbun published an article titled "Sales Continue to Decline," warning that if Nissan failed to take a crucial step toward electrification, it would face even greater hardships in the future.

The Nikkei also pointed out in an article titled "The Long and Arduous Road to Revival" that even with bold reforms initiated by the new regime, it would take at least a year and a half to see results.

However, Nissan's management did not anticipate that, despite the pandemic's shadow lifting, the company would have to initiate a new round of "emergency recovery mode." Along with announcing its half-year financial report data, Nissan recently lowered its annual profit forecast, planned to lay off 9,000 employees, and reduce production capacity by 20%.

In the second fiscal quarter (July to September) of this year, Nissan incurred a net loss of 9.34 billion yen, with an operating profit of 31.91 billion yen. Considering the overall market environment in the second half of the year and the global competitive landscape, Nissan has lowered its operating profit forecast for the entire fiscal year from the original 500 billion yen to 150 billion yen.

In response, Nissan CEO Makoto Uchida announced that he would voluntarily take a 50% pay cut starting this month, with other senior executives also voluntarily reducing their salaries. To strengthen the company's financial position, Nissan will also reduce its shareholding in Mitsubishi Motors from the current 34% to around 24%.

Japanese media has pointed out that one reason for Nissan's poor performance is that the management culture established under former Chairman Carlos Ghosn has not changed. Top-down bureaucracy, such as the practice of "waiting for instructions," remains entrenched and unable to adapt to rapid changes in the industry.

In the short term, Nissan's struggles in the North American market have further exacerbated its downturn. In this market, sales of pure electric vehicles have slowed, while sales of hybrid vehicles are on the rise. Nissan previously prioritized pure electric vehicles in North America, putting it at a competitive disadvantage.

Among Nissan's top 10 best-selling models in the U.S., only one new model was launched in 2022 and 2023 combined. Due to delays in new model releases and a decrease in the number of best-selling models, the number of models achieving monthly sales of over 1,000 vehicles has dropped from 19 in 2014 to 12 currently.

Faced with a shortage of popular new models and sales resistance for pure electric vehicles, Nissan has no choice but to rely on sales incentives and subsidies after price reductions, leading to a significant drop in profits.

President Uchida explained that one of the challenges facing Nissan is its inability to achieve the planned sales targets, acknowledging that the market is changing rapidly and the company's plans have been overly cautious.

To change the management system established during the Ghosn era, Uchida revealed that Nissan's management structure will undergo official reforms in January and April 2025 to quickly adapt to changes in the business environment. "We will clarify the roles of the headquarters and regions, creating a lean organization and efficient processes," he said.

Honda: North America remains the "cash cow"

Honda's second-quarter financial report showed an operating profit of 257.9 billion yen, lower than the market forecast of 431 billion yen, and a net profit of 100.02 billion yen, lower than the market forecast of 297.31 billion yen.

For the first half of the fiscal year (April to September 2024), Honda's consolidated operating revenue was 10.79 trillion yen, an increase of 12.4% year-on-year; operating profit was 742.6 billion yen, an increase of 6.6%; and pre-tax profit decreased by 15.6% to 741.9 billion yen.

Based on the first-half fiscal year performance, Honda has raised its full-year revenue forecast, expecting a 2.8% year-on-year increase to 21 trillion yen and a 2.8% increase in operating profit to 1.42 trillion yen.

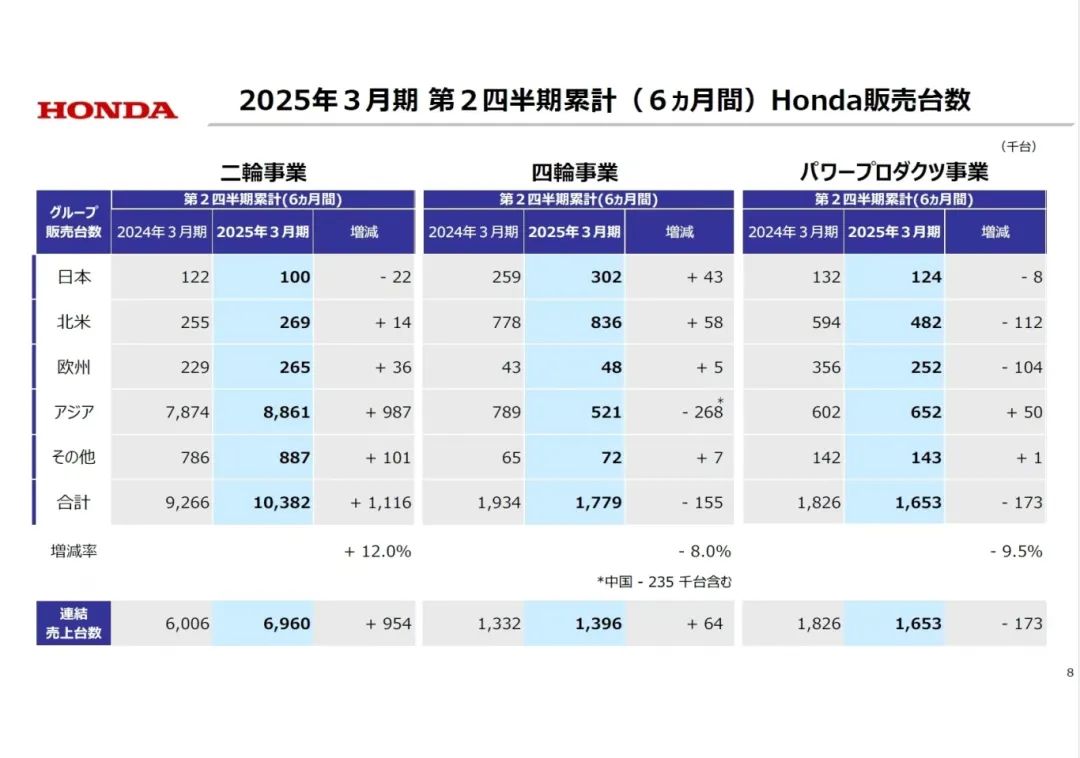

Honda's first-half performance was relatively stable. Sales of four-wheeled vehicles decreased by 8.0% year-on-year to 1.779 million, while sales of two-wheeled vehicles increased by 12.0% to 10.382 million.

Both in terms of operating profit and net profit, Honda's two-wheeled business has consistently outperformed its four-wheeled (automotive) business. As the profit margins of the automotive business remain low, Honda has evolved into a motorcycle-supported manufacturer.

By market, Honda's automotive business saw sales growth in Japan and the U.S., but sales of new vehicles in China declined amid intensifying competition in the new energy vehicle sector and increasing price wars.

It is worth mentioning that North America has always been Honda's "cash cow." The stability of this market has allowed Honda to achieve remarkable results in the past six months. Not only did sales of gasoline and hybrid vehicles remain strong, but sales of pure electric vehicles also increased by 64,000 units compared to the same period last year.

In the motorcycle business, despite the economic slowdown in Thailand, overall sales grew due to strong demand in India and increased sales resulting from Vietnam's economic recovery.

While the U.S. remains Honda's largest cash cow, demand in this market has shrunk by about 30% in recent years due to the impact of the 2008 Lehman crisis. Additionally, large vehicles are more popular in North America, while the sedan segment, where Honda excels, continues to shrink, limiting the upside potential in this market. As a result, Honda has chosen to continuously expand its market presence in emerging countries.