BYD is on the rise, while SAIC-GM struggles to survive with 'fixed price'

![]() 11/08 2024

11/08 2024

![]() 629

629

Lead

In October, BYD's monthly sales broke through the 500,000 mark for the first time. In contrast, SAIC-GM, which has long been in the first tier, has seen its sales pale in comparison. Currently, BYD is far ahead of SAIC-GM. Will SAIC-GM or other joint venture automakers have a chance to make a comeback?

Produced by: Heyan Yueche Studio

Written by: Zhang Dachuan

Edited by: He Zi

2251 words in full text

4 minutes to read

Autonomous brands are further eroding the market share of joint venture brands.

BYD sold 502,657 vehicles in October, a year-on-year increase of 66.53%. This is an unprecedented height for any domestic automaker. Even globally, there are only a handful of companies that can surpass the 500,000 sales mark in a single month. To reverse its declining sales, SAIC-GM, which has long been in the first tier of domestic passenger car sales rankings, has resorted to a fixed-price strategy to stimulate terminal sales.

△BYD sets a record in October sales

SAIC-GM cuts prices to survive

As one rises, the other falls. Many joint venture automakers in China have had a tough year. Take SAIC-GM as an example; its terminal sales have been under significant pressure this year. To address this, SAIC-GM introduced a fixed-price strategy, which has had an immediate impact on boosting terminal sales. A model matrix consisting of the Buick LaCrosse at 159,900 yuan, the Envision Plus at 169,900 yuan, and the Cadillac XT5 at 265,900 yuan has been crucial for SAIC-GM to quickly stabilize its terminal sales. In October, SAIC-GM's terminal sales reached 58,240 units, a month-on-month increase of 6.1%. Although this is far from its peak sales, considering the fierce competition in the domestic automotive market, achieving such results is no easy feat.

△Fixed pricing has an immediate impact on boosting SAIC-GM sales

Of course, price cuts are always a double-edged sword. Given the current state of the domestic automotive market, it will be difficult for the prices of related models to rise again after a price cut. The downward trend in the domestic positioning of Cadillac and Buick brands is also a trend that is difficult to change in the short term. Once Buick sinks, it will inevitably have a greater impact on Chevrolet, which is already struggling. However, for SAIC-GM, survival is the top priority. Only when terminal sales stabilize can it win valuable time for the launch of more competitive models in the future. Otherwise, if the entire system collapses due to prolonged sluggish sales, it may not survive until better days come.

△Chevrolet may become the biggest casualty of Buick and Cadillac price cuts

Concerns about BYD's rapid growth

Of course, BYD is not flawless.

Successfully developing a high-end brand is a significant challenge for BYD. In October, sales of the Denza brand, which has three models, were only 10,781 units, a year-on-year decrease of 6%. Among them, the best-selling model was the Denza D9 with 7,381 units sold. From January to October, Denza brand sales totaled 100,974 units, a year-on-year decrease of 3%. Sales of the two models of the NIO brand were 282 units that month, while sales of FAW-Volkswagen's FAW-Volkswagen E-tron GT were only 6,026 units.

To maintain high sales volumes, BYD will need to make breakthroughs in its mid-to-high-end brands in the coming period. As competitors launch new models in the entry-level market, it will be challenging for BYD's Dynasty and Ocean series to maintain their current market share. However, breakthroughs in high-end brands do not rely solely on cost control or the green license plates that new energy vehicles can obtain. It will take BYD more time to gain consumer recognition for its brand appeal.

△Breaking through in high-end brands is BYD's top priority next

In addition, there is the counterattack launched by SAIC-GM and other joint venture automakers, whose products are constantly becoming more affordable. Take the Buick LaCrosse at 159,900 yuan as an example. It not only has the size of a C-segment car but also boasts a 2.0T + 9AT powertrain, an 8155 chip, and a driver assistance system in terms of configuration. The LaCrosse is on par with BYD models of the same price range, including the Han. When consumers with purchasing intentions learn about the fixed-price LaCrosse, there is considerable uncertainty about whether they will choose the LaCrosse or a BYD model. After all, Buick's brand influence is still present, and the LaCrosse's cost-effectiveness begins to shine.

△The fixed-price Buick LaCrosse offers exceptional value for money

The real competition may just be beginning

Many foreign automakers believe that the overly competitive Chinese auto market is unhealthy. To gain market share, both new forces and traditional autonomous brands are willing to sell cars at a loss, but this unsustainable model of continuous losses will eventually fail. However, if sales remain sluggish for an extended period, foreign automakers can also engage in price wars. Rather than incurring losses due to idle capacity, manufacturers would undoubtedly prefer to reduce prices to increase their market share. At least the latter can boost team morale and stabilize the entire system's confidence. After all, for many multinational automakers, their profits in overseas markets are still adequate, giving them more capital and confidence to engage in price wars.

△Joint venture brands are also willing to reduce prices to increase their market share

For foreign automakers, it is challenging to restore their previous glory. This requires not only introducing competitive new models equipped with leading technology to the market but may also involve adjusting the entire company system. However, by repositioning and stabilizing the company's performance in the domestic market, it is possible to win valuable time for the launch of the next generation of models. Ford China, for example, has focused on the rugged SUV Bronco and the mid-size performance pickup Ranger. In the first three quarters of this year, Ford China contributed over $600 million to Ford's global pre-tax profit. In contrast, many domestic automakers, especially new forces, although making a lot of noise and generating high traffic, are still unable to shake off losses.

△Ford China has turned a profit this year

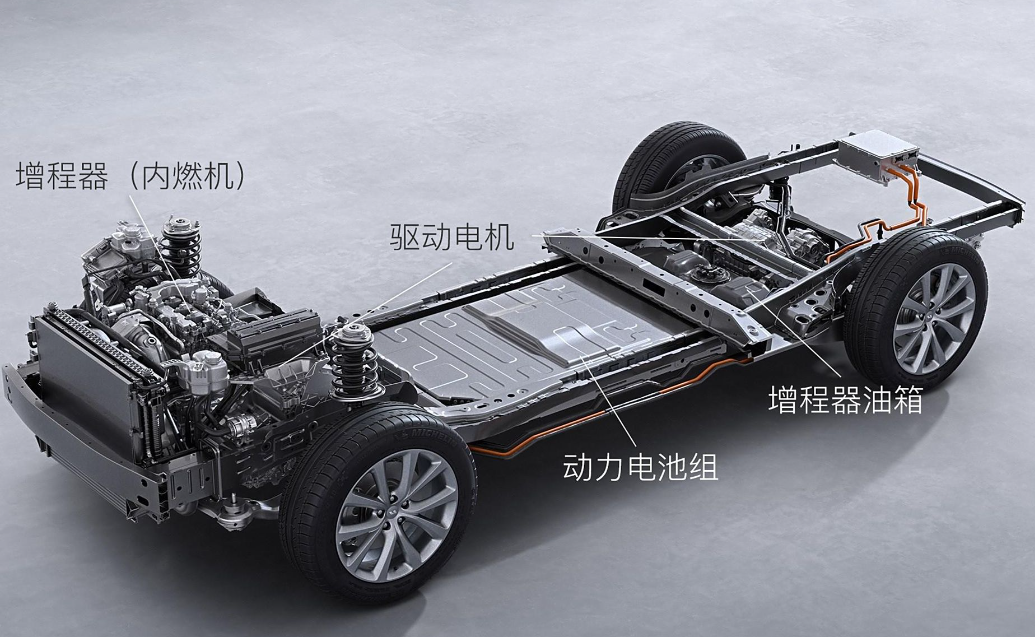

Another point to note is that from the perspective of new energy vehicle technology, electric vehicles are unlikely to dominate the market in the short term. In the future, both domestic automakers and multinational giants will view hybrids as the primary development direction. Whether it's a plug-in hybrid or an extended-range electric vehicle, an efficient internal combustion engine is essential. Whether foreign automakers can leverage their accumulated expertise in internal combustion engines to create more efficient, energy-saving hybrid systems with stronger power will determine their position in the next stage of competition. After all, from a technical threshold perspective, neither plug-in hybrids nor extended-range electric vehicles have a high threshold.

△Hybrid technology poses new demands on automakers' internal combustion engine technology

Commentary

This time, SAIC-GM's fixed pricing was straightforward, essentially achieving a one-step solution. If the LaCrosse at 160,000 yuan cannot persuade domestic consumers, then SAIC-GM or the entire foreign automaker industry in China may be in real danger. SAIC-GM has played its last card, which can be described as a fight to the death. Next, will BYD and other domestic new forces be able to once again suppress SAIC-GM with its fixed pricing by hyping the obsolescence of gasoline vehicles? Or will SAIC-GM and other foreign automakers hoping to follow suit gradually erode BYD's market share with their products' cost-effectiveness and brand appeal? Under the price war, consumers planning to purchase cars will be the biggest beneficiaries.

(This article is originally created by Heyan Yueche and cannot be reproduced without authorization)